Sanara Medtech

a giant in the making!

By Manuel Maurício

July 02, 2021

Symbol: SMTI (NASDAQ)

Share Price: $35.5

Market Cap: $270 Million

Introduction

Sanara Medtech is trying to become a one-stop shop for wound care. Yeah, wound care. Go figure.

I had no idea this was a thing. But it is. And it’s BIG!

As we’ll see on this write-up, Sanara is launching products and services that span from diagnosis to the treatment of wounds at home, thus creating a comprehensive ecosystem unmatched by any other company in the world.

But to understand Sanara Medtech one must understand a few things first. Let’s dive in.

WARNING: This page contains scenes that the viewers might find disturbing.

A bit of history

There’s this guy called Ron Nixon who is Chairman of Sanara Medtech. Remember him, he’s important.

Ron has a Private-Equity firm called The Catalyst Group, that was one of the initial investors in the LHC Group.

LHC is one of the largest providers of in-home healthcare services. The initial investment was worth $10 million 20 years ago. The company is now worth $6.5 billion.

Over all these years Ron was able to see how poorly wounds are cared for in comparison to other maladies. He thought that there was an opportunity to improve on that.

Through the Catalyst Group Ron bought a controlling stake in Rochal Industries, a company that specializes in Research and Development of wound care products and other related stuff.

Rochal was the creator of the liquid bandage that it later sold to 3M and that is still being sold today. Rochal also created the first gas-permeable contact lens which was later sold to Bausch and Lomb.

But Rochal was an R&D company not exactly suited for marketing and selling its own products. Soon, Ron found a public company called Wound Management Technologies (WMT).

WMT was selling one single (and good) product called Cellerate RX. But it was being so poorly managed that the owners of Cellerate who were licensing it to WMT had pulled it out from WMT and cancelled the deal.

Ron believed that Cellerate was a good product and that WMT could still become a success story if it were properly managed. He bought the Cellerate license back from its owners and also bought a controlling stake in WMT, changing its name to Sanara Medtech.

He immediately licensed all of Rochal’s products to Sanara, creating a tight relationship between the two. It’s no wonder that there are several board members at Sanara who are also board members at Rochal.

What does Sanara do today?

Sanara commercializes wound treatment products for surgeries and wound care.

As mentioned above, the company doesn’t do R&D nor does it manufacture the products. It licenses its products from other companies.

So far, its revenue has come from the sale of that single product – Cellerate RX.

Cellerate RX is hydrolyzed collagen. It’s basically a powder (or a gel) that is applied to a patients surgical wounds (during surgeries) to help accelerate the healing process.

The human body already produces collagen naturally, but the hydrolyzed collagen has the added benefit that it has already been “broken down” so it’s immediately absorbed by the organism. Basically, it boosts the body’s normal healing process.

By helping the body heal faster Cellerate RX is helping reduce costs related to complications (such as infections, longer hospitalizations or extended rehabilitative care).

Wound infections have become a huge thing. My girlfriend works for a major pharma company selling wound sutures whose main attribute is reducing the risk of infection. Reducing the rate of infection and saving money for the healthcare systems is where the healthcare industry is going.

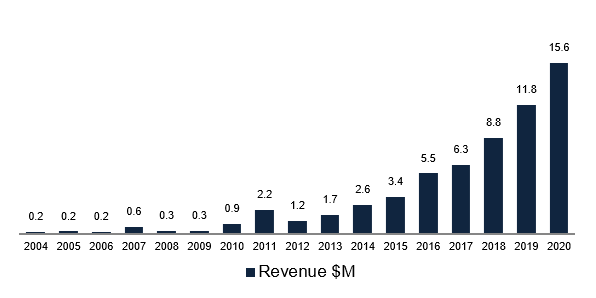

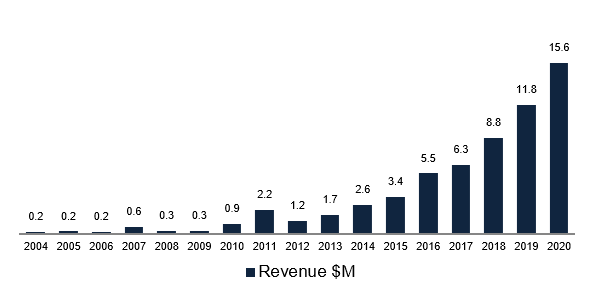

So far, just on the back of this single product, the company has been seeing huge growth.

But a one trick pony with $16 million in revenue wouldn’t justify a $275 million valuation, would it?

There’s more coming. A lot more. In fact, this is probably the first microcap that I look into that has all the right attributes of a major health company: products, technology, partnerships, management team, board of directors, etc.

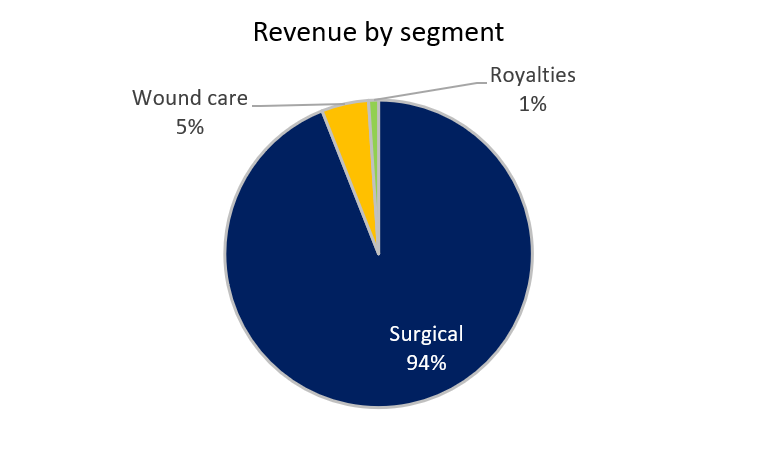

Segments

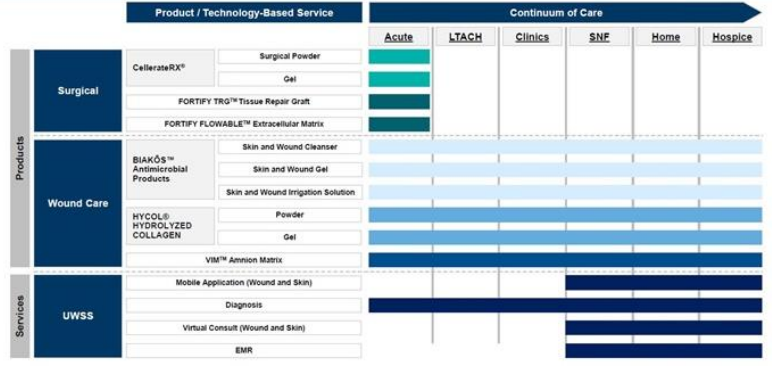

Sanara’s business can be grouped into 3 different segments:

- Surgical

- Wound care (outside of surgery)

- Services

As you can see from the (fuzzy) image above, the company has products (see white boxes) that span across the whole continuum of care (blue bars on the right).

I know that, as this is the first time that you’re hearing about Sanara, you probably don’t want to know what all the different products are, you just want to understand the opportunity, so I’ll keep it nice and simple.

First I’ll be explaining the different segments and then we’ll talk about the big picture and where this company is heading.

SURGICAL SEGMENT

The surgical segment is, obviously, composed of products that are used in surgeries. I’ve talked about Cellerate RX, but the company has recently struck a partnership with Cook Biotech for 2 of its matrixes.

If you don’t know what a matrix is, don’t worry, I’ve got you covered. Coincidentally enough, a few years ago a friend sent me this documentary by National Geographic called “How to make a Human Heart”. It was UNBELIEVABLE. In it, several new and groundbreaking technologies were featured. They seemed to have come from another planet.

One of such technologies was a powder that had such healing abilities that it was used to grow a new finger that had been amputated. You’ve heard me right. That powder is basically a matrix of a pig’s bladder striped from its cells. That’s the technology behind the new matrixes that Sanara licensed from Cook.

I’m posting the documentary below. I strongly recommend you to watch it. The matrix technology is featured in Part 2.

How to make a human heart – Part 1

How to make a human heart – Part 2

To understand how Cellerate RX is applied, watch the video below of a knee replacement surgery.

WARNING: The video contains scenes that the viewer might find disturbing.

Play Video

WOUND CARE

Then we have the Wound Care segment. As the name implies, this relates to all the products that are used in wound care outside of surgery. Think diabetic ulcers or other types of chronic wounds that can be treated at home or in physician’s offices.

For those wanting to understand what I’m talking about and who are not easily disturbed by strong footage of human wounds, head over to the last pages of this presentation.

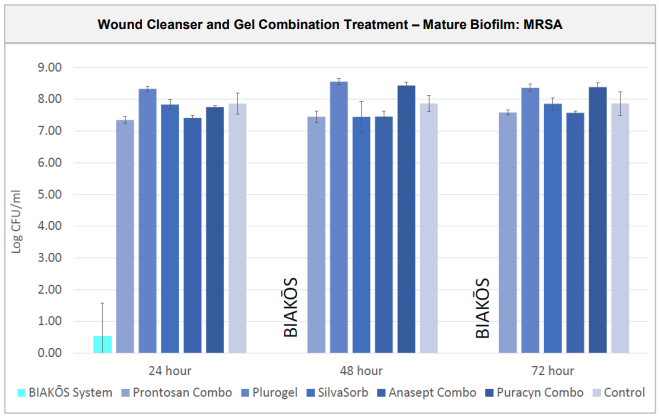

I won’t go into detail on all of them as I would bore you to death, but it’s important to understand that there’s a lot of new products that are about to get commercialized. And all of these products are, allegedly, much better than their competitors’.

Take for instance Biakos antimicrobial wound gel. In a study conducted in 2020, Biakos gel was compared to a number of wound cleansers to treat chronic wounds. The Biakos gel reduced the biofilm (a bad thing in this case) by 99,99% after the first 24 hours and eradicated it after 48 hours – a much better result than the competing products.

SERVICES

And then there are the Services. This is where I finally understood where this company is going and how its strategy differs from your regular microcap.

The company wants to become an all-encompassing wound care company. It wants to be the company that offers everything from start to finish in the wound-care continuum.

Through a series of partnerships and outright investment in other companies, Sanara is becoming just that – an ecosystem for the treatment of wounds.

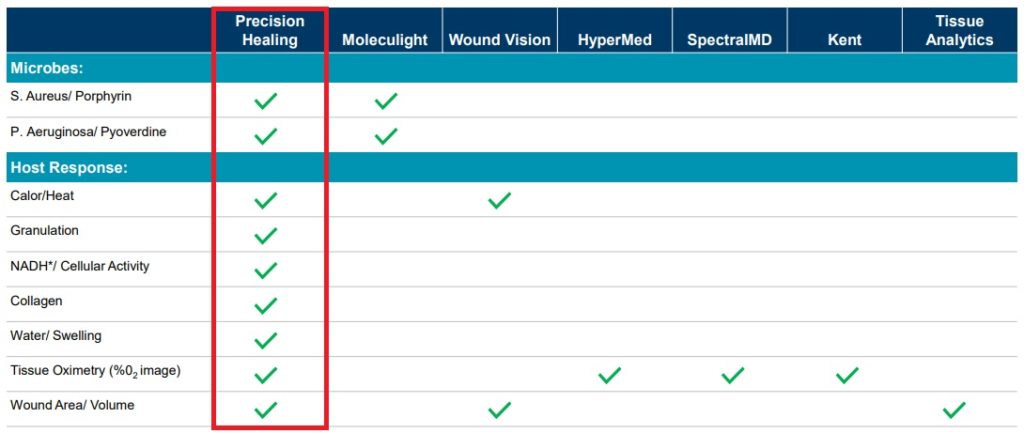

First off, the health conditions must be diagnosed. Through its partnership and investment in Precision Healing, the company is about to launch 2 groundbreaking diagnosis tools – a smart pad that you put over the wound and connects to a smart phone, and an imager device.

In an industry where, until recently, doctors were smelling wounds to assess if they were infected, these devices represent a drastic progress. They will quantify biochemical markers to determine the trajectory of a wound’s condition to enable better diagnosis and treatment.

The video below features a competing (and weaker) device, but it serves to illustrate how Sanara’s device will work.

The table below lays out the existing competing products and how differentiated Sanara’s technology will be (inside the red box).

Then, after the diagnosis is done, doctors will need to store and organize the data that was collected. Enter WounDerm, an electronic medical record (EMR) software platform that the company acquired in 2020. An EMR is nothing new, but it’s needed to create the ecosystem that Sanara is envisioning.

Then, the wounds need to be treated. Also in 2020, Sanara bought a minority stake in DirectDerm, a telemedicine company that has an exclusive network of dermatologists licensed in 23 states.

DirectDerm will be integrated into Sanara’s platform to provide virtual consultations. Sanara expects to expand its network to 50 states by the end of 2021. In the United States it can take up to six months for a patient to get an in-person appointment with a dermatologist. DirectDerm can do it in 48 hours.

Again, this isn’t your typical microcap. As a fellow investor said, most companies of this size can’t even redact an employee’s contract, let alone create partnerships, make acquisitions, and build an ecosystem like this.

Sales and Profitability

The revenue growth has been stellar… (let me remind you that Ron has entered the company in 2018 so we should probably be ignoring much of what is behind that date).

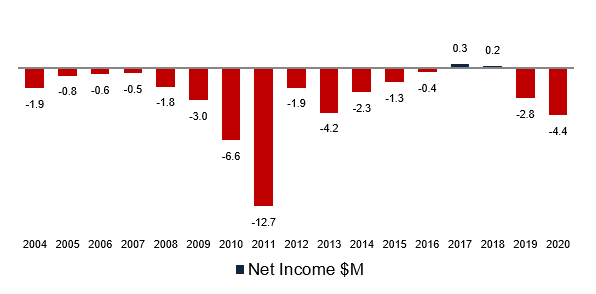

But the fast growth hasn’t yet translated into strong profitability.

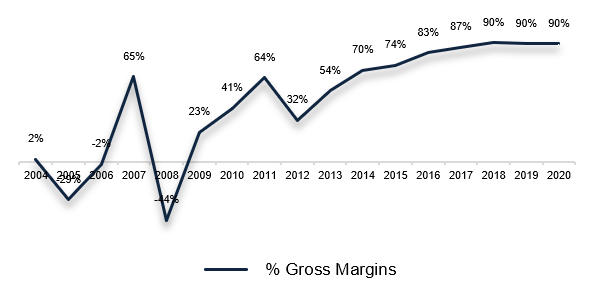

Surprisingly, the company has 90% gross margin (!). This is pretty good. This tells me that, in case of price pressure from increased competition, the company will have room to fight.

On top of that the management has said that they expect to achieve higher gross margins when the telehealth services are commercialized and reach sufficient scale. Higher than 90%?

Last night I had a chat with Callon Nichols, head of Investor Relations at Sanara. He told me that, because telehealth is mostly software, its margins are pretty high.

I get the feeling that they will be accounting for the doctor’s remuneration, not as Cost of Goods Sold, but as General expense, thus making the gross margin look higher.

But the company has been losing money because it has been aggressively spending on Sales & Marketing to grow. At some point, as it reaches scale, it should become profitable as some expenses (admin, legal, etc) are mostly fixed.

A fellow investor who has been following the company for some time told me that he gets the feeling that, due to the Private-Equity background of Ron, they’ll be going after profitability sooner rather than later.

Distribution and growth

As we’ve already seen, the company has been selling one product – Cellerate RX – mostly in Texas, its home state. But that is changing.

Just recently, the company disclosed that it has been hiring Regional Sales Managers (RSM) and that it has expanded the number of hospitals where Cellerate has been approved from 291 in 2020 to over 850 in the first quarter of 2021. That’s a triple in under one year. That’s the reason why some people expect the company to double its revenue in 2021.

To understand the opportunity in front of Sanara, one must understand the marketing strategy and payment process of the different segments.

For the surgical segment (Cellerate), the company will contact a hospital or a group of hospitals and pitch its product to a committee that will decide if the hospital needs the product, if it’s already using a similar product, or if they just aren’t interested in it.

Only after this pre-approval can the company’s sales reps go and market directly to the surgeons inside those hospitals. The doctors may or may not want to order and use the product. Given the sales trend, I have no doubt that surgeons like Cellerate.

The way the surgeries are paid for is that a payor (usually an insurance company) will tell the hospital “we will give you $5.000 to perform a hip replacement surgery and $10.000 for each spinal cord intervention” (these are fictitious amounts) and then the hospitals will use whatever products they want and keep the difference.

You would suppose that the hospitals would be incentivized to go with the cheapest products, but the reality is that a re-do of one of this surgeries or any other post-surgery unexpected treatment will come out of the hospital’s pocket. The payor won’t pay a single dime more.

So the hospitals will need to balance price and quality. If they feel that they’ll save a few thousand dollars for each patient by spending $700 on Cellerate, they will probably be doing it.

DOES IT WORK IN THE SAME WAY FOR THE WOUND CARE SEGMENT?

No it doesn’t. In the Wound Care segment things work in a different way. I asked Callon the reason for such a low growth since they signed a distribution agreement for Biakos in 2019.

He told me that in the wound care segment, which targets Skilled Nursing Facilities (SNF) and in-home treatment, the caregivers will get a fee-for-service.

This means that they’ll get paid for service performed regardless of what products they use. They won’t get paid more for using a more expensive product and, unlike the hospitals, if any complication arises, they won’t be paying for it out of their pocket. So they’re not incentivized to buy Sanara’s products, even if they’re the best.

The way Sanara is tackling this is by creating the whole ecosystem that I’ve just talked about and going directly to the payors. This is called going “at-risk”.

With the whole bundle of products and services, from diagnosis to actual treatment, the company can reach up to an insurance company and tell them “do you wish to offer this package to your clients?”. Hopefully those insurance companies will see the benefits of having such an ecosystem.

But this is easier said than done. It will be a steep climb before the company can claim victory. What Sanara is creating is the solution for a problem that has been around for long, but it’s so radically different that it won’t be easy to convince the relevant players of all the benefits they’ll be getting.

For starters, because Sanara will need to gather the data to corroborate that this comprehensive approach is actually beneficial to everyone, it will take time.

I asked Callon how long it would take to get this data. He told me that yes, it will take time, but the company is already launching some pilot tests so it can reach out to other potential clients and use those results as a selling tool.

He also mentioned that these aren’t new drugs that must go through rigorous and long clinical trials. Wounds take on average 14 weeks to heal so the cycle is much shorter than for a drug.

Then, the company has the added benefit of having Ron as Chairman of the Board. After developing the product, the most important thing is to actually get a seat at the table with the big payors.

I’ve reached out to fellow investors who actually know him and they all tell me that he’s A+ and if there’s someone who has the contacts, he’s the one.

Balance Sheet

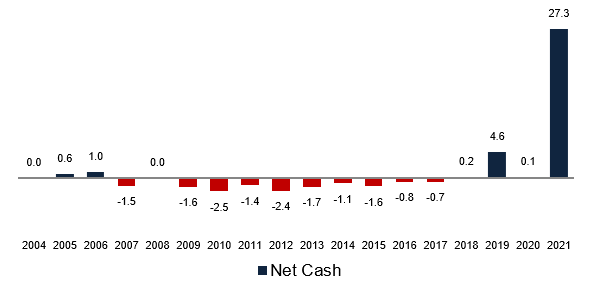

With money losing companies, the balance sheet becomes even more important then normally. Sanara’s balance sheet has been lousy for years.

But all of that has changed in February, when Sanara did a massive raise of $29 million at $25 per share.

The proceeds will be used to grow the business – expand the sales force and develop new products and technology.

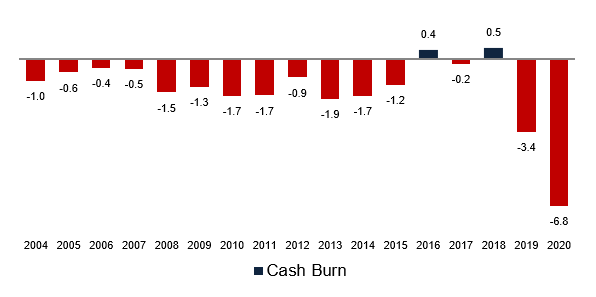

The cash burn has been increasing due to the strategic partnerships and increased sales expenses so it’s hard to say for how long the cash will last.

In 2020 the company burned almost $7 million. At this rate, the cash in the balance sheet will last for 4 years.

As mentioned previously, we don’t really have good visibility on how much the company will be spending from here-on-out so that’s a blind spot.

Management and Ownership

I’ve already mention Ron extensively, but the rest of the management team and board of directors also puts to shame most of the small companies out there.

Many of these managers have come from Healthpoint (a successful wound treatment startup) that was later bought by the giant Smith & Nephew for 5x sales. These guys have been around.

Callon mentioned a minor detail that I believe to be quite instructive. Sanara didn’t use any headhunters to get these guys. They all came from Smith & Nephew to Sanara because they had been working together before and, as a few came on board with Sanara and understood the vision, they brought the others in.

Just as another example of the quality of this board and how the company is preparing for the future, in October of 2020, Bob DeSutter was appointed as a director. Ron has extensive experience with mergers & acquisitions with clients such as Abbott, Astazeneca, Biomet, Johnson & Johnson, Pfizer, Smith & Nephew, Medtronic and others.

Competition

There’s a lot of competition in the wound treatment industry. Although the company states that it believes that its products are much better than those of its competitors, it’s important to bear in mind that Sanara is going up against giants such as Smith & Nephew and 3M, just to mention a few.

On a positive note, to my knowledge, no other company is offering the whole ecosystem of products and services like Sanara.

Risks

- No patent on Cellerate RX (which can also be seen as a plus)

- Highly competitive market

- Reimbursement for wound care outside of surgeries doesn’t take into consideration better products with better results

- Technological and privacy-related issues

- Funding issues

Valuation

At 10x EV/Revenue the company isn’t cheap. But that’s looking backwards.

Going forward, let’s say that each regional manager is able to generate $10 million in revenue. The company currently employs 17 surgical regional sales managers and 5 wound care sales managers.

We could be talking about $220 million in sales. Let’s cut it in half, $110 million.

Now the next question is “what margins can Sanara get at that scale”? This is the trickiest part and I don’t have a good answer to it. I can only speculate.

If it were to get, say, 15% net margin, it would be making $17 million. At a 25x multiple, which is pretty low for such a rapid growing business, the marketcap would be $425 million, less than double of what it is today.

But that’s not all.

Add to that a telehealth platform. The only investment bank following the company is Cantor Fitzgerald. On their initiation report they say that the telehealth platform alone could be worth $1 billion.

These guys get paid to say good things about the company so we should expect them to be over-optimistic on their assumptions, but still, it goes to show the potential valuation – if the platform gets adopted.

Conclusion

What I must ask myself is if I believe in this company and if the price is right.

I definitely believe in the story (it’s a story stock), but the price isn’t quite right for me yet. In fact, if the company were to miss one or more of the growth assumptions that are reflected in the price today, we would probably be seeing the share price go down by a lot. That’s when I’d strike.

This company reminds me of Nephros; a single-product company with a bunch of new products and services, each one of them with the potential to become much bigger than what the whole company is worth today. The difference is that Nephros products should be easier to sell.

So, to make a long story short, I want to participate in this story, but I’m not yet ready to pay such a lofty price. I’ll keep following Sanara, talking to fellow investors, learning more about the business, and if and when I come to the conclusion that there’s a good margin of safety, I’ll let you know.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.