Uranium update

The cycle has turned

By Manuel Maurício

March 04, 2022

What a ride it has been for uranium stocks in recent months!

First, a global pandemic, then, energy prices going through the roof, then, a war in Ukraine, then, sanctions to Russia, and now, the takeover of a large nuclear plant.

What does this all mean for uranium stocks? That’s what I’ll be answering today.

To get more signal and less noise, I always like to learn what Cameco is seeing. They’ve recently held their year-end conference call, and boy, was it bullish for Uranium!

CAMECO IS RESTARTING PRODUCTION AT THE LARGEST MINE IN THE WORLD

Cameco is restarting production at McArthur River, the largest mine in the world. They expect to get it fully functioning by 2024. This can only mean that they’re seeing increased buying activity by the utilities. Confirmation of the turning tides was also the 50% increase of the dividend.

Cameco contracted 70 million pounds since the beginning of 2021, 40 million of which were contracted in January 2022 – even before the war in Ukraine. This goes to show that utilities are back at the negotiations table. The cycle has turned!

Tim Gitzel, Cameco’s CEO, said that 3 things were indication of this:

1. While previously they were seeing the utilities submitting Request for Proposals for uranium contracts of up to 5 years, now they’re seeing up to 10 years. This means that the market is going back to its “classic” term with the utilities understanding that they need to secure long term supply.

2. Cameco is seeing volumes increase from the 100.000 pounds to several million pounds.

3. Cameco is seeing time frames increase, meaning that the utilities are now worrying about the uranium that will start to be delivered 5 or 10 years down the road.

CRITICISM ABOUT CONTRACTING PRICES

Cameco’s management has always been vocal about needing to sign contracts at $40 or $50 to restart McArthur River.

The current spot price it at $51, the highest it has been since 2012.

So, the decision to restart the production at the largest mine in the world can only mean that they’ve gotten the prices that they wanted.

Yet, they don’t have the full production sold out so they can take advantage of the market prices going forward.

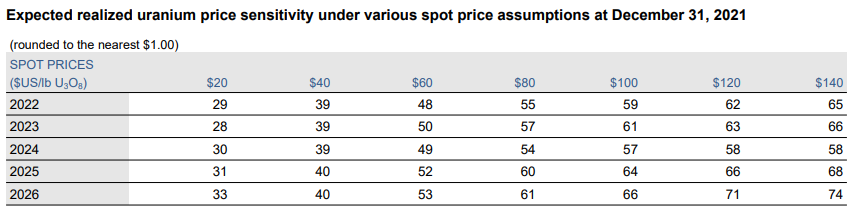

Contract pricing is a very complicated area of the uranium cycle. Some companies set a fixed price, some set market prices – meaning that if they’re supplying a utility for several years, the price will vary according to the spot price at the date of delivery – and there’s companies like Cameco that will do a blend of fixed prices and market prices.

On its report, Cameco publishes a sensitivity table showing what it expects to earn depending on the variations of the spot price. Their strategy has been highly criticized by some experts who argue that Cameco is leaving a lot money on the table.

Instead of setting market prices for their uranium, believing that the spot price will rise dramatically in the future, Cameco is capping their upside by signing fixed priced contracts at today’s price, which many feel are too low.

In the view of Cameco’s CEO and CFO, they want to have a balanced and disciplined approach. You’ll hear them repeat these 2 words over and over again. But what does this mean?

It means that, instead of waiting for the spot price to go up and becoming one of the last uranium companies to sign contracts with a reduced number of utilities, which may be geographically clustered or may be in bad financial condition, Cameco prefers to sign contracts with a diverse base of clients so it doesn’t become dependent on just a few lousy ones.

“What you never want to be in the uranium market is overweight one region or one customer or one product form.” Tim Gitzel, Cameco CEO

I think that’s a sensible approach, even if they’re leaving some money on the table. The truth is, I don’t care much as I think this will have limited impact on the spot prices, which is what really matters to investors in Yellow Cake and Sprott Uranium Trust.

RUSSIA, KAZAKSTHAN, AND URANIUM

Now, the Russian invasion of Ukraine and the economic sanctions have come to scramble everything.

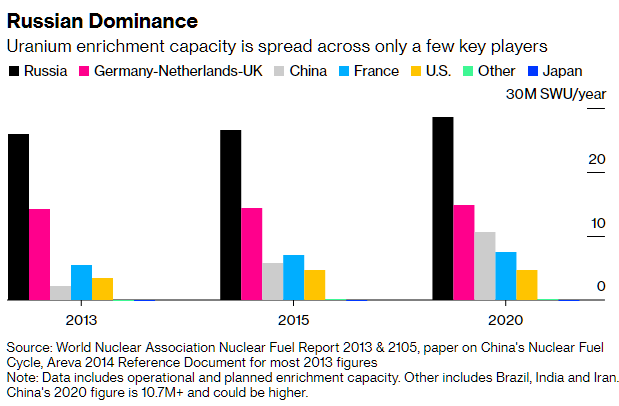

25% of all nuclear fuel comes out of Russia and it isn’t yet clear if the sanctions will apply to uranium too. Note that Russia doesn’t mine those 25%, but it’s the world leader in enriching uranium.

On top of that, Kazakhstan produces about 40% of global uranium production, and it’s no secret that Kazakhstan has close relations with Russia. So much so that a lot of the Kazak uranium goes to Russia to be enriched prior to being sold to Western countries.

Even if the current sanctions don’t affect the Kazak production, utilities will want to get their pounds from safe geographies. No one really knows what will happen going forward, but it all points to a higher price of uranium.

Not only that, but it looks like nuclear power has been gaining popularity recently as energy prices have gone through the roof. Even Germany seems to have reversed its nuclear policy to diminish its dependency on Russian oil and gas. It looks like the tides are turning in favor of nuclear power.

THE DANGERS OF A NUCLEAR DISASTER

Now, it’s just sad that the media – and some politicians – choose to scare us with news of the Russian army attacking the Zaporizhzia nuclear power plant. Even Ukraine’s president came out saying that it would be a chatastrophe if the nuclear plant was bombarded.

The truth is that it’s highly unlikely that a nuclear disaster will ocur. First, this plant’s design is much more advanced than that of Chernobyl. It was built to resist the attack of explosions.

Second, after the Fukushima disaster, the regulations regarding the safety of nuclear plants around the world were severely tightened leading to the implementation of increased safety measures.

Third, the Ukrainians have shut down 5 of the 6 reactors recently due to the threat of war. The danger of radioactive contamination is limited to reactors which are still operating.

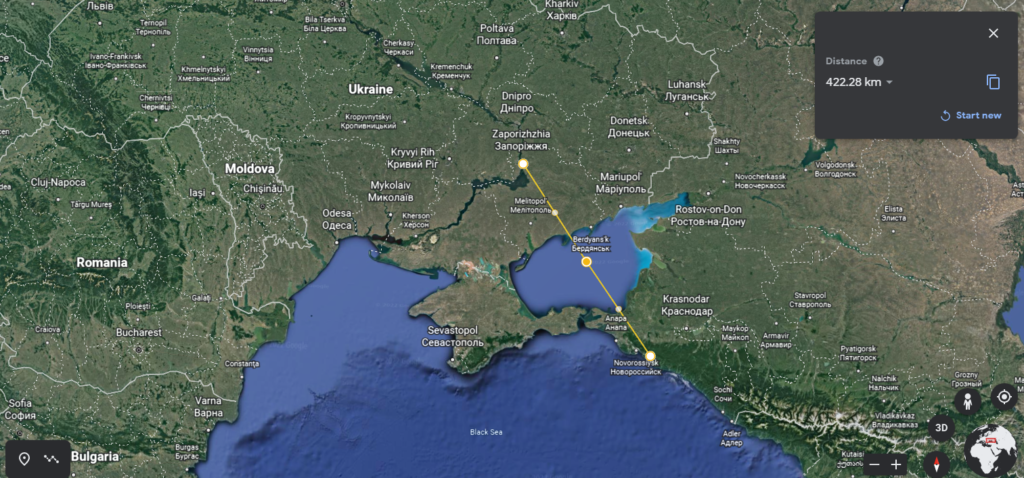

Fourth, I don’t see the Russians wanting to create a radioactive zone right in their backyard, especially so when Putin has just finished building his palace in the Black Sea, not far from the nuclear plant.

It is true that he might want to increase the perception that nuclear power is dangerous in order to keep Europe buying Russian oil and gas, and I don’t know to what extent Putin is willing to go, but I don’t see a nuclear disaster in Ukraine as something that the Russians would want right now.

WHAT DOES THIS MEAN FOR YELLOW CAKE AND SPROTT URANIUM TRUST?

Circling back to the question of what does this all mean for uranium stocks, I believe that, barring any nuclear disaster, the invasion of Ukraine and the sanctions imposed to Russia might just be the catalyst that everyone was waiting for.

Every utility in the world is probably trying to secure supply right now. Cameco’s CEO must be getting a lot of calls. Not only that, but the Kazakhstan government is planning on raising taxes on mining companies by 30%, meaning that the lowest cost producer will become a little less low cost. The perfect storm seems to be brewing.

I think I’ve always said that holding uranium stocks would be a bumpy ride. Little did I know. But it has been fantastic. And yes, I’m still bullish uranium.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.