Alibaba

a fundamental analysis

By Manuel Maurício

January 8, 2021

Symbol: BABA (NYSE); 9988 (HKG)

Share Price: US226.9

Market Cap: US623.9B

Introduction

I’ve been shying away from big cap stocks, but the recent drop in Alibaba’s stock spiked my interest.

Although many people think that Alibaba is the Amazon of China (me included, until recently), it isn’t quite so. While Amazon sells its own stuff together with third-party products – often competing with the merchants selling on its platform – Alibaba is more like a pure-play marketplace (think eBay). It practically doesn’t sell its own goods so it doesn’t hold inventory and it doesn’t require so many distribution centers.

But it’s much more than that. Let’s dig in.

Business

In its essence, Alibaba Group is like a toll business for the Chinese internet. It’s an amazing business. It’s composed of several marketplaces aimed at different sellers and different customers. It’s as if the company owned all of the wholesale markets and shopping centers on the Chinese digital world.

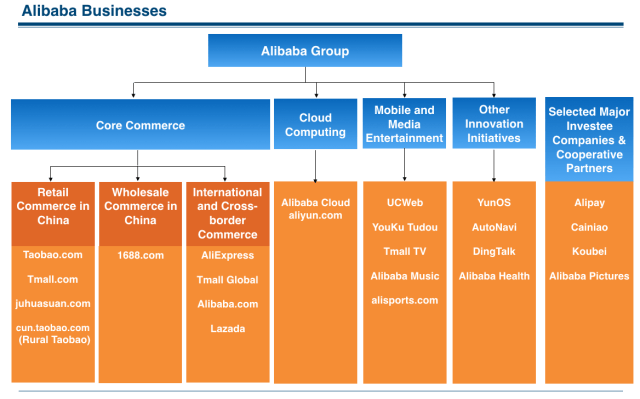

As with many other internet giants of our time, Alibaba is working in so many fronts that it would be a strenuous endeavor for me to expand on all of them here. Instead, I’ll be talking about the most important segments and revenue sources. If you loose track, you can always refer to the chart below.

RETAIL CHINA

The Taobao and Tmall are the two main generators of revenue for Alibaba. And I had never heard about them.

They make money from selling pay for performance and display marketing services, as well as third-party marketing affiliate fees.

TAOBAO: Similar to eBay, connects individuals and small businesses to end-customers. It’s a B2C (business to consumer) and a C2C (consumer to consumer) model. It’s free for both the seller an the buyer. The seller will then buy advertising, better brand display or better search results.

Because it’s free, there’s a huge influx of merchants and customers, which increases the need for higher visibility, thus generating a lot of fees from merchants wanting better product placement and wanting to be the first in search results.

TMALL: Connects established international brands (think Nike or Colgate) to consumers in China. It’s a B2C business for Chinese customers. These brands will have their virtual shopfront hosted on Tmall.com. Here’s Colgate.

Sales in both the Taobao and Tmall make up for more than 80% of all online purchases in China.

RETAIL INTERNATIONAL

ALIEXPRESS: Direct to consumer, targeting consumers from around the world, and enabling them to buy from (mostly) Chinese distributors. No minimum quantities. Tipycal seller is a small business or distributor. Monetized through commissions based on the transaction value.

LAZADA: Largest e-Commerce player in Southeast Asia (Indonesia and Philipines). Has its own logistics network. Monetized through commissions based on the transaction value.

WHOLESALE

1688.com: Chinese only wholesale marketplace. Think large quantities. Typical seller is a manufacturer. It’s a Business-to-Business model. Free plus membership for additional services.

ALIBABA.COM: Connects Chinese manufacturers to international businesses. It’s a Business-to-Business model. Free plus membership for additional services.

LOGISTICS

CAINIAO: This is an open logistics data platform. Got it? Me neither. I must confess my ignorance about this part of the business. Yes, I understand all the words in open-logistics-data-platform, and after reading a bit about it I can sort of understand what it does, but I don’t really understand it. At least not yet.

What I do understand is that the company has agreements with more than 3.000 different logistics partners to make sure the goods are delivered in under 24 hours inside China, and the company is working on something similar for the rest of the world.

CLOUD:

Just like Amazon, Alibaba has been building its own infrastructure to sell as a service, the Cloud. With 50% market share, Alibaba is the largest cloud provider in China.

DIGITAL MEDIA AND ENTERTAINMENT

Alibaba also owns other platforms such as the video hosting website Youku or social media app Weitao. Monetization comes from advertising and subscriptions.

INNOVATION INITIATIVES AND OTHERS

AMAP: The Google Maps of China.

Dingtalk: Something like Microsoft Teams, or Slack.

ANT GROUP

This is Alibaba’s financial arm. It provides digital payments services together with financial services to both consumers and businesses (think micro loans, insurance, wealth management). Alibaba owns 33% of Ant Group. Because this stake isn’t consolidated with Alibaba’s financial statements, it doesn’t count as a segment. This means that its contribution to Alibaba is stated as Interest Income on the Income Statement rather than being a part of the the Revenue.

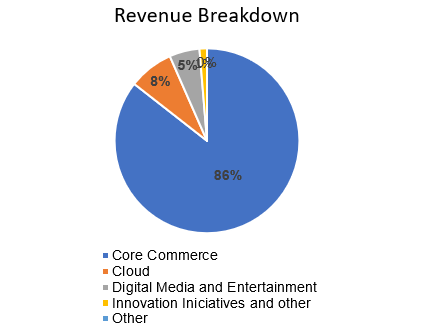

As we can see in the following chart, the largest source of revenue is, by far, the Core Commerce.

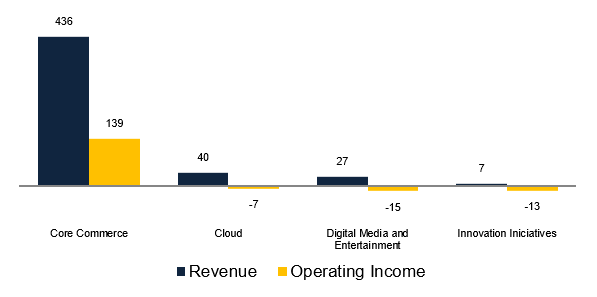

When I found out that the company had a Cloud division and that it was big, I immediately thought that this could be like Amazon where the Cloud brings in a lower share of revenue, but because of much higher margins, it ends up bringing in the most profit.

That doesn’t happen with Alibaba yet:

The only profitable segment is the e-commerce itself. In a way, Alibaba is the exact opposite of Amazon.

While Amazon finances its retail business with the cash generated by the Cloud business, Alibaba finances its Cloud business with the cash from the commerce business.

But, according to the company, the Cloud is close to being profitable (probably in the next couple of quarters) and there is no reason to believe that its margins won’t be similar to Amazon’s AWS, which supports 30% operating margins. That will be big.

Income Statement

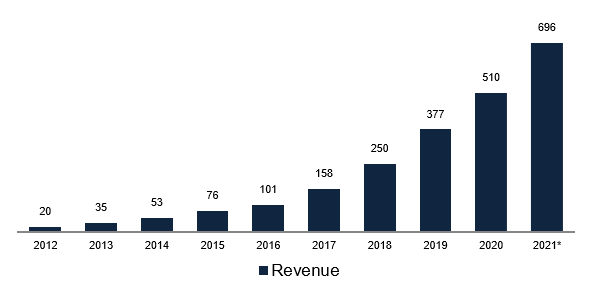

As expected, the overall revenue figure has been going up in spectacular form (up 33% in 2020).

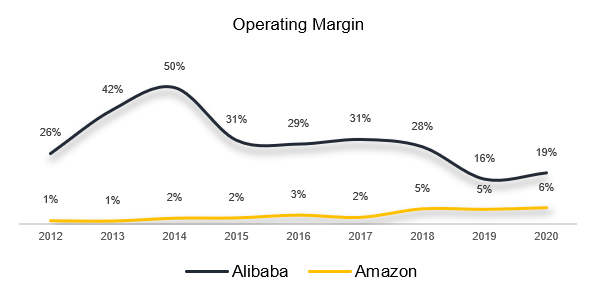

And if we compare its operating margin to Amazon’s, that’s when we begin to see the difference between the two business models.

Alibaba is basically a software business, not a retail business. It doesn’t need to hold a lot of inventory, it’s not responsible for handling the goods, thus it doesn’t need to build large warehouses (Amazon calls them fulfillment centers). Because of this, it has much higher margins than Amazon.

Note that these margins have been going down because the growth in revenue has been increasingly achieved by investing in lower margin businesses such as physical stores (see below), but I expect that to slow down when the Cloud contribution kicks in.

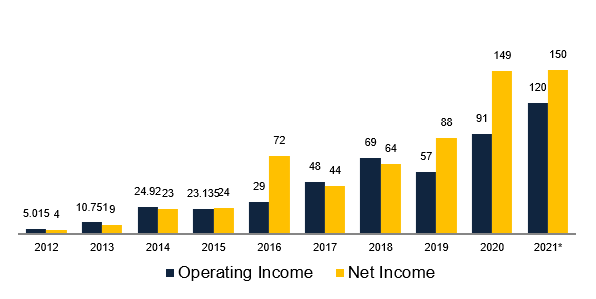

If we keep going down the Income Statement, we see that, in several years, the Net Income (the profit) has been higher than the Operating Income. Hint: It’s usually the other way round.

This happens because of three factors; 1) the company has cash that generates interest, 2) the company has stakes in other companies and the dividends coming from those companies are recognized on the income statement as interest income and 3) one time gains deriving from the consolidation rules of its affiliates such as Ant financial.

Balance Sheet

With more cash than debt in the bank, the company has a very sound balance sheet.

Competition

Management and largest shareholders

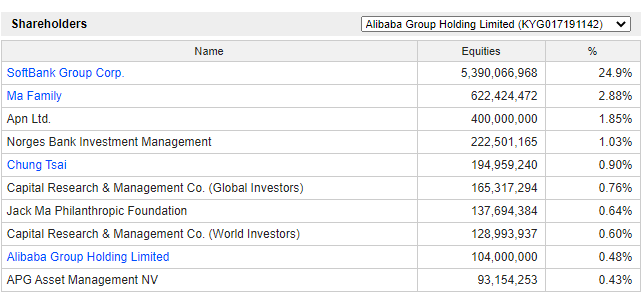

With close to 25% of the company, the largest shareholder is Softbank, the biggest Venture Capital firm in the world.

The founder Jack Ma, the gentleman on the image above, still holds about 5% in total. He was about to take Ant Group public, but the Chinese Government had something to say about it. He “went missing” for a few days and that’s why the stock has gone down.

One of the problems with Alibaba, and almost all other Chinese companies is that investors who buy their stocks don’t really have a claim to the assets of the company (as they should). They are investing in a company headquartered in the Caiman Islands that has an agreement with the Chinese company. I’ve talked about the VIE structure HERE.

Investors looking to invest in these Chinese companies must bear this in mind. In the case something goes wrong, they have very little legal protection. Ok, so far, this isn’t news. This is a well known issue.

What’s news is that this actually brought some problems to Yahoo and Softbank.

Ant Group - Where it gets tricky

Ant Group (former Alipay) was created because there was a big mistrust issue between buyers and sellers on Taobao. With the creation of Alipay, buyers would transfer the money to Alibaba, who would then send the order to the seller to ship its products, and only when the buyer would send confirmation of delivery would Alipay release the funds to the seller.

Fast forward a few years and Alipay became one of the largest financial players in the world. Easy to understand why it would become highly attractive. In 2011 Jack Ma was ingenuous enough to “steal” it from Alibaba and from its major shareholders Yahoo! and SoftBank.

By that time, the Chinese government was looking to prohibit the ownership of financial institutions by foreign companies. Because Alibaba was/is effectively a foreign company, Jack Ma took advantage of it and cut the contractual relationship between Alibaba and the VIE company that he controlled which owned Alipay.

There was a big turmoil around this whole situation, Yahoo! complained, Softbank complained, and in the end there was a deal that led to Ant Group paying 30% of its operating income as a royalty to Alibaba.

But Ant Group was kept by Jack Ma because both Yahoo! and Softbank had no right to block such a move. Touché!

This goes to show why I’m usually so suspicious of investing in these structures where shareholders have no ownership. It’s not a theoretical obstacle that I wish to pay attention to, it’s real.

Risks

- It’s China.

- Variable Interest Entity structure where shareholders don’t have a claim to any of the assets.

Valuation

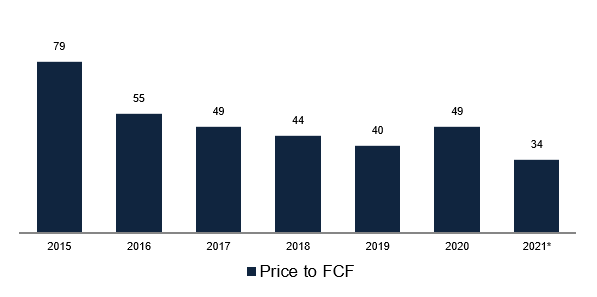

The question we should answer is, is it cheap? It depends. Deep value investors would say that a multiple of 34x is crazy expensive. But if you compare it to historical figures, it has never been cheaper.

And what about the future? Although I’m looking at the company for the first time, I believe that I won’t be wrong in saying that this can probably become a great investment.

Conclusion

This is a super business. There’s no doubt about that. BUT this is the first time I’m looking at one of these companies. I have no idea what the competitive landscape will look like in a few years.

Although the company is already a giant, it still has much growth ahead. Its cloud business will be enormous. It’s also siting on the perfect spot to become the intermediary on a trend that I suspect we’ll be seeing in the future: Chinese consumers buying from international merchants.

Right now, it’s very hard for a small European business to sell to a private customer in China, but as China’s middle class demands more and more western products, someone will facilitate this trade. Alibaba is perfectly positioned to become that someone.

All in all, this was a good first approach to Alibaba. I’ll keep my head tuned in for that side of the world. I’ve already promised on the Facebook Group that I would be looking into Tencent so I guess I’ll slowly be easing my way into these Chinese companies.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.