Snack Empire Holdings

will it become a multibagger?

By Manuel Maurício

June 04, 2021

Symbol: 1843 (Hong Kong)

Share Price: HKD$0,43

Market Cap: HKD$344 Million

Introduction

I’ve been to Asia a few times in my life and everytime I get the feeling that “that’s where the world is right now; that’s where everything is happening”.

The company that I’m bringing today was created in Singapore in 2003 and soon expanded into Malaysia, Indonesia, Egypt, etc. In 2019 it went public in Hong Kong. This is, in and of itself, a good source for misjudgment and often, mispricing. Let’s take a look.

Company History

Snack Empire Holdings owns and franchises Tawainese street food restaurants under the brand Shihlin Taiwan Street Snacks. Its flagship product is the deep fried XXL crispy chicken breast (see below).

The two founders, Daniel Tay and Melvyn Wong, who own 75% of the company, are still Chairman and CEO. These two had big plans for growth when they listed the company in October 2019 right before the global pandemic broke out. Talk about timing.

How does the company make money?

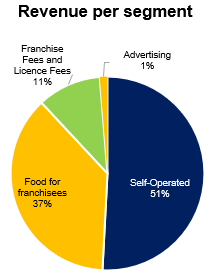

Like the majority of food franchisors, Snack makes money in 4 different ways:

– Sale of food and beverages in its own restaurants (%)

– Sale of food and beverages to franchised restaurants

– Royalty and franchisee fees collected from franchisees (…)

– Advertising and marketing fees collected from franchisees

From these four revenue streams, the royalties are usually favored by franchisors as they’re pure margin with little capital needs whereas the owned restaurants have a higher need for capital expenditures and working capital (inventory, receivables, etc). Said in another way, being a pure franchisor is a better business than being an operator.

That’s why chains like Mcdonald’s have been focusing on franchising up to 95% of their restaurants.

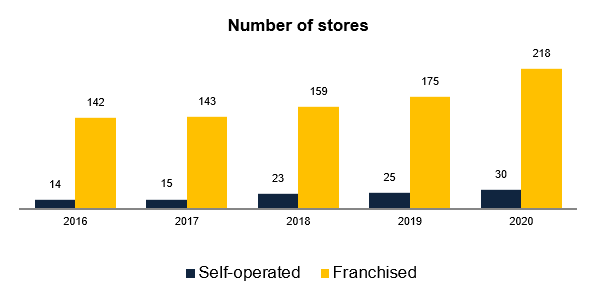

But interestingly enough Snack isn’t actually focused on the expansion through franchising. They want to build their own stores. Let me rephrase that. Snack isn’t solely focused on franchising, the main focus is expanding the self-operated locations whereas the international expansion through franchisees seems to come in second place.

I immediately frowned upon such plan, but these guys might not be as dumb as they appear at first glance.

Why did the company go public?

Whenever I look at newly-listed companies I like to know why they’ve gone public. You’ll find this information on the Prospectus under the “Use of Proceeds” section.

There area few reasons why a company might want to go public, the most common being:

– To get funding for growth (my favorite)

– To pay down debt (less favorite)

– To allow the founders to cash out (my least favorite)

In the case of Snack Empire, the reason for the listing was my favorite one, to get funding to grow as they were financially constrained. Not only that, but the managers believe that by becoming a publicly traded company they’ll gain more credibility in the eyes of their potential franchisees, landlords, suppliers, and banks.

When a company wants to go public, it’s in its best interest to get investors excited about its future prospects so it will paint the rosiest picture it can in order to create the desire for its shares. Snack was a bit different. I think this is the first time I read a Prospectus talking about the shortcomings of the management team.

Just read this out:

Notwithstanding that we had enquiries from various countries, the low number of enquiries per country made it difficult for our Group to effectively convert the leads to become franchisees/licensees as not every lead can successfully be converted to franchisee/licensee, which our Directors believe was due to (i) our Group’s slow reaction time to respond to enquiries from prospective franchisees/licensees, leading to their gradual loss of interest and momentum; and (ii) insufficient manpower of our Group to allocate and spend sufficient time on each and every prospective franchisees/licensees, therefore failing to give an impression to prospective franchisees/licensees that our Group was willing to invest time and money to understand and collaborate with them.

And it keeps going:

One Shihlin Outlet in Hong Kong was closed down during FY2017. The closure of the Shihlin Outlet in Hong Kong was due to underperformance which we believe was caused by insufficient promotion and advertising for our brand to be made known in the market.

Honesty is a trait that I appreciate, but I’m not even sure if I like this much candor.

On the other hand, these guys seem perfectly aware of what they’re supposed to do to expand both their local and international operations. When I talk about the local expansion, I’m talking about Singapore and Malaysia.

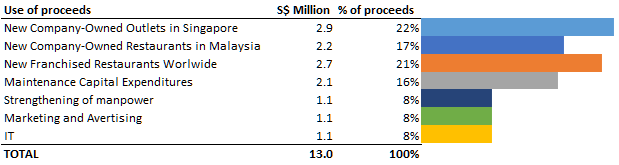

The company raised S$13 million (Singaporean Dollars) on the IPO that were destined to a) open 26 new self-operated restaurants in Singapore and Malaysia, b) hire a new team to support growth activities for international franchisees (new team and trade-fairs), and c) to refurbish existing restaurants among other minor uses.

In all the Prospectuses I’ve read, the section “Use of proceeds” was always very vague. The companies would mention that they would be paying down debt or use it to grow the operations or to improve working capital. But not this one.

These guys took very good care to plan what they would be doing with the money, from the number of restaurants they intended to open to the number of franchise fairs that they wanted to attend each year to the exact number of people they needed to support international growth. I take my hat off to them!

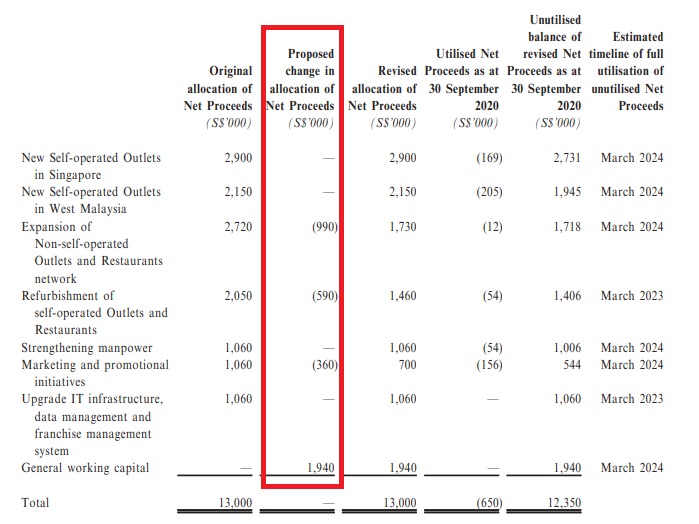

But then things took a left turn when the pandemic broke out. The management took the required precautions, halted the dividend (we’ll get to that later), and decided to slow down the growth plans even changing the use of the proceeds.

Well, it’s not a radical change, they’ve just reduced the investment in international expansion, refurbishment of the existing stores and marketing activities and directed those funds to a line called “General Working Capital”. The management did this out of extreme precaution given the pandemic and potential future needs of capital. I can’t blame them.

At first I didn’t get why they were focusing so much on building their own restaurants in Singapore and Malaysia, but slowly I got to understand that it’s their turf and they’ll make much more money if they operate these places out right in locations that they know well while leaving the international expansion to franchisees with knowledge of local conditions. It seems like a sensible approach.

But it’s the capital allocation skills of the two founders that I’m skeptical of. Although they mention on the Prospectus that they’ll be using the cash for growth purposes, they issued themselves dividends in the amount of S$9.6 million in the years prior to the IPO when they could’ve used that money to grow the business.

Then they raised debt (through a mortgage) to buy their headquarters in a fancy tower in Singapore when they could’ve just kept renting it and, maybe, use the debt to grow the business?

A fellow investor and fund manager named Arden Hah told me that it’s common practice for Singaporean companies to buy their headquarters as the interest rates are so low. I understand that.

And I’m not really sure if they could’ve raised that amount of debt to fund the operations as they mention in the Prospectus that the fact that the company didn’t own any hard assets made it difficult to raise debt and the bank demanded a personal guarantee from one of the founders. I’ll be asking the Investors Relations about this.

The dividend combined with the cost of the headquarters amounted to S$12.2 million, almost the same as the net proceeds from the IPO. Even if they couldn’t have raised debt for the operations, the dividend alone amounted to S$9.6 million. Why didn’t they use this to fund growth?

This gives me pause. Yellow flag!

As you might know by now, as a part of my research process I like to reach out to other fellow investors who have been following the companies I’m looking at for longer than I have. I find it to be a very important source of information.

This week, I’ve contacted two and asked them what they made of this. Arden Hah was a cool guy and helped me a lot. The other guy was the rudest guy I’ve talked to in a while. I don’t know if he was just annoyed by the fact that I was poking holes in his thesis or if he had a bad night of sleep, but he was able to make me nervous.

Minor issues aside, this guy told me that “maybe they didn’t know about the IPO/expansion in 2016-2017. Shouldn’t they have paid dividends?“. I dunno, I guess so. But why were these guys issuing a dividend one month prior to the IPO?

In the end, I believe that the IPO was in part used for growth and in other part as an indirect way for the founders to cash out.

Ok, now that we’ve talked about how the company makes money and what are the management’s plans for growth, lets check the financials.

Financials

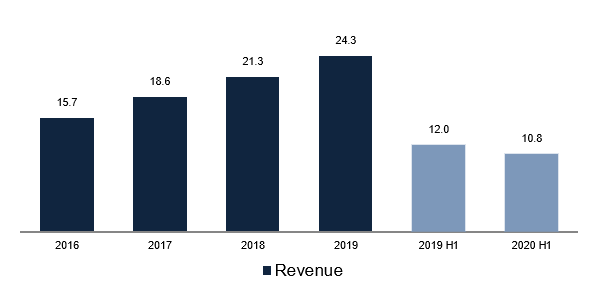

The first thing I’ll want to be doing is to check the revenue trend. As with other recently-listed companies, the information we have only goes as far back as 3 years prior to the IPO.

From 2016 onward the revenue has grown at 16% annually whereas in the first half of 2020 the revenue fell by 10% when compared to the prior year. This was to be expected.

WHAT ABOUT THE SAME-STORE-SALES GROWTH?

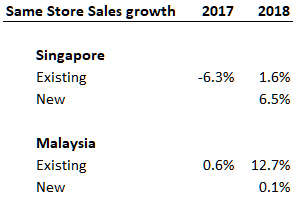

The Same-Store-Sales growth (or comparables, or just comps) is the metric favored to gauge the underlying demand for the concept.

Unfortunately, the Prospectus doesn’t disclose the SSS for the whole network but just for the self-operated locations. Hummm…

But then…. then… on the Annual Report for 2019 the company doesn’t mention the SSS at all. This is a franchisor, a food retailer. And it doesn’t report Same-Store-Sales growth?

Here’s what the company reports.

I could be talking about the poor performance in 2017 or the ensuing positive performance, but the truth is this is just too little information for me to be formulating an opinion. I think it’s scandalous that the company doesn’t report more info on such an important metric.

The other metric I like to look at when researching a retail business is the System-Wide-Sales which are comprised of the total revenue coming from both the self-operated restaurants and the total revenue that the franchisees generate on their restaurants. That too is missing. More yellow flags!

I could try to calculate the System-Wide-Sales by taking the royalties from each country, subtracting the upfront fees that franchisees pay to secure the franchise, and gross it against the percentage that each country pays the company on its total sales… I could… but again, that information is on the Prospectus for the years up to 2018, but not for 2019 or 2020 so it would be of limited use.

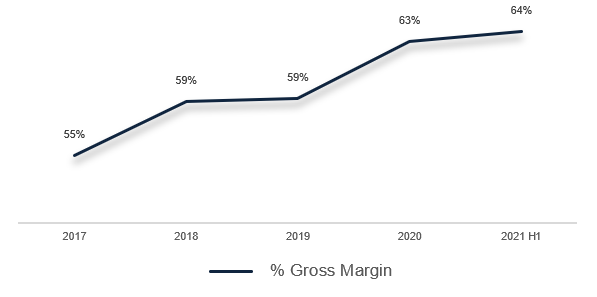

Let’s look at profitability now. The company has been able to grow its gross margin quite nicely over the years.

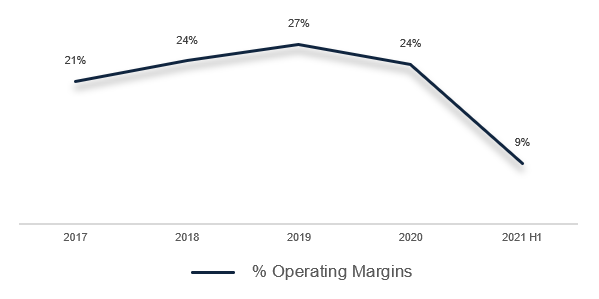

Whereas the operating margin has seen a decline in 2020 showing the inability to control costs, namely the salaries of its employees. Of course, in the first half of 2020 we can see the impact of the pandemic, but I don’t pay too much attention to it as it shouldn’t repeat itself.

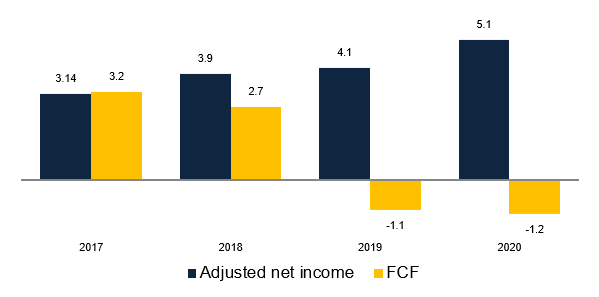

All of this leads to growing profits, which have not flowed into the Free-Cash-Flow simply for the fact that the company has been investing in the business.

WHAT ABOUT THE UNIT ECONOMICS

In retail concepts such as this one the unit economics and consequent return on investment are some of the most important metrics to look at. The better the economics of a single unit the more units the company should open as the costs of the central structure (admin, legal, marketing) get spread across the higher number of units.

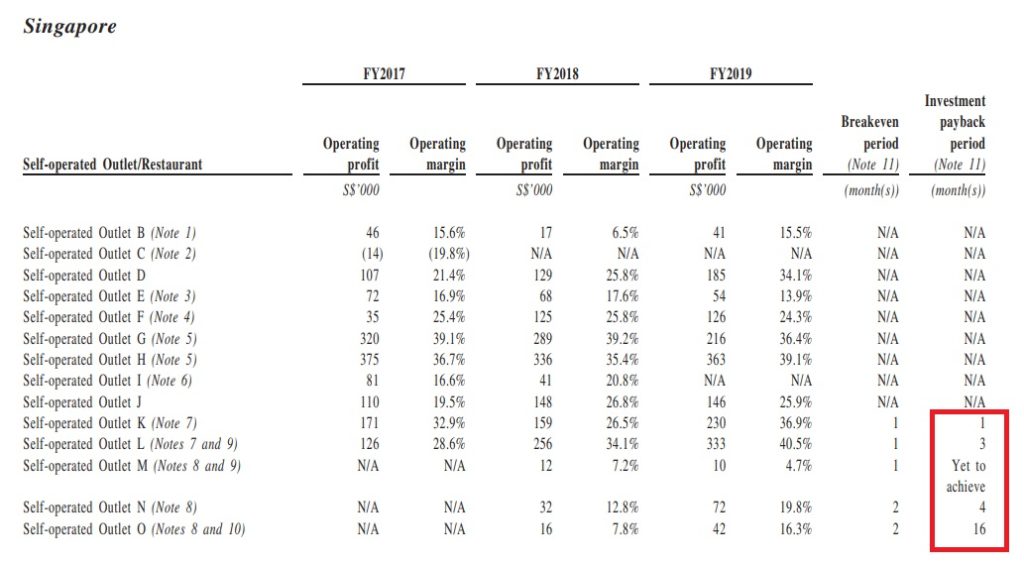

The unit economics for Snack Empire Holdings are the best I have ever seen. Just look at this.

With its restaurants in Singapore, the company gets its money back after 1 to 16 months. This is just bonkers!

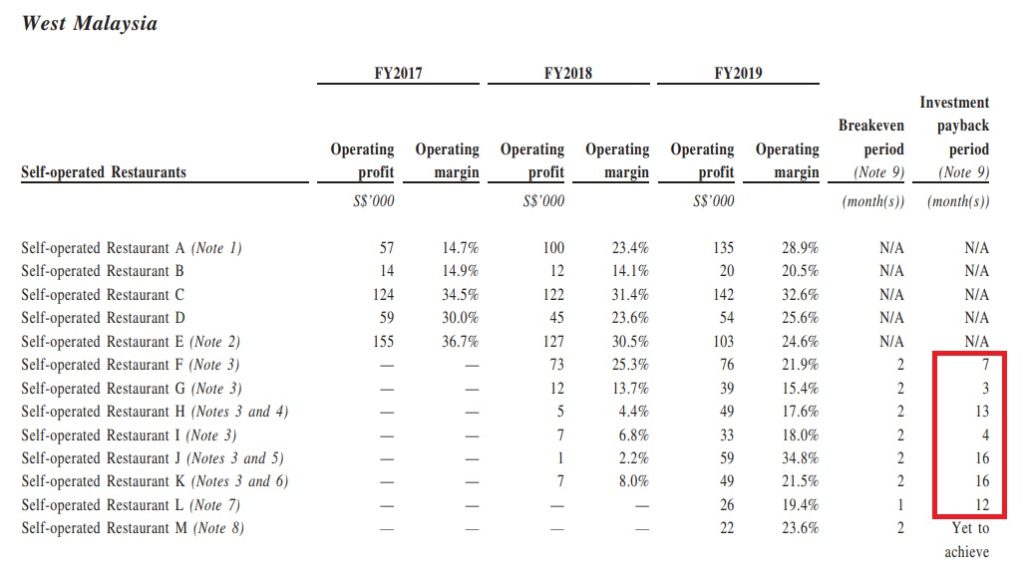

Whereas for the Malaysian restaurants the payback period is typically longer. But still – a payback of 1 year is a 100% return on investment.

With these unit economics, these guys should be opening as much restaurants as they can so I see why they’re doing just that.

And what about valuation?

With the recent listing, the company’s coffers are full with S$23 million in cash and total liabilities of just S$8 million.

Arden Hah has been following the company for some time and he sent an open letter to the board and management team urging them to reinstate a dividend policy of 50% to unlock shareholder value. Let me explain:

Prior to the IPO, the company had a dividend policy of distributing 40% of the net income as dividends. With the pandemic that policy was paused. In his letter, Harden argues that a 50% payout ratio would translate into a dividend yield of 7.8% on the Market Cap of S$30 million (at that time).

A 7.8% yield would be too high compared to the China and Hong Kong treasury notes that yield 1.9% (the valuation of a company is often compared against what you can get on a risk-free investment such as government notes). Arden argued that the price of the stock would re-rate to a more “reasonable” yield of 2.4%, meaning that the Market Cap would go up to S$100 million (around HKD$587 million at today’s exchange rate).

But that was when the stock price was at HKD$0.2. Today the share price has more than doubled to HKD$0.43. If the company were to pay out 50% of the 2020 net income (year ending in March 2020), the current dividend yield would be 3.5%.

If the stock price would re-rate to reach the dividend yield that Arden suggests as being “appropriate” the stock price would have to go up to HKD$0.6 for an upside of 39% from the current price.

If that were to happen, the company would be trading at a Price/Earnings ratio of 16x. If we were to back out the cash on the balance sheet, the PE would be 11x. Either way you slice it, that’s still cheap for a company that has been growing 15% per year and supposedly will be keep growing in future years.

Of course, I would prefer to see the company reinvesting all that cash back into the business.

By the way, if you were thinking why doesn’t the company buy back shares instead of dividends as a means of unlocking shareholder value, due to the Hong Kong listing rules, the fact that the founders own 75% of the company makes it impossible for the company to buy back more shares.

And it would be ridiculous for a company to buy back shares one year after it IPO’ed. right?

Risks

- Bad execution

- Bad capital allocation

- Increased competition from Monga, Devil Chicken, and others

- Recent change of auditor. The reason the company gave was that PWC was too expensive.

Conclusion

Snack Empire Holdings is an interesting story. There’s good chance that the company will be growing a lot in the future and with such good unit economics that should lead to increased margins and to increased bargaining power with its suppliers, leading to better flow through of profits into Free-Cash-Flow.

I don’t doubt that with the new dedicated team, these guys might be seeing both the local and international businesses grow like crazy.

I take this as a first approach to the company and yet another step into getting more comfortable with Asian companies. I’ve asked the Investor Relations for a Zoom meeting and I’m still awaiting a reply. Without knowing the the Same-Store-Sales growth and other important metrics I can’t possibly make an investment in Snack Empire Holdings.

I also still need to make an Excel model to estimate its future cash flows, but that will only come after I talk to the company.

I’ll be following Snack Empire Holdings and if I gain new insights, I’ll let you know.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.