Card Factory

a lesson learnt!

By Manuel Maurício

April 07, 2021

I might have made an unforced error with Card Factory. I was too slow to act.

When you’re looking at a compounder, you usually have the time to research it and to act. But when you’re looking at a situation where there is a temporary overreaction by Mr. Market, odds are that he will soon get his act together and recognize the full value of the company. That’s what has happened with the Card Factory.

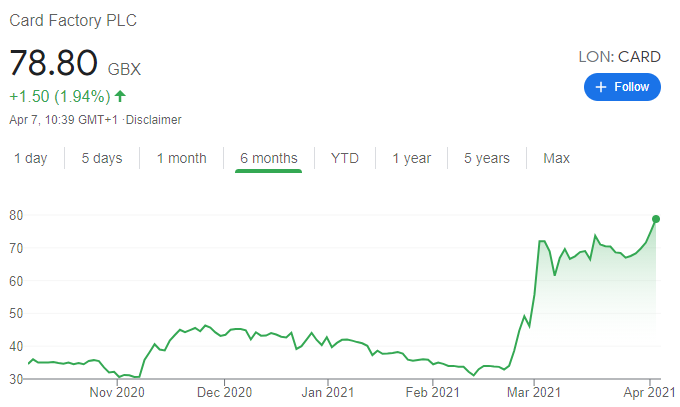

When I first looked at the company, it was trading for around £35. I wrote about it when it was trading for £67,5. Today it’s trading for £78.8.

I liked Card Factory the moment I saw it. It was the clear leader in a stable industry that was being badly affected by the lockdown. Its competitors had filed for bankruptcy, and Mr. Market thought that the same could happen to Card Factory.

But a deeper dive would tell us that the Card Factory had the cash to withstand some months of lockdown and its creditors were unlikely to force a bankruptcy process on a company that had been highly cash generative in normal conditions.

The important point here was to be sure of the math and assumptions behind the liquidity test. As you know, I’ve uncovered Card Factory from DKValue, a blog run by two European guys. They had done a marvelous job analyzing the company, and their liquidity test was more educational than most university courses. I highly recommend you to read it.

It took me some time, but I was able to reproduce it. In fact, when I said on my initial write-up that I would be doing a liquidity test, I had already done it. But the assumptions I used weren’t mine. I wasn’t knowledgeable enough to know that the management had been deferring rent payments since December or that their printing factory costs around £2 million per month to run.

I had to learn some things about the business really quick if I wanted to get comfortable making my own estimates. I did my best to set up a call with the guys running DKValue, and after a week I was talking to them. They’ve explained their assumptions to me (many were coming from the company itself), and I didn’t follow up. I should’ve tried to talk to the management immediately. Truth be told, given the critical situation, odds are that I wouldn’t be able to get to them, but I didn’t try. I thought I had time. My mistake.

So where are we today? As planned, the UK is putting an end to its lockdown next week, Card Factory hasn’t filed for bankruptcy nor has it been forced to issue new shares (that is still a risk), and Mr. Market finally woke up to those news, driving the share price up to £78,8 as of this writing.

The question now is “Is the company still mispriced? If so, by how much?”. I believe that the company is still mispriced. We could easily be seeing Card Factory netting £50 Million in profit in a couple of years from now.

The current Market Cap is £270 Million. This means that we’re talking about a forward Price/Earnings ratio of 5.4x. Still cheap. What would an adequate Price/Earnings ratio be? I guess 8x would be the minimum. Historically, the stock has traded in between 19x and 12x. If Mr. Market were to ascribe it a multiple of 10x, we could be seeing the stock price double.

But the truth is I’m still not comfortable enough to buy it. I don’t know if it’s because the company might still be issuing shares in the near future, or because the price has run up and I’m anchored to a lower price, or even because of the fact that the company had been slowly declining in the years prior to the pandemic and I’m not enthusiastic about its future.

In fact, now that I think of it, I’m not entirely sure that if the price had remained depressed, I would be buying the stock. I’m not sure I would ever be confortable making assumptions “in the dark”. I guess I’ll never know.

What I know is that I’ve (finally) tried to set up a call with the CFO. Am I too late? Probably. But it would be foolish of me not to try after recognizing my mistake.

All of this has served me to learn something: with temporary overreactions by Mr. Market, I’ve got to act fast.

Lesson learnt.

“My strategy isn’t very complex. I try to buy shares of unpopular companies when they look like road kill, and sell them when they’ve been polished up a bit” Michael Burry (the guy that predicted the Great Financial Crisis)

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.