Pax Global

competition is coming

Pax Global

competition is coming

By Manuel Maurício

August 24, 2022

New to Pax Global? Read my previous posts here.

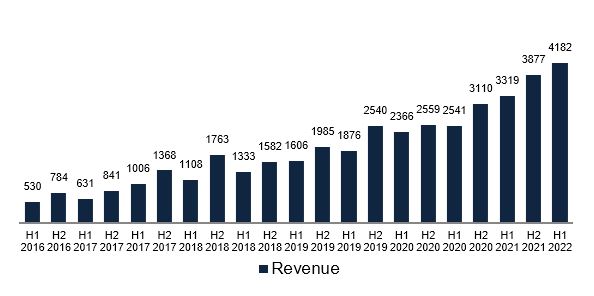

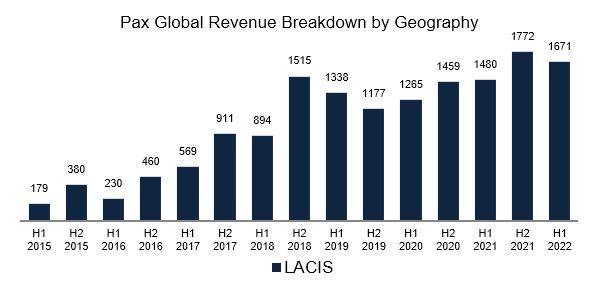

In the first 6 months of the year, revenue grew 26%…

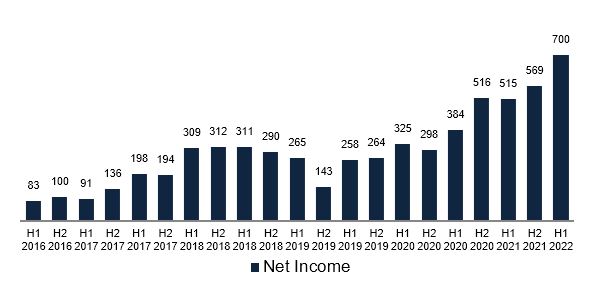

…and the profits grew 36%. Impressive.

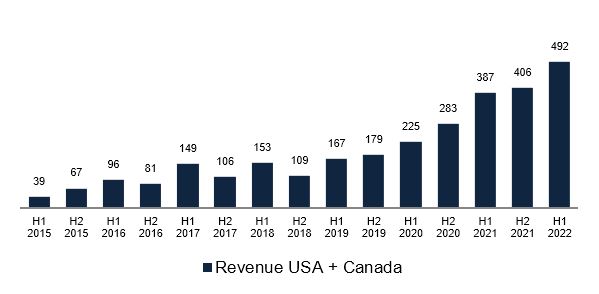

Perhaps more importantly, revenue got back to growth in the USA. The company recently signed a big deal with Bank of America. This goes to show that the FBI thing might’ve been a hand full of nothing.

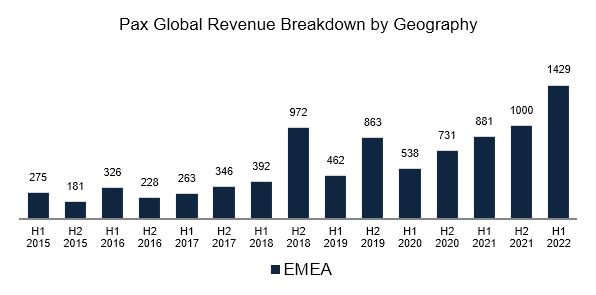

But the USA still represents a small part of the total revenue (12%). In EMEA, the company grew 62%…

…and in Latin America, it’s largest market, it grew just 13%.

This is because of the Brazilian Presidential Election that will take place in October. I’ve lived there for 5 years and I know how every business decision can be put on hold months before the elections.

With these apparently great results, the management increased the dividend by 42% to HKD0.17 per share. The current dividend yield is 4.5%.

MAXSTORE

Customers having several devices from different brands want to integrate all of them under one software. That’s what Pax has done by opening up its Maxstore (previously PaxStore) to other hardware providers. Smart move.

Revenue coming from the software isn’t growing in line with device growth because the company allows for a free tryout of a few months before starting to charge for the software. This is smart because it allows its customers to get used to working with the software and then the sale should be easier. The management is also counting on adding functionalities and will increase the fees in the future.

COMPETITION

The management also mentions increased competition in the SmartPOS devices in China and abroad. So, although revenue has gone up, it was led more by the shift to more expensive products than by unit growth.

When asked about future margin compression as a result of increased competition, the management mentions that they’re continuously developing new products, that they’re faster at it, and that they have better cost control than their competitors. It should be expected that prices drop due to this increased competition but it will not hinder the overall margin. This is something to keep a close eye on.

As an anecdotal evidence, I traveled through Corfu by bus this summer. On each bus, there was a person selling tickets. They were all using Sunmi devices. I think it was the first time I saw such widespread use of Sunmi devices in Europe.

NEW HEADQUARTERS AND INDUSTRIAL PARK

The company has been seeing some setbacks in the construction of its new headquarters and industrial park. I didn’t even know that they were building a new headquarters… or did I? Wait. Let me check my previous write-ups. No, I don’t think I did. Hmmm…

Either way, the new headquarters should be ready in the fourth quarter of the next year.

Regarding the industrial park, the management isn’t that worried about it as Pax Global has three outsourced manufacturing sites and all of them have spare capacity.

As I’ve mentioned before, I’m reading Capital Returns by Edward Chancellor (highly recommend it). I can’t stop thinking that Pax Global might fit the description that Edward makes in the book: building capacity when times are good; meanwhile the competition is doing the same thing and when the new capacity is built, there is an oversupply leading to lower margins, lower returns on capital, and some bankruptcies.

CONCLUSION

The other day, while I was troubleshooting the website, a follower and non-subscriber was able to access the Portfolio without logging in. He then asked me why I put Pax Global in the Opportunistic bucket and not in the Long-Term bucket of the Portfolio.

I told him that I’m not that confident about Pax Global and that I will be selling it if and when the undervaluation disappears. In fact, as I think more about it, I’m not really sure if the company is that undervalued.

If we look at accounting profits, it appears so. But the fact that it carries so much Inventory and Accounts Receivable makes the Free Cash Flow much lower than the Net Income (as long as the company is growing). On a FCF basis, the stock is trading at a much higher multiple. It’s hard to say how much higher given the noise created by the pandemic. But since 2007, the company generated $6.4 billion in profits but only $3.6 billion in free Cash Flow.

There’s a saying that the Market looks at cash flows, not profits. I guess Pax Global is a good example of that – appearing to be cheap on a PE basis, but not so much on a P/FCF basis.

Now, if the company would stop growing, the Net Income and the Free Cash Flow would match and shareholders could get all the net income for themselves. But the company can’t stop growing. And the competition is coming.

I’ve always been wary of the competitive landscape for Pax Global. And this is the first time that I hear the management talk about the competition becoming aggressive outside of China. Let me remind you that Pax exited China because the competition was too fierce there. I remember writing that it would only be a matter of time until the same would happen globally. It seems that we’re beginning to see it happen. That’s why the company can’t take the foot off the gas, meaning that its profit will be diverted into buying inventory and funding accounts receivable, not to the shareholder’s pockets.

Pax Global will remain in the Portfolio for now as I think it still has a good runway for growth, but given the above, my confidence is starting to decrease.

If you want to discuss Pax Global, head over to the forum and let me know your thoughts.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.