China Maple Leaf

a fundamental analysis

September, 20 2019

TICKER: 1317

ISIN: CA29410K1084

SHARE PRICE: $2,53 HKD

MARKET CAP: $7,7B HKD

September, 20 2019

TICKER: 1317

ISIN: CA29410K1084

SHARE PRICE: $2,53 HKD

MARKET CAP: $7,7B HKD

1. INTRODUCTION

The business I’m presenting you today is one of the most ingenious I’ve ever come across. In every regard.

Investors in Europe and the USA have certain fears about investing in Asian companies, especially those that are less known in the West.

Although I share those fears myself, I also think that the “new world” is on that side of the globe. Whenever I travel to Asia I feel like I’m being left behind. It’s an amazing part of our planet right now.

Today we’re looking at Maple Leaf Educational Systems, one of the largest private schools operators in China.

I must thank Rupam Deb and Fun Liang Chia, both of which have been phenomenal in helping me understand this company. They’ve done a remarkable job researching it and I can only aspire to reach their level someday.

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

China Maple Leaf operates a network of bilingual private schools and pre-schools in China. Education is booming there and Maple Leaf is definitely taking advantage of those strong tailwinds. It offers a double curriculum (western and chinese) which allows its students to go on to foreign universities.

In fact, the company’s selling card is the fact that 69% of its students have received offers from top universities around the globe. On top of that, 99 of their students went on to top-10 global universities. This is music to the Chinese parents’ ears who understand that studying in foreign universities will be highly beneficial to their kids.

The other day a German friend who lives in Hong Kong was telling me about how chinese families raise cash among the family members so their children can go to school. I promptly said “Wow, cool”!

But then he went on to say that these family members were all expecting for the cash to be returned (and then some) so the whole family would exercise a big influence in the youngsters’ career decisions. Now, I can’t say for sure if my friend was generalizing a particular case he had heard of or if indeed this is common practice but it goes to show the importance that the chinese families place on their kids education.

Back to Maple Leaf. The company operates the boarding schools and earns money mostly from tuition fees but also from the sale and lease of textbooks, summer and winter camps, the sale of uniforms, supermarkets in their campuses, etc.

The company is incorporated in the Cayman Islands and trades in the Hong Kong Stock Exchange. This alone is reason enough for many investors to shy away from this company. But let’s proceed.

It’s strategy is to focus on Tier 2 cities due to the lower competition and the greater willingness from local authorities and developers to help the company.

It took me some time to fully understand the intricacies of its business model. About 67% of its schools are self-owned (we’ll get to that in a minute) and the other 33% are rented, profit-share or even free. How does this work?

Because there is a great need for international schools in China, the local governments build new schools or picks existing ones and hand them to Maple Leaf to operate them. This is what’s called an “Asset-Light” model. This way, the Group can earn significant amounts of cash without investing a single dollar. Smart, hein?

The schools we’re talking about here aren’t small schools. They can house more than 8.000 students each.

Now, this is going to get really detailed and boring for some of the readers but given that it’s my first incursion into chinese lands and the education industry in particular, I had to go deep on this one. I’ll try to post cool pictures as I go along.

In China there are three types of international schools:

1. Foreign National Schools

2. Sino-Foreign joint ventures and

3. Domestic Chinese owned schools. Most of Maple Leaf’s schools belong to this category.

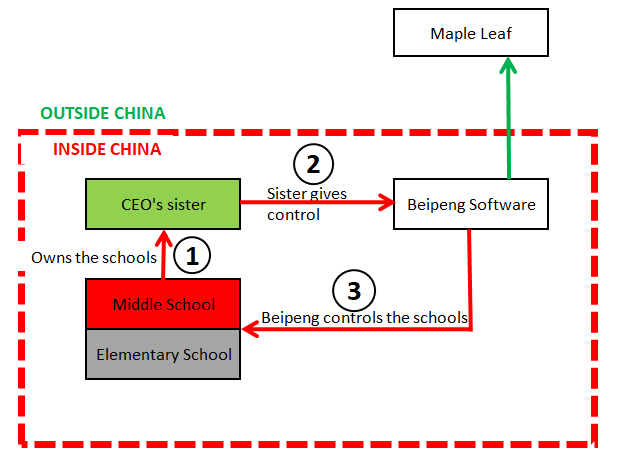

The compulsory curriculum in China encompasses the elementary schools and the middle schools. Maple Leaf owns all types of schools stated on this picture. You’ll understand why I’m posting this in no time.

2.2. LARGEST SHAREHOLDERS

At first, I looked at the shareholders structure and thought “Great, the founder has a 51% stake in the company”. But then I digged a little deeper and found out that the ownership structure of this Group isn’t as clear as I’d like.

Dr. Sherman Jen, the founder (which on the table below is called Shu Liang) is a Chinese born entrepreneur who went to live in Canada and got is citizenship there. He is now officially a foreigner in Chinese lands.

This is a problem because the Chinese law prohibits foreign ownership of elementary and middle schools, the compulsory years of school.

So how can this foreign company (and foreign owners) own more than 90 schools in China? Well, there are go-arounds.

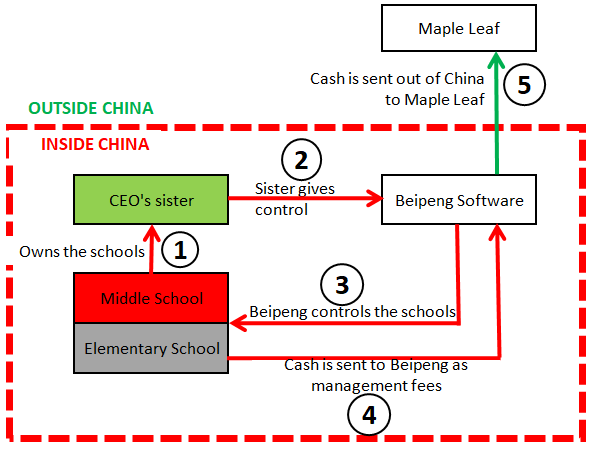

The company owns a chinese subsidiary called “Beipeng Software”.

The schools belong to the CEO’s chinese sister (1) who has given Beipeng Software a Power of Attorney (2), which means that Beipeng effectively controls the schools (3).

We’ve cleared the first “go-around the law”: The property of the schools.

Let’s now go to the second go-around: The profit making.

In China, the compulsory level schools must choose between being for-profit or non-profit. If the schools choose to be non-profit, they are tax exempt. That’s why Maple Leaf’s schools are non-profit.

So why on Earth would a company chose to operate non-profits schools?

Aha! The schools are indeed non-profit but that doesn’t mean that the company doesn’t earn any money from them.

The profits of these schools are siphoned as expenses through a management agreement with Beipeng software before they get to become profit (4). The cash gets out of the schools leaving them with just enough to be considered non-profit and Beipeng in turn sends the money out from China to Maple Leaf (5).

We’ve now cleared the second go-around: The profit making. (This took me two days to understand. If it wasn’t for Rupam and Fu Liang, it would have taken me two weeks)

This seems like a shady one-of-a-kind structure but the truth is that there are many other companies doing the same. Until now, the chinese authorities have turned a blind eye to such ingenious schemes but if they get stricter, these schools must change their status to for-profit which will take the tax exemption away.

The thing is, there’s a draft for a new law that targets the ultimate beneficiaries of the schools and these can’t be foreigners. It’s still a draft but that’s why the stock has tanked last year.

2.3. MANAGEMENT TEAM

The founder is still the CEO and he has turned one school into one of the leading private educational groups in China.

There are a lot of videos of Sherman online. Here’s one in English.

Play Video

His total compensation – which in 2017 lost its variable component – was RMB3,5M in 2018 (aprox. €493K) which is equivalent to 0.3% of sales and 0,7% of the net income. I would say that’s appropriate. Fortunately he can earn a lot more through dividends than from his day job.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

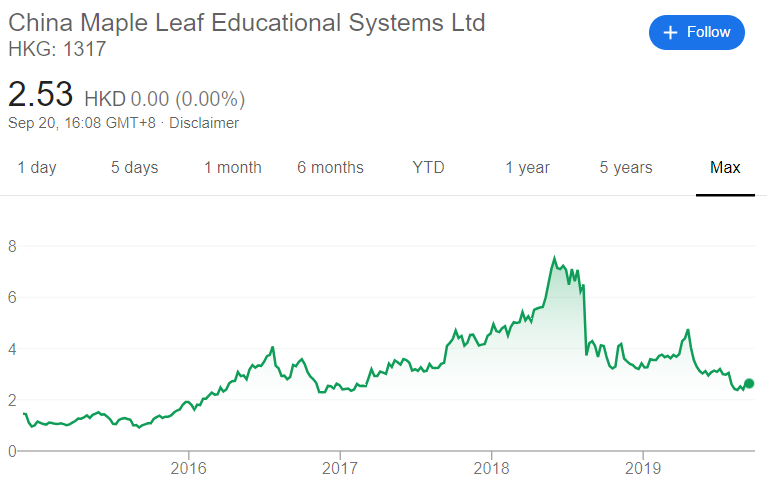

As I mentioned before, there have been great ups and downs. These are due mostly to the expectations and rumours created around future laws. Asian stocks trade much more in relation to Mr. Market’s humor swings than western ones.

After reaching its all time high of HKD7,5 in August 2018, the stock price is now HKD2,5. That enormous plunge in mid-2018 was the reaction to the draft of the new law.

3.2. MARKET CAP AND SHARES OUTSTANDING

At HKD2,53 share price, the whole company is valued at HKD7,7B (USD$1B).

There have been recent equity raises to fund acquisitions.

Note: All currency in RMB unless stated otherwise.

But the good thing about it is that the CEO has been buying HUGE amounts of shares lately. By my calculations he has bought over USD$14M in the last year alone.

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

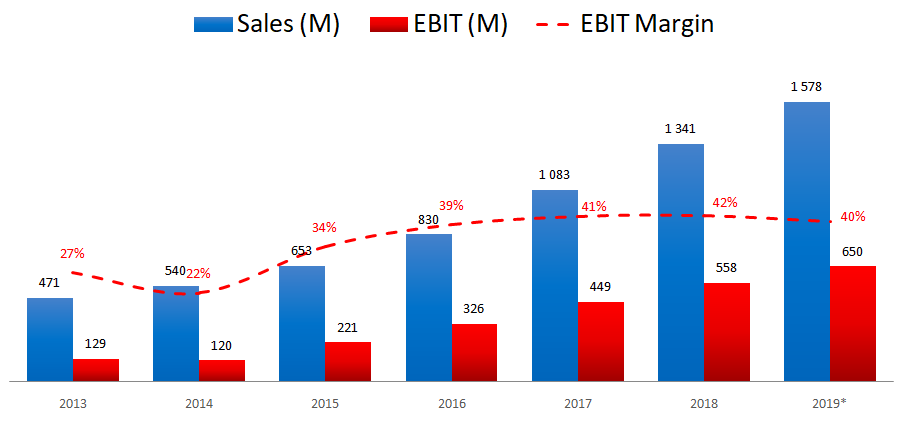

Now to the operating performance.

The company has been growing sales at a 23% CAGR and operating income at a 34% CAGR which goes to show that the managers have been able to control costs.

The operating margin has gone from 27% seven years ago to 40% this year.

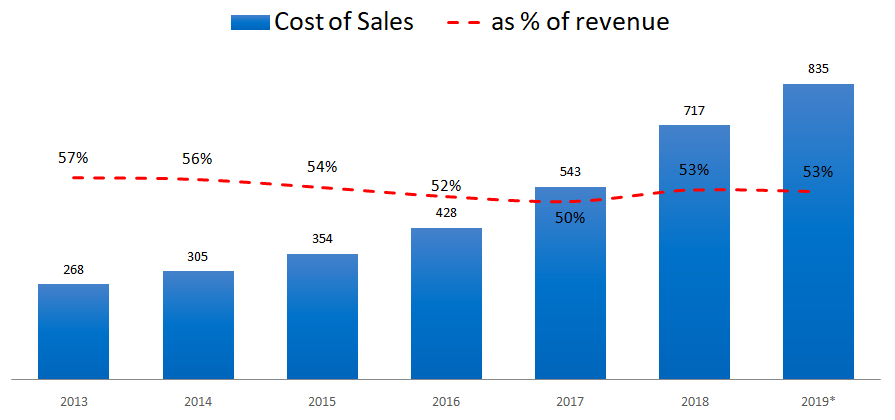

Of all the costs the company has, no doubt the highest one is the salaries it pays to its teachers. At the end of the fiscal year – which ended on the 31st of August, but hasn’t been reported yet – I estimate that it accounted for 53% of the revenue.

3.4. SALES BY GEOGRAPHY

The group has a couple of schools in Canada and Australia but most of its schools are located in Tier 2 cities in China.

3.5. NUMBER OF SCHOOLS

The number of schools has been growing at 22% CAGR, especially the middle and elementary-schools (the compulsory level). About 67% of the total number is owned by the CEO’s sister while the rest is rented, free or profit-share based.

3.6. SALES BY SEGMENT

And if we now look at the revenue breakdown, we can clearly see that the high-schools are the biggest source of revenue, even if their number is much lower, as we’ve just seen.

Now, this might happen for two reasons. Or these schools are bigger and can take a lot more students, or the students pay a lot more than in the other segments.

Let’s look at the number of students per segment.

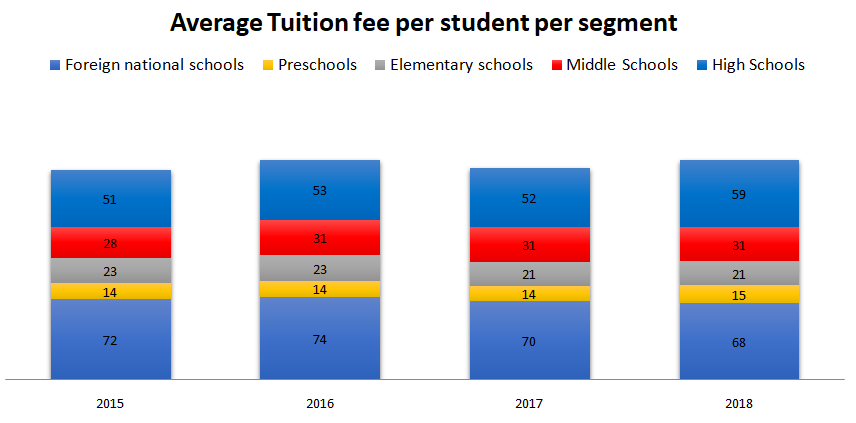

The first thing I see here is that the number of students in high-school is lower than that of the elementary schools. If these are bringing in the largest cut of revenue, then I must conclude that the high-school students pay more than the others.

And so it is. The other segment with even higher revenue per student is the “Foreign National Schools” but there are only three such schools. Not enough to make a difference.

We’ve already seen that the high-school students pay the most. Let’s now see if the schools are bigger or not.

It seems that this was another correct assumption. The high-schools are bigger than the other schools.

In 2018, the number of students per high school has dropped significantly. I didn’t find any comment on that but I would say that happens because the company has recently bought new schools that aren’t working at their fullest capacity yet.

3.7. NET INCOME

I am amazed by the profit margins and the profit growth. May I remind you that a 40% margin is what Facebook gets from its business?

3.8. CASH FLOWS

Virtually any business that collects cash from its clients before paying its suppliers is – in principle – a great business. It’s called a “negative working capital” business.

One of the particularities of such businesses is that it creates “float”. Money that isn’t yours but that you can hold for a certain period of time. And that money can be invested to generate additional profits.

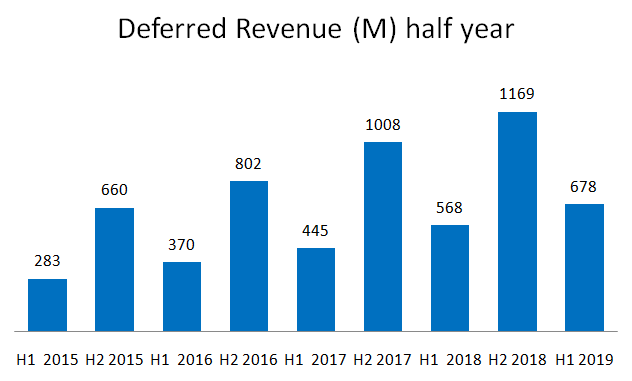

That’s the case with Maple Leaf Educational Systems. Parents pay the full year tuition in August, just before the school year starts (which coincides with the financial year). We can see this reflected on the “Cash from Operations” line on the Cash Flow Statement.

All of this leads to a similar pattern on the Deferred Revenue liability:

The management team knows at the beginning of each year how much its revenues are going to amount to because they’ve already been for.

But this revenue can only be recognized throughout the year as the services are provided. Similarly – and due to the matching principle – the proportional amount of costs can only be recognized when the related revenue is recognized.

All of this to say that the clients are financing this business by paying in advance for services that will be rendered throughout the year.

Let’s check how much cash this business would be generating if it were to stop growing tomorrow…

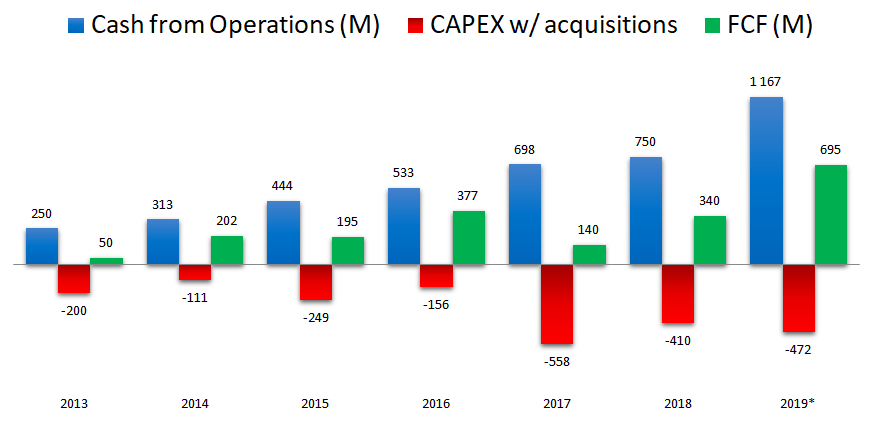

Capital expenditures are minimal, leading to a high conversion of cash from operations into Free Cash Flow (the cash that can be taken out of the business without affecting the normal course of operations).

Around RMB1B which is equivalent to USD$140M. Remember that the company is valued at 7,7B, so the Price-to-FCF is at 7,7.

And now let’s factor in the acquisitions as well.

Of course, this is more volatile given the unpredictability of such spending. Even so, I expect the FCF this year to be much higher than in previous years.

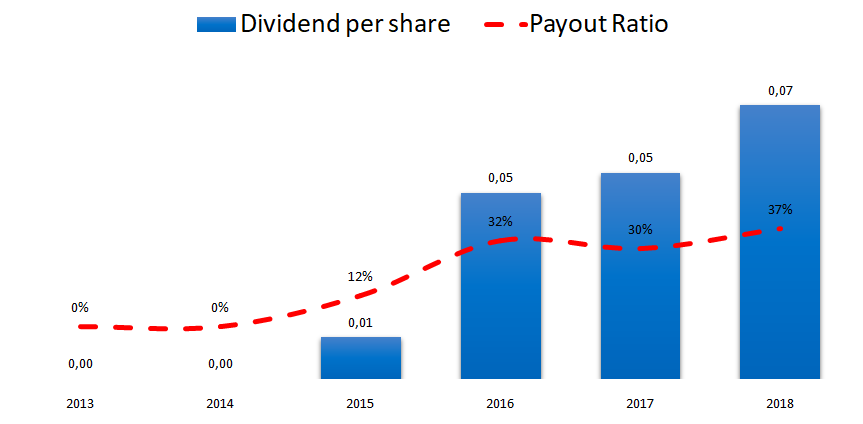

3.8. DIVIDEND

The dividend has been rising in tandem with the increasing profits.

3.9. PROFITABILITY RATIOS

And so has the Return-on-Equity. In 2018 it has reached 15%.

3.10. BALANCE SHEET RATIOS

And with almost zero debt, the balance sheet is pristine.

As we’ve previously seen, this is a negative working capital business and this working capital has been (negatively) growing through the years. This means that the company is increasingly being funded by the kids parents.

3.11. PRICE RATIOS

Given the recent share price drop, the company is now trading at a ridiculously cheap valuation. A forward PE of 11 and a forward EV/FCF of 6 indicate that Mr. Market is very frightened about this company’s future prospects.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

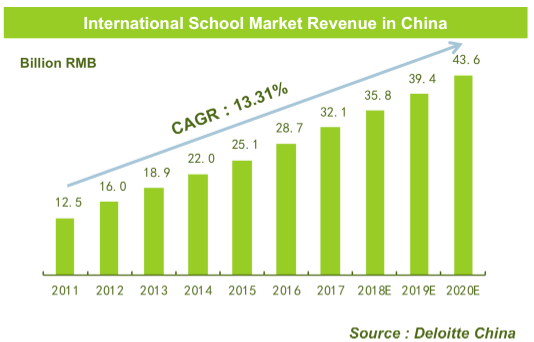

With the number of middle to high income chinese families growing every year, there is huge demand for international schools right now in China and the company has been riding that wave with proven success.

The management sets five-year plans and one of its goals is to reach 45.000 students by the end of the 2019/2020 school year. In February 2019 the number of enrolled students was 36.564 so that’s an ambitious goal.

They’ve recently acquired new middle and elementary schools to secure the pipeline of students that will attend their high schools.

80% of its international schools charged more than RMB50,000 per year in 2016. The tuition level has declined in recent years due to the lower tuition fees paid in the acquired schools. In time, I suspect these will converge to values similar to the other schools.

4.2. SEASONALITY

The cash comes in in August but this business is in fact highly stable.

4.3. TYPE OF PLAY

Maple Leaf Educational Systems is a growth play.

4.4. RISKS AND COMPETITION

This is probably the most important section of all. Given the ownership structure of this business and the regulatory threats, the downside must be heavily weighted.

No doubt, the most important risk facing this business is the regulatory risk.

The second one would be the integrity of the management team. Yes, you might tell me that the CEO has won several awards and he is highly respected in the community but we’ve seen the lengths he is willing to go to reach his goals. This can be good and bad.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

The time has come to stop and think about the brilliance of this business.

The need for international schools in China is massive. Maple Leaf doesn’t have to spend a dime building or buying a lot of these new schools. Moreover, sometimes it’s exempt from paying rent for the first couple of years.

Then, when the schools are built, the parents pay the annual tuition before the company needs to spend a dime and on top of that neither the schools nor Beipeng Software pay any taxes.

The icing on top of the cake is the price. If these risks turn out to go up in smoke, this company is super cheap. This could be the investment of a lifetime if the shadow of stricter law enforcement wasn’t lurking.

After a week researching the intricacies of this business, what I must ask myself is: If I were to invest in this company, would I be sleeping in peace?

Unfortunately the answer is no. I’m growing more conscient of the fact that the downside of an investment is far more important than the upside. Even so, this was a great company to study and it served me to dip my toe in the incredible sea of chinese companies. I’ll definitely be following it very closely.

In the meantime, you can join our community at our:

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431