Riwi,

a fundamental analysis!

April 21, 2019

TICKER: RIW

ISIN: CA7496011007

SHARE PRICE: $2,7 CAD

MARKET CAP: $47,47M CAD

April 21, 2019

TICKER: RIW

ISIN: CA7496011007

SHARE PRICE: $2,7 CAD

MARKET CAP: $47,47m CAD

1. INTRODUCTION

I believe that one of the most important skills an investor must possess is the ability to control his emotions. Last week I wrote on the AllinStocks Facebook group that I thought I had found a one-in-a-million hidden gem. Because I know that sometimes I get too enthusiastic about a stock that I like, I’ve recently began postponing some of my conclusions and investment decisions to a later date, one when I am less excited and when I can think in a more clear way.

This might lead to the occasional loss from omission, but I believe that the benefits of this strategy largely outweigh its shortcomings. All of this to say that although I don’t think this is a one-in-a-million stock, I still think it is one of the best I’ve found so far, a true potential multibagger.

The name of the company is Riwi Corp.

Acknowledgment: I must thank Trevor Treweeke from Veritas Vatillum for bringing Riwi to my attention.

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

At first I was kind of puzzled with the simplicity of what Riwi does but then it began to grow on me. Let me explain:

In simple terms, Riwi is an opinion survey company. The problem with traditional opinion survey companies is that their reach has been kind of limited by a multitude of factors and their polls are not considered “scientific” due to coverage bias and non-random sampling.

Riwi figured out a way to do randomized surveys in real time across the world. The company started when its founder Neil Seeman was challenged by a Canadian governmental entity to find a way to track people’s responses to pandemics around the world.

Neil was an academic involved with public health for the most of his life. His brother was an website domain names expert and so the two started to figure out ways to create what is now RIWI’s patented algorithm called RDIT (Random Domain Intercept Technology). You can read more about it here. This algorithm does something wonderful.

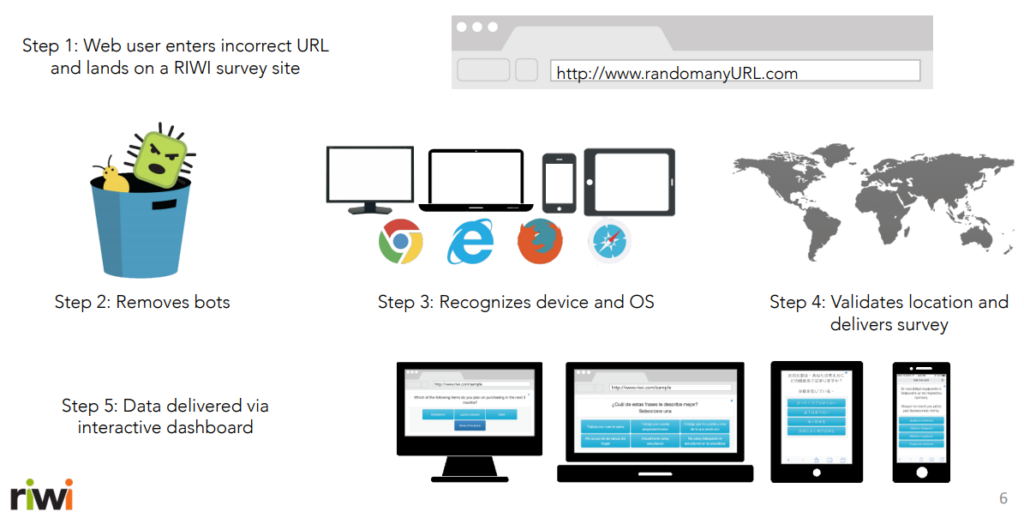

Everyday there are thousands of people who misspell the URL’s on their browsers. Riwi’s algorithm scans through these misspelled URL’s, automatically chooses the users it wants to target and delivers them a quick survey. Cool hein?

Now, the first time I’ve heard about this, I thought to myself, “But the number of misspelled URL’s today must be really low because, on the one hand, people just search whatever they want on Google, and on the other hand the browsers redirect users to the correct websites”. It turns out it isn’t quite like that.

First of all, about 23% of people prefer to access the web through the URL bar and this number has been steady for almost a decade now. Second, RIWI’s algorithm filters out popular or trademarked words and only goes after navigation errors leading to lapsed or inactive websites. It also filters out every website that might autocorrect.

The next question that came to my mind was “But surely, no one ever answers random surveys online”. Again, I was wrong. There are lots of people who do. Their surveys have already reached more than 1 billion different people, and with the increasing number of domains like “.hotel” and “.design”, they have been seeing year over year growth in the number of people surveyed.

Even the CEO says he doesn’t exactly know why people do it, but the fact is that people do it. I think he could just launch a survey asking people why do they answer random internet free surveys.

Here’s a great presentation by the CEO if you become as interested as me on this stock.

And here’s a graphic representation of how Riwi’s surveys work:

2.2. MANAGEMENT TEAM & LARGEST SHAREHOLDERS

This time I’ve decided to merge the “Management Team” and “Largest Shareholders” because they are all the same.

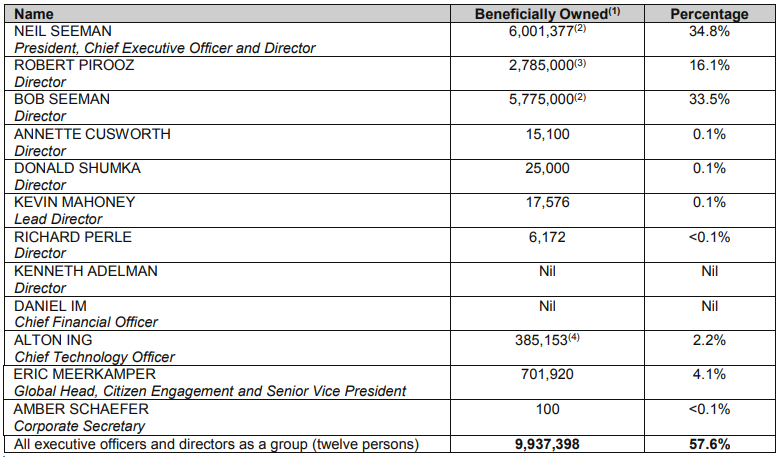

Neil Seeman, the founder and CEO owns approximately 35% of the company and the whole management team and board of directors combined own 57%. I would say that’s the level of skin in the game I’m interested to see on my micro-caps.

As you might’ve noticed from my previous write-ups, I put a lot of emphasis on a management team that is well aligned with the shareholders.

Neil is reportedly a very intelligent and very focused operator. I’ve even heard that when he meets other shareholders, he always has a pen and a paper on which he writes anything he hears that he must learn and on subsequent meetings he will have learnt everything there is to know about such topic.

He has gone from an academic to a full grown executive and he says he’s loving it.

Here is a recent interview with him.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

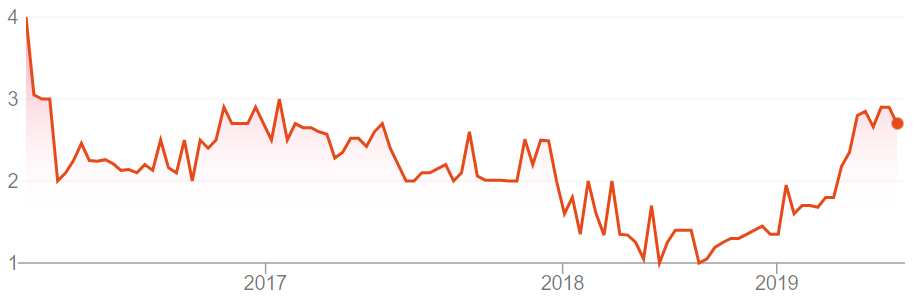

Riwi hasn’t been a great stock to hold for most of its existence and its trading at $2,70 CAD right now.

3.2. MARKET CAP AND SHARES OUTSTANDING

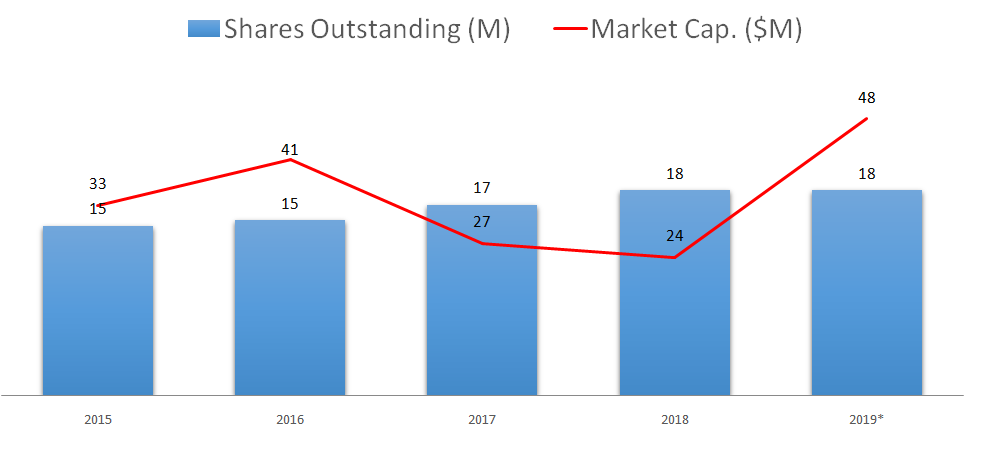

The company went public through a non-offering prospectus which means that it didn’t raise any cash at the time.

The number of shares outstanding has been kept quite stable over the lifetime of the company. That’s one of the advantages of a management team with significant skin in the game. They do not wish to dilute their stake unless they really have to.

With a market cap of $52M CAD, this is a micro-cap (almost a nano-cap) so investors in this company must be prepared to deal with high volatility.

Note: As the company’s revenue in USD starts to become higher than in CAD, the company decided earlier this year that it would report its figures in USD so I’ve used the current 0,75 exchange rate to assert previous figures. Every number on this analysis is in USD except for the share price and market cap.

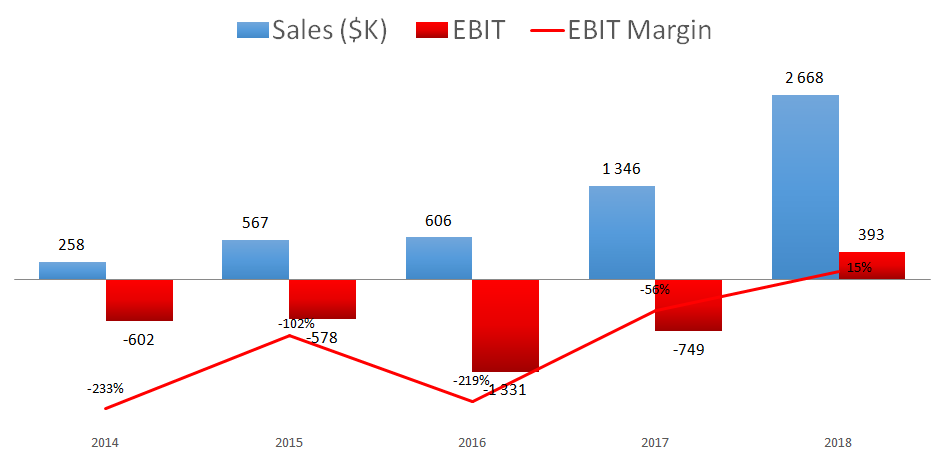

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

A great thing I like in this business is that its revenue is mostly recurring. They’ve got all these clients signed on multi-year contracts so there is high visibility into the future revenue streams.

The company sales have been growing at a 79% CAGR since 2014. This is truly astonishing. In 2018 alone, sales have grown 98% having reached $2,7M.

2018 was the first year of positive profitability for the company. Until recently, the company had only 12 employees. That number has grown to 28 right now as the company expands its sales team but there isn’t a need for many more in order to double or triple revenue.

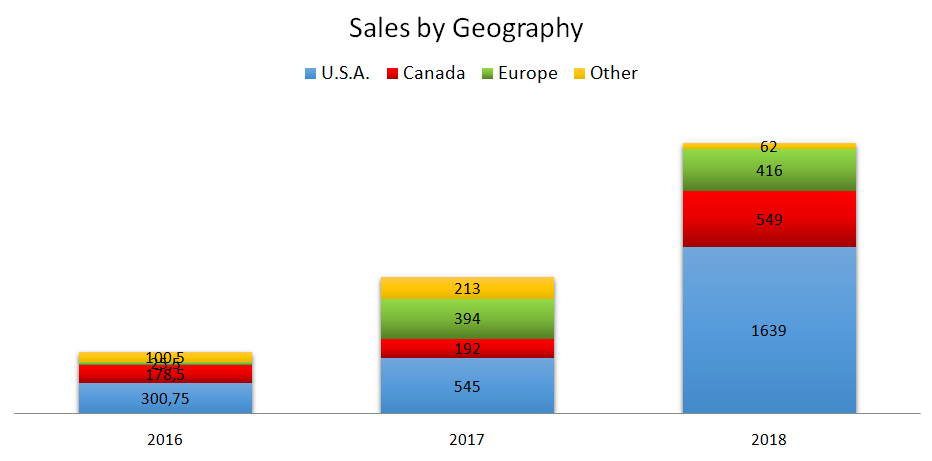

3.4. SALES BY GEOGRAPHY

The U.S.A. is the largest contributor to Riwi’s revenue and although I think the future will be somewhat similar to this, I also think that there will be great variations between the other geographies in the next couple of years.

3.5. SALES BY SEGMENT

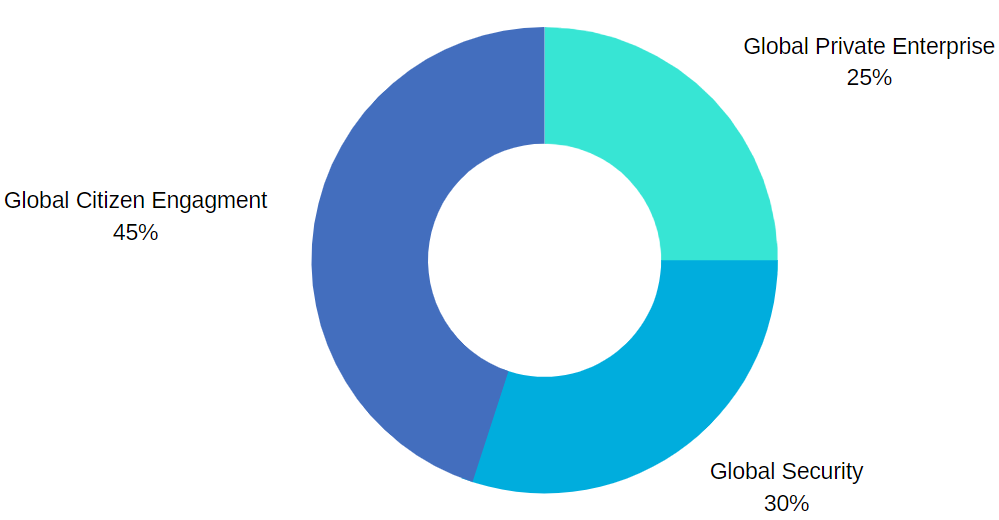

In previous years the company distinguished 5 different segments but earlier this year they’ve figured that they could optimize their sales efforts if they merged two of those segments:

Global Private Enterprise (previously finance and consumer goods): Within this segment, finance is the fastest growing source of revenue with edge-funds, banks, private equity and insurance companies all racing against each other to get the latest analytics and global trends in stock prices.

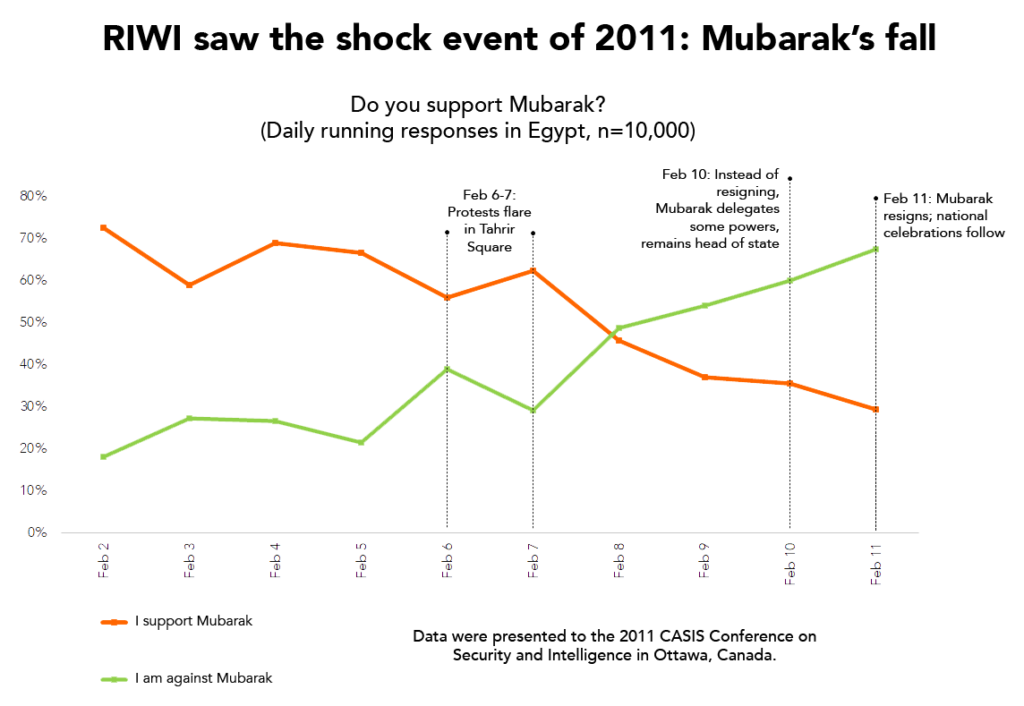

Global Security: As the name suggests, this is the segment related to military and defense. The company gained notoriety by predicting the fall of Egipt’s president Hosni Mubarak back in 2011.

After that, they’ve been winning lots of multi-year contracts with the U.S. Department of Defense and its CEO and CFO even have Top Secret clearance. They state on the MD&A that the DD has teams of programmers working exclusively with RIWI’s analytics so RIWI expects its revenue from Security to steadily increase over the next 20 years. This segment represents 30% of the company’s revenue and they are aiming at contracts between $1 million and $20 million or more.

Global Citizen Engagement: This is the company’s most mature business line since it is where it all started. It accounts for 45% of the total revenue and relates to humanitarian aid, geo politics, global health and it counts many G7 agencies as its clients.

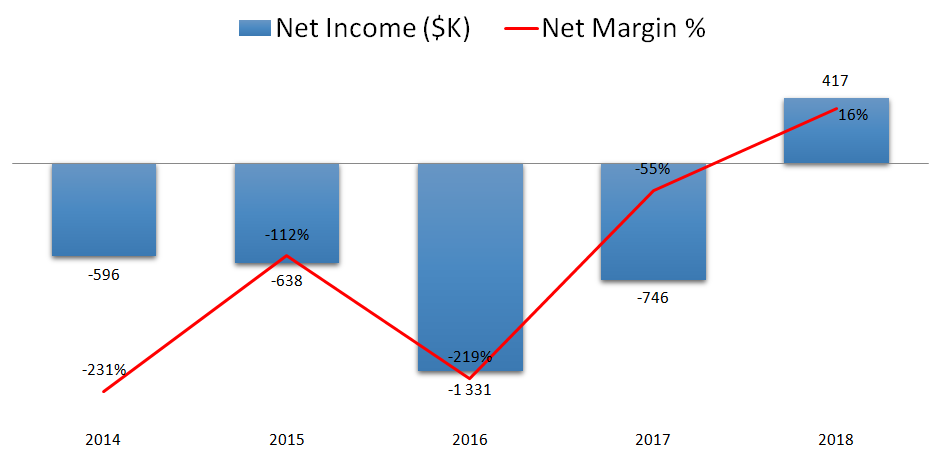

3.6. NET INCOME

The $417,000 in net income in 2018 represented the first profitable year for the company.

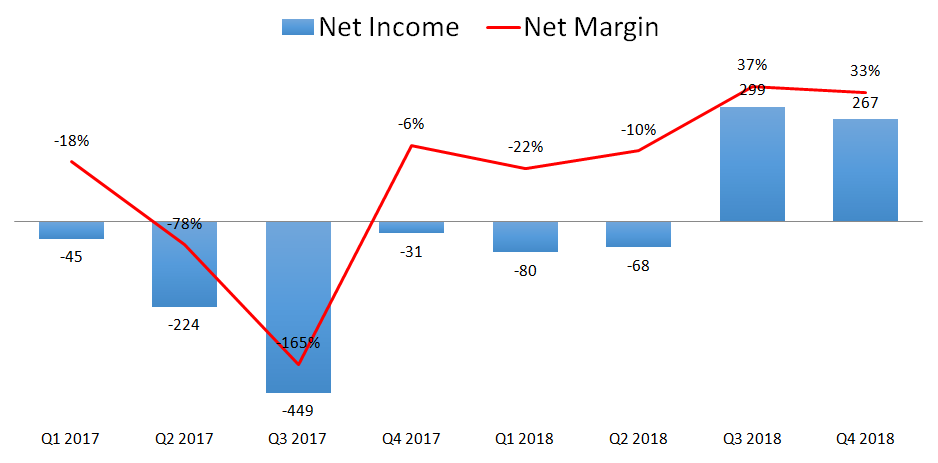

And if we add some granularity to that, we can see that the net margin for the last couple of quarters was actually more than double that of the full year.

This business has high operating leverage, which means that with just a few people working at headquarters, they can effectively grow their profits much faster than the revenue. After paying for all the fixed costs, every new dollar that comes in is more profitable than the previous one.

I am really interested in finding out what kind of margins this business is able to get. If they’ve just recently reached profitability and the net margin is already at above 30%, where can it go from here?

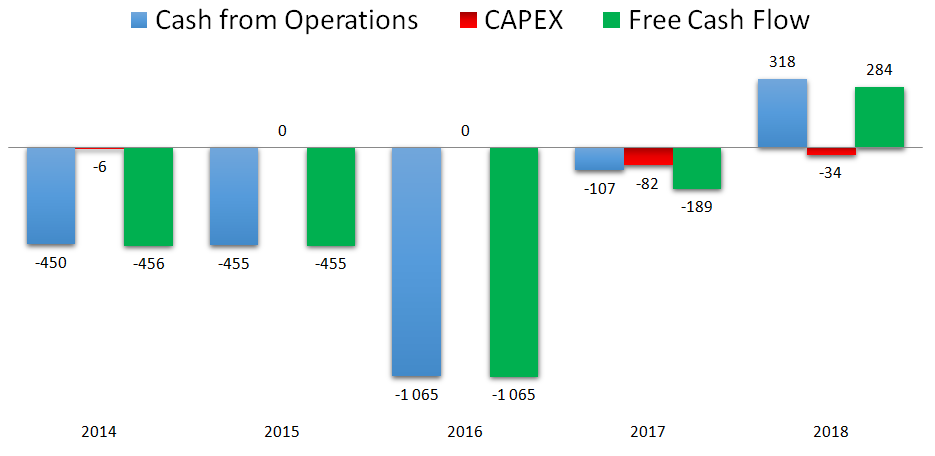

3.7. CASH FLOWS

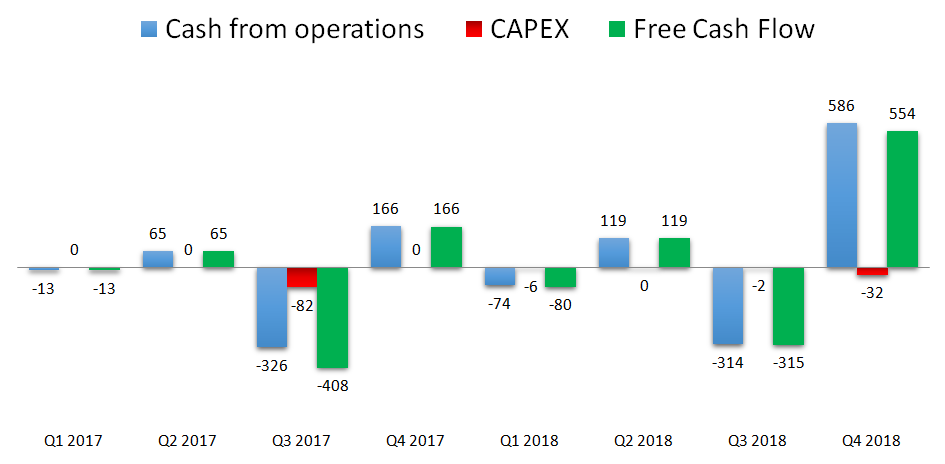

Whenever we look at SaaS businesses or DaaS (Data as a service), we should be looking at the cash flows. Not only did the company reach profitability in 2018 but it has also reached positive FCF.

And again, let’s add some granularity to that. Although the company reported just $284K in FCF in 2018, the truth is that in the fourth quarter alone it generated $554K in FCF.

3.8. PROFITABILITY RATIOS

There is no chart here, as the company has just recently reached profitability. In 2018 the ROE was 17% and the ROA 16%.

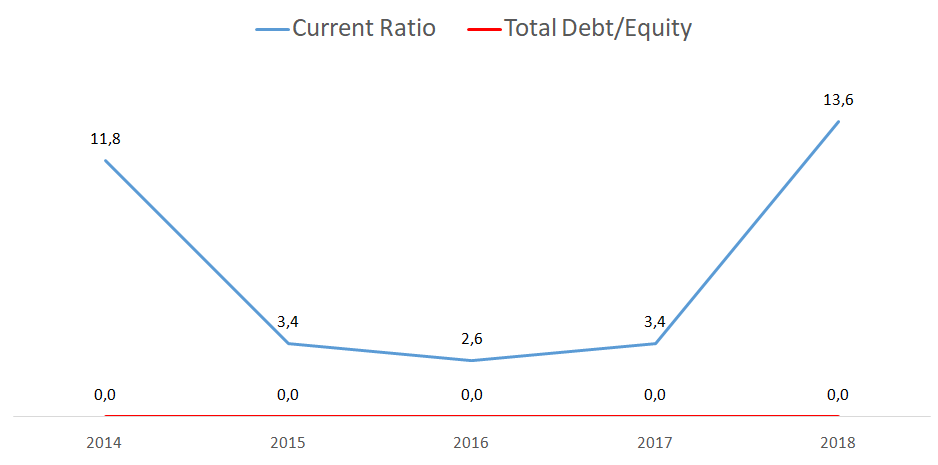

3.9. FINANCIAL RATIOS

One of the things I look for in microcaps is a low debt level. Riwi has no debt whatsoever. In fact, it has $1,7M in the bank which leads to that incredible current ratio of 13,6.

3.10. PRICE RATIOS

Riwi isn’t cheap on any traditional metric. Its P/S is 13, its P/E is 84 and its P/FCF is 123.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

For anyone interested in knowing more about this company, I’d recommend you to take a look at the precious MD&A documents. You’ll find a lot of important info there.

As I was saying before, Neil has grown from an academic to a full grown CEO with sales growth being his biggest priority. For 2019, the company wants to “increase revenue, increase profit, increase diversity and number of contracts, a larger average contract size and ensuring that a strong majority of its business is long-term, recurring revenue.”

In order to achieve this, they’ve hired a head of consumer focused sales, Bruce Caven, a sales executive with more than 30 years experience; they’ve hired a head of finance and private-sector research for lead generation, Danielle Goldfarb, also with more than 30 years experience; they’ve hired data analytics and data visualization personnel; they are developing automated real-time visualization of pilot tests in order to quickly demonstrate their work to prospective customers and they are aiming to open sales offices around the world.

Also in the MD&A documents, management has said that revenue coming from Global Private Enterprise and Global Citizen Engagement should grow at least 150% in 2019 and that revenue for Global Security would be at least the same as it was in 2018. This would lead to a total combined revenue of $5,5M, a growth rate of 105%.

Bellow are just come of RIWI’s clients:

4.2. SEASONALITY

There is no relevant seasonality to RIWI’s sales but it seems that there is some seasonality to its cash flows.

4.3. TYPE OF PLAY

Riwi is a growth play.

4.4. RISKS AND COMPETITION

Although the way this company collects data is quite unique, this industry is very competitive. There are a lot of players in the different segments where Riwi operates. The company pinpoints the following:

- Companies that provide quantitative data and analysis of users opinion like GeoPoll, Google, Qualtrix, SurveyMonkey;

- Full service market research firms including Ipsos, Nielsen, Gallup;

- Specialty information providers for industries the company serves as Oracle, Cloudera and Palantir.

In relation to the risks the company is facing, these are the most important:

Technology and patent challenging: The whole competitive advantage here is the peculiar technology RIWI uses, its algorithm. Although the algorithm is patented, if it were to be challenged, copied or somehow stopped working, the company would be in real trouble. This for me is the main risk RIWI is facing. RIWI is a disruptor. If a new disruptor comes in to this space tomorrow, RIWI’s sales will suffer.

Regulation: RIWI has been able to follow its path and not be affected by the recent turmoil surrounding data privacy. If any laws regarding online surveys should be passed, the company would certainly be affected. Fortunately RIWI doesn’t keep any data on the people that complete their surveys.

Economic slowdown: In an economic downturn, companies and bank’s budget cuts almost always start by the market research, so we could expect some headwinds for RIWI.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

The other day I was watching an investor I follow being asked if he thought that knowing every technical aspect of a product was fundamental for his investment decisions, to which he answered something like “We need to understand the basic way of how the company is making money. We don’t need to know exactly what goes into a phone in order to understand a phone maker’s business”.

And that’s how I feel about Riwi. Are there things that I still don’t understand? Of course there are. Are they fundamental to my investment thesis? I don’t think so. If there is something I feel I need to understand better, it’s the competitive landscape, not the intricacies of the algorithm.

I think we’re witnessing the beginning of a huge growth story right here. One that isn’t followed by Wall Street yet. Although this is a very illiquid nano-cap, the company isn’t cheap by any metric so one should expect high volatility and use it in his favour.

With RIWI, we have to take the longer view. I believe this one might become a beautiful compounder. A DaaS (Data as a Service) business which is asset light, has huge operating leverage, a huge runway and a management team completely aligned with the rest of the shareholders. It all comes down to securing more long term contracts and keep delivering results.

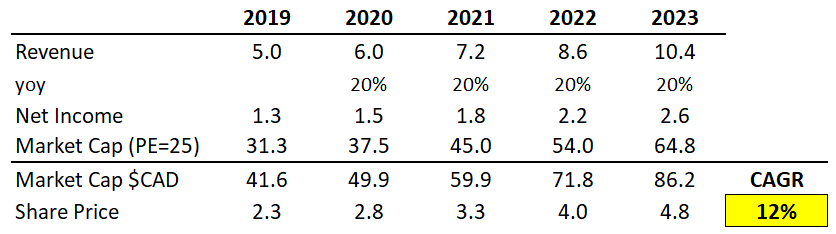

Given the guidance, revenue for 2019 will likely by in the order of $5,5M but let’s be conservative and say that it will be $5M.

If we estimate a growth rate of just 20% after that (let me remind you that the company has grown by 100% in 2018), we get to a $10,4M revenue in 2023. Let’s be really negative and think that this business doesn’t have any operating leverage (which it has – a lot) and net margin will be kept at 30%.

In fact, let’s say that net margin will be 25% five years from now (I can almost bet that it will be north of 30% given that it was 37% in the third quarter). This way the net income could be $2,6M. Apply a SaaS or DaaS PE ratio of 25-30 and we get a market cap of $65M USD. If we use the current exchange rate of 1.33, that’s $86,2M CAD which would mean a 12% CAGR.

Imagine what it would be if the company were to grow more than what I’ve laid out or if the net margin expands.

Summing things up, this stock isn’t cheap if we look at the current year or even next year, but if we are willing to look at where it can be five years from now (as we sould), we could be looking at one hell of a growth stock. In the meantime…

…Happy Easter to you all!

Bonus Track: If you like RIWI as much as I do, this recent letter from the CEO Neil Seeman to his shareholders will be of interest to you.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.