Quick Opinions #3

NVR, Costco, Trigano, Thor

By Manuel Maurício

June 17, 2022

This week I’ve been reading about a few businesses and it’s funny to see the trends shifting from high growth tech businesses to good old cyclical businesses. Or maybe it’s just me.

Today I’m writing about a homebuilder (NVR), two recreational vehicle manufacturers (Trigano and Thor), and Costco.

NVR

How many companies do you know that have compounded at 21% over 22 years? Not many, right? Old boring NVR is one of those.

What does the company do?

NVR is a homebuilder from the USA. The company targets the first-time homeowner and first-time move-up buyers.

How does it make money?

NVR makes money mostly by building and selling houses. To a lesser extent, it also makes money from mortgage origination (it originates the mortgage loan and sells it to other financial entities to bear the risk).

But unlike traditional homebuilders, NVR doesn’t own and develop the land. Instead, it pays the land developers (who will build the roads and all the infrastructure) a fee (typically 10% of the value of the land) for the option to buy the land in the future. If the company chooses not to proceed with the purchase of the land, it will only lose the 10% deposit. In financial lingo, NVR buys “call options” on the land.

In the construction business, you’re just a few bad development decisions away from being in real trouble so, through this ingenious model, NVR avoids the financial requirements and risks associated with land ownership and land development.

On top of that, the company pre-sells the homes before the construction starts so most of the risk typically associated with the construction is mitigated.

This means that NVR has a much healthier balance sheet than its competitors.

Is it a great business?

Although homebuilding is obviously a cyclical industry, the land light model allows the company to work with less capital, thereby enhancing the returns on invested capital.

In fact, the company has been profitable even in the lows of the Great Financial Crisis of 2008/09 (unlike its competitors Lennar and Toll Brothers).

Where is the business heading to?

There is a serious lack of home inventory supply in the USA. Until recently, there was this idea that younger generations favored experiences (like travel) to the detriment of homebuying. I don’t argue about that, but the pandemic seems to have changed the picture in favor of home ownership. In fact, homebuilders in the US have never seen such high demand as currently. Now, more than ever, people want to live in detached houses with a garden.

So the company will keep doing what it has been doing for the past few decades: building houses and using the Free Cash Flow to repurchase shares.

How inside or outside my circle of competence is?

On a high-level basis, this is a business that is easy to understand, but I get the feeling that I would need to spend many hours understanding the US housing market as well as the company’s performance during the Great Financial Crisis before I could say that I really understand the business.

Are there signs that it’s undervalued?

Given my lack of deep knowledge on the industry, trying to figure out if the stock is undervalued is an exercise in futility, but ever since 2007 – which is as far back as my data goes – the company has never been cheaper on a PE multiple basis – currently at 7.7x. Of course, everyone is thinking that the current boom won’t last.

Conclusion

NVR appears to be a great business in a cyclical industry. But don’t expect to see gains overnight. This one is a boring compounder that will likely test the patience of most investors out there. As mentioned previously, to consider adding it to the Portfolio, I would have to dig deeper into the sector.

COSTCO

Most hardcore stock investors know about Costco.

What does the company do?

Costco is USA’s second-largest retailer behind Walmart.

How does it make money?

This is where it gets interesting. Costco is a one-of-a-kind business.

Instead of carrying thousands of SKU’s (Stock Keeping Units) just like most retailers, Costco limits its inventory to just 4 thousand SKU’s (Walmart keeps 120.000 SKU’s). Because Costco buys massive amounts of just a few products, it has huge bargaining power with its suppliers leading to a low cost of goods sold. Costco will then sell the products with a 14% mark-up. If Costco is able to buy, say, a mayonnaise jar for a lower price than last month, it will still mark it up at just 14% thus passing the discount to its customers. And the customers love that.

But how does a 14% mark-up allow Costco to be profitable when all the other retailers have a much higher gross margin (13% for Costco vs 25% for Walmart)? It doesn’t actually make money selling goods. After paying salaries, distribution, and warehouses, the 14% is just enough to break even. That’s where the brilliance of the model kicks in.

Costco makes money through its subscription business. To buy at Costco and gain access to the discounted prices, you need to become a member. And to become a member you need to pay a $60 annual subscription fee. And that fee is virtually all profit. Smart, hein?

In 2020, there were more than 50 million Costco members. That’s $3 billion in subscription fees alone.

Costco is a subscription business disguised as a low-margin retailer.

The beauty of this is that, because Costco feels no pressure to make money from the products it sells, it can offer lower prices than the competition, thus attracting new customers, thus gaining even more scale to negotiate with its suppliers, thus lowering prices even more which attracts more customers. This virtuous cycle is what the famous investor Nick Sleep called “Economies of scale shared”. It works so well that it was the source of inspiration for Amazon Prime.

On top of this there’s Costco’s own private label, Kirkland, which is considered to be the best brand across many products. Obviously, it has a higher margin and it contributes for customers to keep coming back to Costco.

Is it a great business?

Costco is one of the best businesses in the world.

Where is the business heading?

Costco will keep doing what it has been doing so far. Offering the best quality at lower prices while expanding into other countries. Take China for example. Apparently, Chinese people love Costco and there are just 2 stores in the country yet.

How inside or outside my circle of competence is?

Costco is a ver simple business to understand (as most retailers are).

Are there signs that it’s undervalued?

The stock has traded as low as 13x earnings in 2009 and as high as 49x in 2021. It now stands at 35x definitely influenced by the acknowledgment by the investing community that this is a very high-quality business. At these levels, I don’t see a clear undervaluation.

A fellow investor said that Costco is like an equity bond, yielding 3% and growing 7% per year. That’s clearly not what I’m looking for.

Conclusion

Costco is a great business to keep an eye on. I would like to buy it when there’s a selloff, but I doubt that will ever happen.

Trigano

Being a camping lover myself, the other day I went camping with my girlfriend to a small beach location in the south of Portugal called Vila Nova de Mil Fontes . On our first night we slept in a tent. On the next morning my back hurt so much that I decided to spend the second night in a bungalow – which was basically a towable home. And contrary to my prior belief, I liked it. I can see the allure of bringing your own home with you on holidays.

What does the company do?

Trigano is an European manufacturer of recreational vehicles (motorhomes, campervans). It buys the chassis from the OEM’s (Fiat, Ford, Mercedes, etc), and then it builds a small plywood house on top of it. After watching the video below I can’t help but to think that these things aren’t that safe in the case of a crash.

How does it make money?

This one is fairly straightforward, the company makes money by selling the recreational vehicles to specialized distributors. Depending on the country, the company might own its distribution channel as was the goal with the recent acquisition of 3 distributors in France.

Is it a great business?

There’s no way around it, motorhomes and recreational vehicles are big-ticket discretionary products. This means that the industry is cyclical, which in turn means that returns go up and down with the economic cycle. So… it’s an OK business.

Where is the business heading to?

Right now the company is seeing two different trends. The first is that demand is at all-time highs. The second is that the car manufacturers aren’t delivering enough chassis.

Even with the addition of 2 new manufacturing plants in Italy and Slovenia, the management says that demand is outpacing production capacity. They estimate a loss of production volume of 3.000 to 4.000 vehicles in comparison with the 52.600 sold last year. The way Trigano has solved this was by raising prices.

But that’s in the short run. In the long run, I expect the company to make use of its strong balance sheet to make acquisitions and further consolidate the market.

The rest of the cash… well, the management has favored dividends over buybacks, which for me is a turn-off. Surprisingly to some readers who know that I like founder-led companies, the fact that the Feuillet family controls 58% of the shares is a negative because it means that there can be no shake-up from outside investors looking to improve the capital allocation.

How inside or outside my circle of competence is?

Manufacturers of recreational vehicles are easy to understand. The fact that this is somewhat of a commoditized product means that I would have to research a few of its competitors (which I am doing below), but it isn’t rocket science.

Are there signs that it’s undervalued?

At 8x earnings, Mr. Market seems to be expecting the current big profits to come down, especially if we think that motorhomes run on gasoline and diesel, which are going up very quickly in price.

Because this is a cyclical industry, a good way to think of valuation is to estimate the mid-cycle profits, apply a multiple of 10x (equivalent to a yield of 10%) and demand a margin of safety, maybe 30%? I estimate the mid-cycle profit to be around €100 million which would mean Earnings-per-share of $5. That means that I would be willing to buy this stock at around $35.

Conclusion

As the stock price is currently above €100, I’m not interested in owning Trigano (even if we see a few more years of increased demand).

Thor Industries

So if I think that Trigano is in the top part of its cycle, why am I looking at Thor, the largest manufacturer of RV’s in the World?

What does the company do?

Although similar to Trigano, there’s a fundamental difference between Europe and the US. In the US, because people love their pick up trucks, the towable vehicles sell much more than the motorhomes. In Europe the opposite is true.

How does it make money?

It makes money by manufacturing and selling RV’s to independent dealerships.

Is it a great business?

Just like with Trigano, Thor Industries is in a cyclical industry, but within that industry, it appears to be the best company. Thor has never lost money. Not even during the Great Financial Crisis. The company seems to be able to adapt its workforce and costs to the overall economy.

As an aside, Thor largest competitor in the US, Forest River, is owned by Berkshire Hathaway.

Where is the business heading to?

Seeing the US market stagnated (prior to the pandemic), the company aimed its eyes at the European market. In 2019 the company bought Hymer, the historical European RV brand, for $1.7 billion. Some say that this was an expensive acquisition at the top of the cycle. I can understand that.

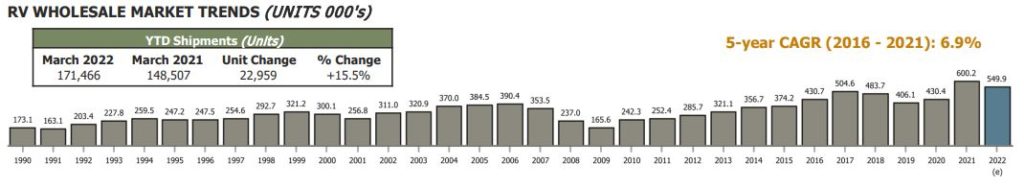

And just like with Trigano, Thor is seeing major demand for its products. The backlog is at all-time-highs while the dealers’ inventories are at all-time-lows.

As illustrated by the Hymer example, Thor also grows by acquisitions. And while Trigano seems to be going downstream by buying distributors, Thor has recently bought a parts businesses, hinting at a strategy of going upstream.

Unfortunately, Thor also distributes dividends instead of repurchasing shares.

Are there signs that it’s undervalued?

At a Price/Earnings multiple of 4x, the stock looks cheap. But this might be the classic trap that unexperienced investors fall into. A lot of demand was pulled forward, meaning that the company is overearning and Mr. Market is already discounting future declines in profits so it attributes a low PE ratio to the stock.

I estimate a mid-cycle profit of $330 million. This would mean Earnings-per-share of $6. That means that I would be willing to buy this stock at around $42. It’s trading for $71.

Conclusion

I would say that, due to its lower reliance on motorhome sales, Thor Industries is in a better place right now. It’s apparently cheap, but I have little doubt that we’re near the top of the cycle. No, I’m not saying that it’s downhill from here since the pandemic has come to shake things and maybe contribute to higher long-term demand. But still, Thor has never sold as many RV’s as today.

Conclusion

It looks like some areas of the market are signaling a significant downturn going forward.

NVR, Trigano, Thor, Crocs, GoPro, HP are all trading at single digit multiples. Don’t tell me that there aren’t plenty of investment opportunities out there.

In fact, there are so many “trends” that interest me that I don’t really know what I’ll be researching next week. Apart from HP, I would like to dig deeper into NVR and the home builders, and I would also like to look into copper and tin. Yes, commodities. Not very fashionable, I know.

Well, I’m always open to suggestions. If you’d like my opinion on some stock, just let me know on the Forum as some of you already have.

As always, I encourage you to fill out the survey below (it’s anonymous) to help me make the subscription better for you.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.