Berry Global

a boring cannibal

Berry Global

a boring cannibal

By Manuel Maurício

August 05, 2022

New to the Berry Global? Read my previous posts here.

The company posted results early in the week and they didn’t disappoint. They didn’t get me all excited either.

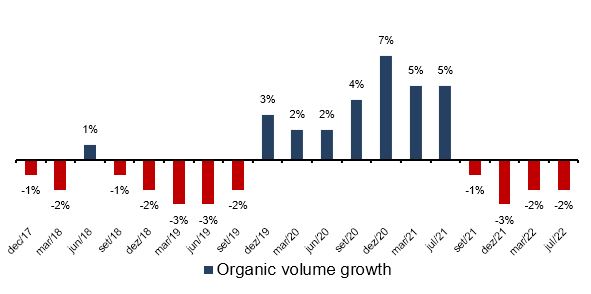

The volumes were down -2% from last year…

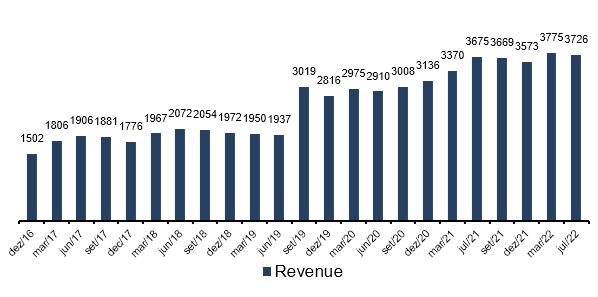

… but due to effective cost-pass-through, the company was able to get the revenue up 1% (6% on a comparable basis)…

This is obviously poor performance. The management argues that last year was an abnormal one. I get that. But still.

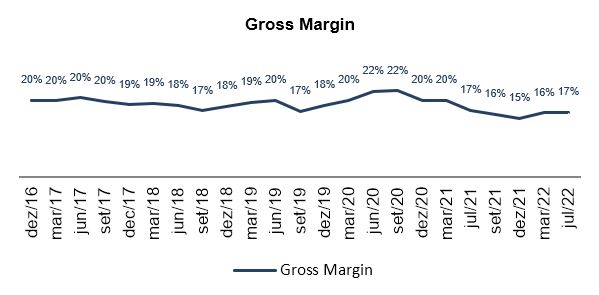

As expected, the gross margin has ticked up with the resin prices going down…

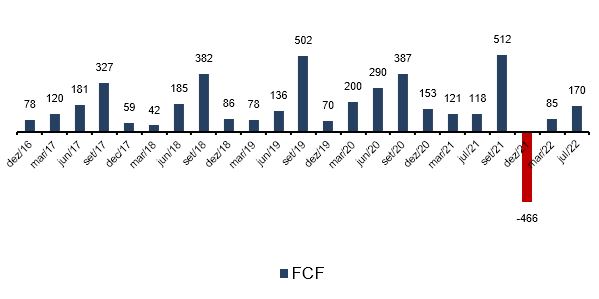

And also as expected, the Free Cash Flow as ticked up.

The management is guiding for $750 million in Free Cash Flow from the previous estimate of $900 million. This is due to the effects of the pandemic. The company is increasing inventory by $150 million – thus reducing Free Cash Flow by the same amount. Most of the raw materials used by Bery are transported by rail. And there has been employment challenges in the North American railway industry. The company wants to guarantee that it has the inventory to meet its clients needs. Going forward, the FCF should come back to the $900 million.

They are “sure” about this number going forward because 70% of the products that the company sells are non-discretionary, meaning that people will buy them in both good and bad economic times.

Capital Allocation

So far all of this was boring stuff. Here is where it starts to get interesting.

Earlier in the year, the Board of Directors authorized a $1 billion share repurchase program. But for no apparent reason, they said they would only be spending $350 million buying back shares in 2022. I couldn’t understand why. It’s now apparent that there was no reason for this.

The management (and Board) have now changed their tune to one that is more of my liking ( I guess the backlash from the investing community was strong). They’re now focused on buybacks and not dividends. Halleluiah! The proof of this is that they already repurchased $637 million of shares year-to-date (8% of total shares outstanding).

Conclusion

Berry Global is such a stable business that the conclusion to my previous analysis could be copied and pasted here. This isn’t a great business. It’s an OK business. BUT… on a normalized basis, it should be making $900 million in Free Cash Flow. The current market-cap is $7.25 Billion, which means a Price/FCF of 8x. Cheap! And the company is buying back shares aggressively. Let’s just hope they continue for many years.

At some point, one of two things should happen: a) the market gives it a higher valuation leading the share price higher, or b) even at a low valuation, the Earnings-Per-Share will be so much higher that the share price will go up.

Berry will remain in the Portfolio.

If you want to discuss Berry Global, head over to the forum and tell me all about it.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.