Card Factory

a fundamental analysis

By Manuel Maurício

March 26, 2021

Symbol: CARD (LSX)

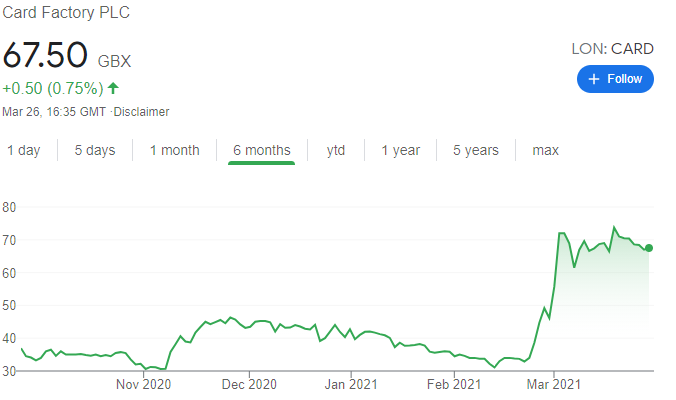

Share Price: £0,675

Market Cap: £230 Million

The Opportunity

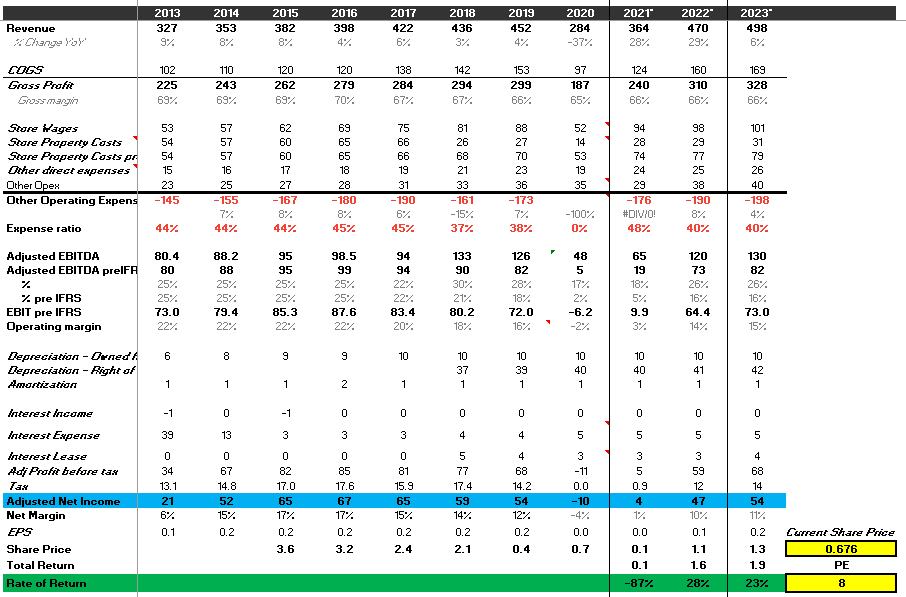

What if I told you that Card Factory is trading at 5x profits of 2022 and that its share price could double again in the near future? Would you be interested? If the answer is yes, read on.

* Before we proceed, I would like to thank DKvalue for helping me better understand this situation.

Business

Card Factory is UK’s largest retailer of greeting cards and party related products (balloons, confetti, small gifts, etc).

Yes, I know. First it was the scratch cards manufacturer, now greeting cards manufacturers. Not very high tech nor hot industries. But bear with me.

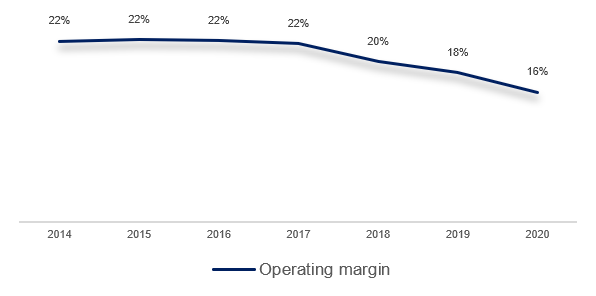

I might as well say it right away. This business isn’t particularly attractive given the low pricing power and constant margin pressure.

But there are a few things that make Card Factory stand out (that wouldn’t matter if it wasn’t so cheap). The fact that it’s vertically integrated gives it a competitive advantage over its peers. It has its own design studio, a printing facility currently producing over 210 million cards per year, a distribution center, and over 1000 stores spread across the UK. It reminds me a little bit of Zara. The company has high visibility into what the customers want and quickly adapts to the current trends.

But isn’t retail dying? Yes, some of it is dying. But not all.

Industry

There is a deeply entrenched culture of sending greeting cards in the UK, with approximately 76% of adults purchasing cards and sending an average of 20 cards per year. Whaaatt??? People are still sending greeting cards in the twenty-first century?

When I first heard about Card Factory, I immediately sent text messages to a few friends living in the UK to make sure that it was true. And it is. One of those friends, Orlando, is a subscriber, and I should thank him for the help.

They tell me that everyone sends cards, especially when there are kids involved. My friends, being Portuguese, and not sharing the same traditions, say that they get to feel bad for not sending the damn cards.

The UK greeting card market is a stable one, and it’s very little affected by economic swings. Most cards sell for pennies so it’s not as if people will stop offering them to save money.

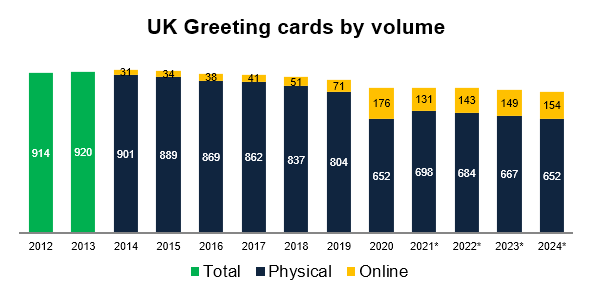

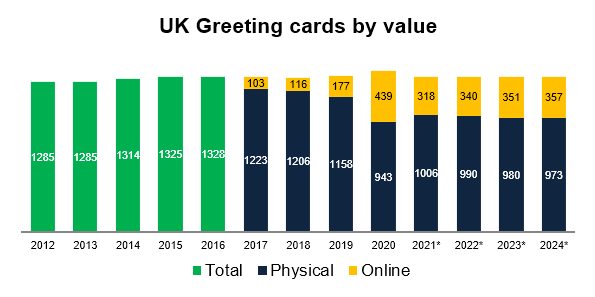

Although the overall volumes have been decreasing by about -2% historically…

…by value, they’ve remained quite stable. And the management expects this to continue going forward.

This happens because of the higher average price per unit in retail stores and the shift to the online channel, where the cards sell for about double the average price.

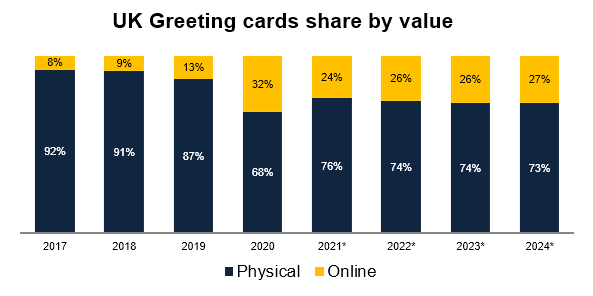

Up until 2019, the online penetration had been slow to catch up with the brick-and-mortar stores. But in 2020, they’ve experienced a big jump.

It’s hard to accurately predict what the share split will be going forward, but the company expects it to stabilize at around 27%.

Sales Channels

BRICK AND MORTAR

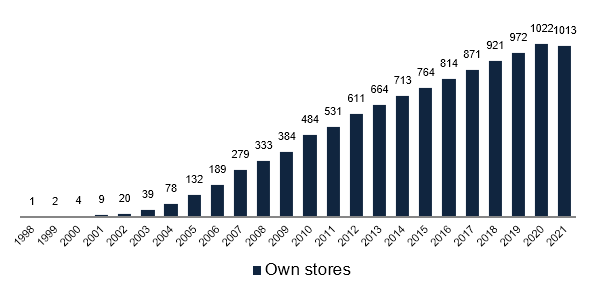

With 1013 stores across the UK and Ireland, Card Factory is, by far, the largest player in the brick and mortar channel. The plan is to get to 1100 by 2024.

There’s a range of competitors; the discounters such as Poundland and Home Bargains, there’s the supermarkets such as Tesco and Lidl, and there’s the specialist card chains such as Clintons and PaperChase, both of which filed for bankruptcy recently.

There’s 2 major factors that influence the success of this business: Price and Variety.

Clintons has the variety, but it’s too expensive. The discounters are cheap, but they don’t offer the breath of cards that the specialists do. The supermarkets and convenience stores are in the middle.

That puts Card Factory in a great place. Due to its vertical integration, it’s both cheap and it offers a wide range of gift cards.

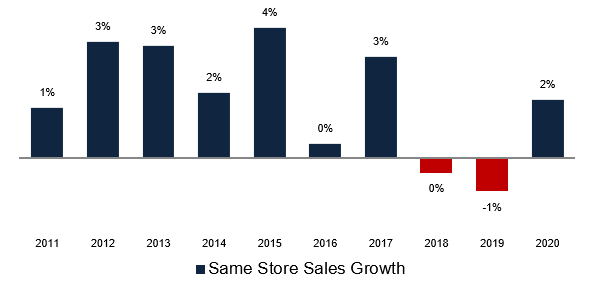

That has translated into positive Same-Store-Sales growth in most of the recent years. With the filing for bankruptcy from both competitors, there should be some benefit to Card Factory’s stores.

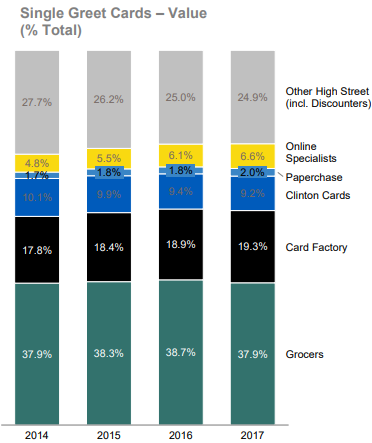

The chart below is a bit outdated, but it serves its purpose of illustrating the different market share of the different competitors. The company has been increasing its market share from 19.3% in 2017 to 24% in 2020, and it expects to get to 31% in 2024.

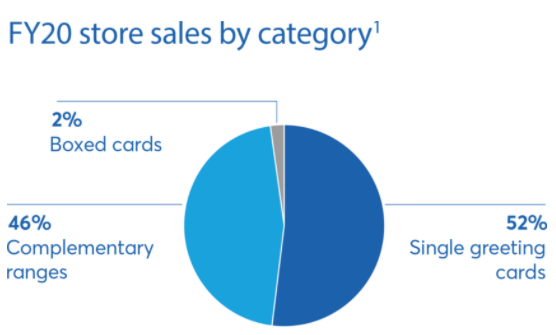

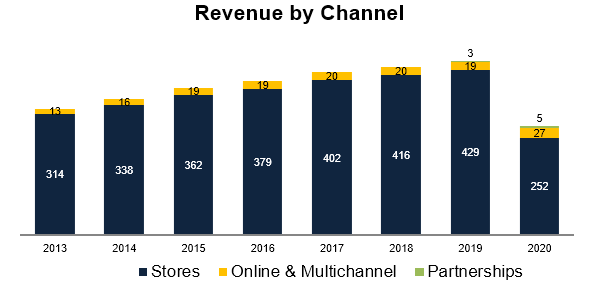

So far, 95% of all revenue has come from the stores.

ONLINE

But that is likely to change (slowly). The company has consistently been screwing things up in the online channel.

The online peers are much more focused on the personalized gift cards than on the “regular”cards. In stores, the personalized gift cards make up just 10% of sales versus 65% on the online channel.

Back in 2012, the company acquired gettingpersonal.co.uk in an attempt to go after the online personalized market, but that turned out to be huge flop. In 2020 the company decided to collapse the gettingpersonal operations into the cardfactory.co.uk website and close its headquarters.

In 2020 the company has also launched its new website and app to go against the clear online leader, MoonPig. Great name, by the way.

MoonPig has a 60% online market share (down from 90% a few years ago). It spends big bucks on advertising (as every other online business). CARD’s management has mentioned that they won’t go that route, they will take advantage of their 1000+ stores to drive cross selling opportunities like click-and-collect-in-store. Several retailers have been successful in this model; Banknote which I recently wrote about, does it brilliantly driving up the sales of the scratch cards in physical locations. Let’s see if Card Factory gets it right this time.

Right now, the revenue from the online business has been going up dramatically, from £19 million in 2019 to around £27 million in 2020. The management is guiding for £60 million in revenue in 2024 with a contribution margin of around 16%. I’m suspicious of such growth…

PARTNERSHIPS

The company still has a third sales channel that is about to grow even larger, the partnerships with large retailers in the UK and overseas. The first one was with The Reject Shop in Australia.

By partnering with these retailers with large footprints, the company is, not only expanding its revenue, but also using the full capacity of its manufacturing facility, with very little need for capital expenditures. The company just needs to ship the racks (once) and the cards every time there is an order.

The greetings card market in the US is around £4 Billion, Australia is £400M, Canada £300M, and New Zealand £50M.

The management has identified these 4 countries as markets where it intends to establish partnerships. It aims for a 10% market share.

That would dramatically increase its current revenue, but it will take many years to achieve, if it can be achieved. Right now, the revenue coming from the partnerships with Australia and Aldi in the UK is just £5M, which is roughly 2% of the total revenue figure.

The guidance is for the revenue coming from the partnerships to reach $75M in 2024 with a contribution margin of 20% (lower gross margin, but no operating costs). Again, lofty goals.

Financials

Up until 2020, the overall revenue had been growing at 5.5% since the IPO. On a stable market, this means that the company has been able to gain market share over its competitors.

Obviously, for a company with 1013 stores, 2020 was a train wreck. The fact that its stores were closed in the most important dates for such a business (Father’s day, Christmas, etc) really hurt its sales. It didn’t help that its online platform was so sh*tty too.

As mentioned above. the company has been seeing several cost headwinds such as the minimum wage pressure and a weaker Pound. In a business where customers expect the cards to be priced in the pennies, not the pounds, it’s hard to raise prices.

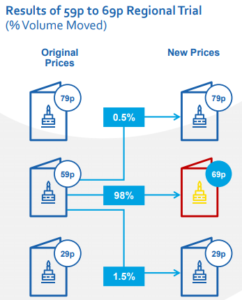

But the company is starting to do it nonetheless. It sells cards in several price ranges. After years of not touching its prices, in 2020, the management has been testing which ones it can mess with without loosing its clients. It seems that they’ve been successful in increasing its 59p cards to 69p without major disruptions. This alone will bring in an additional £6 million in revenue.

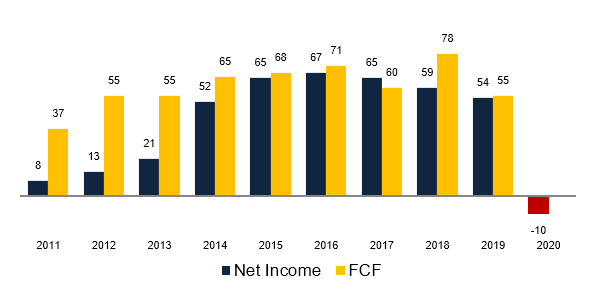

Historically, the company has been highly cash generative. Of course, in 2020 things didn’t go according to plan, and that’s exactly why the stock is so cheap.

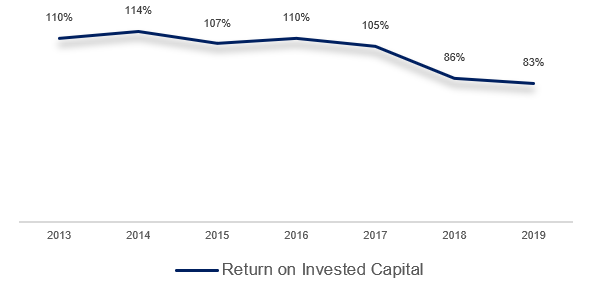

Apart from 2020, the returns on investment are amazing. Yes, they’re going in the wrong direction for the reasons I’ve just explained, but still, 83% return on investment? Damn!

Balance Sheet

This is the tricky part and the reason why the share price is so depressed. The UK, like many other countries, has been in intermittent lock down for the past year. With such a high dependency on foot traffic and with such a small online operation, each day that the stores are closed is a day closer to bankruptcy.

The company has issued a series of liquidity updates recently, which has helped investors assess its liquidity position going forward and I am currently performing a liquidity analysis to find out how likely it is for the company to raise more funds, be it through the issuance of new shares or raising additional debt. I count on having it done sometime during the next week. By the way, I’m not considering that its lenders decide to call bankruptcy, they’ve been supportive so far.

Dividends

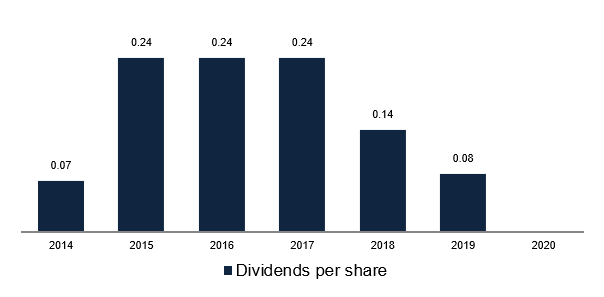

As you should know by now, I’m not a huge fan of dividends. But they play an important role in this story. The company has one of those bad policies of paying dividends regardless of the share price. Right now, the management has obviously halted the dividend, but if it were to reinstate it at the same payout ratio of 60% as before, we could be seeing dividends per share going to 15 pence per share, which at the current price would represent a dividend yield of 22%!

Risks

- Liquidity issues

- New CEO

- Lower foot traffic

Estimates and valuation

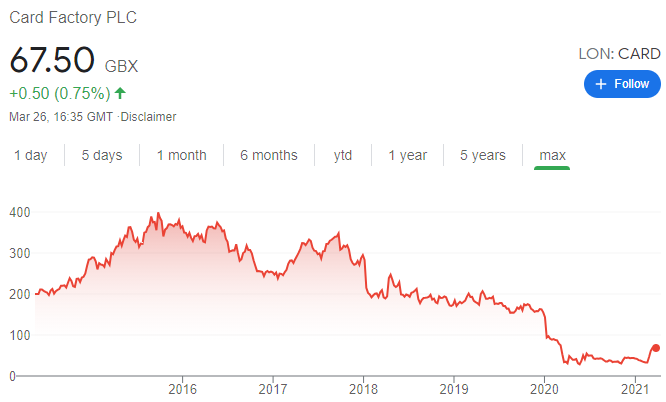

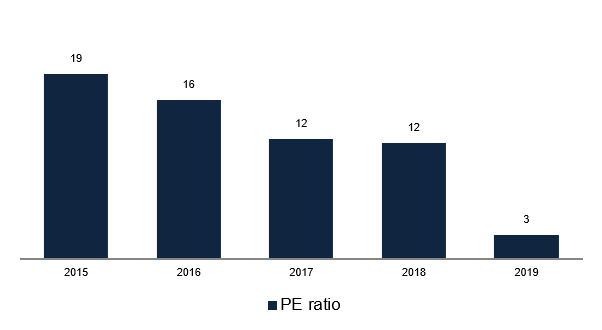

With lower profitability investors have been paying less and less for Card Factory; to the point where they were paying a PE of 3 around May of 2020. This is due to the concerns around the liquidity position I’ve just mentioned.

But we should be looking forward. After things go back to “normal”, the company should become cash generative again. And even after having doubled in price recently, I believe it could “easily” do it again.

If things turn out as I expect them to, the current price is just too low and must go up. At the current Market Cap of £230 Million the company is trading for 5 times 2022 profits. This is obviously too low. I believe that Mr. Market would conservatively ascribe it a multiple of 8 or 10 times.

Just as a sanity check, Mr. Market is ascribing a PE ratio of 20x to MoonPig. If the online business is successful, Card could be seeing its multiple go up even higher than 10x.

Como sanity check, pegar no q o Multichannel director comentou aos 53min do online representar 10% e PBT de 10M, o que seria uma margem de 17% e diz que seria in line com as lojas. Eu das lojas tenho um bocadinho mais. Ele tb diz q as vendas seriam de 600 e eu estou a por um bocadinho mais.

Comparação com MoonPig.

I think you will find it is a bit of both. Card Factory and Moonpig both have 340m shares in issue and 150m GBP of debt which makes a direct comparison easy. Card shares closed at 61.5p whilst Moonpig closed at 414p. On an EV basis, Card is worth 360m to Moonpig’s 1550m. Pre pandemic Card had four years of ebitda between 80-100m, taking the latest figure, 80m, it trades on a pandemic look through ebitda multiple of 4.5x. Meanwhile, the last ebitda for Moonpig was 44.4m GBP (April 20), it may hit 80m this year but I expect it to settle back to say 65m after Covid. That is an ebitda multiple of 23.8x. CF online offer is currently less good than Moonpig but has more growth potential as a result. Which would you rather buy?

Conclusion

I’m obviously interested in Card Factory, but any estimates are worthless if the company needs to raise equity. That’s why I’m deferring my conclusion to a later date (hopefully next week) when I can be more certain of the quality of my assumptions, the liquidity position, and the possible outcomes.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Não vê os bancos a registar uma imparidade, mas os concorrentes entraram em insolvência.

The new stores aren’t as profitable as the existing ones, but they still have high ROIC’s. Payback is under 24 months. Low Capex, quick payback, highly profitable.

Ouvir aos 33min do capital markets as contas dele.

Average lease foi reduzido para 2.5 years.

9M savings on rents/leases in FY20 and they’re guiding for more.