Pax Global

no signs of the FBI...

By Manuel Maurício

March 25, 2022

I was almost falling asleep reading GreenVolt’s Prospectus when I got a message from Diogo Gonçalves saying that Pax Global had just posted results.

Ah, Finally! An excuse to drop the biomass, Gigawatts, decree laws, co-generation of energy and all that boring stuff… Ok, maybe I’m being a bit unfair. Maybe when I get it I’m going to like this green energy business after all. For now, I feel like I’m back to architecture school studying for a statistics exam 😒.

So, Pax! Ever since the FBI visited Pax’s warehouse in the US I’ve been dying to know how that affected Pax’s results, most specifically its revenue. Did Pax clients panic and go for another solution or did they stick with Pax?

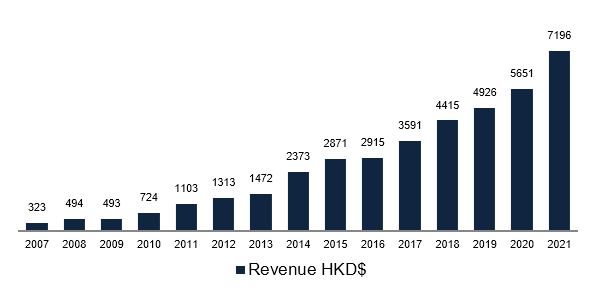

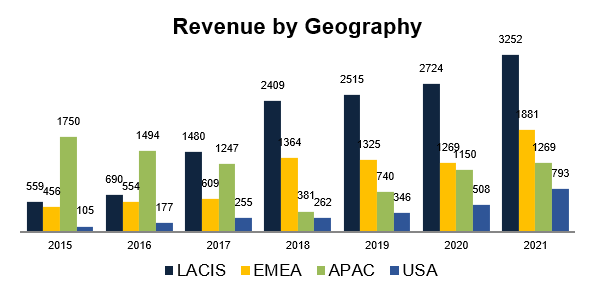

Well, it looks like they’ve stuck with Pax. The revenue went up by 27% in 2021!

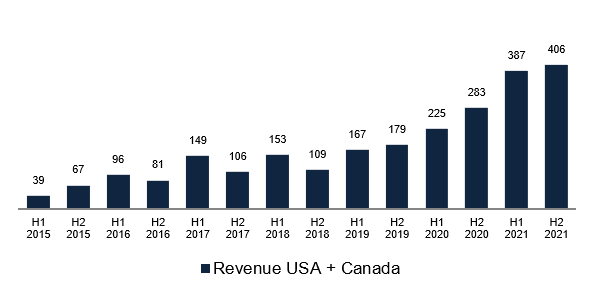

But this doesn’t tell the whole story. I wanted to check how the American clients had reacted to the “scandal”. It’s apparent that there was a strong deceleration in growth in the US in the second half of the year with the revenue growing by “just” 5%.

The management mentioned that growth in the US in November and December was zero so maybe that’s the reason why Mr. Market is paying less for the stock today then before the earnings release.

The management also mentioned that they’re now back to levels similar to those before the FBI raid so it seems that Mr. Market is choosing to trust the numbers rather than the story.

To add to the good news, there’s no news from the FBI. I had mentioned it before, if we don’t hear from the FBI, that’s good news.

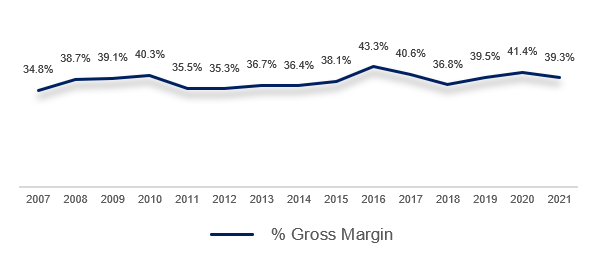

Now, the gross margin came down a bit due to the appreciation of the Renminbi (most costs are borne in Chinese currency) and also due to the inflation in the price of some of the components.

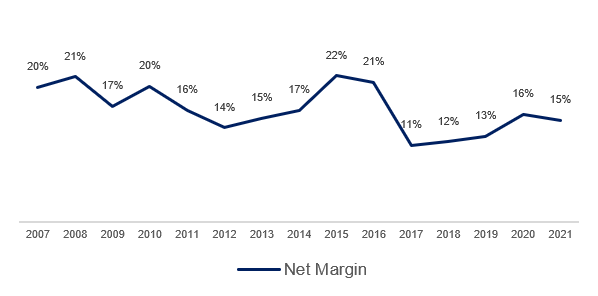

That, together with a higher spend in sales commissions and R&D costs led the net margin to fall by 1% when compared to 2020.

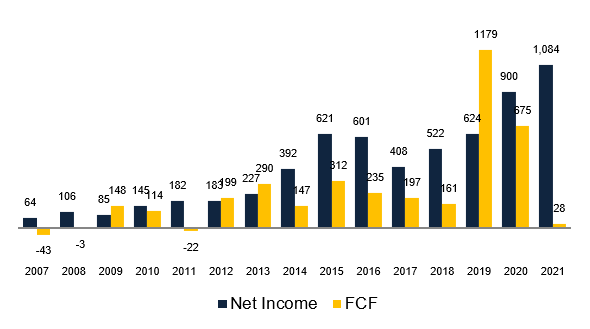

Unfortunately, the conversion of those profits into Free Cash Flow was very poor.

First, because of changes in Working Capital; to secure the inventory needed to grow sales – microchips – the company chose to speed up that spend. It also didn’t get paid by a large customer in December – as is usual – having collected that payment only in January.

The second reason why the FCF was almost zero is related to the increased spend in the construction of the new Industrial Park which is estimated to be completed by year end at the earliest.

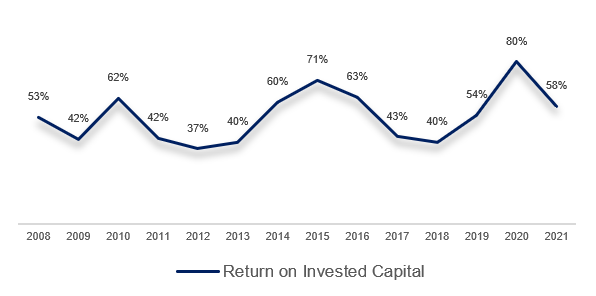

The Return on Invested Capital dropped hard due to the incremental invested capital mentioned above, but it’s still at a very sound level.

Which leads me to the capital allocation policy…

Dividends and Share Buybacks

Yes, the company is investing in its operations by building a new Industrial Park and that will help double the current capacity, but apart from that this is an asset light business so the only thing left to do with the cash is to distribute it to the shareholders (and a potential acquisition, maybe) .

How? By buying back shares or issuing dividends.

The management has chosen a mix of both. Unfortunately, the recurring share buybacks that I’ve been praising on the Forum have only served to offset the dilution created by the options awarded to the company’s employees so the number of shares outstanding has even grown a bit.

As to the dividends, the company paid an interim dividend of 12Hk and it’s raising the final dividend by 50% to 15HK cents. This means that the dividend yield on today’s share price of $5.81 is 5.1%. Pax is a growth stock with a nice dividend yield.

Conclusion

Pax is trading at a Price/Earnings ratio of 5.9x. If we discount the $3.14 per share sitting on the balance sheet, the PE ratio goes down to 2.7x. That’s a 37% yield! For a stock growing 30%! Where else can you find that?

The management, conservative as always, guided for 15% growth in 2022. And they’ve mentioned that they’re not including any growth coming from the USA. They’ll probably shatter that estimate as they’ve been doing all along.

As an anecdote I’ve heard rumours that Worldline (Ingenico), Pax’s largest competitor, mentioned that Pax is “destroying” them with the new Android terminals. This is good.

Having said that, Pax Global still remains the oddball in the Portfolio. I don’t have a clue as to where the industry is going – in fact, if you ask me, I think that handheld terminals will be extinct in the near future as they’ll probably be replaced by smartphones. But the company is extremely cheap , it’s growing a lot, and I might be wrong in my marco view.

So, on the one hand I can’t add to my position because I’m not entirely confident on the company’s future prospects, but on the other hand the company is so cheap that it would be foolish of me not to own a position.

For those reasons Pax Global will remain in the Portfolio.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.