Quick Opinions #1

BlackBerry, Palantir, FICO, Iteris, America's CarMart

By Manuel Maurício

May 27, 2022

This week I’m stepping out of my circle of competence to see what’s out there in the wild.

But before we begin, I’d like to ask for your cooperation. As you might’ve guessed by the title, I’m trying this new model where I write quick opinions on a few companies (previously called Medleys).

At some point, I’ll find an idea that makes me want to dive deeper and that’s when I’ll do a full write-up. Maybe that will happen once a month, sometimes more, sometimes less, but I think once a month is a good ratio. A company will only enter the Portfolio after, at least, one deep dive.

I want to know your opinion about this model. If the majority of my subscribers like it, I’ll be adopting it.

So, in order for me to know if you like this model or not, please leave your opinion on the survey form at the end of this post. You can write whatever you want in the last section of the survey and I welcome all your opinions. Thank you!

BlackBerry

Most people think that BlackBerry was killed by the iPhone. And it was. Kind of. However, for the past decade the company has been reinventing itself. And it looks like they’ve been doing a pretty good job.

What does the company do?

Today, BlackBerry is focused on Internet of Things and Cyber Security.

Its QNX operating system is installed in 195 million cars – 14% of the total number of cars in the world. 24 out of the 25 current EV car brands are using QNX (guess who the outlier is?).

A car runs plenty of different software at any given time. From the software that controls the mirrors to the software that controls the GPS, the tire pressure, etc. BlackBerry’s is the operating system behind it all- think how you run a bunch of different software on Windows.

Whereas there’s little competition in the car OS segment, the cybersecurity segment is dominated by well-known companies such as CrowdStrike. But CrowdStrike as been growing its revenue every single year whereas BlackBerry’s revenue growth has been anemic.

How does it make money?

The company makes money by charging royalties to its clients through a Software-as-a-Service (SaaS) model, and also by charging for services as they’re performed.

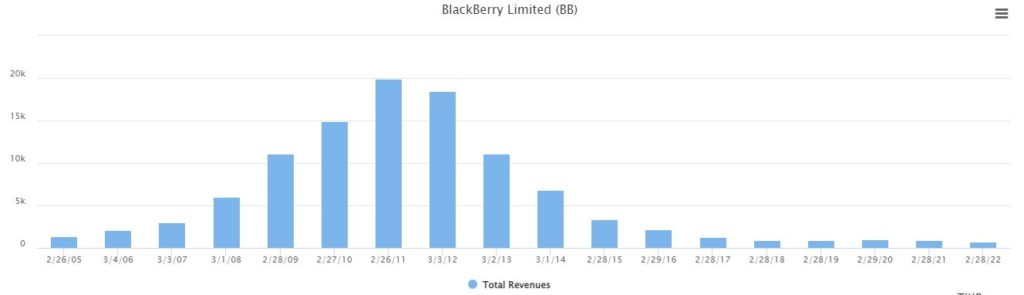

When I look at BlackBerry’s financials I feel an urge to look away.

But this is how looking at turnarounds should feel like. The trick with turnarounds is to buy them before they turn or before the market gives them credit for it.

Is it a great business?

The business has been turning around for the past 8 years and it’s a B2B software company which makes it hard to understand the product’s value proposition, but I guess that the car OEM’s wouldn’t trust any company with their cars, right?

The truth is, I don’t know if this is a great business or not. So far, it hasn’t been a great business, but it could be brewing.

Where is the business heading to?

Cars are becoming smartphones with wheels. And BlackBerry’s software is perfectly positioned to become the backbone of the auto industry in the next couple of decades. Not only that, but the company also provides software for a wide range of endpoints (fridges, industrial machinery, laptops, etc). With everything becoming connected to the internet, it’s easy to imagine that this segment has a long runway ahead of it.

The company recently launched BlackBerry Ivy, its solution for connected cars. It will allow for a whole host of apps to be developed and sold to the users, insurance companies, vehicle maintenance providers, and other interested parties. The car will allow us to do a bunch of stuff in the future and it will be a profit generator for many businesses through software.

It’s harder to read the leaves for the Cyber Security segment, but the company has been making important investments and my feeling is that this is also a growing industry.

Is it inside my circle of competence?

Unfortunately, BlackBerry is well outside my circle of competence. Yes, I recognize the potential of it all, but I don’t really understand even the most basic technology that the company offers.

Are there signs that it’s undervalued?

As I don’t understand the business, I wouldn’t know.

Palantir

With a name that could’ve come out of the Lord of the Rings, Palantir is the most incredible company you never heard of.

What does the company do?

The way Palantir’s software works is, I guess, it reproduces the physical infrastructure of the real world in a digital world. It creates digital twins of real world assets and uses that virtual world to optimize stuff in the real world.

For example, companies can have a digital representation of their fleet of vehicles that will be fed data from sensors in a real car. The system will learn from that data, and it will be able to suggest optimization choices such as delaying maintenance repairs. This is a very basic example, but it quickly gets complicated, and scary. The software can even perform war simulations.

How does it make money?

The company sells its software to private companies and Government agencies. It combines the resilience of a defense company with the growth of a software business.

The truth is that the software seems to be so complicated that the company’s engineers had to spend looonggg periods of time adapting it to their customer’s specific requirements. A few years before going public (and probably to please Mr. Market), there was a shift to a more software like model where the company is beginning to have off-the-shelf products that can be easily sold and deployed.

Is it a great business?

Although I don’t understand everything that the software does, I don’t have doubts that this might be a great business.

The problem is that a lot of companies claim to be Big data leaders, but as far as I know, this isn’t quite so simple. Big data is messy because the real world is messy. If one thinks that it’s as easy as filtering real life through a set of algorithms and have it presented on a clean dashboard, think again. There’s all sorts of complications so, just like with BlackBerry, it’s hard to say if this is a great business or not. So far it has been losing money, but if it works, it could become one of the stickiest products in the world. Also just like with BlackBerry, if a bunch of Governmental agencies trust Palantir with their operations, they must be doing something right.

Where is the business heading to?

As the company productizes its services, the result should be faster and easier customer adoption.

It’s software is composed of hundreds of component parts, each of which can be sold as a standalone product. That’s what they’re doing.

Palantir has the potential to take over the world. Soon, companies won’t be building whatever they’re planning on building without first simulating it on Palantir’s software. At least in theory.

Is it inside my circle of competence?

For now, Palantir is way outside my circle of competence. But I’ll want to know more about the company so I’ll be following it from afar.

Are there signs that it’s undervalued?

As with BlackBerry, I have no doubt that I’ll be hearing about Palantir in the future. Right now the company is worth $16 billion and if you were to tell me that it will be worth 3 Trillion in a few years, I wouldn’t be surprised.

But I have no way to judge their software quality or what they claim to achieve, so it’s a NO for me right now.

Iteris

Iteris is that microcap company that could easily be bought by either BlackBerry, Palantir, or Google.

What does the company do?

Iteris makes and operates roadway sensors to help ensure roads are safe. Traffic congestion and road deaths are a big headache for cities. Iteris helps alleviate the traffic by connecting the traffic lights to Artificial Intelligence that will make adjustments in real time to the timing of the traffic lights. For example, if it senses that a car will have trouble stopping at a red light, the system will keep the greenlight on for a few seconds more so that car will go through the crossroads safely.

How does it make money?

The company earns revenue by selling the hardware as a one time purchase and also by selling the software and services on a recurring basis as a Software as a Service (SaaS). I think one could call it Infrastructure as a Service.

Is it a great business?

Smart intersections are the future that is already here. The more traffic lights in the system, the more valuable the system is as it becomes better at predicting and reacting to the real world.

Once Iteris gets into a city it’s hard to replace it as municipalities won’t be risking a perfectly functioning system for a less known system just to save a few bucks.

So yes, this can become a great business. For now, they’re still losing money, but I guess that’s because the company is still on its growth phase.

Where is the business heading to?

Biden’s infrastructure bill may come as a tailwind for the company as $1.2 Trillion will be spent on infrastructure.

A couple of years ago, the company hired an Investment Bank to look for “strategic alternatives”, meaning that the management was looking to find a buyer for the business. But then the buyer came, offered $8 per share, and they didn’t sell. The share price is currently $2,66. That buyer was their competitor, Rekor. This goes to show how hard it is for Rekor to build a competing network on its own.

Is it inside my circle of competence?

Given the company’s lack of profitability over the years, I would need to really dig deep into the industry’s fundamentals to understand if this could really become a good investment or not, but, compared to the previous two companies, Iteris seems way easier to understand.

Are there signs that it’s undervalued?

A way to value a company is to figure out what an informed buyer would pay for it and then pay a lot less.

Well, we already know how much an informed buyer would pay for it – $8 per share. So, I guess that, from that point of view, the current $2,66 is a steal. It wouldn’t surprise me to see Iteris being bought by a larger company. Imagine having Waze or Google Maps connected to the traffic lights.

FICO

FICO is the diamond every investor is looking for.

What does the company do?

The company is known for its FICO Score, a 3-digit rating that scores a customer’s propensity to repay debt (credit risk). The FICO score is the standard measure of consumer risk in the US. Every player in the industry depends on FICO’s rating to run their businesses. It’s like the Moody’s or Standard and Poor’s, but instead of rating companies and countries, it rates individual people.

How does it make money?

FICO is a royalty business. It buys data from the Credit Reference Agencies – Equifax, Experian, and TransUnion – runs that data through its algorithm to generate the rating, and then sells the rating back to the CRA’s who will sell it to financial institutions like banks and insurance companies. It’s estimated that each score is sold for around $5. That’s what we want to be seeing: a mission critical step that is cheap enough for the customers so they won’t be thinking of switching providers.

Is it a great business?

This is a resounding YES. This is one of those great businesses that I would like to own and it will go to my recently created watchlist (I’ll be publishing it soon).

It’s interesting to see that, in theory, the CRA’s could just build their own algorithm and replace FICO’s scoring system. And they have, but it hasn’t gained much traction. FICO is still the industry’s standard.

Where is the business heading to?

The business is expanding internationally and also teaming up with tech companies to be able to source more data points from players other than the CRA’s.

Is it inside my circle of competence?

I believe I can understand it well after I research it.

Right now, the biggest risk I see is regulatory risk. The company is a monopoly and there is the likelihood that FHFA makes life more difficult to FICO and easier for new entrants.

Are there signs that it’s undervalued?

Fico’s PE ratio has ranged from 7x in 2009 to 70x in 2018. It currently stands at 26x. Although this might be very cheap for such a business, I would like it to be more of a no-brainer than it is now. What would that look like? I dunno, maybe 17x earnings?

America's Car-Mart

America’s Car-Mart is one of those businesses that bores you to death, but one that has delivered a 13% annualized return for its shareholders over the past 20 years.

What does the company do?

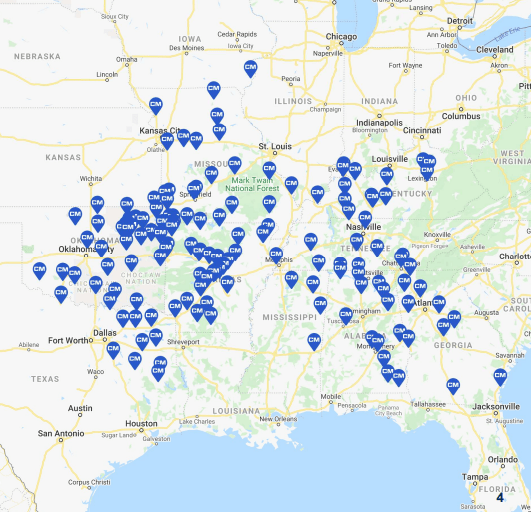

The company sells used cars through its 151 dealerships. Not only that, but it also offers financing for its customers to purchase those cars. Most of its customers are rated sub-prime by FICO.

America’s Car-Mart focuses mostly on cities with a population lower than 50.000. It’s often the only or one of the few car dealerships in town.

How does it make money?

The company makes money by selling cheap cars ($13k per car) and by collecting a 15-20% interest rate on the loans.

Is it a great business?

It does good in any economic environment, but it’s not a great business.

In fact, I recently invested in an auto dealership in the UK. It was trading at a price below the book value of the assets (nice margin of safety). That isn’t the case here since America’s Car-Mart leases most of its locations.

This reminds me of Credit Acceptance, an amazing company that has been rewarding shareholders very well over the past 30 years. If I were to look deeper at America’s Car-Mart I would have to look at Credit Acceptance first.

It’s interesting that in an economic downturn, the more consumers default on their loans, but the more consumers fall into this last bucket of sub-prime buyers so I guess one offsets the other.

Where is the business heading to?

They’ll keep doing what they’ve always been doing: expanding their footprint by acquiring smaller competitors, and buying back shares.

Is it inside my circle of competence?

With a little research, I could understand it well.

Are there signs that it’s undervalued?

It was very cheap until very recently. Is it still cheap today? Well, yes, but not as ridiculously cheap as before.

There were 3 times in its history when the company was trading at a Price/Earnings multiple of 5x. During the Great Financial Crisis of 2008/09; in 2020 during the COVID19 crash; and on the past Monday. On Tuesday the company posted results, which were much better than expected, leading to the recent share price appreciation. Could it double from here? Yes, it could. But for most of its life America’s Car-Mart has been trading in a range between 10x earnings and 15x earnings. Yes, this has proven to be low because the stock outperformed the market, but it isn’t a screaming buy now.

Conclusion

BlackBerry and Palantir, though clearly companies for the next century, are way outside of my circle of competence so I won’t be losing much time on them.

Car-Mart was obviously a miss. I’m late to the game. It isn’t a business that I would like to own for the long run, but just as a “reversion to the mean” play – buy it when it’s out of favour and sell it when it gets fairly priced by Mr. Market.

Iteris is interesting and I’ll be doing some more research behind the curtains, but for now, it isn’t a no-brainer.

FICO is the one that I’m interested about. This has “monopoly” written all over it. Great business, great moat, some regulatory risk, but amazing returns on capital. It doesn’t look cheap, but who knows, some day it might be.

I encourage you to give me your opinion on the Forum by clicking one of the following names:

BlackBerry, Palantir, Iteris, FICO, America’s Car-Mart.

And please, don’t forget to give me your opinion below.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.