RCI Hospitality

a fundamental analysis

Symbol: RICK (NASDAQ)

Share Price: $19,44

Market Cap: $177,4 Million

Source: Google

By Manuel Maurício

September 18, 2020

Introduction

With 38 clubs, RCI Hospitality is the leader in gentlemen’s clubs (ahem, strip-clubs) in the US. And it isn’t stopping here. The company’s strategy is to grow by acquiring other already functioning clubs.

I’m a sucker for roll-up stories. A roll up is a company that grows through acquisitions, usually of smaller independent companies, thus consolidating an otherwise fragmented industry.

Business

RICK’s core business is a simple one. It owns and operates strip-clubs across the USA. It also owns and operates 10 sports bars under the name Bombshells.

The company buys independent clubs for 3x-4x EBITDA from owners that are tired of the business and want to monetize their investments. If you have the stomach for it, these are actually cash generative businesses with low capital needs that are protected by regulation. But in an industry to which the banks aren’t keen on lending money, how does the company do it?

RICK stands on a pretty interesting place. Given that the company buys the land where its clubs are sitting on (and sometimes the surrounding land as well), it has access to bank debt. This may seem a non-issue for investors who have never looked at a strip-club company before. After all, companies usually borrow money from banks, right? With strip-clubs, it isn’t quite so.

One of the things that the banks will take into consideration when lending to a business is the ability for the bank to take ownership of the business in the case of a default. But no bank will want to run a strip-club. So it’s rare for these guys to get access to bank financing.

Fund managers would also have issues in explaining to their clients why they own a strip-club business. Strip-clubs are pretty shady businesses surrounded with stories of paid sex, drugs, extortion, fights, and even murder. No one wants to be associated with that. And that’s why the opportunity exists. There’s no natural buyer besides RICK. RICK is the only exit strategy for many of the 2100 clubs in the US. Because RICK usually owns the land, the debt is secured by the land, not the business itself.

Segments

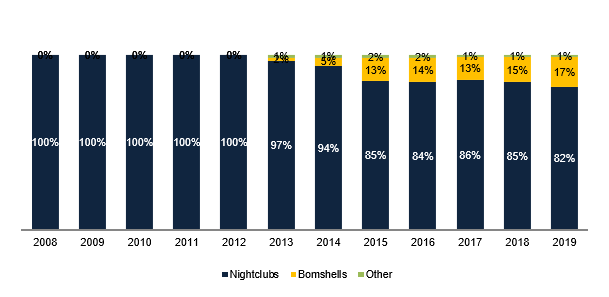

The company reports under 3 different segments: Nightclubs; Restaurants and Other.

Segment Contribution to Revenue

Source: Company data

Clearly the bulk of the revenue comes from the nightclubs. There has been the ongoing hope that the company would be able to franchise the Bombshells concept, but that hasn’t happened yet.

The Bombshells concept was created around the military theme. These are large sports bars with lots of TV screens and hot waitresses. Something similar to Hooters.

Management, Ownership and Capital Allocation

Eric Langan, the CEO, owns 7,65% of the company and has earned $1,3 Million in 2019. A bit excessive, maybe. He has no formal management education and founded the company back in the 90’s. A guy who built an empire of strip-clubs. He must be quite the character, ein?

Back in 2016, someone handed him the book “The Outsiders” by William Thorndike. As I’ve mentioned in other instances, this is one of my favorite books on investment. It talks about the 8 best CEO’s of all time and how they’ve dealt with Capital Allocation decisions at their companies (if you’re interested in investment or management, be sure to read it).

After reading the book twice, the CEO dropped his growth-by-any-means strategy to focus more on FCF per share and Return-on-Invested-Capital. It’s not every day that you come across a CEO who publicly acknowledges he was pursuing the wrong strategy and corrects his course. One can only applaud such shift.

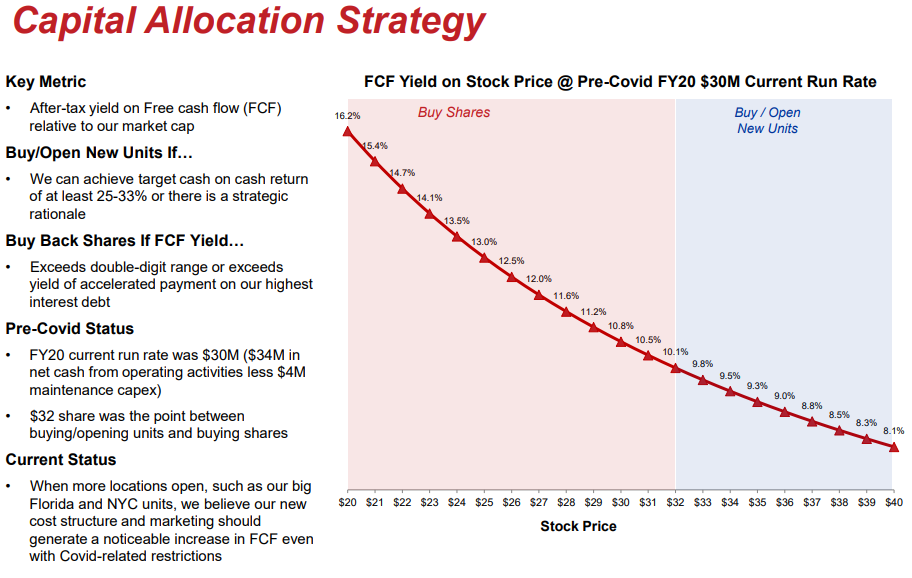

After the CEO found his religion, he implemented a new capital allocation policy, of which the most important points are:

a) the automatic buyback of shares when the Free-Cash-Flow yield gets higher than 10% (equivalent to saying that the share price is 10 times the FCF per share)

b) a minimum cash-on-cash return of 25%-30% for new restaurants or clubs.

The slide above is pretty interesting for investors who focused in finding great capital allocators. I would just love to see this focus on per-share value from other CEO’s.

Eric has mentioned that he has been talking to many strip-club owners and we will probably be seeing further acquisitions in the next year.

Financials

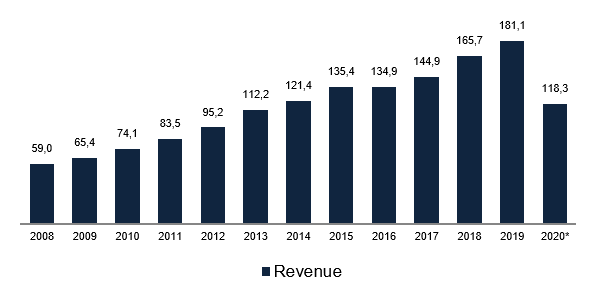

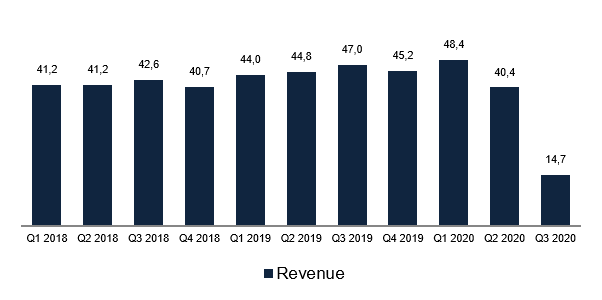

Apart from the previous chart, the chart below is one of the other reasons I got interested in RICK in the first place. Every investor loves an up-and-to-the-right revenue chart. The company has been able to grow its revenue at a 11% Compounded Annual Growth Rate for the past 11 years.

Revenue, US$ Millions

Source: Company data

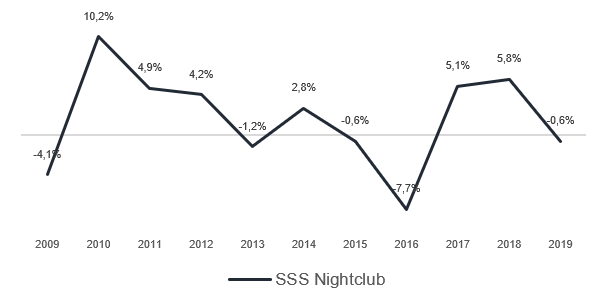

But, as in all other retail businesses, we must cross check the revenue growth with the Same-Store-Sales-Growth (SSS).

Same Store Sales Growth – Nightclubs

Source: Company data

Although the SSS have been quite erratic over the years, I don’t see anything worrisome. Most of the time, the comps have been positive.

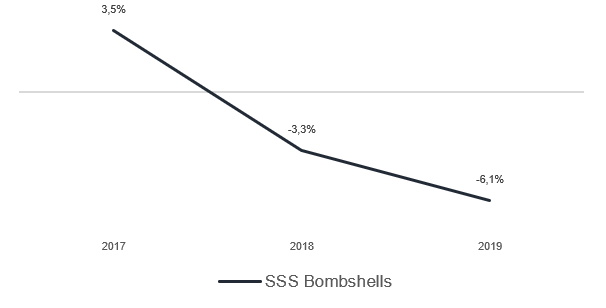

The same doesn’t happen with the Bombshells restaurants:

Same Store Sales Growth – Bombshells

Source: Company data

But I’ve got to be honest here. Three years might be a short period of time to be making assumptions, so I went looking for other sources. My friend Kuppy, from adventuresincapitalism.com, says that he went to one Bombshells restaurant and he hated it. Loud music, bad food, you name it. If you go to Yielp, you’ll also find a pretty bad rating.

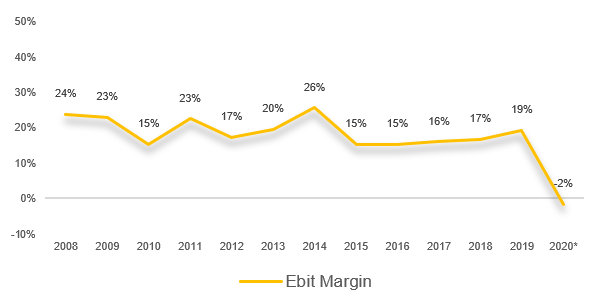

But given that the main business are the clubs, the company has enjoyed sound operating margins in the mid-teens (sometimes more) for the past 12 years. Of course, now with the whole social-distancing thing going on, the margins have fallen abruptly, but I expect that to be temporary.

Operating Margin

Source: Company data

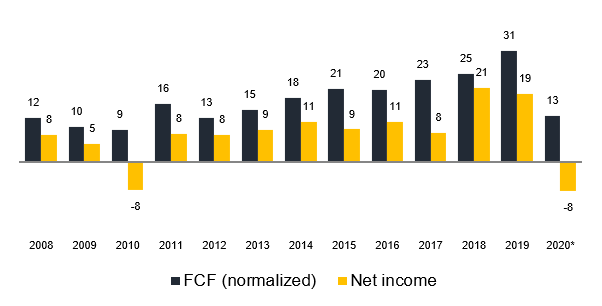

Due to the high Depreciation and Amortization charges as well as recurring impairment charges, the Free Cash Flow has been consistently higher than the Net Income. The fact that the FCF has been positive (and growing) for so many years, including 2009/10, goes to show the resilience of this business.

In a recent interview, the CEO said that they weren’t in the strip-club business, they weren’t in the restaurant business, they weren’t in the real-estate business, they were in the Cash Flow business. I believe a lot of these recurring impairment charges are taken to reduce the taxes ( a la John Malone).

Net Income and Free Cash Flow, US$ Millions

Source: Company data, AiS estimates

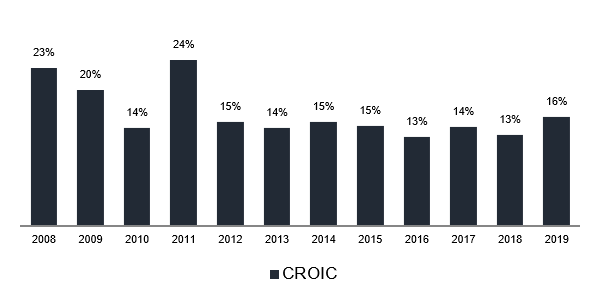

Either way, the FCF has been on a consistent path up, which has led to a pretty good (not great) Return-on-Invested-Capital.

Cash Return on Invested Capital

Source: Company data

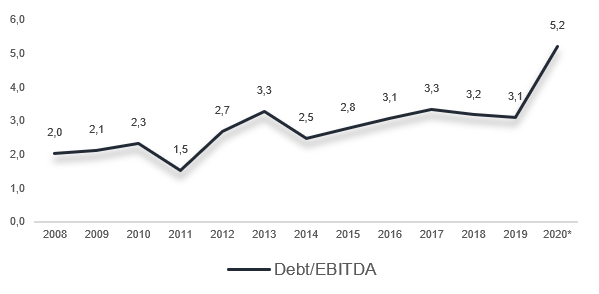

Balance Sheet

Regarding the balance sheet, the company hasn’t been run aggressively, especially if we bear in mind that it owns most of the land where its clubs are located.

As mentioned previously, RICK is one of the few night-club operators that is able to raise debt. Most of it is collateralized by the land and some of it is sellers financing. How does this sellers financing works? Let’s say that RICK buys an existing club. It will pay 1/3 up front and the rest will become debt paid over the ensuing years at attractive rates (for the seller). The seller will effectively become the lender.

With the COVID-19, the debt ratios have gone up, but I wouldn’t mind that too much. If you listen to (or read) the latest Earnings Call, you’ll hear Adam Wyden from ADW Capital – the largest shareholder – ranting about the numerous ways the company can access liquidity. It’s so aggressively funny that he even alleges that the company could just stop paying its debt commitments to both the banks and the sellers and no one would come knocking on the door because no one would want to operate the business.

“Because of how we’ve done things and how conservative we’ve been through all these years, and the focus on owning all of our real estate so that our rent goes down every month, as I like to say, as we pay off the principal, and then we’re able to go borrow money against it again. And that’s one of the things we’re looking at right now, in this refinance, how much cash can we pull out, because as we move forward, if the stock stays in these ranges and stays below our capital allocation target price, we will be back in the markets buying back stock.” RICK CEO

Competition

There are many strip-clubs in the US, but given that this is a regulated industry and you can’t build a strip-club anywhere you want to (there are per capita ratios), I don’t believe there is much to worry about on this front.

Regarding the restaurant business, this is a cruel industry with lots and lots of competitors.

Recent Developments

RICK is as much (if not more) affected by the COVID-19 as STKS (the VIBE dining restaurant chain that was previously profiled hare at All in Stocks). Depending on how long this social-distancing lasts, RICK might be up for a long period of running at half steam. And, let’s face it, strip-clubs don’t go hand-in-hand with social distancing. On the other hand, it seems that Bombshells is holding pretty steady with revenues coming back to normal in recent months and the company was cash flow positive on the last week of August.

Valuation

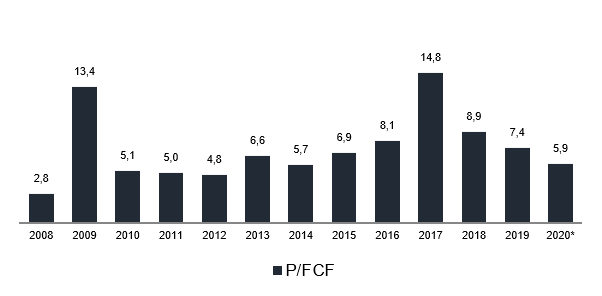

Given the explanation above about FCF, one should look at RICK on a Price-to-Free-Cash-Flow basis.

Price to Free-Cash-Flow

Source: AiS estimates

Yup, a really cheap business. And the management agrees. that’s why they’ve been buying shares and why they’ll keep buying them as long as the multiple is below 10x and stated that they have a minimum of $15M in the bank.

Red flags, red flags everywhere

BUT (and there’s always a but), apart from the fact that there aren’t any natural buyers bidding the stock up, there are plenty of other reasons for this business to be cheap.

I don’t even know where to start. Some years back there was – what appears to have been – a coordinated attack on the company. Short reports, allegations of misconduct, you name it. Among these reports, there were allegations of:

The company that builds the Bombshells restaurants is partly owned by the CEO.

The company loaned money to the CEO without reporting it.

The company hired a lawyer to whom the CEO owed money.

The company owned (not clear if it still owns) 3 residential houses and a ranch in Texas (why would a strip club need a ranch?).

The company owned a fleet of corporate jets (why on earth would it need a fleet?) and both the CEO and CFO had been using it for personal purposes.

The company’s auditor resigned after allegations of poor reporting.

The CFO left recently.

Countless delays in releasing the earnings (a classic red flag).

…

…

I could go on and on with the list of all the shady stuff related to the company, but you get the point. I’ll just leave a few articles at the end of this write-up for those of you who are interested.

Risks

- Shady industry

- No checks and balances for the CEO.

- One man risk. Warren Buffet once said that he liked to buy companies that even an idiot could run. Well, that’s not the case. you need a special set of skills to run this business.

Conclusion

I had been eyeing RICK for some time and I really wanted to look into it. Now that I’ve done it, I’ve come to the conclusion that it’s of no interest to me. It’s pretty alluring that the CEO has read “The Outsiders” and that he has outlined a great capital allocation strategy. I’d love to see more CEO’s doing the same. But that obviously isn’t enough.

As in other companies that I’ve profiled here at All in Stocks, we might be seeing RICK achieving great success in years to come, but I wouldn’t want to own it. More important than doing your research is to know what works for you, what makes you sleep well at night.

I had made up my mind about RICK a few days prior to posting this write-up. I could’ve written about several other companies. And even so, I’ve decided to write about it so the more novice subscribers can take a lesson from this. Always do the work. Be sure to research the people that are managing your companies. It’s not that hard to google a person or a company and spend some time learning about the business you’re thinking of investing in. And even if you had spent a lot of time researching it and you like te business, try to find opposite opinions from yours.

If there is any doubt about the people who are running it, just take a pass. You don’t have to invest in every single company you research. As Warren Buffett says “In investing, there are no called strikes”.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.