Whole Earth Brands

FY 2020

By Manuel Maurício

March 22, 2021

I’m selling Whole Earth Brands. Wait, what? Yes, you’ve heard me right. I’m selling it.

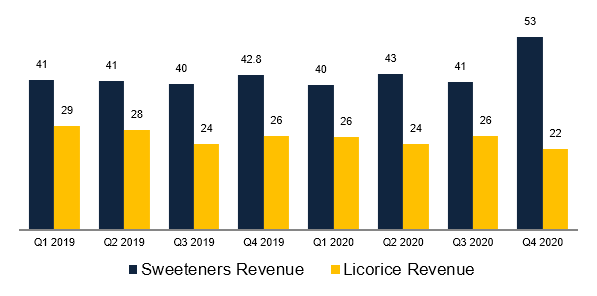

The full year financials came out last week and they were unimpressive. Yes, the Sweeteners segment went up, but I believe that was influenced by the Swerve acquisition.

But that’s not the main reason why I’m selling it. Although I can see the revenue growing for the foreseeable future at single digit rates (not counting 2021, when the revenue should be around $500M due to the recent acquisitions), at these prices, I need way more conviction than I currently have to hold it.

After I bought Whole Earth Foods for the Portfolio when it was trading at $8.4, Afonso Pinto de Almeida told me that he didn’t get it. He didn’t get why I was buying it. He saw all the historical metrics that I had posted on my write-up and he didn’t like them because they showed a declining business (the licorice segment, mostly).

You know what? Afonso had a point. This isn’t a great business (although it could become one in the future). But it was trading for 10x Free-Cash-Flow. And the Chairman is an influential guy in Wall Street, he would be telling the investment bankers to write good reports about the company. And write they did.

One of them currently has a price target of $22. The stock is trading for $14.6. It will soon be added to the Russell 3000, and that alone should force the funds and institutions to buy it. That means we’ll likely see it go up even more.

But although I believe that Mr. Market can easily put a 30x multiple on this company, I’m unimpressed by the management team and I find myself looking for signs of great execution and transparency, and I don’t find them.

In fact, I feel that both the management team and the Chairman dodge a lot of the analysts’ questions when it comes to concrete financial details. You just need to look at the presentations of the recent acquisitions of Swerve and Wholesome; they both mention adjusted EBITDA everywhere, but no mention of real profits.

Similarly, the management says that they’ll reduce debt, but they don’t give specific targets. This should be a fairly stable business. They should be able to forecast it with reasonable accuracy. I know that they’re probably thinking of making some smaller acquisitions and that would mess up the targets, but still, I sense weird vibrations coming from these guys.

On my latest analysis I wrote “I believe that this can be a good short-term play and I will keep it in the Portfolio until it’s fairly valued. What would that look like? A 15x or 20x FCF multiple would make me reduce my position.” and the stock is now at around 16x -20x next year’s earnings. At this price, the risk has gone up and the upside has gone down. Classic value investing play. Buy when it’s cheap, sell when it becomes less cheap.

So, although I’m still able to envision how this business could grow in the foreseeable future and how the share price can still go up a few dollars, at the current prices, the story depends more on the management’s execution than when it was trading for $8. And I’m becoming suspicious of the management team. And that’s a big no-no for me.

That’s why I’ll be selling Whole Earth Brands tomorrow at close. I’ll be following Whole Earth Brands for a few more quarters to gauge the merits of my arguments so I can improve my investing process going forward.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.