Pollard Banknote

a fundamental analysis

By Manuel Maurício

March 17, 2021

Symbol: PBL.TO (TSX)

Share Price: CAD$52,12

Market Cap: CAD$1.4 Billion

Introduction

Warren Buffet is known for saying that in investing you don’t get points for difficulty. You don’t get points for originality either. This idea was first written by Connor Haley of AltaFox Capital. You can find his write-up here.

Until Connor posted his research, Pollard Banknote was somewhat of a misunderstood company due to the lack of disclosure of the financials related to its highest growing segment, the iLottery. Let’s then check if Pollard Banknote is truly a great investment opportunity.

Business

Pollard Banknote core business is designing and manufacturing instant tickets for the lottery industry (think scratch cards). Lame, right?

Not at all. This is actually a very good business with high barriers to entry. Pollard is the largest producer of instant tickets in Canada and the second largest in the world. The first one is Scientific Games (competitor of Aspire Global as well in the iGaming segment).

Just so you get a sense of the numbers here, Pollard sold over 14.6 billion instant tickets in 2019. Its mind-blowing!

I encourage you to check out one of their manufacturing facilities HERE. You can get a pretty good idea of the scale of the operation.

In most parts of the world the lotteries are State monopolies and there’s strict regulation regarding its suppliers. After a lottery has chosen its printing partner, it’ll be hard to switch providers. Contracts typically span between 2-5 years with renewal options of 1-5 years. Pollard usually sells the tickets for a per unit price or for a percentage of the retail value of the tickets sold.

It prints the tickets at 10 facilities, 4 of which are owned and the other 6 are leased. I knew that the lottery business was big, but I guess I never really put much thought into it. 10 manufacturing plants just spitting out massive amounts of scratch tickets is staggering.

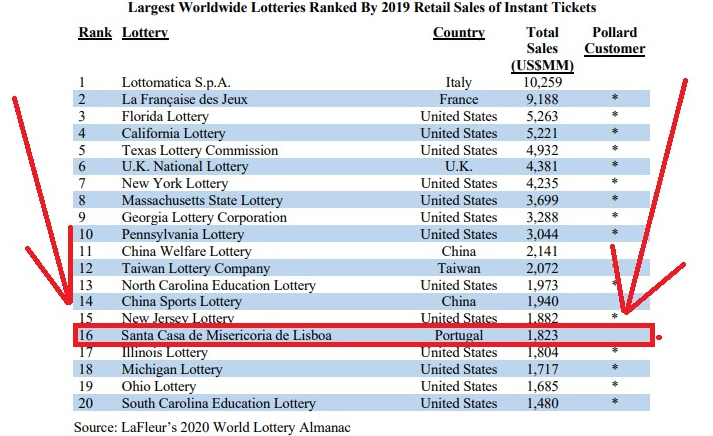

PORTUGAL vs ITALY

One of the interesting (and depressing) things that I’ve learned while researching Pollard is that Portugal ranks number 13th among the biggest lotteries in the World. We’re competing with the likes of China and big US States.

And then I look at the first place, Italy, and I almost fall of my back. It’s twice the size of number 3. Wow!

If you’re reading this Lorenzo Biagiotti, I’d love to hear your thoughts about what makes the Italians so fond of gambling.

But besides that, on the image above what really matters is that among the 20 biggest lotteries in the World, 16 are customers of Pollard Banknote.

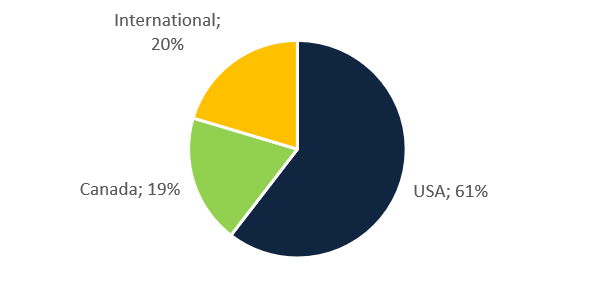

44 of the 52 states in the USA sell instant tickets. Pollard has contracts with 26. The USA accounts for more than half of the sale of scratch tickets in the world, so it’s no surprise that the great majority of Pollard’s revenue comes from the north american country.

Outside of the USA, Pollard also has contracts with France, Sweden, Austria, Finland, and many more.

Segments

To understand Pollard, we’ve got to break down its income streams:

RETAIL

The retail business is the core business of printing and selling instant tickets, be them scratch cards, bingo cards, or pull-tab cards.

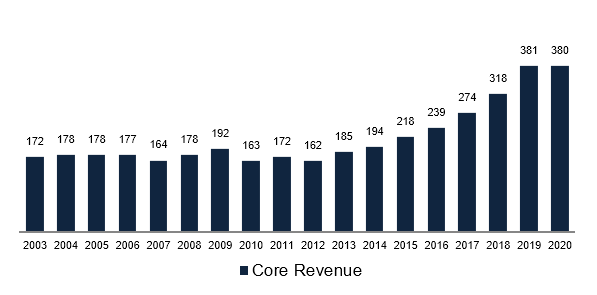

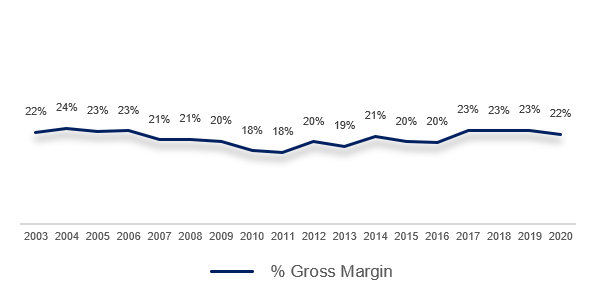

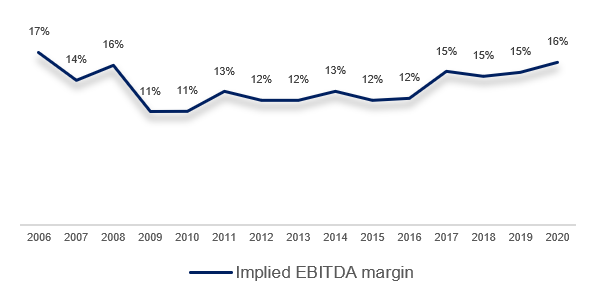

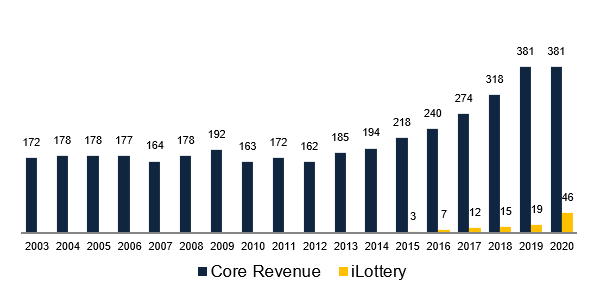

Its revenue has been growing at 4.8% since 2003 and accelerating in recent years. In 2020 we’ve seen some weakness related to the pandemic, but the fact that the revenue remained flat goes to show the resilience of these businesses.

And because the instant tickets are a low value/high volume product, the gross margins aren’t all that great…

…but the company has been able to compensate these somewhat low gross margins by running a lean operation, thus getting a fair and increasing EBITDA margin.

Unlike its largest competitors, Pollard has been able to reinvest funds back into the business and successfully provide the Lotteries with newer designs and technologies.

Not only that, but Lotteries have been looking to outsource more and more components of the business and Pollard has been able to help them be it by taking on the distribution or helping with new solutions.

RESILIENCE OF THE BUSINESS

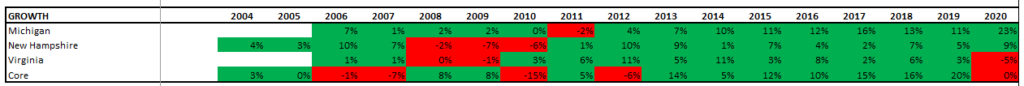

I wanted to understand how resilient these businesses are during an economic downturn. I’ve gathered information for the sale of instant tickets from 3 of Pollard’s customers and what we can clearly see is that, in an economic downturn, these businesses suffer a bit, but they hang on pretty nicely. (click the image to enlarge).

iLottery – Read slowly!

Enter iLottery. After researching Aspire Global and the iGaming industry it now seems that every gambling business in the world is going online. Frankly, I thought these businesses were already well established on the internet. I guess I was wrong.

The great thing about iLotteries when compared to iCasino or online Sports-Betting is that, given the fact that the Lotteries are state-owned monopolies, once Pollard gets a contract, there’s no more competition for the duration of that contract. There are no other lotteries in the same country or state.

Here, as in the iCasino business, the iLottery platform provider gets a stake of the revenue, varying from 15% for draw based games (think Euro Millions) to 22% for instant ticket games.

Now is where you need to read slowly:

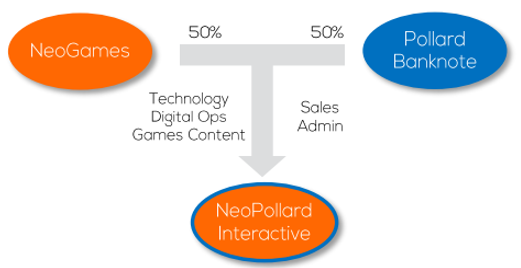

Back in 2013, Pollard won a contract to set up and operate the online operations for the State of Michigan. But Pollard didn’t have the technological skills to do it alone. It was just a scratch card manufacturer.

That’s why they’ve partnered with NeoGames. The joint-venture they’ve created is called NeoPollard Interactive, or just NPI (remember this name).

This Joint Venture was set up with the sole goal of winning and servicing iLottery contracts in North America.

Pollard had the street credibility and the contacts, NeoGames had the technology, it was mutually beneficial. Within this joint-venture, everything is shared on a 50/50 basis.

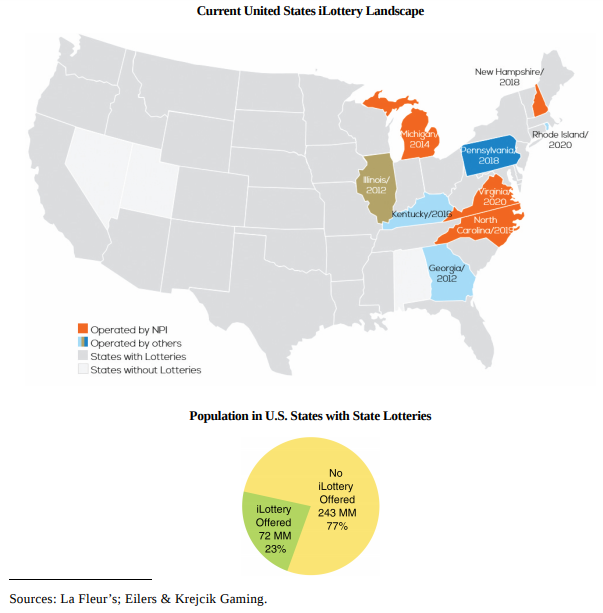

From the 44 US states that currently offer lottery, only 7 offer iLottery. That’s a huge opportunity. You see, these businesses are like a hidden tax. And with the devastating economic effects of the pandemic, I’m sure many states will welcome the increased revenue.

So far so good, right?

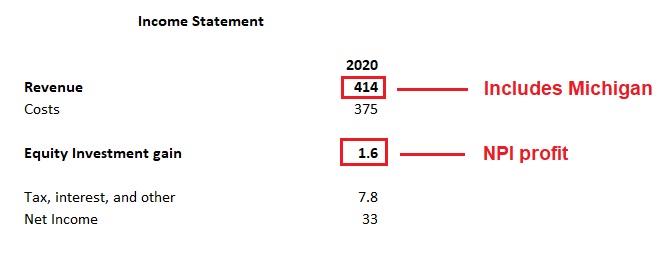

The issue is, the revenue coming from Michigan is accounted for on Pollard’s statements as “regular” revenue and is mixed with the Core Revenue. The rest of NPI is accounted for as gain (or loss) on Equity Investment. Until NeoGames went public a few months ago it was very hard to know the profits for Michigan or the revenue for NPI.

But now we have more data.

iLottery Michigan

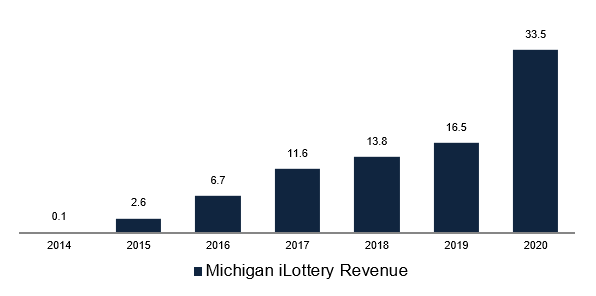

Michigan is that state that every other state looks up to. It has been the most successful geography for NPI (remember, NPI is the joint venture between Pollard and NeoGames). It has seen high growth…

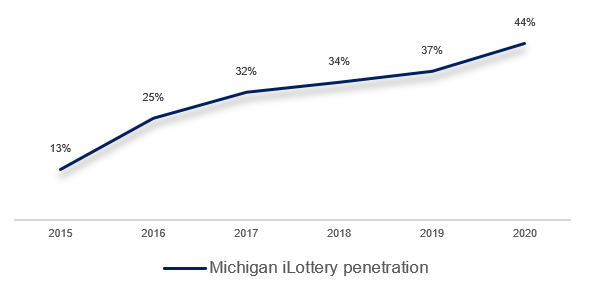

…and high penetration.

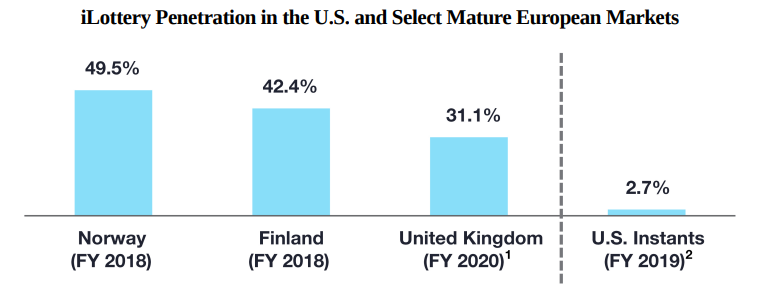

In case you were wondering if 44% penetration is too high or too low, the penetration for the whole USA is just 2.7% whereas for the leading European countries is above 30%. This means that Michigan is very well positioned.

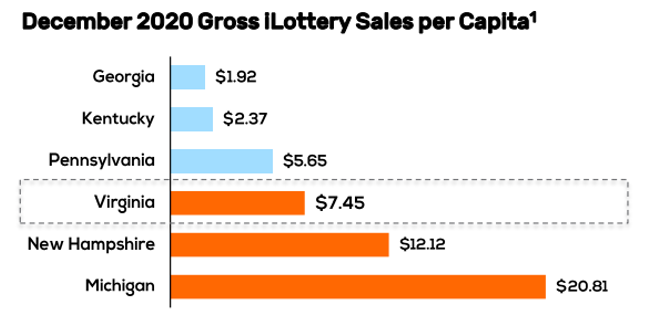

In fact, all of NPI’s iLotteries rank first in almost every single metric (they’re the orange ones).

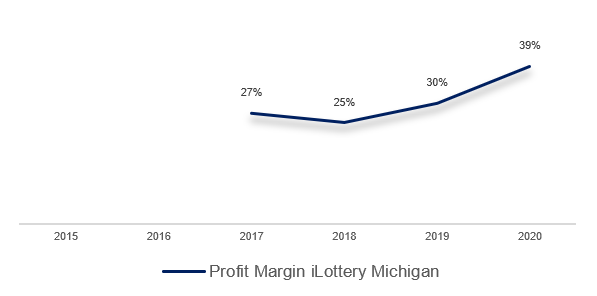

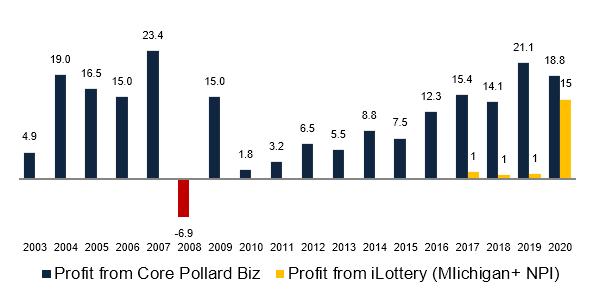

Given the scarcity of information, it’s hard to know the profits coming from Michigan prior to 2017, but there’s no doubt where they’re going.

Because iLotteries are highly scalable businesses, as the revenues go up, the profits go up even more leading to margin expansion.

NPI has done such a great job in Michigan that it has recently won an extension of its contract until 2026.

What about the physical lottery? Doesn’t it get harmed?

There was the fear that the iLottery would cannibalize the physical lottery, but Michigan proved that fear wrong. In fact, the iLottery helped the physical lottery grow by engaging the players with cross-sell promotions (you buy in the store and check the prize on your phone or you buy online and collect your prize in the store).

iLottery NPI

And then there’s NeoPollard Interactive outside of Michigan.

NPI is currently running the iLotteries in 4 States + 1 Canadian Region: Michigan, Virginia, New Hampshire, North Carolina, and Alberta (in Canada).

Although the iLottery penetratio in these states is still lower than in Michigan, it’s higher than the initial penetration for Michigan.

In fact, NPI is so successful that the 4 US States where it runs the iLottery account for 70% of total US iLottery sales.

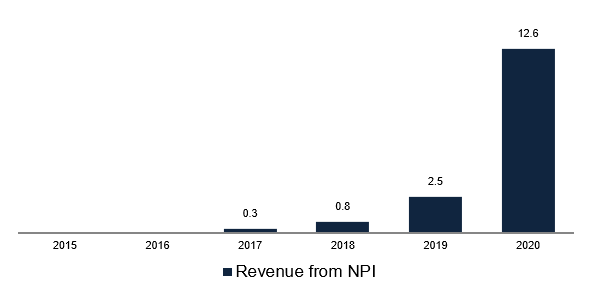

And that’s translating into huge revenue growth…

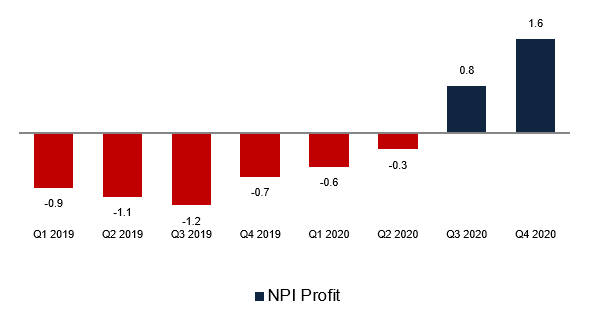

… which, in turn, has led to profit growth.

If we look at the profit on a quarterly basis, we can clearly see what’s happening to the profitability of NPI. It’s going up, massively!

Income Statement

When we put the Core business and the iLottery side by side, we see that the iLottery, although representing a small percentage of the whole revenue for now, is creeping up really fast.

And given the fact that the iLottery is much more profitable, its profits are already almost equaling those of the core business. Crazy!

Management and Ownership

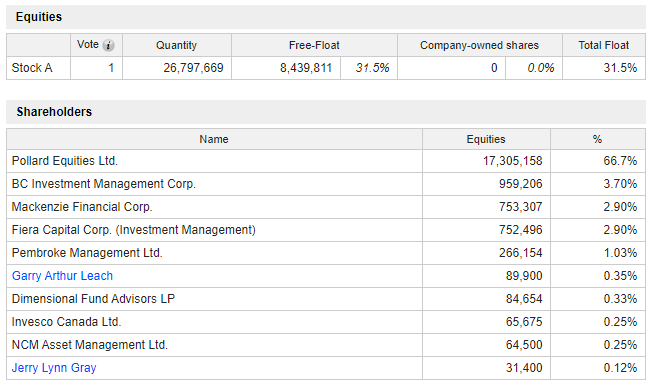

The largest shareholder in the company, with 66.7% of the shares outstanding, is the Pollard family, with the two Pollard brothers acting as Co-CEO’s.

They’ve been pretty good stewards of capital, not diluting shareholders other than for a few small acquisitions (which I won’t be talking about today).

Over the years, they’ve issued a small dividend (currently 12% payout ratio) and reinvested the remainder of the profits back into the business.

Competition

There are significant barriers to entry in the core business of printing instant lottery tickets. First of all, it’s capital intensive, you don’t just decide to build a multi-million manufacturing facility out of the blue.

Then, new contracts are only signed once every few years, and most lotteries demand that their suppliers have at least 10 years’ experience. Pollard Banknote has over 30 years of experience. You see how there’s not much competition.

On top of that, it’s illegal to import instant tickets into the USA from countries other than Canada and Mexico. This protects the business from companies coming from “low-cost countries”.

I highly recommend watching this short interview with the CEO’s to better understand the barriers to entry.

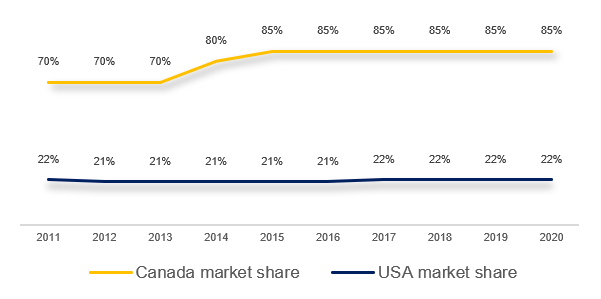

All of this has led to a steady market share over the years.

The other two major players in the core business in the USA are Scientific Games and IGT. Scientific has around 68% market share, and IGT around 10% market share.

But although in North America the core business has been protected, in the international markets the company says that it’s seeing increased competition from low-price printers. This is something investors in Pollard should keep an eye on.

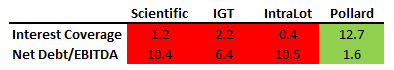

Regarding the iLottery business, Pollard’s most serious competitors are Scientific Games, IGT, and Intralot.

Although these companies are bigger than Pollard (not Intralot), their balance sheets are in a critical situation.

This gives Pollard a lot of optionality regarding investment in new technologies, be it organically through the buying of new machines, or inorganically through acquisitions.

Risks

- Changes to NAFTA that may allow new competitors from overseas.

- Changes to the Wire Act.

- Breaking the relationship with NeoGames.

- Low pricing power.

- Increased competition from other platform providers.

Estimates and Valuation

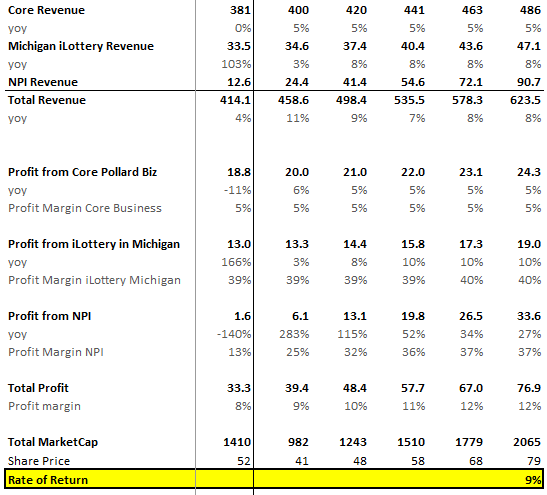

This is where I’ve struggled the most. Given the recency of the iLottery business together with low disclosure of its financials, it’s hard to make estimates for the future. After battling with Excel for a few days, I’ve finally arrived at a point where I’m comfortable making some estimates.

I won’t go into detail on all of them or I would bore you to death. Suffice is to say that I project the Core business to grow by 5% going forward (this is the historical average, very conservative compared to recent years) and apply a 20x earnings multiple to it given the high barriers to entry and recession resistant profile.

I also conservatively estimate that Pollard will win 1 new iLottery contract per year going forward and its growth and penetration will be worse than Michigan. For such high margin / high growth business, I apply a 30x earnings multiple. This might seem too high, and it probably is, but that’s what these businesses are selling for currently.

All of this summed up, I get to a share price of around $79 Canadian dollars five years from now, or an annualized rate of return of 9%.

Conclusion

There are many things to like here. One that I really like is that Pollard has a reinvestment moat. I’ve talked about it on episode 5 of the podcast Ações & Companhia. If you’re not fluent in Portuguese, you can read about it here.

The traditional cash cow is well protected, and on top of that a new cash cow is rapidly growing. I must confess that I don’t consider the iLottery business to have such high barriers to entry as the core manufacturing business.

For starters, you don’t need a factory to bid on an iLottery contract. Then, as we’ve seen on the analysis of Aspire Global, there’s a lot of companies with platforms that could be adapted to suit iLottery needs.

I get solace in the fact that NeoGames could’ve gone at it alone but chose to partner with Pollard. It means that having Pollards at its side must add some value (relationship with the lotteries, marketing, etc). On top of that, the fact that the contracts are multi-year also helps to deter new competitors.

After almost 2 weeks of researching Pollard, I’ve got to say that I like it. But I’m not there yet. Although I’m convinced that my assumptions of growth, penetration, and margins are pretty conservative (maybe too conservative), the high multiple that would be needed in 5 years in order to justify a purchase today still doesn’t make me comfortable enough to make an investment.

I’m passing on Pollard Banknote, but this won’t be the last you’ll hear of it.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.