Was Buffett right

in buying HP?

By Manuel Maurício

July 24, 2022

Symbol: HP (HPQ)

Share Price: $33.87

Market Cap: $35.03 Billion

The other day I took a quick glance at HP and I got intrigued by Warren Buffett’s decision to buy the stock. You see, everyone knows Buffett is technology averse. He invested in IBM and it was a flop. But he also invested in Apple and that turned out to be a great investment. Today I’ll be uncovering what he saw in this mature business.

I’ve had some of you giving me amazing feedback through the survey at the end of the previous write-up. Thank you. There was one comment in particular that caught my attention.

I don’t think there should be a hard rule. Quick opinions should be a way to source ideas. It’s how it works, anyway, right? We go through many ideas, get quickly bored or scared of most of them, and every now and then something catches our eye. As is the case with HP on this article. So probably HP is calling for a deep dive soon. Are generic ink providers a real threat? Is the subscription model taking off? Could they be soon offering the printers for free and charging you a monthly subscription for ink? How much money are they making on subscriptions from people who don’t actually print, and therefore give them high margins on the subscription? If there are no good ideas, why force a deep dive? But if there are 3 great ideas, why not 3 deep dives?

These are important questions, but to answer them, we must first learn about the business.

There are two distinct businesses inside HP: the Print segment (ink and printers), and the Personal Systems segment (desktops, laptops, and peripherals).

The Print business has long been HP’s cash cow. It’s known among investor circles as a razor/razor-blade model. The company subsidizes the printers, sometimes at a loss, because it knows that it will more than make up for that by selling the ink.

But with ever-increasing digitization, people are printing less and less. And the pandemic has come to speed up that trend. That’s headwind number 1.

Headwind number 2 is the low-cost ink competitors. I remember reading an article saying that ink was more expensive than cocaine. Before the rise of e-commerce, HP sold its ink through its distribution partners. Because of its size, it had the leverage to negotiate the placement and positioning of its ink cartridges and toners.

But e-commerce has come to disrupt the traditional retail models. Today, everyone can sell cheap ink on Amazon. I haven’t printed anything for quite a while, but I remember buying ink from whatever seller was cheaper. I didn’t care if it was HP or Mr. Chen from across the street. HP alleges that its ink is superior, but most people wouldn’t know the difference. So, ink is a commodity product that has long been sold by a hand full of players who have taken advantage of the existing distribution model and made billions out of it.

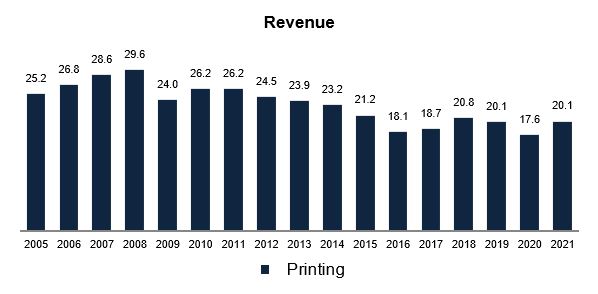

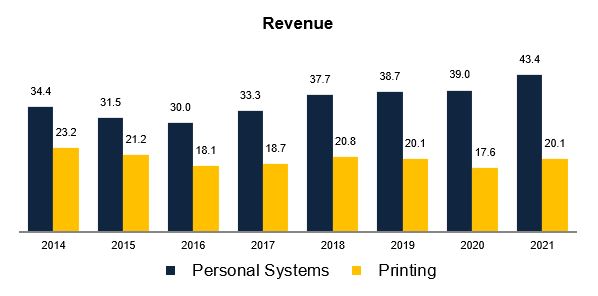

So, how have these 2 massive headwinds affected the printing revenue for HP? They have led to a long and steady decline.

This decline seems to have stabilized from 2016 onward, but the pandemic has come to blur the picture. (Bear in mind that the chart above includes the sale of, not only ink, but also printers).

The pandemic has brought an unexpected dynamic. Home printing had been declining faster than office printing before the pandemic. The new Work-From-Home (WFH) trend accelerated the decline in office printing but brought increased printing at home. This is where reading all those Conference Calls (I spent one week reading like 30 of them) was fundamental to understanding the business.

For the laser printers, which are mostly used in offices, HP sources components from Canon and pays Canon a percentage of the profits. But such a deal doesn’t exist for the inkjet printers, which are mostly used at home. This means that a page printed at home is more profitable than a page printed at the office.

Not only are margins higher at home, but HP has a higher market share on the home printers than on the office printers. So when everyone got stuck at home, more pages were printed with HP printers. This helped both revenue and margins.

The other reason behind the recent up-tick is that, because there’s more demand than supply right now, the company is raising its prices.

This leads us to the management’s strategy for the printing business.

As mentioned above, HP had long been subsidizing the printers with the expectation that the sale of ink would more than compensate for it. And it did for many years. It was one of the world’s best moats (aka competitive advantage). But even the management acknowledges that they took it a bit too far. In other words, they shamelessly took advantage of their customers. But we know that when a company is earning high returns on capital, competition notices and wants a piece of the pie.

So the management was at a crossroads. Seeing the erosion of a great moat in real-time, they had to come up with a new strategy.

The management estimates that 25% of its customers buy a printer at which the company loses money and then they never buy HP ink, opting for lower-cost products. HP lost money with them so the management chose to let them go, focusing only on the high-use customers.

They took a series of measures to implement this strategy:

INK AS A SUBSCRIPTION

First, they introduced, wait for it… Ink-as-a-Service. They don’t actually call it that, they call it “Instant Ink” and it’s a subscription for ink. Supposedly, it’s more attractive to those who print more pages.

CHARGING MORE FOR THE HARDWARE

Then the management introduced its major shift, HP+. Instead of losing money on the printer and hoping to recover it through a lifetime of ink sales, they’re now shifting that profitability to the hardware. By charging more for the printers they get to pull the revenue forward. This is happening as I write. If you want to buy a cheap HP printer, the time is now.

So, a customer who chooses to buy an HP printer but doesn’t want to keep buying HP ink will now pay a lot more for that printer.

On the other hand, a customer who chooses to buy an HP printer, but also chooses to keep buying HP ink will pay the same subsidized price as before (plus $40 for an initial 6 months worth of free ink and an extended guarantee period). The printers bought through this model are exactly the same as the other ones, but they only work with HP ink.

This is the same model as with phones. You can buy an unlocked phone for a higher price or you can buy a cheaper one and get stuck to your carrier’s subscription.

The management believes that this HP+ model will be attractive to high-use customers. Those are the ones they want to focus on, not the mere mortals that print one page every 6 months.

Depending on the plan the customers choose, they can print up to 1,500 pages a month for free. For 6 months, that’s 9,000 pages. If you dollarize that at anywhere between $0.01 and $0.04 per page, that’s somewhere around $150 worth of value. So… $150 worth of value for $179. For a high user, it’s almost as free printing.

So, although the company is choosing to lose customers, those are the loss-making customers. This means that going forward, we should see some revenue decline, but higher profit dollars. That’s the metric the management is focusing on, and investors should too.

The challenge here is, of course, making this value proposition clear to the customer.

So “is the subscription model taking off”? Well, not so much yet. In 2021, on the Analyst Day, the CEO mentioned that 10% of the installed base in the US is on a subscription plan.

Right now they have 11.7 million subscribers with a revenue of $500 million. This represents 2,5% of the printing revenue. The Instant Ink subscription has been active for 6 years, so those numbers aren’t that exciting. But the HP+ initiative is what should drive the number of subscribers up going forward. I guess we’ll just have to wait to see if it’s a success or not.

BIGGER CARTRIDGES AND TONERS

In the emerging markets, the company is selling bigger ink cartridges and toners. This pulls revenue and profit forward as there are fewer buying opportunities to shift to a competing product. I would like to understand why they are rolling out this model in emerging markets. Maybe it’s because the e-commerce there is in an earlier stage and the competition hasn’t yet arrived? I’ve inquired the company about his and I’m still waiting for their reply.

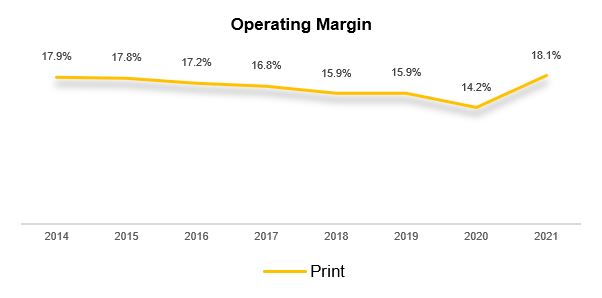

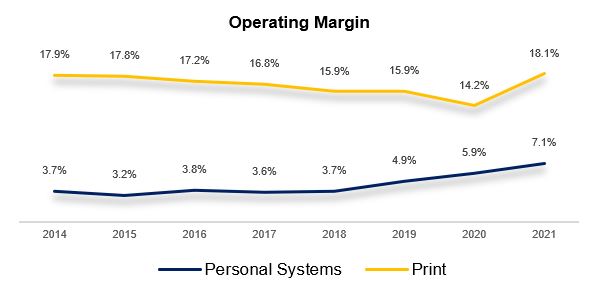

By taking these 3 steps, the management hopes to maintain a long-term margin of 16-18% in the printing segment.

It’s also important to mention that the company is advancing with industrial graphics printing and 3d printing. Maybe one day it will be HP’s new moat, but for now, it’s still too small.

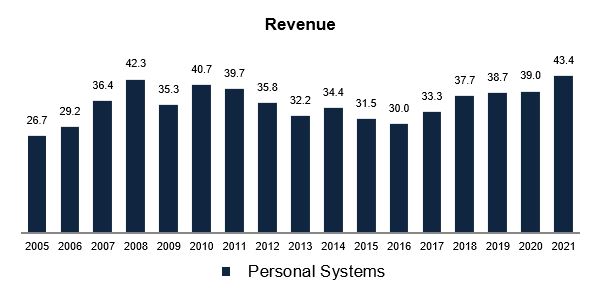

PERSONAL SYSTEMS

The other big revenue generator for HP is the laptops (and to a minor extent desktops and workstations). I own an HP laptop, but the truth is that I wasn’t looking to buy an HP laptop. I could have gone with a Lenovo, Dell, Asus, or Acer. These are HP’s major competitors. I bought HP because it had the better proposition (it’s not easy to find 17-inch laptops).

These brands buy the hardware components from other manufacturers (Intel, AMD, NVIDIA, etc), assemble them, put their logo on them, and then it’s a marketing game.

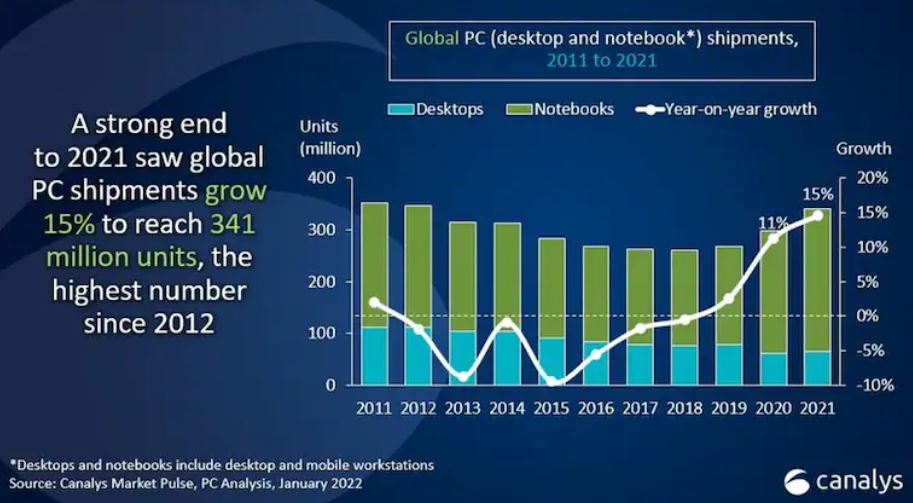

This, together with industry-specific dynamics such as the Windows launch cycles, make the PC industry somewhat cyclical. In fact, just before the pandemic, everyone was heralding the demise of PCs in favor of smartphones…

…but it looks like this is a new world.

Before the pandemic, the management estimated that every household would have a PC. Now it’s more like every person must have a computer. Kids need laptops to learn. Parents need laptops to work from home. Digital nomads need laptops to work in their new sunny cities. And the same goes for keyboards, mice, headphones, and webcams. This means that the addressable market has grown from $350 billion to $550 billion in 2024.

In the learning market, HP is the number 1 player, much on the back of the recent Chromebook demand. PC sales have doubled due to remote learning. But as much as this has given a boost to the adoption of PCs by younger generations (the ones that were shifting to mobile), the number of PCs per 100 students remains in the single digits.

If we believe the management – and it’s not just HP’s management. Lenovo’s management is of the same opinion – the PC market has gone from a declining market to a growth market.

So far, because of the supply shortages, HP has been surfing the trend by increasing the average selling price of their computers. I’m not sure that will remain the case after the supply chains get back to normal.

In fact, we’re seeing several retailers – mostly home improvement businesses – getting into trouble because they’ve ordered large amounts of inventory that they now can’t sell. I don’t think that will happen here because HP’s management has mentioned that they were keeping an eye on that. DELL, with its build-to-order supply chain strategy, is in a better position to avoid the inventory trap.

The fact that DELL has simplified its products and reduced the number of different components so that they can be interchangeable between different models together with its tight relations with its suppliers has allowed it to be better prepared for the current situation than HP. HP has kind of acknowledged this on the Conference Calls and is now playing catch up.

Another part of HP’s strategy is to go after the premium categories, especially in the commercial side of the business (where HP sells to companies).

There are other initiatives that may benefit HP (and all other competitors) in the long run such as Device-as-a-Service: you won’t have to buy a new laptop, you’ll just pay HP a subscription. When your PC gets slow or outdated, HP will gladly send you a new one. This is already happening with the iPhone and I believe it will happen with cars as well. This should dampen the cyclicality of the business and create increased stickiness.

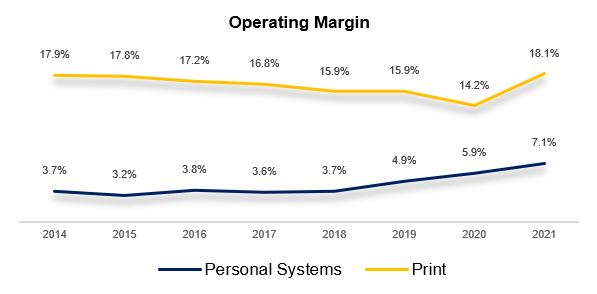

All these trends and strategies lead the management to believe that they’ll be able to get long-term operating margins for the Personal Systems segment of 3.5-5%. As we can see from the image below, the pandemic has helped them to reach a staggering 7.1% margin.

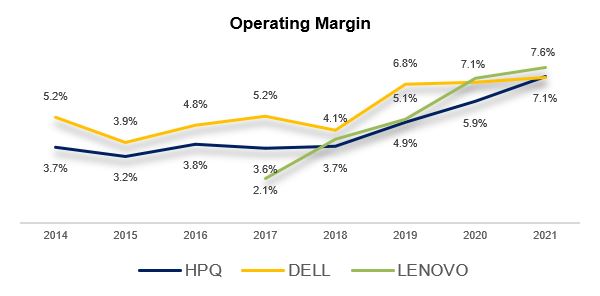

But this isn’t exclusive to HP. All the other major players have been seeing their margins go up too.

PUTTING IT ALL TOGETHER

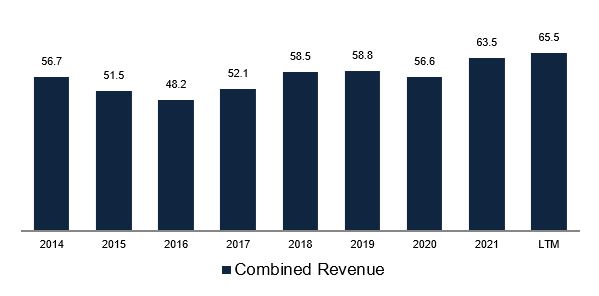

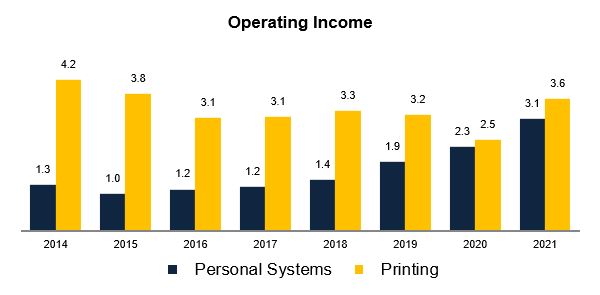

So far, we’ve been looking at the two segments separately. But how do they compare? Well, whereas the Personal Systems segment has become a larger and larger portion of the revenue, and as the Print segment has remained stable over the past 6 years or so…

… the combined revenue has remained fairly stable.

The Print business, because of its higher margins…

…has been the cash cow. But we can see that that is changing. The Personal Systems business has been contributing more and more to the profitability of the business.

And that trend seems to have started well before the pandemic. The question to which we’ll never have an answer is “How would the following years have looked like if there had been no pandemic?”.

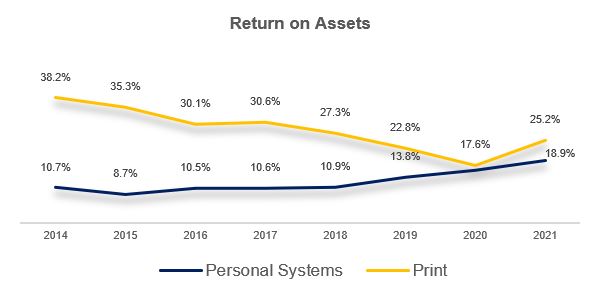

But what the graphics above don’t tell us is that, although the two businesses have strikingly different profit margins, the Return on Assets for both businesses has been converging.

Is this an outlier year or the start of a multi-year trend? We will never be sure, but it looks like the Personal Systems segment was already getting higher margins and returns back in 2019.

GETTING GEEKY (AND INTERESTING)

But the Return on Assets tells us just one side of the story. The most interesting side is that the Personal Systems had a negative Cash Conversion Cycle, meaning that the company collects the cash from its clients before having to pay its suppliers.

Not only that, but the management states that this business needs very little capital to grow. Most of the capital expenditures are made in the Print segment where the company has the ink factories.

So, not only does the Personal Systems segment need less capital to grow, but it also runs on other people’s money. These are two signs of a great business.

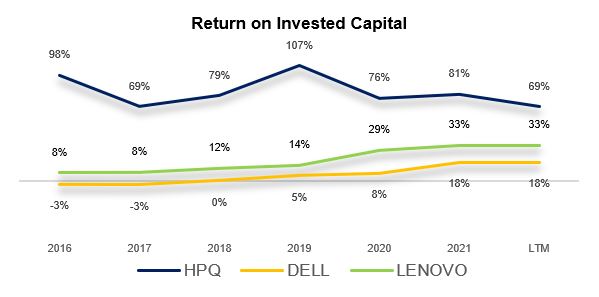

As mentioned on my previous write-up, the Returns on Invested Capital for HP are phenomenal, especially when compared to the competition.

Peripherals

An analysis of HP wouldn’t be complete if we didn’t talk about peripherals such as screens, headphones, web cams, mice, or microphones. That’s where the company is betting big right now.

Peripherals have a gross margin twice the personal Systems’ average. And HP can scale them globally almost immediately through its distribution footprint. Also, the replacement cycles on peripherals are shorter than on computers, which helps with the revenue. According to the company, people refresh their peripherals 5x faster than the laptop.

This ties to the company’s strategy of going after gamers with its Omen brand of gaming laptops. A gamer spends, on average, 15x to 16x more on accessories than a normal PC user.

Back in 2021, HP acquired HyperX, a gaming peripheral brand, for $425 million and is now about to acquire Poly, a company that makes video and audio equipment, for $3.3 billion. This goes to show how serious HP is in the peripherals segment.

Balance Sheet and Capital Allocation

The management intends to keep the debt level in a range between 1,5x and 2x Net Debt/EBITDA and that’s about where they are right now. 100% of the Free Cash Flow will be directed to share repurchases unless they find good acquisition targets.

It’s important to note that the operating leverage and the negative Cash Conversion Cycle are very good when revenue is stable or growing, but they can become sources of trouble if the revenue starts to decline.

An astute analyst asked the CEO about this and the CEO just dodge the question and reinforced their plans of growing operating income.

Management and Ownership

I hate to see the management avoiding answering tough questions. No, I don’t feel like HP’s managers are sleazy. I just think the CEO could’ve done a better job addressing the question.

Anyways, Enrique Lores, who became CEO just in 2019, seems to be doing a good job both on the operating side as well as the capital allocation side. He acknowledges the short-term issues he has to solve such as getting a more direct relationship with its component suppliers and seems to be working hard on it.

On the ownership side, Warren Buffett recently bought 11,5% of the company making him the largest shareholder. The remaining top shareholders are all institutions.

Risks

- The cyclicality of the business might lead to lower demand in future years and a decline in profits.

- A negative cash conversion cycle can kill a business when revenue declines.

- Operating leverage can cut both ways.

Valuation

The valuation for HP is quite simple and we don’t need to be doing advanced math.

The company is trading at 7x Free Cash Flow, or a yield of 14%. That’s very attractive. I understand why Buffett bought a large stake. Yes, it’s likely that the company is over earning today, but even if profits go back to where they were back in 2019, the stock would be trading at 10x Free Cash Flow, which is still attractive.

This is a classical value-cannibal play. A mature company with limited growth prospects returning the cash to the shareholders through share repurchases. What investors must be able to answer is how sure are they that those cash flows will remain constant for the foreseeing future.

For now, my opinion is that the company has seen an influx of business related to the pandemic, and sooner or later that will stabilize. If it will stabilize at this higher level or come back to levels seen prior to the pandemic, I can’t say.

On the one hand, we’ve got a whole new world that demands more and more laptops and peripherals. On the other hand, we’ve got the same new world that demands fewer printed pages and maybe doesn’t need that many laptops as the current trend is suggesting.

I’ll tell you what my suspicion is: we’re looking at a good company trading at an attractive valuation and which might surprise us on the upside.

Conclusion

So, to answer the question of whether Buffett is right in buying HP? Maybe he is.

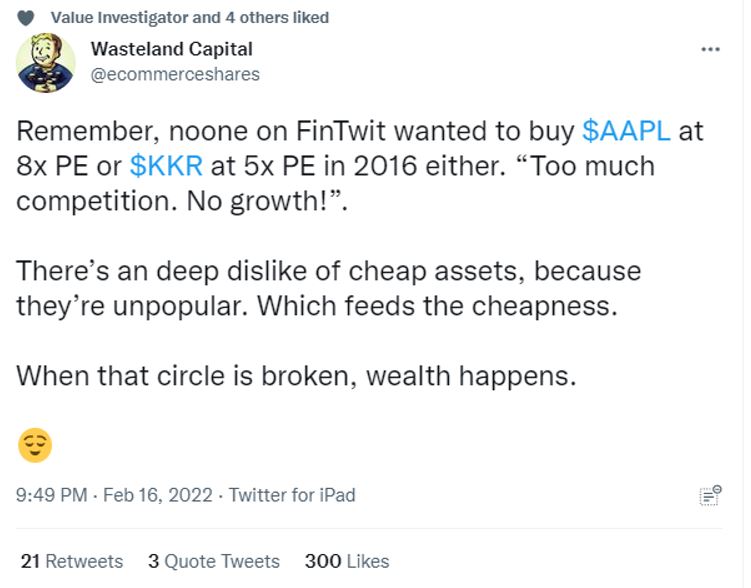

I thought of sharing the twit below as it illustrates why Buffett is Buffett and all the rest aren’t.

So, if there are clear signs that this is a great business and the valuation is undemanding, why am I feeling like I need to do more work to convince myself that this is a good investment opportunity?

Maybe because of the cyclicality of the computer business and the decline of the print business?

I guess that’s what most of the market participants are thinking and why the valuation is so undemanding. When I think of Buffett buying Apple when nobody wanted it, I kind of get FOMO (Fear of Missing Out) on this one.

Truth be told, not a lot has to go right for HP to become a successful investment. If the management is able to keep the printing profits stable, and its vision of the growing long-term demand for laptops and peripherals is correct we might be seeing Mr. Market attributing a PE of 12x or 15x to HP.

That, combined with aggressive share buybacks, might give investors pretty good returns.

But I’m not convinced yet. HP won’t be entering the Portfolio, but I will be following it closely as I’m deeply interested in the outcome of Buffett’s bet.

Have questions regarding HP? Ask them here!

As always, I’d be very welcome if you could take the survey below. Thank you.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.