Xpel

a fundamental analysis

By Manuel Maurício

July 3, 2020

Symbol: XPEL Technologies (Nasdaq)

Share Price: US$15,11

Market Cap: US$417 Million

Xpel: Share Price History

Source: Google

Introduction

I’ve been hearing about Xpel for about 2 years now and I regret not looking at it sooner. You see, since the beginning of 2018 the stock price has grown tenfold. €1000 invested in this company 2 years ago would have turned into €10.000 today. I finally decided to look into it and this write-up is the result of a great week learning about….wait for it … plastic films used to wrap your car. Uhum, I know. Not sexy.

To understand the value proposition of such a commodity-like product, I’ve talked to several installers here in Portugal and I even went to visit one of them. I was there for about an hour and the owner was very helpful in explaining how the business works and talking about their great relationship with the brand. Unfortunately, I wasn’t allowed to take pictures to share with you. I’ve learned many things, but probably the most important one was the fact that they usually have a 3 to 4 months waiting list. It goes to show the demand for these products.

Business

Xpel is a $400 Million fast growing company that is known around the world for being the best there is in Pain Protective Film (PPF) for cars. The company started out as a software developer with the goal of making it easier for PPF installers to make the precision-cuts they needed in order to fit the film to the corresponding car part, but at some point the management decided to go into the PPF business themselves. And what a move that was. Fast forward some years and the company is now offering a whole range of products such as window protective film (window tint), architectural glazing films, accessories and installation services.

What is PPF?

The Paint Protective Film, or PPF, is a multilayered film that is applied to the car surface to protect it from rock chips, bugs acids, birds poop, smog, scratches and general road debries. It can be applied just to the front of the car or to the whole car, depending on the client’s budget. My channel checks tell me that here in Portugal, for a Tesla model 3, it will cost anywhere between €1600 for the front of the car to €6000 for the whole car, which isn’t far from what the company states on the ints investor’s presentation (see image below).

Source: Xpel presentation

PPF’s have been around for some time, but in 2011 Xpel introduced the Xpel ULTIMATE with self-healing properties which was a game changer. Although today this is quite common, back then it was a “revolution” and that’s what propelled Xpel to becoming the most famous brand in the world.

It reminds me of what iPhone did for Apple back in 2007.

PPF is not a vinyl wrap. PPF is transparent while vinyl is usually coloured and heavier. The vinyl wraps don’t have the protective capacity nor the self healing ability that a PPF has and they are usually applied to change the color of a car. My contacts made it very clear that the target audience for both products is very different. The PPF is usually applied to new high-end cars such as Porsches, BMW’s, Ferraris, etc. while the vinyl wraps are used primarily for aesthetics reasons, be it for private car owners or companies who wish to have their graphic identity on their fleets.

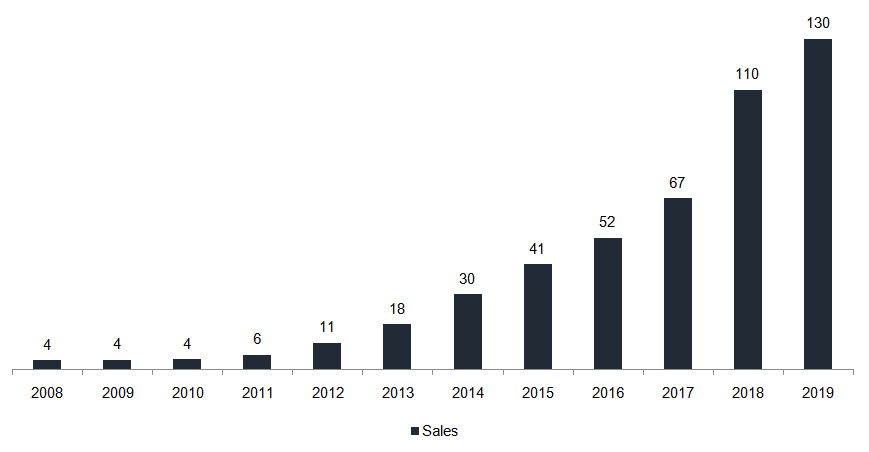

Revenue

The company has been able to grow its revenue by 47% year-on-year since 2011, when it launched the self-healing PPF.

Total Revenue, US$ Millions

Source: Company data

This growth rate – especially from 2017 to 2018 is just mind boggling if we take into consideration that we’re talking about a “plastic” film company.

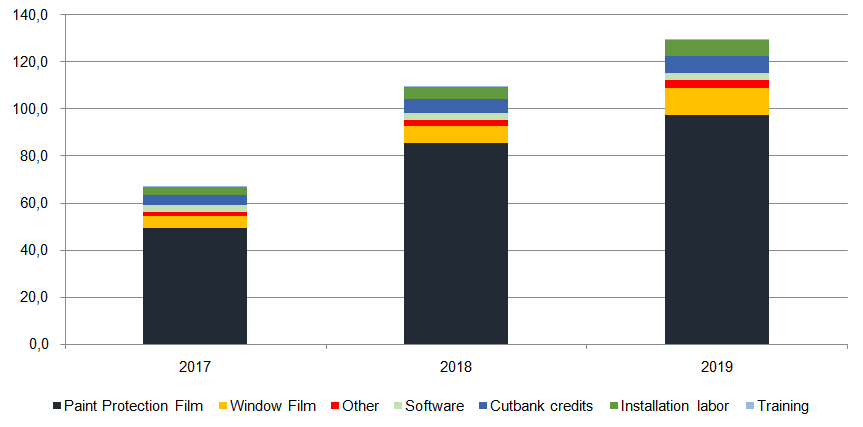

Revenue sources

The company largest share of revenue comes from the sale of the PPF’s (75%), but there are other minor segments such as Car Windows Film, Software, Installation Labor or Cut-bank Credits.

Now, although the other segments are low in comparison to the PPF business, it’s important to understand them to understand this business:

SOFTWARE AND CUT-CREDITS

Every single person I talk to about Xpel mentions its software. The way traditional PPF installers work is by applying the film directly onto the surface of the car and then cut the excess film around the car part. This is obviously a suboptimal method that leads to high amounts of wasted (expensive) film. A much better way to do it is by having a Computer Assisted Design (CAD) to automatically plan how each piece will fit on the film and cut it out with a cutting plotter (a plotter is a big printing machine designers and architects use).

The Design Access Program (DAP) is a proprietary software with more than 80.000 design patterns (doors, front-hoods, bumpers, etc). The moment a new high-end model is out, Xpel will immediately trace all its outer body and insert the “molds” into its database. This means that every installer around the world will have its work made easy immediately. Another good thing about the software is that it allows the installers to make small tweaks to the molds to better fit their needs.

This works as a razor-razor blade model where the company sells the razor (product + software) but then the client will pay the company for every cut that he makes (cutbank credits). By allowing the installers to reduce film waste and even change the original designs, the company is addressing one of the major pain points installers face.

In order to prevent the installers from using its software on films manufactured by other companies, each roll of PPF that Xpel ships to its customers has a code on it and the company knows exactly where each roll is, how much film there is left in it and it also when an installer is using the software on films made by competitors. To incentivise the use of Xpel products, the company prices the cut-credits lower if the installer uses Xpel film.

INSTALLATION LABOR AND TRAINING

Every Xpel installer must be certified by the company. It takes 4 days to train a new team and Xpel sends one of its team members to train new teams wherever they are. That’s one of the reasons why Xpel is also adding to its own shops. Currently there are 9 company-owned shops that the company can use as Distribution Centres and if an independent installer is having troubles with one of the more intricate designs, he can send the car over to one of Xpel’s shops or ask them to come to his shop and lend a hand.

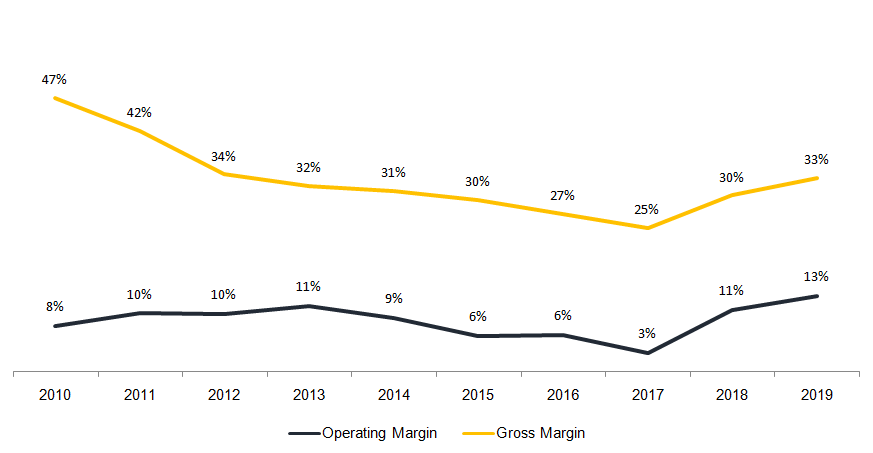

Margins

Now that we’ve understood the sources of revenue, let’s look at the margins.

As we’re able to see from the image below, with a 33% gross margin, we’re clearly not talking about a software company here. The management is guiding for a mid 30’s gross margin in the coming years.

Margins

Source: Company data

Although the gross margin isn’t spectacular, luckily the company has been able to control its operating costs and the result is a rising operating margin, currently at 13%.

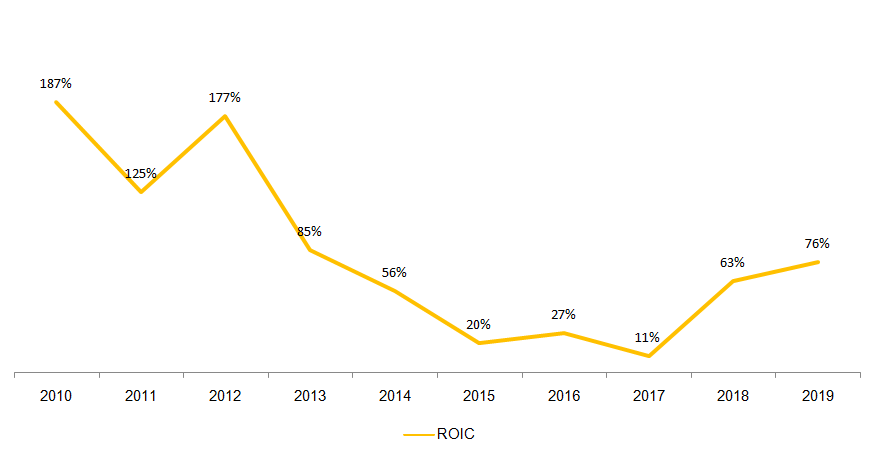

Return on Capital

But the margins alone tell us very little. Because the company doesn’t have much in the way of factories or buildings and machines, its capital needs are low (PP&E is 3% of revenue). And that’s why Xpel is able to get such high returns on invested capital. 76% is just bonkers!

Return on Invested Capital

Source: Company data, AiS

Whenever you come across a business that can get returns on its invested capital higher than 50%, do me a favor: take a good look at it and send me an email.

But high returns on capital aren’t enough (I’m getting picky, I know). What we should also be looking for is the capacity and opportunity to reinvest that capital at such rates, or else we would be left with dividends (yuck). Fortunately, there is still a long runway ahead of the company (more on that later).

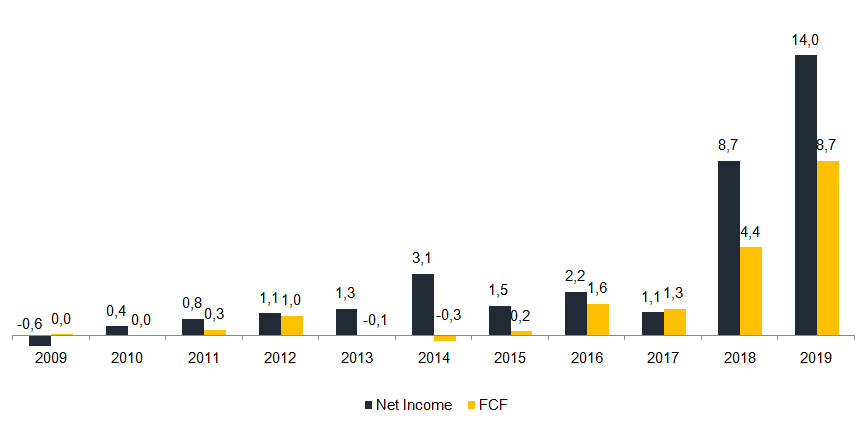

Net Income and FCF

All of this has led the company to grow its net income massively in 2018 and 2019. The Free Cash Flow has been lagging because the company is still growing and those investments don’t show on the Income Statement yet (If you’d like a clarification of this, please let me know).

Net Income and Free Cash Flow

Source: Company data, AiS

Either way, the company was able to double its FCF in 2019 to almost $9 Million. If it were to stop investing, it would’ve gotten somewhere around $16 Million in FCF, which at today’s market value of $416 Million would mean a Price/FCF of 26.

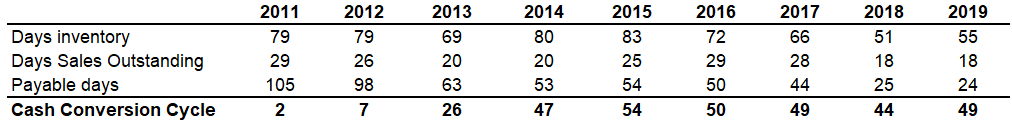

Balance Sheet and Efficieny

The balance sheet is in a strong position right now. With $15 Million in cash and $7,5 Million in debt, the company has a net-cash position of $7,5 Million and it still has $5,5 Million in undrawn facilities.

Most of its debt has a variable minimum interest rate of 3,5%, which equates to $260K per year, which in turn translates into an interest coverage ratio of 66x, which is pretty safe.

Efficiency Ratios

Source: Company data, AiS

Regarding the efficiency of its working capital, the company has been able to reduce both its Days Inventory and Days Sales Outstanding, but unfortunately that benefit has been offset by the lower Payable Days as well. The fact that the company sources most of its PPF from one single supplier (more on that later), gives the supplier a high leverage in what comes to payments terms.

Management team and ownership

The insiders still own 40% of the company, which is enough skin in the game for me.

Ryan Pape, the notorious CEO, first joined Xpel in 2004 when it was still a software company. Then in 2008 he left, and a year later the Board of Directors invited him to join as CEO. The company was in such a bad shape that the previous managers got into a sponsorship with a much larger company for $250K. Xpel didn’t have that money.

When Pape came in as CEO, he called the company, told them that if they wanted to pursuit litigation, Xpel would go bankrupt and they wouldn’t see a dollar. He then told them that he still had one personal credit card with a $25k limit that he could use to pay down the debt, but that those $25K was all the money they would get. The other company hang up the phone only to call him back a week later accepting the $25K. These $25K were not the company’s money. They were Pape’s money. He “knew” that the company would pay him back later.

This story goes to show the level of commitment of the CEO and it seems to permeate through the rest of the company.

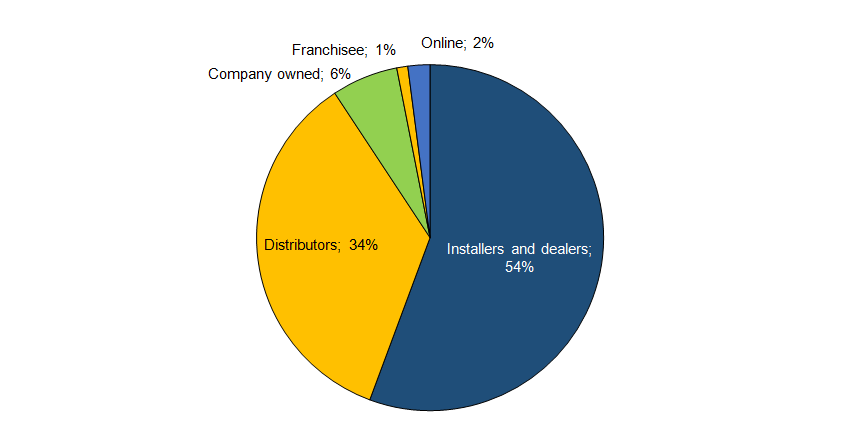

Customers and Distribution

Revenue by channel

Source: Company data

The main differentiator from its competitors is the way the company goes to market. Xpel doesn’t work with distributors (China being the notable exception). It sells its products through a networks of independent installers, new cars dealerships, and company owned shops. This way Xpel is in control of distribution. And this is no small matter. In stark contrast with its competitors, who use local distributors and don’t really know who their installers are, Xpel has a very close relationship with its installers. It knows who they are and tries to help them in the best way it can. This is how you get customer loyalty.

But there’s the flip side of the coin too. Due to this close relationship, Xpel is now “strongly encouraging” its installers to use Xpel’s automotive window film and ceramic coating as well.

As I’ve mentioned earlier, in China Xpel has chosen to pursuit a different strategy. It has an agreement with a Chinese distributor who accounts for 24% of total sales. This is a source of risk and should be monitored.

Suppliers

Xpel buys its film in many different sizes from several suppliers. After receiving the film-rolls, Xpel does some minor transformations to them (cutting, boxing, branding, etc) and then ships them to its clients. Xpel’s has a supply agreement with its largest supplier, Entrotech (80%) which allows it to exclusively distribute and sell its products for periods of 2 years, after which it gets automatically renewed. Both parties can terminate the agreement within 2 months notice. My sources tell me that Xpel accounts for a slight majority of Entrotech’s revenue, so it’s in the best interest of Entrotech to keep the partnership. But the fact that Entrotech accounts for 80% of the Xpel’s supplier’s share is a major risk that should be monitored.

Competition

Xpel’s main competitors are 3M and SunTek, which was bought by Eastman Chemical back in 2014.

The installers I’ve talked to don’t even want to hear about 3M. It seems that they don’t like the product nor the service, but my sample is very limited so far (4 installers). They tell me that they like Xpel’s glue better than SunTek’s, but the difference between the two films isn’t material. Unlike Xpel, SunTek develops and manufactures its own films.

The fact that the ones using SunTek buy the film from the distributors and don’t have access to the software leads me to believe that Xpel is losing ground in what relates to lower end installers, but on the other hand it’s guaranteeing that it has the best (and better capitalized) installers. I believe we will be seeing a lot of other manufacturers in the future coming into this space, but none with the dealership network and proximity focus of Xpel.

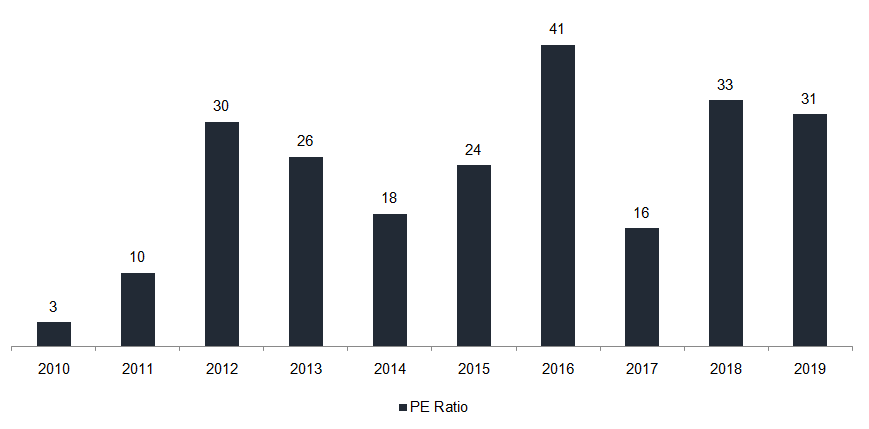

Valuation

Now, is it cheap? Not by traditional metrics. At 31x earnings, the company isn’t a scream buy. It’s a great business, it has tremendous returns on invested capital, but the fact that it was listed for so many years on the Toronto Stock Exchange and in 2019 it got listed on the Nasdaq, made it possible for many funds to finally get a piece of it which in turn led to a three-fold rise in share price since the beginning of 2019.

Price to Earnings Ratio

Source: AiS

Looking at it in another way, Suntek was bought by Eastman Chemical back in 2014 for 4,4x sales. At the current valuation, Xpel is valued at 3,5x times and one might say that it should even trade at a premium given it’s high quality and competitive position.

Growth Opportunities

This is a story I know well because it’s more or less what happened to the company where I worked at for almost a decade prior to becoming a full time investor. The company developed a product – which wasn’t that hard to manufacture – before everyone else, made tons of money and established a name for itself. Then competition came in.

The way you deal with competition when you have a good product and a quasi-monopoly is by outperforming on quality of service. If you keep delivering, your customers will come back to you and new customers will knock on your door. If you lose that, you’ll lose your leadership position. That’s one side of the coin.

The other side is constant product innovation. I mean, how hard is it to make a protective film when someone has done it already? Not that hard. If you treat your customers well and you give them new products, then things will likely turn out for the best. This is how a small, nimble and focused organization can outmatch one of the largest companies in the world (3M).

That’s also the reason why, if one were to invest in Xpel, reaching out to a few of its installers from time to time, as well as installers from other brands, is one of the best ways to get a sense of their competitive position.

After so much growth, it’s easy to jump to the conclusion that there’s nowhere else to expand into, but in fact, it’s estimated that the PPF’s penetration rate is currently at about 5-7% of the new car sales in the US. Back in 2013, this number was estimated to be around 1% and going forward this number could reach the mid teens. And this is only in the US.

Ryan says that in Europe the penetration rate could be even higher and he feels that the European market is today where the American market was 5 years ago in terms of penetration and product awareness.

Probably the most important alley for growth is the car dealerships. The end customer is usually a high-end customer with a new car. Think supercars and Teslas. That’s why the car dealerships are a natural place to expand into. New car dealerships are always trying to find ways to upsell all kinds of products and services to their clients. Xpel has recently signed a sponsorship agreement with Team Penske. You see, Roger Penske owns a lot of car dealerships (apart from IndyCar and other automated sports ventures). Ryan is obviously trying to expand into this market and I believe it will be a great source of growth going forward.

Then there are the other products; the automotive window tint (more mature market), the ceramic coating, the architectural film, etc. All in all, I believe there is still much room to grow into.

Risks

- Supplier concentration, together with not controlling the R&D process

- Distributor concentration in China

- Patent infringement. Xpel had a patent infringement lawsuit filed against it by 3M some year back that after several years was finally settled in 2017.

- Economic downturn, leading to lower new car sales.

- Competitors coming up with a new a better product, or even start a price war.

Conclusion

In hindsight, it’s easy to say that one should’ve invested in Xpel back in 2017 or beginning 2018. Hell, even if one had invested in 2019, he would be sitting on a

3-bagger. But that wasn’t the case, unfortunately.

This is definitely a great company, it has a great CEO who I believe is the reason behind this success story, a great culture, great returns on capital, but I’m not buying Xpel at this price because I’m not finding a clear mispricing here.

Making estimates for Xpel isn’t easy, but let’s stay on the conservative side and say that it can grow its revenue by 15% per year until 2024 and reach a net margin of 15%. At a 18x PE, that would mean a share price of $28 and a rate of return in the order of 13% from here. Not bad. But hardly the returns it promised just one year ago.

This is one of those companies to keep an eye on and if its price comes down to, say, around 20x earnings, I will probably be buying it for the Portfolio.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.