Playboy

a fundamental analysis

By Manuel Maurício

January 29, 2021

Symbol: PLBY (NASDAQ)

Share Price: $12.35

Market Cap: $428 Million

Introduction

The other day I was reading a thread on Twitter by Kuppy where he mentioned how Playboy was going public and how promising its future was. I got interested, but didn’t follow up at the time. I’m doing it now.

Business

We all know Playboy, right? The bunny brand that got famous for its magazine and playmates.

The history of the company is long so I won’t be talking much about it on this write-up. If you’re interested, you can read it here. A small briefing is important nonetheless:

Originally, Playboy was a print and media business. It made money by selling magazines and advertising space on its pages. Over the years, the printing business went into accelerated decay while the debt was mounting. In 2011, the founder, Hugh Hefner, took it private with the backing of the Private Equity firm Rizvi Traverse.

Since then, the company shifted from a media business to an e-commerce business particularly focused on licensing its brand and collecting royalties from products that are sold around the world with its name and logo on it.

Last year, news came out that the company was going public again through a reverse merger with a SPAC (Special Purpose Acquisition Company). This is the same process through which Whole Earth Brands became public. Ant that’s why you don’t see Playboy’s name up there on the chart, but the name of Mountain Crest. The name should change in the coming weeks.

But it seems that, even under the Private Equity control, the company has never been able to turn around. Several CEO’s have come and gone, and none have quite made it. Let’s see if this is one can.

The licensing business is one of the best businesses out there. Other companies pay you to print your brand on their merchandise (clothes, perfumes, etc). You just need to sit back, relax, and collect the money. That’s why it has such high margins.

But the management wants to change that. They want to expand from a purely licensing model to a Owning & Operating model where they’re the ones selling the consumer goods. Businesses usually go in the opposite direction.

I guess the management is looking at the $3 Billion worth of Playboy stuff sold around the world every year and they must be thinking “humm, wouldn’t it be nice if we were the ones selling all this stuff?”. This, of course, raises a lot of questions and risks.

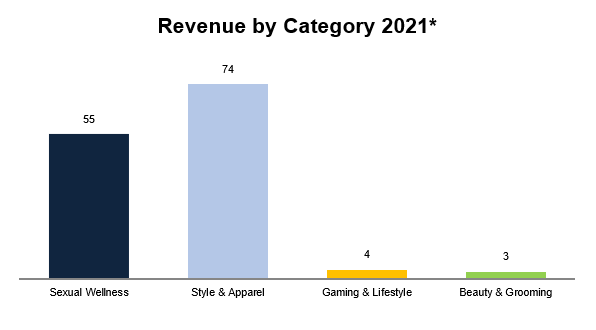

Let’s start by taking a look at the different categories:

Categories

SEXUAL WELLNESS (condoms, lubricants, wipes, oils): The Sexual wellness segment is the key focus for the company. They’ve launched CBD arousing products in September 2020, and started selling in 10.000 stores across the US, including Walmart and CVS.

It’s a very fragmented industry and the management expects it to be the largest contributor of growth going forward.

Style & Apparel: Playboy branded clothing is very popular among the Gen Z, especially in China where the company sells in over 2500 stores and one thousand e-commerce stores.

Chinese youngsters don’t have the stigma of wearing something by Playboy because they haven’t gone through the 60’s and 70’s in the US.

The company says that they’re the leading brand of apparel in China. I’m not sure about that, but the truth is that China alone accounts for 40% of total sales.

Gaming & Lifestyle (Digital Gaming, Casinos & Hospitality experiences, spirits).

Playboy has been in the gaming business for 60 years. It has recently signed several partnerships with physical casinos such as Caesers, and also with digital players such as Scientific Games. It’s also thinking about getting into the sports betting business.

Then there are the Lifestyle goodies. Playboy Vodka is launching in China and there are several other initiatives that the company is planning on launching or re-launching such as the Playboy Jazz Festival.

Beauty & Grooming (fragances, CBD based bath, beauty grooming and skin care).

This is the smallest category, but one with some potential. The man’s grooming and skincare is the fastest growing consumer product category in China.

Distribution

Licensing

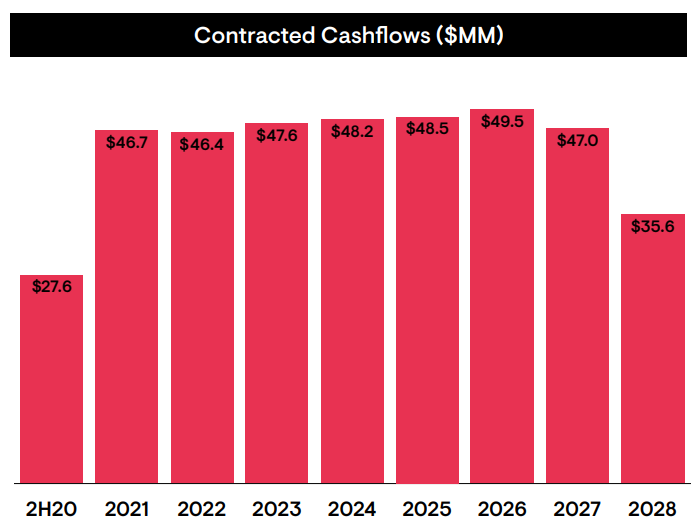

By licensing its brand to third parties for products, services, and events, the company gets a high margin revenue stream. Not only that, but the visibility and predictability of these cash flows is very high. The company already has $400 Million of contracted future cash flows.

But the CEO wants to grow the revenue aggressively, so instead of relying on the high margin royalty streams, he’s of the opinion that the company should be selling its own stuff. But that won’t happen in all the geographies.

In Asia, where the company doesn’t have a “structure”, they’ll keep licensing the brand.

Direct to Consumer

But in the western world, they’ll be going Direct-to-Consumer (DTC).

The CEO often mentions Disney as a reference. Disney is the largest licensed brand in the world. Not only that, but Disney also sells licensed products on its own e-shop. This way it earns money in two ways. The CEO wants Playboy to be the Disney of adults. Interesting.

To pursue this DTC strategy, the company needed the infrastructure to fulfill all the deliveries they are anticipating. That’s why it acquired Yandy.com at the end of 2019. Not only did the company acquire a new brand and sales channel (Yandy is an e-commerce site for lingerie) but also 2,5 Million customers, and a distribution center. According to the management, it was much cheaper to buy it than to build it.

Digital Subscriptions and Content

Then there’s the digital subscriptions and content. This includes the subscriptions to Playboy TV and online gaming.

I’ve heard Ben (the CEO) mention that he wanted to get into online dating. To him, the problem with the current dating apps such as Tinder is “what happens when you meet someone”? When the client finds a relationship, the apps loses a client. Ben is of the opinion that they should own that customer for 20 to 30 years. How he’s planning to do that, I don’t know.

Financials

The first thing that jumps to the eye is that, on its investors presentation, the company doesn’t disclose the financials for the years prior to 2019. In the Prospectus (the document needed to go public), the company reports figures for 2018, but it’s not easy to get there. This makes our job much harder.

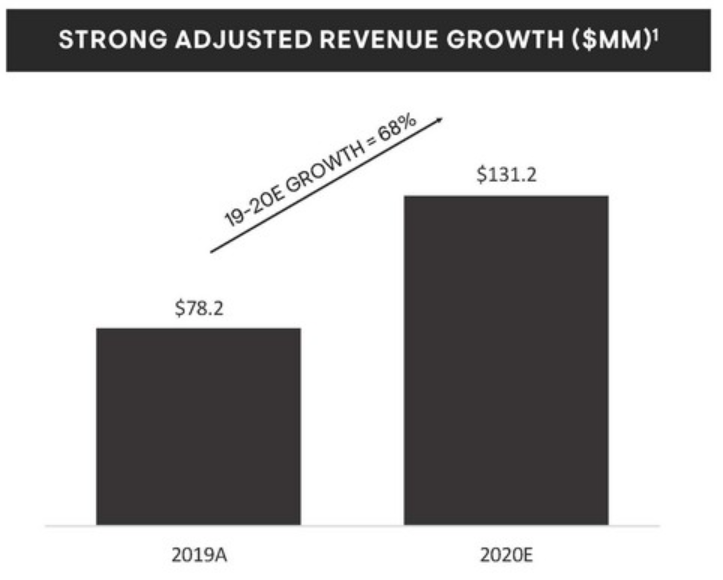

I hate it when I see a sleazy management team. It makes my stomach turn. Just check this out. This is how the company presents its revenue growth:

One would’ve thought “Wow, 68% growth in one year? That’s amazing”. But what this chart doesn’t tell us is that they’ve acquired Yandy.com right at the end of 2019.

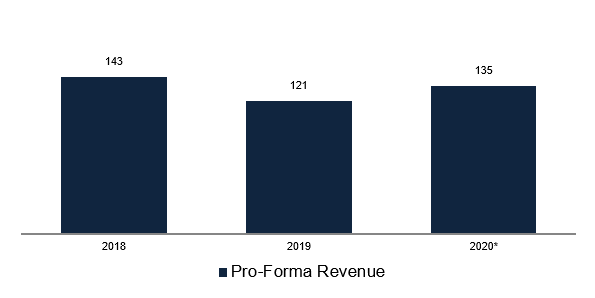

In these situations, it’s common practice to use pro-forma numbers, which restate prior periods as if the acquired company had been part of the business all along.

If we look at the pro-forma revenue, we can clearly see that the growth rate isn’t anything near to what the CEO brags about. In fact, he could even show the image above, but when a reporter congratulates him on the growth, he should be mentioning that the growth was due to the acquisition.

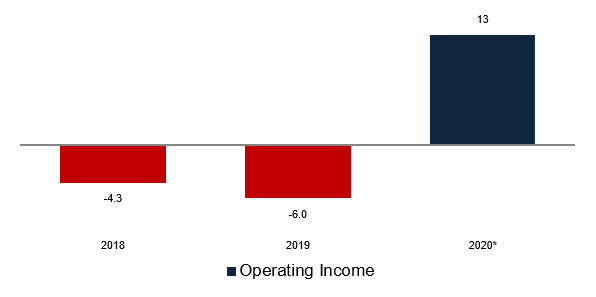

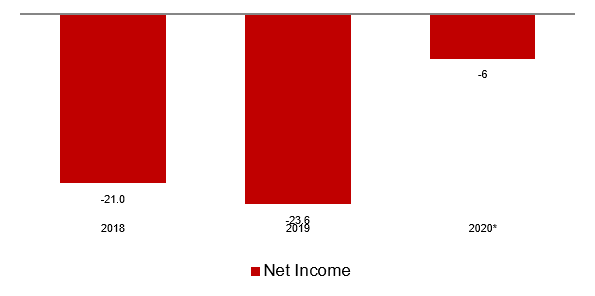

Truth be told, the business is getting better. In 2020 I expect it to show an operating profit of around $13 Million.

But that still won’t be enough to reach profitability given the high interest costs that will eat away those profits.

Balance Sheet

As with the Income Statement, the balance sheet also presents its challenges to interpretation. We’ve got the legacy Playboy, the new Playboy with Yandy, Mountain Crest, and Mountain Crest with Playboy.

To make a long story short, when the combination occurs, the company will probably be left with $100 Million in net debt. That represents a Debt/EBITDA of about 5x from my point of view. From the company’s point of view, that will be less than 2x. That’s because they use adjusted EBITDA. You say potato, I say potáto.

That debt has an interest rate of about 8,5%, too high for the current day and age. The company is already in negotiations with its lenders to lower it to a more reasonable rate. That should give an immediate bump to the profitability.

On top of that, the company has incurred in Net-Operating-Losses (know as NOL’s) of $182 Million in previous years. This means that it has about $40 Million (roughly 21% of 182) that it can use to lower its taxes in the future.

This is a good thing. It will allow the company to acquire cash generating businesses and use those NOL’s to lower the tax expense, thus generating even more cash.

Ownership, Management and Compensation

As you might’ve noticed by now, I’m not really a fan of Ben, the CEO. Don’t get me wrong, he seems like an able guy. But I don’t trust him.

He was one of the partners on Rizvi Traverse, the Private Equity firm that owned Playboy together with Hefner, and became CEO of Playboy back in 2017.

After the deal is done, which should be in the next few days, Rizvi Traverse will own 58% of the company, and Ben will own about 3%. From this alone, I would say that the interests are aligned between the management (and board of directors) and the retail investors.

But then there are other things that I don’t like. The bonuses are tied to growth in EBITDA. EBITDA means “Earnings-Before-Interest-Taxes-Depreciation-and-Amortization”. A mouthful, I know.

What this means is that the management isn’t quite aligned with the rest of the shareholders. You can grow EBITDA in one of two ways; grow the revenue, or reduce costs.

It doesn’t matter if it grows revenue by issuing new shares (thus diluting the existing shareholders) or by raising high amounts of debt, and it also doesn’t matter if the company is profitable or not.

This is the perfect setting for growth at any cost. It’s quite common, but I don’t like it. Now that I think of it, I should be looking at the incentives for Whole Earth Brand’s management team.

The management is also very public in saying that they have a lock-up agreement, which means that they won’t be able to sell their shares for 1 year, as if 1 year was a long period of time (for Whole Earth, it’s 5 years).

Besides, they can also sell their shares if they trade above $14 for 20 trading days, but the CEO seems to always forget to mention this.

Competition

Depending on which segment you’re looking at, there are a lot of competitors.

In the Style and Apparel, any other clothing company can be considered a competitor.

In the Sexual Wellness, there are also a few competitors, but the CEO has mentioned that their most direct rivals are Hims and Roman. Hims is also about to go public through a SPAC, so investors in Playboy should be looking at it too.

In the Gaming and Lifestyle and Beauty and Grooming, a lot of competitors as well.

Risks

- Growth at any cost

- Slow adoption of the brand

- High debt

Valuation

Estimating future revenues for Playboy at this moment is quite difficult, and it entails a lot of guessing. Anyways, if the company is able to grow revenue by 15% in 2021, I estimate that it will generate $22 Million in Net Income.

At the current Market Cap of $438 Million, that means a Price/Earnings ratio of 20x. Not blatantly cheap for a turnaround story with lots of unknowns.

Final Thoughts and Conclusion

So here it is. I liked learning about Playboy. The brand clearly has a lot of potential.

It’s very likely that we’ll be seeing the company grow in the coming years, especially through acquisitions to take advantage of those NOL’s.

This could be one of those companies that we’ll be talking about in the future while saying to ourselves “How could I be so stupid not to buy it in 2021?”.

But at this point, I have more doubts than certainties. Growth for growth’s sake means nothing. A lot of value has been destroyed in pursuit of growth.

Right now, we have scarce financial information and I always have a hard time looking at these businesses with a lot of one-time costs and adjustments related to acquisitions or divestitures, not to mention the costs of going public. It’s hard to get a picture of what the business could look like in a steady-state.

Besides, the guys over at Rizvi Traverse had years to make this a successful story, but they clearly haven’t. I don’t really know why that would change now.

And at a Price/Earnings ratio of 20x, it’s not as if this is an undiscovered gem as some investors are saying.

I’m not buying Playboy right now.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.