TheWorks

H1 earnings... and a surprise

By Manuel Maurício

January 27, 2022

I bought TheWorks on the 7th of January for £0.55 per share and in the meantime the company posted results and the share price went up by 23%.

My first impression of the results posted last week was very good.

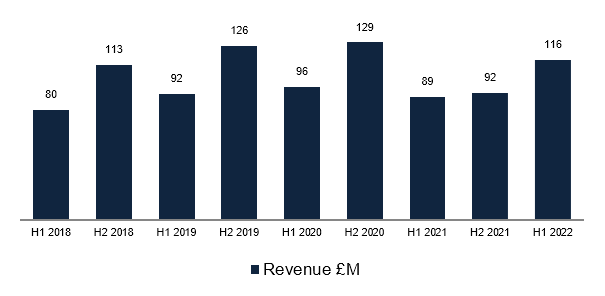

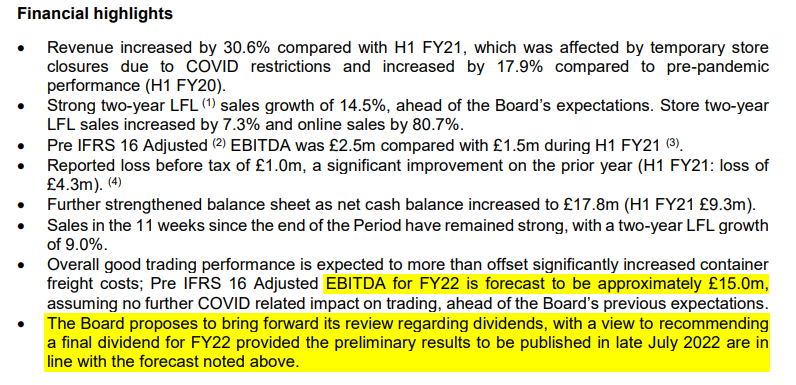

The revenue went up 31% from a year ago and 20% from two years ago to £116 million.

The management attributed the strength to people bringing forward their Christmas shopping fearing further lockdowns and supply chain disruptions.

*Note that the first half of the year for TheWorks ends on October.

The 2 year Like For Like sales grew by 14.5% for the whole business.

The 2 year Like For Like sales for the physical stores grew 7.3% led by higher average transaction volume offsetting lower foot traffic.

The 2 year Like For Like sales for online grew 80.7%.

On the second half of the year, the company is seeing Like For Like sales growth of 9%, led mostly by the online channel with the store Like For Like growth decreasing as people shopped for Christmas earlier in the year

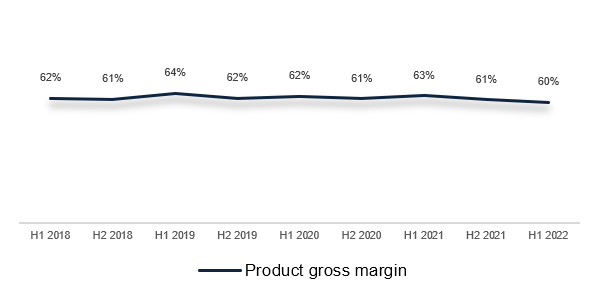

The product gross margin went down to 60%. The management attributed this to higher freight costs and also to the product mix including a greater proportion of front-list books and branded games and toys, which sell at a lower percentage margin, although they bring in more cash.

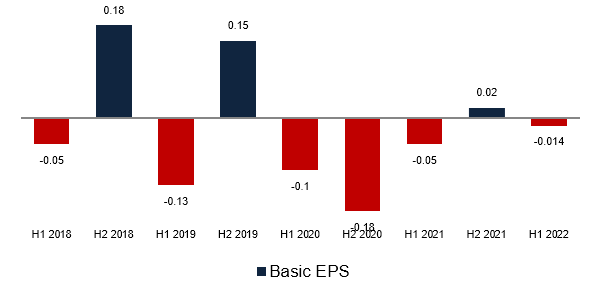

The management was able to keep the operating costs low leading to Earnings-Per-Share of -1.4 pence, materially higher than in previous years. TheWorks’ typically loses money in the first half of the year and makes up for it in the Christmas season.

COMPETITIVE LANDSCAPE

The other day, as I was reminding Gonçalo Garcia that TheWorks was trading at 3.3x Free-Cash-Flow, he replied saying that a low multiple is worthless without knowing the management’s incentives, the competitive threats, the capital allocation policy and other stuff. It’s a pleasure having such demanding subscribers.

I think that assessing the competitive landscape and threats for a retailer in another country is always hard without doing some primary research (like visiting the stores, talking to customers and employees, etc).

As mentioned on my previous write-up, I’ve asked a fellow investor to visit his local store in Christmas to check how full it was, but that was as far as I got. Primary research is one area of research that I would like to improve upon in the future.

Having said that, I believe that the competitive landscape for TheWorks couldn’t be fiercer. We’re talking about a retailer of low-priced, undifferentiated goods. As we all know, foot traffic has been declining and e-commerce as been gaining that share of the market.

TheWorks sells products that, because they’re cheap, aren’t optimal to be shipped (the cost of shipping represents a big part of the overall cost). On top of that, you can find everything that you find at TheWorks at other retailers.

The company states that they offer lower prices than the specialists and more choice than the discounters. Translation: they must work hard to stay relevant.

MANAGEMENT’S INCENTIVES

Regarding the management’s incentives, these are a little easier to evaluate.

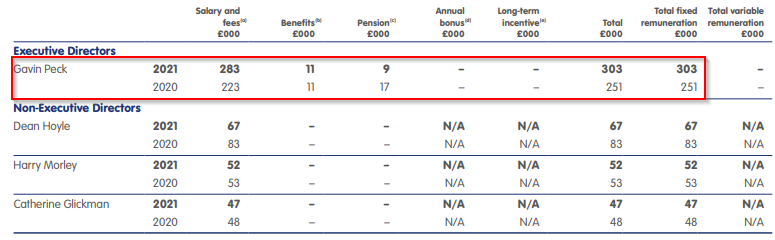

The CEO’s base salary is £300K (although he agreed to earn less in 2020 and 2021 due to COVID19).

ANNUAL BONUS

Then there’s an annual cash bonus that can reach up to 100% of salary. 90% of this bonus will be tied to EBITDA goals with the remaining 10% tied to strategic objectives. Of course, EBITDA can be gamed.

One way to increase EBITDA is to reduce costs. This poses the risk of reducing costs so much that the business suffers.

LONG TERM INCENTIVE PLAN

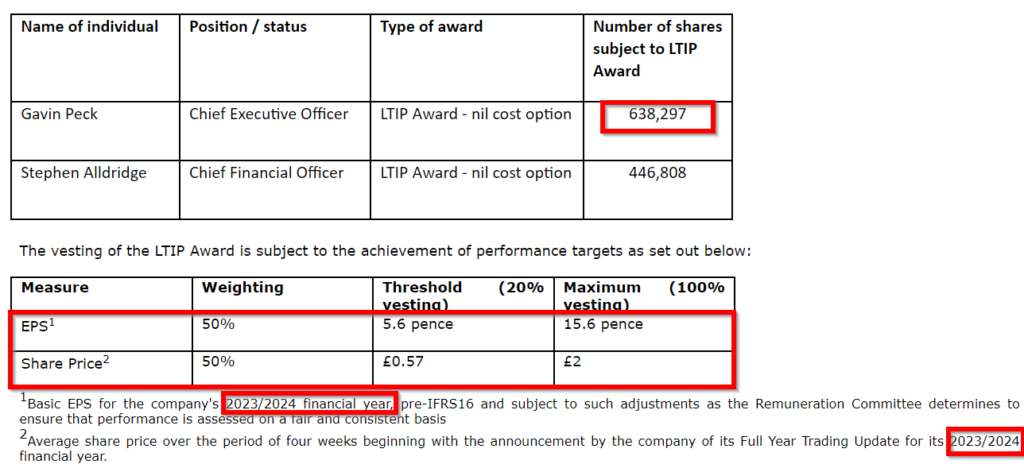

In order to incentivize the management to take the long term view, there are also option plans – the company gives the CEO free options to buy the shares at a certain price. If the shares are trading for more than that price, the CEO makes money.

This incentive can reach up to 100% of salary (200% in special circumstances), this time based on Earnings-Per-Share (50%) and Share Price (50%). That’s better.

Earnings-Per-Share is harder to manipulate than EBITDA. Regarding the share price measure, it may incentivize the management to become overly promotional, but from what I’ve seen of the CEO, that risk is limited. Besides, who wouldn’t want a higher share price?

The CEO is new to his role – apparently capable of leading the company to where the Board wants to get to – and because the current option scheme was of negligible value in recent years due to the pandemic, providing little retention power, the Board decided to grant him and the CFO an options award.

So, in order to get his hands on 20% the prize, the company must be making 5.6 pence by 2024 and the share price must be at a minimum of 57 pence by then (representing a 10x PE ratio). In order to get the prize in full, the company must be making 15.6 pence in EPS and the share price must be above £2 (representing a 12x PE ratio)

The company will be making 12 pence in EPS this year already, and the share price is already above that minimum threshold of £0.57.

All in all, I believe that the management’s incentives are reasonably aligned with those of the shareholders. Could they have been better designed? No doubt. I would love to see ROIC measures, but…

Also, the previous Chairman of the Board (and still Director) owns 17% of the company, so there should be some oversight of the business by an aligned insider.

ESTIMATES AND CAPITAL ALLOCATION

The management guided for £15 million in EBITDA and expects the net cash balance to be at least £10 million by year end.

They also tell us that they’ll be reinstating the dividend.

Conclusion

The £15 million in EBITDA should translate into roughly £9.1 million in Free Cash Flow. The marketcap is currently £42 million. If we adjust for the £10 million in cash, the stock is trading for 3.5x Free Cash Flow. This is very cheap. Barring any material change to the normal course of the business, one could expect the share price to double from here.

Yes, there’s the risk of further lockdowns, and more importantly, there’s the risk that the market never recognizes the undervaluation, the business materially deteriorates, and investors never get to see the share price appreciate. I’m willing to take that risk. So much so that I’m buying an additional €5.000 for the Portfolio tomorrow.

To discuss this stock, head over to the Forum.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.