Berry Global

a fundamental analysis

Symbol: BERY (NYSE – New York Stock Exchange)

Share Price: US$43,75

Market Cap: US$5,8 Billion

By Manuel Maurício

July 10, 2020

Introduction

I first noticed Berry Global a couple of weeks ago when I wrote my second Medley. You can read it HERE.

Berry is the classical deleveraging play. It raises debt to buy other companies, it uses the cash flows to reduce the debt, it raises debt again to buy other companies, it pays down the debt ad infinitum. These days, it seems that everyone is looking for high flying tech companies with no profits. I, on the other hand, believe that there’s a lot of money to be made in other niches of the stock market. Deleveraging plays is one example.

Berry is as stable as they come. It’s also a cash cow and that’s why the Private Equity firms love these companies so much. For the lazy ones amongst you, you can just skip to the conclusion.

Berry Global: Share Price History

Source: Google

Business

Berry Global Group is the world leader in plastic packaging. Almost anything that you can think of that is made out of plastic, they make it. The company likes to say that there is one of its products at less than 5 meters away from you at any time. From paint buckets to shampoo caps, to shrinkage films to asthma inhalers, you name it.

Until recently, the company operated in 3 different segments: Consumer Packaging (think plastic cups, paint buckets and spray caps); Health, Hygiene & Specialties (think baby diapers, face masks and surgical drapes) and Engineered Materials (think duct tape, shrink films, and trash bags). In 2019, with the buying of the British RPC plastics (the largest player in Europe – more on that later) it added a fourth segment, the Consumer Packaging International.

Revenue by segment, $ Millions

Source: Company data

Berry is huge (especially after the RPC acquisition). It’s the largest plastic resin buyer in the world ($7 Billion annually). It has over 293 facilities around the world. This is a business where proximity to your client is important. You won’t be shipping laundry detergent bottles around the world or you’d be shipping mostly air. That’s why there are literally thousands of plastic factories around the world. And that’s where the opportunity for growth is.

Source: Company presentation

Being a commodity-like business, the lowest cost producer has a serious advantage over its competitors. The prices of resin are correlated to gas and oil prices, but Berry makes the same for each pound of plastic that it sells, regardless of the price at which it buys it due to cost pass-through contracts. Let’s say that the company makes $0,2 per pound of plastic. If the price of the resin drops tomorrow, the price that Berry charges its client will also drop, but the company will still be making those $0,2 anyway.

Industry and Strategy

The plastic packaging industry has some big players, but for the most part, it’s highly fragmented. About half of the total participants are small scale, which represents an opportunity for the big guys (see dark blue n the chart below).

Industry Fragmentation

Source: Company presentation

Also, due to its steady and predictable cash flows, the packaging industry is a frequent playground for Private Equity firms. A Private Equity (or PE) is a firm or a fund that raises cash (n the form of equity or debt) and buys whole companies (private or public). Usually, when they take control of a company, they’ll “restructure” it, optimize processes, reduce costs and more often than not, fill the company with debt only to sell it aftwards for a profit (on the stock market or to another PE firm).

Back in 2006, Berry was acquired by Apollo Global Management, one of the most well known Private Equity firms in the world. In 2012, Apollo “floated” back the company on the New York Stock Exchange. But the PE culture has stuck with the company. In fact, Apollo is still the largest shareholder and still has directors on the Board.

Although Berry is now public, its strategy for growth is still to buy smaller competitors using debt, restructure them, apply best practices, reduce costs, take advantage of its scale by gaining purchasing power, use the cash flows to reduce debt, when it gets to a comfortable level of debt, it will start the same process all over again.

Deleveraging Model

Source: Company presentation

As you can see from the image above, they have been following this strategy for a long time. Even longer than what the image shows.

Here’s the living legend John Malone explaining the concept of leveraged acquisitions (start at 53:30).

But the market (aka Wall Street) doesn’t like the roll-up strategy (i.e. growth by acquisitions) because it presents risks. More often than not, acquisitions destroy shareholder value.

Right now, the management’s goal is to deleverage (reduce debt) to around 3x to 4x EBITDA. I believe they’ll be able to reach that goal in less than 2 years. And then what? Then, they will have several things they can do with the money. If their stock is cheap, they can just buy back shares. If the competitors are cheap, they can increase debt and start this process all over again.

You see, in some cases, reducing leverage isn’t the best thing a company can do with its cash. Yes, it brings some optionality (for buying back stock, for example), but at such low rates, the return on that capital is very low (Berry’s combined interest rate is 4%). If this was a private company, it could be leveraged 7x or 8x. But stock market investors don’t like that. And that’s the fine line that the management has been walking on. It knows that if it were private, it would be a whole different story.

* EBITDA: Earnings before Interest, Taxes, Depreciation and Amortization

The RPC acquisition

So at some point in 2019, Apollo – the PE firm who owns 10% of Berry – offered £3,3 Billion pounds (US$4,3 Billion dollars) to buy RPC Plastics, the largest plastics manufacturer in Europe. Things were going nicely, but at the last minute, Berry took advantage of a British law that prevented Apollo from raising its offer and made an offer for $6,5 Billion pounds and bought the company. Berry is a $6 Billion company, so this was a huge acquisition.

When a company makes such a large acquisition, it’s of the highest importance that the acquisition goes according to plan and there are no hidden surprises. Investors are still suspicious of this acquisition. It seems that RPC itself was a roll up story with doubtful success. So far, 3 quarters have passed and there is no sign of shenanigans.

The acquisition has allowed for geographical diversification. Berry’s European operations were very small prior to this. With the acquisition, a giant was created. A lot of the clients of the two companies overlap. They’re the consumer staples blue-chips. Today, what I’m most worried about is RPC’s exposure to the European auto manufacturers.

Client overlap

Source: Company presentation

RPC is expected to contribute with around $3,9 Billion in annual revenue, $0,9 Billion in EBITDA and $300 Million in FCF. This means that the transaction was done at a EV/EBITDA multiple of 7,2x after synergies (cost cutting and lower cost of goods sold) and 14x FCF. The good part is that it was all debt financing. No equity. This is amazing. The company didn’t spend a dollar in this acquisition.

Financials

The company has been able to grow its revenue at 11% annually since 2007 and 19% for the past five years. Due to its acquisition strategy, growth isn’t smooth, but lumpy.

Total Revenue, $ Millions

Source: Company data

That’s one of the arguments against Berry. Its organic revenue growth has been negative for many years so investors are afraid that the acquisition strategy is being used to mask a declining underlying business.

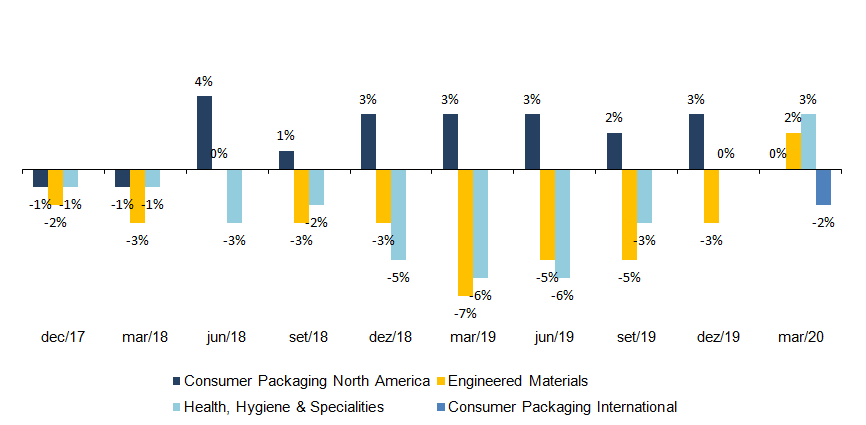

Organic volumes growth/decline

Source: Company data

That’s a legitimate argument and true to some point. The management is also aware of that. That’s why they’ve been taking measures to get those numbers back to positive. Let’s see it quarterly and add some granularity to it.

Organic volumes growth/decline

Source: Company data

As we can see, the “Consumer Packaging” was holding up quite well before the virus hit and the other two segments had been improving since March 2019. Having said that, I believe investors should expect the long term trend of low single digit decline to persist going forward.

Regarding the gross margin, I’ve chosen two other peers as a means of comparison. Although the company has slightly lower gross margins…

Gross Margin

Source: Company data, Morningstar

… it has been able to compensate by keeping its operating costs low. As we can see, the fact that this is a commodity-like business, leads to low margins.

Operating Margin

Source: Company data, Morningstar

Turning now to the Net Income and FCF, given the high Amortization charges result of the acquisitions, FCF is always higher than the Net Income. In this business no one cares about Net Income. All the PE firms pay attention to is the cash generation ability. Net Income can’t be used to pay down debt.

Net Income and Free Cash Flow

Source: Company data, AiS

The management is used to beat its own FCF guidance, and it’s guiding for a $800 Million FCF in 2020 ($1400 Million in Cash from Op’s minus $600 Million in Capital Expenditures). For the 2021, the guidance is for $900 Million. Depending on how the world goes through this virus thing, I believe they can get to $850 Million this year.

This in turn leads us to the balance sheet.

Balance Sheet and Efficiency Ratios

Berry has significant debt on its balance sheet. The regular investor would look at the debt/equity ratio of 6,7x and would turn the page. But we don’t want to be regular investors, do we? At the end of the second quarter (March) the leverage ratio (Net debt/EBITDA) was 5,5x. A “regular” company is usually leveraged at a maximum of 3x, but as mentioned previously, these companies can handle high levels of debt due to their strong and stable cash flows.

Leverage

Source: Company data, AiS

And typically, the banks will impose some limits for financial ratios that the company can’t breach (aka debt covenants). Interestingly enough, this is the first time I see a company with no debt covenants. The banks have lended the money without conditions. Very interesting.

Right now, the company has about $1 Billion in cash and an undrawn credit facility of $800 Million for a total of available liquidity of $1,8 Billion. I don’t see the company needing it since there are no maturities for the debt on the short term and the business shouldn’t suffer much with this recession.

It’s not my intention to turn my readers into finance geeks, but I’ve highlighted those two portions of debt above to illustrate the state we’re at in Europe. The company is paying 1% and 1,5% to borrow money. I don’t even know if I want these guys to pay down debt. They should be raising even more of it (and lend me some).

Management

The current CEO, Tom Salmon, has been in the industry forever. He has been the CEO since 2017 and after just 1,5 years on the job he’s done the largest acquisition ever. Way to go!

He is also the Chairman of the board. I typically don’t like this. The Board of Directors is there to oversee if the management team is doing the best for shareholders. If the Chairman is also the CEO, the roles are mixed together and obviously the accountability isn’t the same. It’s also my belief that the incentives are misaligned with those of the shareholders. Apart from the base salary, these guys have EBITDA and FCF goals (not even on a per share basis). In order to grow each metric, you just have to buy more companies or reduce spending. This incentive structure is quite common in Corporate America and I don’t like it.

Having said that, I believe that the current path to deleverage is the right thing to do.

Activist Letter

Just recently, one of the largest shareholders in the company, Canyon Partners , wrote a public letter to the board demanding 1) that the company deleverages as quickly as possible 2) that management pursuits an investment grade credit rating and 3) further efforts on the ESG (Environmental, Social and Governance) front.

This isn’t that unusual in the US, and I wouldn’t have brought it up it if it wasn’t for them mentioning an interesting correlation between the level of debt and the valuation.

This isn’t new. Everyone knows that the market rewards companies with low debt by paying a premium, but it’s interesting to see it so clearly nonetheless.

Valuation Ratios

Now, is this company cheap? I would argue that it has never been cheaper. This is like a public Leveraged Buyout (LBO) and as such, it should be valued on an EV/EBITDA and on a Price/FCF basis. If everything goes according to plan, the company is trading at 7x 2021 EBITDA…

Enterprise Value to EBITDA

Source: Company data, AiS estimates

… and 6x 2021 FCF. This is freaking cheap.

Price to Free Cash Flow

Source: Company data, AiS estimates

Risks

- Higher rate of decline for organic growth

- Strike

- Management doing anything else but deleveraging

- Accounts quality of the RPC. It has only been 3 quarters from the acquisition and there might be some surprises still

- Loss of clients

- Cost pressures that can’t be passed on to the customer

Valuation and Conclusion

We’ve come to the part that really matters, right?

I must say that this isn’t the best business in the world. This isn’t the best company in the world. The balance sheet is highly leveraged. The RPC relation to the auto industry isn’t ideal in a virus scenario, but I’ve been wanting to add some defensive companies to the portfolio and I believe Berry fits the bill.

You see, if things go according to plan, the company will have deleveraged to 4x by the end of 2021, making around $900M to $1 Billion in FCF which at a multiple of 12x would lead to a share price of $81 or a 37% rate of return. At an EV/EBITDA of 9x, that would mean a share price of $73 or a rate of return of 30%.

So here you have it. Berry Global Group is entering the Portfolio on Monday with 5% of the initial funds. I will be buying it sparsely over the next 5 weeks.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.