Types of Orders

when buying or selling stocks!

By Manuel Maurício

April 05, 2021

Sometimes I’m so focused on finding the next great stock that I almost forget that some of my subscribers are still struggling with basic concepts like which type of order to chose when buying or selling a stock. This article is for them.

On most online brokers you’ll find different types of orders. At first, these might seem a bit confusing, but once you learn what each one means you’ll see that it’s pretty easy.

Before getting to the orders it’s important to note that a stock price is the last price at which someone bought and sold that stock. It may have been just one stock that has exchanged hands; it doesn’t necessarily mean that you’ll be able to buy it or sell it at that price.

This leads us to an important concept, the volume of a stock. The volume of the stock is the number of stocks (of the same company) that have exchanged hands in one day. Now we’re all set to learn about the different order types.

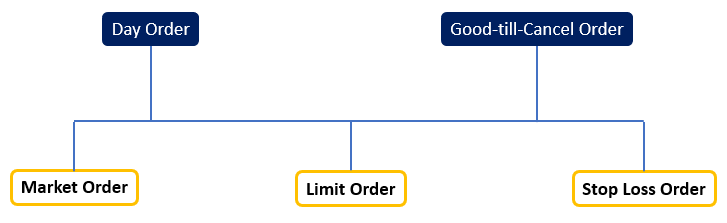

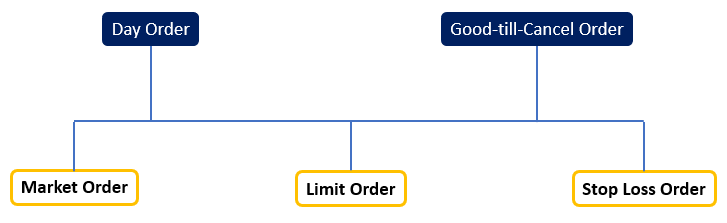

First, the orders can have 2 types of duration: they can be Day Orders or Good-Till-Cancel orders (also called GTC).

Day Order

This one is pretty straightforward. The Day-order will only be valid for the day on which you are placing the order. After that day has ended your order will have expired, and in the case it hasn’t been executed (no one sold or bought that stock), you’ll need to place it again.

Good Till Cancel Order (GTC)

The name says it all. The Good-Till-Cancel order will remain “live” until its fulfilled. Let’s say that you want to buy stock XYZ at €10 and the stock is trading for €12. Until someone is willing to sell it to you at €10, the order will remain “live”.

The expiration date for the Good-Till-Cancel orders will depend on the stock exchange. For stocks traded on Euronext it will be 12 months whereas for stocks trading on other exchanges it can be 90 days.

So far so good, right? Both of these types of orders will branch out into 3 sub-types:

Market Order

The Market order can also be called “Best” order. By using the Market Order you’re saying that you’re willing to buy or sell a particular stock at any price. Most of the times you’re guaranteeing that the order is executed, but you’re not setting the price.

In stocks with high volume and low volatility this shouldn’t be a matter of concern as there’s always someone willing to sell you their stock at prices near the last trading price, but when we’re talking about low volume stocks (also called low liquidity), a market order can be dangerous.

Let’s say that you want to buy the stock of a company called “Out of Nowhere” and there’s only 1 seller. Let’s also say that the last trade was done at €10.

Unlike a popular stock with high volume, when we’re talking about low liquidity stocks, there’s no guarantee that you’ll be able to buy it anywhere near those €10.

If that single seller issues an order to sell it for €30, you’ll automatically be buying it for €30. That’s why you shouldn’t use market orders if you’re just starting.

>> When to use: Only when you want to buy or sell highly liquid stocks with high volume and low volatility, and when we don’t care about the price at which we buy or sell those stocks. It’s also important that we use these orders only during market hours (to protect us from unexpected news after hours).

Limit Order

If you’re just starting to invest, this is the stock you’ll probably want to be using.

When you’re buying a stock, you’ll be setting the upper limit at which you’ll want to buy the stock, and the order will only be fulfilled when a seller is willing to sell you at that price or lower.

Similarly, when you’re selling a stock, you’ll be setting the lowest price at which you’ll want to be selling that stock.

>> When to use: Most of the times.

Stop Loss (sell) order

The stop loss order was created to limit your loss in the case a stock that you own falls below a certain price. At first, this seems like a good protection device, but it’s fundamentally flawed.

Let’s say that you’ve bought the stock “XYZ” for €10 and you immediately put a Stop Loss order for €8. By doing so you’re saying that you’re willing to sell that stock at any price in case someone trades that stock for €8. It doesn’t mean that you’ll be able to sell it for €8.

You’re letting others set the price at which you’ll sell your stock because when someone buys or sells that stock for €8, your order will immediately become a market order. If the next buyer wants to buy shares for €4, that’s the price that you’ll be selling your stock for.

Now, with high volume and low volatility stocks, this mismatch between buy and sell prices doesn’t happen in most of the times, but it goes to show the principle underlying the Stop Loss Order.

The Stop Loss order is usually used by novice investors for protection against further drops in the share price, but if you’ve done your research and you’ve decided that you’re willing to buy a business (that’s what a stock is) for €10, why would you not buy more at €8? I know of no seasoned investor who uses Stop Loss orders of any kind.

I understand the allure of a stop loss order for those of you who are just starting. You’re not that confident about your research and you want to guarantee that you don’t lose much if you’ve made a mistake. I get it. But not doing the work in the first place is the fastest way to lose money in the stock market.

Whenever you feel like using a Stop Loss order, what you should be doing instead is researching that company better.

When to use: Almost never.

Stop Limit order

The Stop Limit order works much in the same way as the Stop Loss order except for one detail; you set the price at which you want to sell the stock.

Let’s say that you’ve bought the stock “XYZ” at €10 and you want to sell it if it goes below €8. You can then set the price at which you want to sell it for, say €7.5. If no one buys your stock for that price, you’ll be keeping your stock.

When to use: Almost never.

Conclusion

So here you have it, the most important types of orders that you can use to buy or sell stocks. In fact there are a few more that are used in special situations such as short-selling (betting against a stock), but I won’t get into those today. These should be more than enough for the common private investor.

I hope this article has helped you understand the different types of orders, but if you still have doubts, do let me know: [email protected]. I’ll be happy to help.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

JOIN THE

ALL IN STOCKS SUBSCRIPTION

In depth courses and training

Portfolio with Top Picks

Active, supporting community