Alpha ProTech

a fundamental analysis

By Manuel Maurício

October 09, 2020

Symbol: APT (NYSEAMERICAN)

Share Price: $15.47

Market Cap: $210 Million

Source: Google

Introduction

Alpha ProTech is a small company that manufactures masks, face shields and products for the housing industry. Yes, masks and face shields! I know. I shouldn’t be looking at short term plays, but I’ve been reading about how this company is still way undervalued so I couldn’t help myself. Besides, I know there are at least a couple of subscribers that like this type of opportunities, so I might as well share with you what I’ve learned.

I first heard about Alpha ProTech from Kuppy over at adventuresincapitalism.com. When the virus came from China to the USA, Alpha ProTech shares went from $3.5 to $25.5, a 7 fold appreciation. That’s what fear and greed can do to stocks in the short term.

As with my Ocean BioChem write-up, what I’m trying to figure out is if (and how) this surge in demand can benefit these companies in the long term. You see, the company where I worked at prior to becoming a full time private investor benefited massively from one single job (Casa da Música in Porto). This job gave it the cash needed to get a licensing deal from the best windows brand in the world, increase its manufacturing capacity and become the world leader in luxury windows. This little story goes to show that sometimes what seems like a short term event might be transformational for a small company – if the management knows how to take advantage of it.

Business

Alpha Protech works under two segments: Disposable Protective Equipment and Building Supply. Under the Disposable Protective Equipment, the company manufactures face masks, eye shields, gowns, shoe covers, bouffant caps…

and under the Building Supply segment, the company manufactures housewrap and roof underlayment.

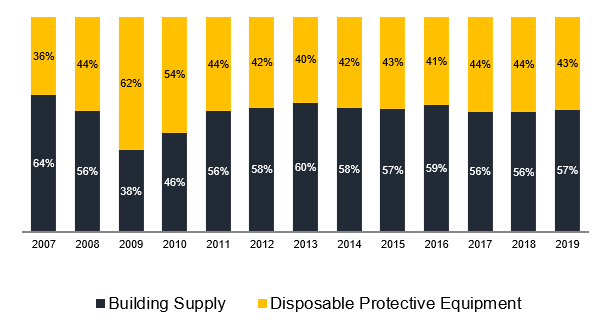

The contribution of both segments to the overall revenue has been pretty stable throughout the years, apart from 2009.

Revenue by segment

Source: Company data

Financials

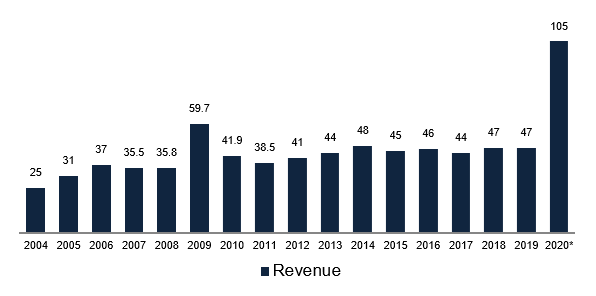

And if we look at the revenue figures, we can see that, not only did the mix change in 2009, but there was also a massive spike in sales.

Revenue, US$ Millions

Source: Company data, AiS estimates

This was due to the huge demand for N95 masks created by concerns relating to the H1N1 Influenza virus, also known as the Swine Flu. Can you see the parallel here?

Here, let me pull up the chart for the share price in 2009/10.

The stock went from $0.77 to almost $7.7. A ten-bagger in 9 months. But, as the demand wasn’t sustained, the share price quickly dipped back to (almost) previous levels.

The obvious question investors must ask themselves today is “How likely is demand to keep at these levels?“

But we’ll get to there later. Let’s look at the profits.

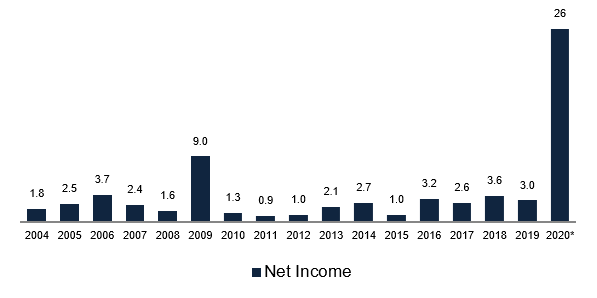

Net Income, US$ Millions

Source: Company data, AiS estimates

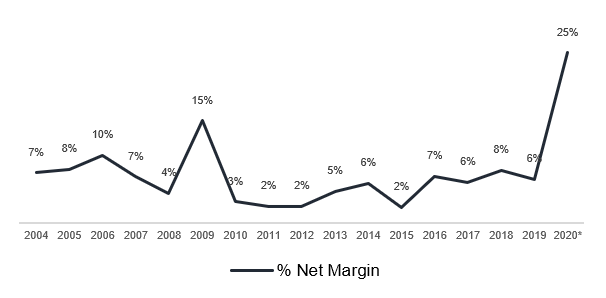

Wow. As with Ocean BioChem, there’s a high level of operating leverage. When the revenue rises, the costs don’t rise as much (there are fixed costs that don’t change) originating a disproportionate increase in the profit margins.

Net Margin

Source: Company data, AiS estimates

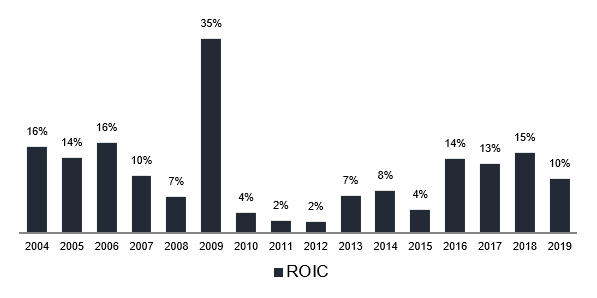

But unfortunately, apart from the good years, the Return on Invested Capital has been pretty average.

Return on Invested Capital

Source: Company data, AiS estimates

Balance Sheet

With zero debt and a cash cushion of $25 Million, the balance sheet couldn’t be stronger. As with Ocean BioChem, one could argue that a bit of debt wouldn’t hurt the company and it would benefit the shareholders.

Another interesting detail from the balance sheet is the newly created “Customer advance” line.

This means that the customers are now paying upfront so the company can secure inventory and increase its producing capacity.

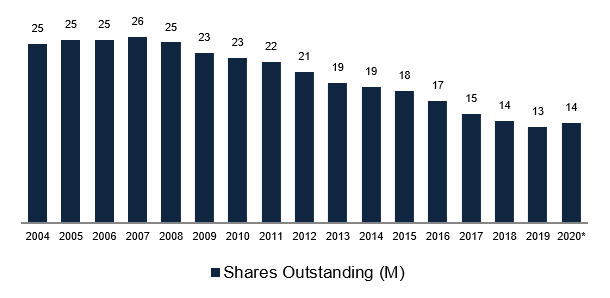

As a result of the improved fundamentals, the company is ramping up its share repurchase program. This is great news. I love to see a chart like this.

But it also tells me that even in the midst of the biggest surge in demand ever, the management isn’t willing to risk it all by building excess capacity. If the management were to believe this level of activity would be sustainable, it would be building a new plant, not buying back shares.

*As a side note, I like it that the company has issued $1,8 Million worth of stock in the first quarter when the stock got way ahead of their fundamental value.

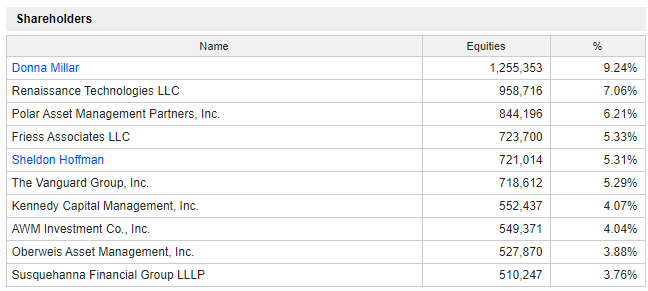

Management and Ownership

Donna Millar, the largest shareholder with 10% was the wife of the late founder Al Millar. She’s still a director and handles the Investor Relations department. There’s no other insider shareholders. Interesting to see Renaissance here as well. It’s also a shareholder at Ocean BioChem. For those who don’t know Renaissance, I’d recommend you to read this article.

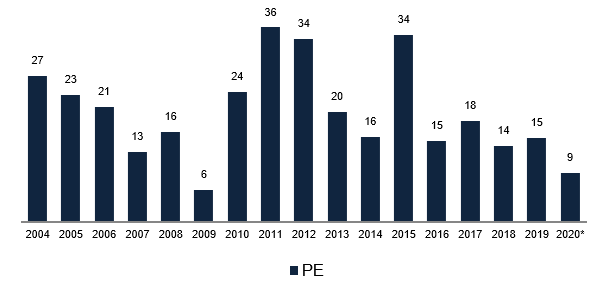

Valuation ratios

The current PE ratio is at 9x, but we should be careful before reaching conclusions here. The Price-to-Earnings ratio has been all over the place in the past 16 years. This seems like a cyclical company. When the company is making loads of money, the multiple contracts because investors are already expecting the profit to come down. And then it “seems” expensive because of the depressed profits.

And as with any cyclical company, the “trick” is to buy it right before an inflection point, not when we’re at the peak of the cycle. The problem is it’s very hard to predict when a new pandemic will arise.

Competition

There’s lots of competitors and almost all of them are much bigger than Alpha Protech. Some are 3M, Prestige Ameritech, and I would suppose that there’s many more in China.

Risks

- My estimates might be wrong or Mr. Market might just don’t care

- Any disruption in the operations

- High customer concentration (the 2 largest customers account for 32% of sales)

- Increased competition

- Issues with the Indian joint venture

- Issues with the supply chain

Thoughts and estimates

The US is currently facing a massive shortage of masks and the stock pilling hasn’t even begun. No institution in the US will want to be caught off-guard with low inventory of masks in the future.

Here’s what 3M spokeswoman Jennifer Ehrlich said on a recent interview:

“Even though we are making more respirators than ever before and have dramatically increased production, the demand is more than we, and the entire industry, can supply for the foreseeable future.”

Given this scenario, all the mask manufacturers are increasing their productive capacity. Alpha ProTech has increased its capacity for N95 masks from $9 Million per quarter to $25 Million per quarter. That’s $100 Million per year for a company that had $47 Million in revenue in 2019 – spread around several products, not just masks.

The issue with this company is that it’s very hard to make estimates. It’s the first time we’re going through a pandemic. I’ve read lots about it and some people believe that the demand will be very high at least through 2025. I’m not so sure about that.

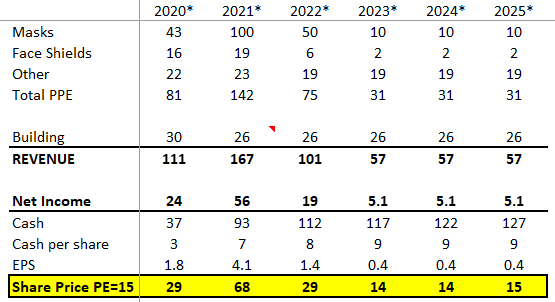

Either way, I’ve modeled what I believe to be very punitive assumptions and I get to a 2023 share price of $14, a little bit under today’s share price.

Now that I think of it, according to these assumptions, the risk would be to be left holding a stock that didn’t move for 3 years while being exposed to a high chance for it to double or triple in the meantime. Humm…

But how likely is the scenario above to happen? I’m still not sure. Not even the mask producers know what will happen. They’ve been in similar situations before, and that’s why they’re reluctant to keep adding capacity. Without a guarantee from the US government that there will be sustained demand for years to come, it’s a big risk to be spending huge amounts on new production lines. And that adds to the deficit between supply and demand.

It’s important to note that the company is also highly dependent on a Joint Venture in India for its sourcing of raw materials. Given that India is exactly known for its great hygiene and health conditions, I’m not sure how the business would be affected if some problem were to arise in one of its Indian plants.

Conclusion

With all of this in mind, I’m waiting to talk to a few people who are responsible for the buying and stockpiling of masks in hospitals here in Lisbon so I can get a feeling for the future demand. If I get convinced that there will be steady demand in the coming years, this could become a small speculative position for the Portfolio.

By the way, I know I’m comparing apples to oranges here, but I’m very interested in knowing where Alpha Protech and Ocean BioChem will be 10 years from now.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.