Quick Opinions #7

FTI, Silgan, SomnoMed, Adobe

Quick Opinions #7

FTI, Silgan, SomnoMed, Adobe

By Manuel Maurício

August 19, 2022

FTI Consulting

After finding out that the consulting firm Accenture had a stock price trajectory like this…

I started paying more attention to consulting businesses. And you know what? I recently came to know FTI Consulting.

Promising chart, right?

I actually don’t know why I’m looking at this company. I had a tab on my browser with the stock chart so I decided to look into it and see what I could find.

What does the company do?

FTI is a consulting company working in 5 segments: Forensic and Litigation; Corporate finance and restructuring; Economic consulting; Technology; and Strategic communications. So, a lot of stuff happening under one roof.

How does it make money?

Just like with all other consulting businesses, FTI makes money by renting its employees time at a higher rate than what it pays them😉.

Now seriously, as the company does a lot of things its revenue will be affected by a multitude of factors.

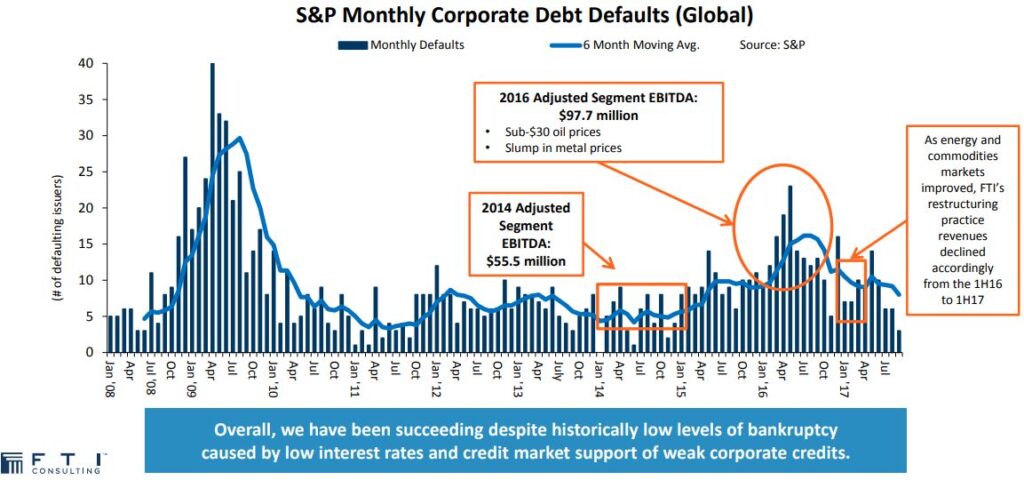

On the company’s presentation there was one slide in particular that caught my attention – the number of defaults on corporate debt since 2008.

Just take a look at the sentence at the bottom.

So…. the more defaults, the more the company earns. At least, on its Corporate Finance and Restructuring segment. And defaults tend to go up when interest rates are going up. That’s the case now. So there’s some counter-cyclicality to FTI’s revenue, which I like.

Is it a great business?

I’m still not sure about it. These companies grow their revenue by growing their headcount. And that doesn’t require a lot of capital. They just need to buy a desk and a computer every time an employee joins the company. But growing revenue in this way is slow. That’s why these companies do Mergers and Acquisitions – to rapidly increase the number of consultants. And M&A has historically been a destroyer of value for shareholders.

Managers are usually incentivized to grow revenue, but not Return-on-Invested-Capital. So you need to watch out for this whenever you look at consulting companies as it’s easy to make bad acquisitions just to earn your annual bonus.

Where is the business heading to?

Given the broad scope of work that the company performs, it’s not clear to me what their strategy is. But one thing I know: The management isn’t making M&A just for the sake of growth. They’ve been disciplined about it and they’ve even bought back shares instead. I applaud that.

How inside or outside my circle of competence is it?

Right now, consultancy companies are well outside of my circle of competence.

Are there signs that it’s undervalued?

Given what I’ve just mentioned, it’s hard for me to know what undervalued means in an industry that I know little about, but from its historical PE ratio, at 22x earnings, I wouldn’t say that it’s undervalued.

Conclusion

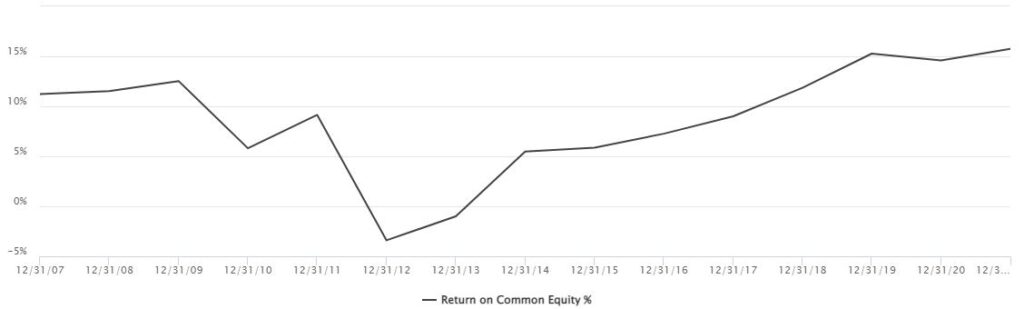

I’m not interested in FTI Consulting right now, but I note that its rising Return-on-Equity suggests that, maybe, I should be looking into it a bit deeper.

Silgan Holdings

I’ve been wanting to do an industry breakdown for plastic packaging companies ever since I bought Berry Global for the Portfolio. I will do it in the second half of the year. But in the meantime I decided to drop an eye on Silgan Holdings.

What does the company do?

The company operates in 2 major segments. Metal cans for the food industry (mostly pet food), and closures for the home and personal care industry. To a smaller extent, it also manufactures plastic containers just like Berry Global.

How does it make money?

Nothing new here, the company makes money by selling the cans and closures. The closures have higher margins than the cans.

Is it a great business?

No, this is not a great business. It’s an OK business with some defensive characteristics.

Where is the business heading to?

The company has been looking to reduce its exposure to metal cans, a segment which is slowly declining (although generating good cash), and pivoting into closures, which are a better, more differentiated business.

As with Berry, the company will keep growing through acquisitions and may even one day get acquired.

How inside or outside my circle of competence is it?

The metal can industry is still outside of my circle of competence, but I believe it’s an easy one to understand.

Are there signs that it’s undervalued?

Not really. The stock is trading at around 11x earnings, which is the lowest it has traded in its history…

…. but the truth is it doesn’t get me excited. I would consider buying it at a single digit multiples, preferably closer to 5x than to 10x.

Conclusion

I get the feeling that I should be looking at its competitors as this is a commodity business and you need to know what everyone else is doing, but right now, I’m not that interested about it.

SomnoMed

I remember going to Vilar de Mouros, a music festival in the north of Portugal, with a friend who had sleep apnea. We set up camp on an old man’s vineyard and my friend asked the man for an extension cord to connect his sleeping machine.

That was the first time I saw such a machine. Basically, it’s a ventilator that gently keeps pumping air to the patient’s mouth or nose.

I’ve got a couple of friends that use such a machine. They tell me that, at first it’s uncomfortable, but that after a few days you get used to it. This is a small sample, but there are studies that suggest otherwise – that half of the people stop using the machine by the 6th month.

But what if there was a better solution?

Instead of a bulky machine that forces air into your mouth or nose, SomnoMed’s device goes into your mouth. By moving the lower mandible forward it guarantees an open air flow.

How does it make money?

The company makes money from selling the devices to dentists. In recent years, the previous management tried to bypass the dentists in the USA, but it got a big backlash so they stepped back.

Is it a great business?

Right now, it’s not possible to answer this question as the business is still in an embryonic phase. If it gains adoption by the market, yes, it could become a very good business.

Where is the business heading to?

I’m intrigued by this business. On the one side, this could be huge. On the other side, the company is trying to displace a well known and widely used technology.

Somno recently introduced its newest technology – RestAssure. This comes to respond to the need of tracking the sleep of those using Somno’s devices. The traditional machines have tracked the use’s sleep for quite some time now. The fact that SomnoMed’s devices weren’t able to do the same has been a major barrier to prescription and reimbursement rates.

How inside or outside my circle of competence is it?

Right now, SomnoMed is outside my circle of competence, but I intend to bring it closer inside. I need to understand the validity of the company’s claims, the competition, and the reimbursement schemes in the different geographies where the company operates in.

Are there signs that it’s undervalued?

Since the company is still loss making, it’s hard to say how under or overvalued it might be. I will need to make some estimates for the coming 5 years to understand if there’s money to be made here.

Conclusion

I’m interested in SonoMed and I’ll be learning more about it in the future. I suspect that this might become of those multibagger stocks that I wish I had bought when no one was watching.

Adobe

I use 2 Adobe products on a regular basis: Photoshop (to edit images), and Premiere Pro (to edit videos). PDF’s I open in the web browser.

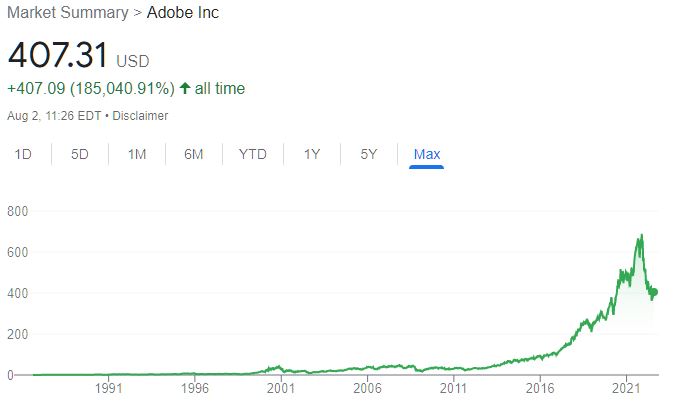

Let me tell you something. Whenever you find a company with a chart like this…

…you can be sure that you’re looking at a great business.

What does the company do?

The company develops and sells software (mostly) for creative design. It has so may products, that it wouldn’t make sense to list them all here.

How does it make money?

Most of Adobe’s revenue comes from subscription fees. It’s a Software-as-a-Service business (SaaS). But it wasn’t always like this. The company started shifting its model back in 2014 not without a fair bit of criticism (similar to Autodesk more recently). But the bet paid off and the revenue got the stickiness that investors like so much.

Is it a great business?

Adobe is definitely a great business.

Where is the business heading to?

Digital content consumption is exploding. I don’t doubt for a second that the company will still be relevant in the future, although I should say that competition has never been fiercer. Even GoPro is offering a mobile app for editting videos.

How inside or outside my circle of competence is?

Well, it depends on which segment of the business we’re looking at. I can understand Photoshop and Premiere well (among other), but I don’t really understand the e-signature business for example. In fact, the other day I was talking to Diogo Gonçalves and we were both wondering what DocuSign does (although Diogo works frequently with it).

Are there signs that it’s undervalued?

There were just two occasions when the stock traded cheap: during the financial crisis of 2008/09 and when it pivoted to a subscription model in 2012. With hindsight bias, those were the times to buy Adobe.

But, and I want to make this very clear, even looking expensive on a Price/Earnings ratio for most of the past 15 years, the stock has rewarded investors quite nicely. This is the main argument of the so-called “quality compounder bros”: even at seemingly high valuations, good businesses can turn out to be good investments. I’m a bit more cautious.

Conclusion

Adobe is one of those great businesses, but it isn’t for me. At least not at these prices. Adobe gets a NO from me at this time.

Conclusion

So, Adobe is a great business, Silgan is an average business, FTI I really can’t tell right now, and SomnoMed might become a great business. That’s the one I’ll be keeping an eye on in the future.

As always, if you want to share your opinion, head over to the Forum by clicking the button below.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.