Regis Corp

who needs a haircut?

By Manuel Maurício

September 17, 2021

Symbol: RGS (NYSE)

Share Price: $3.96

Market Cap: $142 Million

Introduction

Regis Corporation first caught my attention about a month ago when I found out that it’s shifting its model from owning and operating hairdressing salons to being fully franchised.

Good franchising businesses are very valuable, especially if they’re not cyclical – people will still cut their hair in a recession. They also tend to be asset light and the revenue can be like a subscription – highly recurring.

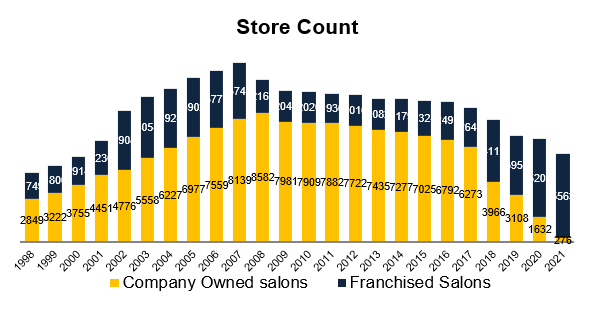

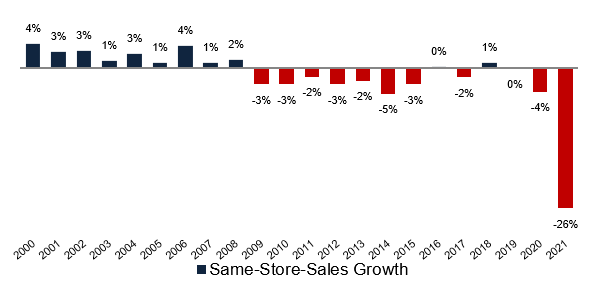

From looking at the chart below we can clearly see that the turnaround hasn’t come yet.

In fact, Regis has been a turnaround story for so long that I should stop looking at it right now.

But, on the other hand, if these guys are able to turn it around, we might be seeing this ugly chart become a beautiful exponential curve.

Regis Corp. owns and franchises hairdressing salons mostly in the US, but also in the UK, Canada, and Puerto Rico.

The company started out in the 90’s with a roll-up strategy growing trough acquisitions.

Then in the 2000’s, it shifted to a different model and started buying back its own franchisees. Wrong move. All else being equal, having independent franchisees is better than having employees.

By the end of 2007 Regis had become a bloated company and needed to go on a diet so it started selling company owned stores.

As we can see from the image above, there are hardly any company-owned locations left. Almost all of them have been sold to the franchisees.

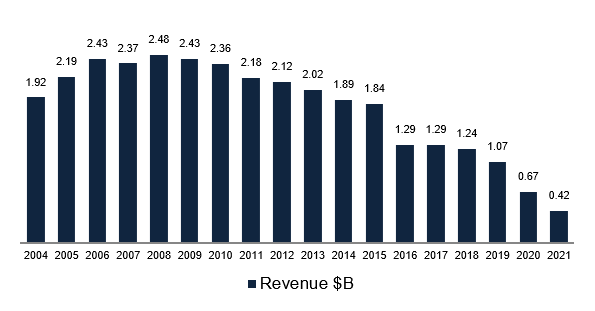

And, as is often the case with companies that are shifting to a franchise model, the revenue has been going down.

The theory is that, at some point, the revenue should stabilize albeit with much higher margins as the company does not bear the costs of operating the salons.

It should also allow for much higher Returns on Capital as there will be little capital employed in the business when all the stores will be owned by the franchisees.

In 2017, Hugh Sawyer came in as CEO with the mandate to transform the company owned locations into franchisees. Good idea.

He was doing his job when he suddenly got replaced by Felipe Athayde in 2020. Felipe is a pupil of the well known Brazilian private equity firm 3G Capital who owns Burger King, Kraft Heinz, Ab Inbev, among many other businesses.

If you haven’t read the book “Sonho Grande” (Dream Big) by Cristiane Correa, I can’t recommend it enough.

So, as many other private equity firms, these guys are known for buying badly run companies, cutting costs, streamlining operations and reviving the business.

One of the big differences between these fellows and other PE firms is that these guys actually want to own the companies for a long time and not just sell them tho the next fool.

Back to Felipe. He had been working for the Brazilian trio for a decade and he was one of the guys behind the huge success of Popeye’s chicken sandwich.

He came in to Regis to accelerate the re-franchising strategy, but this time with a slightly different angle from his predecessor.

Whereas Sawyer led a brand agnostic team, meaning that everyone in the team was working for the different brands owned by Regis (Supercuts, Cost Cutters, Roosters, SmartStyle, etc), Felipe decided to create brand-specific teams that can take responsibility for each managed brand.

He is also very clear in saying that he wants his franchisees to be profitable. Without profitable franchisees, there’s no Regis (obviously!).

For that he is also introducing a new software that will help the franchisees with hiring new professionals, managing inventory, and get data analytics in order to create promotions.

Whereas with the previous CEO, each location or region would be responsible for marketing and advertising, Felipe is taking a different approach. Like many other franchise businesses, he’s centralizing the sales and marketing efforts in order to gain control over those initiatives and have better insights into the corresponding results.

DISTRIBUTION SHIFT

A large part of Regis business was working as a distributor for hair care products such as shampoos. It would buy these products, store them at two distribution centers and then sell them to the individual salons.

With Felipe the company is ditching this approach. It has signed agreements with two external distributors and each franchisee will buy directly from them. As a result, both distribution centers are being vacated.

By doing this, Felipe hopes to reduce costs and also reduce the capital needed to hold so much inventory. He wants Regis to become a very asset light business.

ZERO BASED BUDGETING

Which takes me to the famous Zero Based Budgeting that is now widely studied in business schools around the world, the most famous of all being Harvard Business School.

This management strategy has been devised by the 3G partners early on in their careers. If memory serves, they used it when they first bought Brahma back in the 80’s.

Basically, at the start of every year, they will set their budget for that year from zero and from the ground up. It doesn’t matter if in the prior year they had $1 Million or $10 Million to spend on scissors. They will assess that need as if it was the first time.

In theory, this will allow the management to run a tight ship based on cost control and it will force each team/brand inside Regis to justify every dollar needed.

This model has been proved time and time again, but, of course, there are exceptions to the rule – Kraft Heinz being the most famous one because of its size and because Warren Buffett is 3G’s largest partner (3G cut marketing and R&D costs so much that Kraft-Heinz has been struggling to grow its profits).

If you listen to Regis’ earnings calls, you’ll see the analysts asking the management what level of General & Administrative costs they should expect going forward (largest costs for a franchising business).

For a few quarters the management had been telling them that it was in the process of creating the Zero-Based Budgeting so they would have to wait a little longer for the response.

ESTIMATES

On the last earnings call, the number finally came. The management guided for G&A to be around $80 million.

As the company is going full-franchise mode, I won’t be factoring in any service revenue (coming from company owned locations), nor product revenue (shampoos, etc).

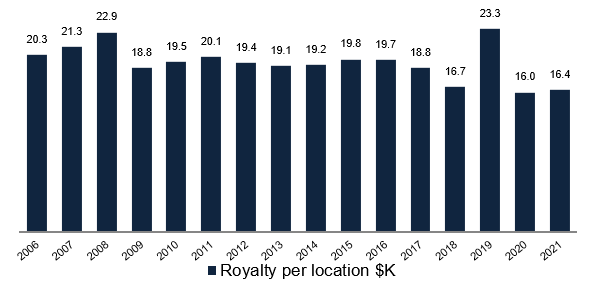

Historically, the royalty per average location has been around $19K so let’s go with that.

The company currently has 5.917 locations, and although I’m sure they’ll cut some more in the next couple of years, that’s the number I’m working with.

That means that we could be seeing Regis achieve $112 million in sales per year. If we subtract those $80 in General & Administrative costs, we get to $32 million.

I expect the company to max out its debt lines thus paying around $15 million in interest. Applying a tax rate of 25% we would get to net income of around $12 million.

Now comes the hard part. What would be a reasonable multiple to apply to these $12 million in profits? Good franchise businesses can go up to 30x earnings or more.

But this isn’t a good franchising business. Just look at the Same-Store-Sales growth over the years.

This business has obviously been catastrophic. Not only that, but the debt is high right now and I expect the company to be issuing more shares in the coming quarters, thus diluting existing shareholders.

Let’s say that the company is able to stabilize its SSS growth at zero percent and let’s also apply a 10x multiple on those $12 million in profit.

That would mean a marketcap of around $120 million. At a multiple of 15x earnings, that would mean a $180 million marketcap.

The current marketcap is $142 million, so there’s no margin of safety at all taking into consideration how disastrous this business has been.

Not only that, but we have no visibility whatsoever on unit economics. We don’t know if the franchisees are profitable or if they can become profitable in the future.

Conclusion

For now, Regis corp gets an obvious NO from me, but I’ll keep following it from afar just because I want to see what Felipe is capable of. Who knows, maybe I’ll run into him in another company.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.