Quick Opinions #4

Dino Polska, Copart, Heico, Site One

By Manuel Maurício

July 08, 2022

For the past couple of weeks, I’ve been working double shifts in preparation for the Masterclass that will mark the launch of the All in Stocks Investing Course. If you’d like to learn more about how to value stocks, you can register here. It will be on the 20th of July at 19:00 (Portuguese time).

All of this preparation has kept me away from looking at new businesses. Luckily, João Fernandes and Diogo Perneta gave me a little help by suggesting a few companies. Thank you, guys. Your suggestions couldn’t have come at a better time.

Dino Polska

We’ll begin with a European company for a change.

What does the company do?

Dino Polska is a proximity supermarket chain from Poland. If I had to define Dino’s concept in a sentence it would be “Keep it simple”. The company sells basic food products and its stores are as simple and standardized as they come. They are typically located in low-density regions where competition from the big discounters is reduced. In fact, the populations in these low-density areas are so reduced that it’s uneconomical for the big store formats to play there.

How does it make money?

Just like any other supermarket, Dino makes money by selling food and consumer product goods. By keeping it simple and vertically integrating all of the meat it sells (the founder’s family was in the meat business before he started the company), Dino can offer attractive prices, usually reserved to the big discounters. The company builds and owns its own stores, which allows it to get better margins than if it leased the stores.

Is it a great business?

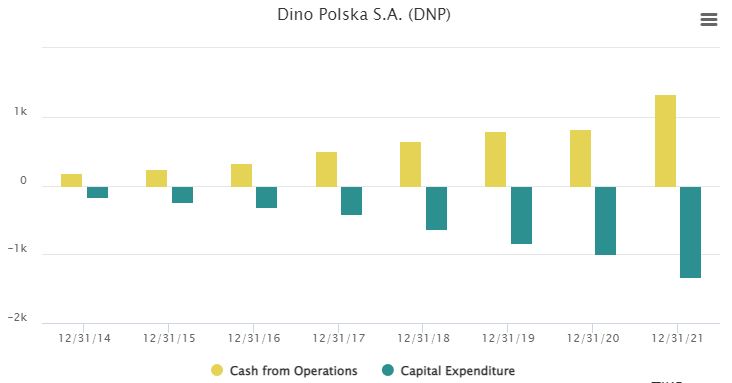

It took me less than 1 minute to realize that I like the business. I opened Tikr.com, saw the meteoric rising trend in sales, rising margins, stable number of shares outstanding, conservative debt profile (decreasing over the years), but what got my attention was the huge amount of money that the company is investing. The capital expenditures match (or even exceed) the cash generated from operations in every single year.

I applaud this as Dino’s Return on Capital has gone from 13% in 2014 to 23% in 2021. This means that every new dollar (or Zloty) invested in the business is more profitable than the previous one. So to answer the question, yes, this looks like a great business.

Other signs that back this up are the consistent doube-digit Same-Store-Sales growth over the cycle and the fact that the company hasn’t closed a store since 2007 (not usual for supermarket chains).

It was a delight to read Dino’s presentation. They mention all the right metrics and focus on all the right things.

Where is the business heading to?

The proximity supermarkets are usually smaller than those of the big discounters and with lower SKU’s (5.000 for Dino).

In its 2017 presentation, the company offers a compelling view of how the demographic trends in Poland are a tailwind for the company. That’s also the reason why the Portuguese company Jerónimo Martins expanded into Poland with the acquisition of Dino’s largest competitor Biedronka.

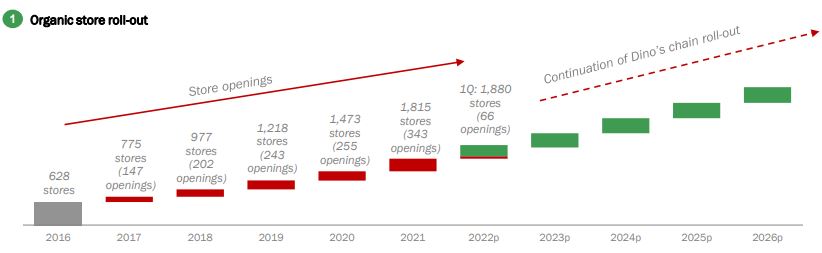

In 2017, the management was planning on getting 1,200 stores by 2020. It got 1,473 instead.

Going forward, the management wants to keep doing what it has been doing. Opening more stores and getting better margins.

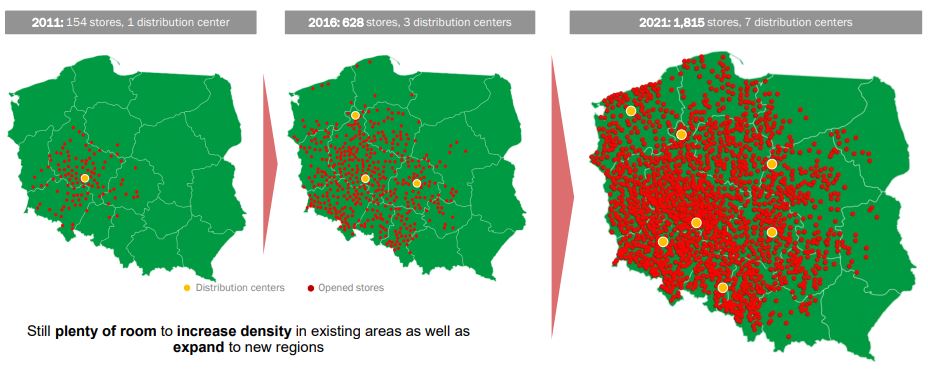

By looking at the image above one might be fooled into thinking that the opportunities for growth inside of Poland are reduced. But according to the management, that’s not true. The company still feels that there is a big runway for growth as is exemplified by the chart below.

How inside or outside my circle of competence is?

As I’ve said in prior stances, retail concepts are easy to understand, but in the case of supermarkets, one must tread carefully as this is one of the most competitive industries in the world.

Are there signs that it’s undervalued?

With the benefit of hindsight, I wish I had read Dino’s presentation back in 2017 when it was trading at a Price/Earnings ratio of 25x.

But of course, the attractiveness of such a business hasn’t gone unnoticed by the market. For most of its history, the stock has been trading at a Price/Earnings ratio above 35x with some extended periods above 40x.

Conclusion

Right now, the company is trading at about 30x earnings. Not a clear bargain. But this apparently high multiple might be deceiving. The proper way to do this would be to estimate the company’s number of stores 5 years from now, calculate the profits as if all the stores were mature, apply a conservative multiple to those profits and then calculate the rate of return. But to do that one must first learn more about Dino’s competitors. I’ll be doing that soon.

CoPart

I’ve talked about Copart before on the podcast Ações & Companhia after reading an article by Chris Mayer on the competitive advantage of owning land.

What does the company do?

When a car is too old or has been in an accident, owners can 1) break it apart and sell the parts, 2) repair it, or 3) salvage it. This is where Copart comes in. Copart operates online salvage car auctions.

How does it make money?

Not only does Copart operate the auctions, but it also owns the yards where the cars are kept. And what yards these are.

Copart works mostly on an agency model, meaning that most of the time Copart will make money through auction fees (vehicle purchasing fee, listing fee, selling fee, transportation fee, storage fee, etc). Basically, it’s an online two-sided marketplace with a physical presence.

In a minority of the cases (10%), especially in the UK, Copart will work on a “principal” model where it buys the car from the previous owner and sells it to the new owner.

Just so you get a sense of the scale of this business, Copart remarkets over 3 million cars a year.

Most of the vehicle sellers are insurance companies accounting for 80% of the cars, with the remainder distributed by banks, charities, dealers, and individuals. The vehicles sold are damaged or have been stolen and consequently recovered for which an insurance settlement with the vehicle owner had already been made.

Some of the cars go on to being restored and back to the roads, but most will be bought by dismantlers, who will recycle and refurbish parts for vehicle repair. A tiny portion will be scrapped.

I found it interesting to learn that, although the majority of the auctions performed by Copart are in the US, the majority of the cars is exported around the world, as lesser damaged vehicles are attractive to foreign demand.

The company also owns ProQuote, a software that allows for insurance carriers to estimate the value of damaged vehicles.

Is it a great business?

Every business that presents a chart of its 10 year Return on Invested Capital on its investor’s presentation is likely to be a good business. Copart is one of them.

By performing the auction online, the company eliminates the expenses and capital requirements associated with performing live auctions.

Copart isn’t a monopoly, but it’s very hard to compete with as acquiring all the land would require huge amounts of capital, and leasing it would cost too much.

Another data point that speaks about the quality of this business is the positive Same-Store-Sales growth in every year since 2005 (with the exception of 2009).

“As long as we’ve got the land in the right place to put the cars on, we can’t fail. We are like the septic tanks of the sewer system. You can’t have the system without us.” Copart founder – Willis Johnson.

Where is the business heading to?

I had this perception that cars today are much safer than before and that should reduce the number of crashes thus reducing Copart’s potential business. But the truth is that the more technologically advanced cars become, the costlier it is to repair them (think adaptative headlights, computer and navigation systems, cameras, lane departure warning systems, etc). That means that, contrary to what I thought, Copart’s addressable market is increasing, not declining.

Not only that, but the average age of cars on US roads has been trending up. This is good for Copart.

So, the company will keep doing what it has been doing so far, acquiring car yards in key markets, including foreign markets; attracting more sellers; increasing the range of services it offers; and expanding the software into new markets.

How inside or outside my circle of competence is?

Copart is still outside of my circle of competence, but I don’t see why I couldn’t understand it well after a bit of research.

Are there signs that it’s undervalued?

Well… it depends. The stock is currently trading at 23 times earnings, which should be overstated by the pandemic. Just recently, it traded at 45x earnings! Oh, the perils of paying too much!

23x earnings might actually be cheap. Of course, I would like to have bought in that period between 2009 and 2016 when it was trading below 20x earnings.

Copart Conclusion

While reading the Risks section on the Annual Report, I haven’t seen a critical risk. This looks like a very resilient business. As I think more about it, I guess that if the software fails or gets hacked, that will be a major disruption.

Copart’s business has a lot of specific metrics and dynamics. I couldn’t possibly understand them all in such a short time. This is certainly one of those businesses that deserve a deep dive.

I am not interested in buying Copart at these prices (at least not right now), but I could almost bet that investors buying Copart today and holding it for many years will do very well.

If you ask me what would a good price be to buy the stock…. I guess if it traded under 20x earnings I would consider it.

Site One Landscape Supply

Another simple business.

What does the company do?

Site One is the largest distributor of landscape supplies (think irrigation systems, fertilizers, trees and shrubs).

Site One reminds me of Pool Corp. in the sense that there are real scale advantages to this business.

The business plays a crucial role in helping both sides of the equation. Manufacturers and suppliers are typically focused on shipping bulk quantities from only a few locations. But most customers just need a few items from each SKU to complete their projects. With its widespread store footprint, SiteOne makes that bridge between supplier and customer.

How does it make money?

SiteOne sells mostly to contractors and professionals. I remember that only 15% of Pool Corp’s revenue was coming from the construction of new homes with the other 85% coming from refurbishment and maintenance. SiteOne has 36% of its revenue coming from new construction. In that sense, this is a worse business.

Is it a great business?

Although SiteOne has a higher gross margin than Pool, the operating margin is nearly half. This suggests a heavier operation or lack of cost control. I would need to dig deeper to understand its distribution model.

This lower margin leads to lower returns on invested capital, also half of what Pool gets. All of this leads me to conclude that, right now, SiteOne is a worse business than Pool.

Where is the business heading to?

The management estimates that they have a 15% share of a $23bn market, with the remaining 85% being local or regional competitors. They believe that they can expand market share up to 40% both organically and through acquisitions. The company is an acquisition machine.

How inside or outside my circle of competence is?

Just like with CoPart, I could understand this business better with a little more research.

Are there signs that it’s undervalued?

I researched SiteOne for a few hours without looking at its valuation. Until now. And I’m surprised. The stock is currently trading at a Price/Earnings of 21x or a yield of 4%. I’m not saying that it’s cheap, but it has never been cheaper.

Conclusion

Site One is easy to understand, it has a decent moat, but surprisingly, that moat hasn’t led to high returns on capital. For that reason, Site One gets a NO from me.

Heico

And we end with a business that I had heard about, but that it’s completely surprising to me.

What does the company do?

Heico operates under 2 segments: Flight Support, and Electronic Technologies.

The Flight Support segment is Heico’s legacy business. The company designs, manufactures, and repairs jet engines and aircraft replacement parts. They’re called PMA’s (Parts Manufacturer Approval). Basically, the company is a supplier of generic parts for the aviation industry. I make it sound very simple, but it isn’t. It’s very hard to get to where Heico is. It takes years of building trust with the airlines, the regulators, and also with Boeing and Airbus as Heico also manufactures parts for them.

In the Electronic Technologies segment, the company designs and manufactures a whole set of products such as infrared missile simulation, laser systems, satellite components, and much, much more.

How does it make money?

52% of the revenue comes from the Flight Support segment, but only 36% of the Operating Income comes from this line of business. The Electronic Technologies segment is the most profitable one and is also growing the fastest.

Is it a great business?

It’s no doubt a very resilient and good business. It’s also very conservatively financed. They could raise some debt to increase shareholders’ returns.

Where is the business heading to?

The company keeps introducing new products on a regular basis, both by developing them themselves and also by acquiring other competitors.

The management understands that they can’t be just another commodity parts supplier. That’s why they’ve been getting more and more integrated into the airline’s decisions of where to source their parts from, selling a solution, quality, price, time to market, repair, and maintenance. In fact, it’s the repair and maintenance that is shaping Heico’s future.

There is an added advantage to also becoming an MRO (Maintenance, Repair, and Operations) as the airlines might not have the people to perform the maintenance. The company that does the repair on the aircraft will have more of an advantage to introduce its own parts.

Unlike some of its competitors (Transdigm being a notable one), Heico’s management team has kept a very sound balance sheet, which will help it grow by acquisitions or endure difficult periods when they come.

How inside or outside my circle of competence is?

Right now, this business is well outside my circle of competence.

To understand Heico, one must understand the entire ecosystem composed of the OEM’s (Boeing and Airbus), the Airlines, the lessors (especially Aercap who doesn’t want any PMA parts on its planes), the MRO’s, and the competitors. So, it’s not as easy as it might seem at first. That’s why I don’t yet have a strong opinion on the business.

Are there signs that it’s undervalued?

At a Price/Earnings ratio of 46x, no, I don’t see any signs that this business is undervalued.

Conclusion

I tend not to be comfortable investing in these conglomerates. I’m not really sure why. Maybe my brain just doesn’t grasp all the segments and markets they’re in. Or maybe it’s because when I get to know them, they’re already so big (like 3M) and so expensive that I don’t find the price inefficiencies that I’m looking for.

Conclusion

I’ve got to thank João Fernandes and Diogo Perneta for introducing me to such great businesses. With the information that I have today, I think Copart might be the more resilient business and Dino Polska the most attractive to me. I didn’t like SiteOne all that much, and Heico is too far out of my circle of competence currently.

If you like this Quick Opinions format and want to get my opinion on a business that you like, let me know here.

As always, I encourage you to fill out the survey below to help me make the subscription better for you (it’s anonymous).

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.