Enwave

a fundamental analysis!

September, 13 2019

TICKER: ENW

ISIN: CA29410K1084

SHARE PRICE: $2,27 CAD

MARKET CAP: $241M CAD

September, 13 2019

TICKER: ENW

ISIN: CA29410K1084

SHARE PRICE: $2,27 CAD

MARKET CAP: $241M CAD

1. INTRODUCTION

There is a Cannabis farm 30Km away from my parents house. It is a subsidiary of the Canadian Tilray and it recently bought a new machine for drying its weed. Guess who makes that machine? You’ve got it. Enwave!

Once again, I’ve got to thank the person who brought this one to my attention. I would like to ask a round of applause for John Gay. I would also like to thank Zach Trease, who is an active member of our Facebook group, for helping me out too.

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

Enwave has developed a dehydration technology called Radiant Energy Vacuum (REV). In short, it’s an autoclave that drys food, plants and hopefully pharmaceutical drugs using microwaves in a vacuum.

Typically there are three processes for dehydrating food: air drying, spray drying, freeze drying, but all of these lead to a loss of nutrients which doesn’t happen with REV technology. REV is also faster and more economical than the other drying methods.

Enwave has a peculiar business model. It earns money in four different ways:

- Renting machines for development purposes

- Selling machines to its clients

- Royalty agreements with those same clients that bought the machines so it gets a small part of their revenue

- Nutradried, a wholly owned subsidiary that sells Moon Cheese snacks

Why do its clients pay the royalty? To secure the exclusive rights of usage of REV technology in a defined territory to produce a specific product. I find this selling and royalty model pretty ingenious. It allows for a lower upfront capital investment for Enwave’s clients and a constant revenue stream for the company.

During an interview, the CEO said that, in the future, they want to pay for the whole operation with the revenue coming from the royalty fees while returning extra cash to shareholders through dividends.

EnWave’s dehydration technology has been in use for multiple market verticals, including fruits and vegetables, cheese products, yogurt products, meat products, pharmaceuticals and cannabis products.

The image below shows us a new machine that Enwave is developing together with the French frozen foods giant Bonduelle.

2.2. LARGEST SHAREHOLDERS

Aurora Cannabis is the largest shareholder with 4,5% of the company and there are some members of the management team holding small stakes as well.

2.3. MANAGEMENT TEAM

Brent Charleton who was previously Vice-President was appointed President and CEO in August 2018 when the founder and second largest shareholder, Dr. Durance, stepped down as a CEO.

The current CEO doesn’t have considerable skin in the game which is something I always look for, but at least Budreski, the Chairman, does.

Their total compensation increased by a lot in 2018 especially because of the variable compensation. The CEO’s total compensation was $729K equaling 3,2% of the company’s revenue which I think is still ok but the jump from $270K was big. Ok, he wasn’t the CEO back then and now he is so he deserves a higher pay-grade but even so…

Skipping through the Circular form I was hoping to find quantifiable parameters for the attribution of such bonuses but I’ve learned that the Independence Committee – which is composed of three directors – holds all the cards and those parameters are mostly subjective to their opinion of the management’s performance.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

The share price has had its ups and downs – especially in 2011 when it reached its all time high – and is now at $2,23.

3.2. MARKET CAP AND SHARES OUTSTANDING

This means that the company is currently valued at $241M. From the end of 2018 until now, it has practically doubled!!! Zach beat me to it. Congrats to Zach and to all the other investors who saw it coming. Let’s see if this can go any higher…

Note: All currency in CAD unless stated otherwise.

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

The revenue has been growing year after year for the past five years and its expected to surpass the $40M mark this year. It will take a stratosferic fourth quarter to achieve that goal.

Unfortunately the company hasn’t turned a profit yet although it seems to be on the brink of it.

In fact, the CEO as alluded several times to the goal of reaching profitability this year. I’m not sure if that will happen but it would be very good if it did.

3.4. SALES BY GEOGRAPHY

The sales from the USA are in hyper growth mode mostly due to NutriDried, the wholly owned subsidiary that makes the Moon Cheese.

3.5. SALES BY SEGMENT

And if we look at the segmented revenue we can see that the largest part of it comes from the “Product Sales”, which mean Moon Cheese.

It’s rather curious that a company that makes “drying machines” earns its money from snacks.

And due to the Most Valuable Member campaign at Costco, I bet that the Moon Cheese sales will skyrocket in the fourth quarter (Enwave’s fiscal year ends in September). I would love to have the costs broken down by segment but unfortunately the company doesn’t disclose such figures.

The revenue coming from the Royalties and licensing is still minor but in time it’s expected to grow as the company deploys its machines around the world.

And because we’ve been talking about the Moon Cheese from the beginning of this write-up, here it is. There’s cheddar, gouda and pepper jack.

On a more technical note, the company follows a “percentage-of-completion” method to recognize revenue from the manufacturing of the machines. This means that the management team is responsible for estimating the stage of completion of each machine and consequently the revenue and costs it reports in each period. Needless to say that a lot of the accounting frauds we see these days happen in companies following the percentage-of-completion method.

3.6. NET INCOME

As expected after seeing the operating income, the company still hasn’t turned a profit.

3.7. CASH FLOWS

And the cash flow isn’t that great either. it generated cash for the first time in 2018. I expect this picture to drastically improve in the coming quarters.

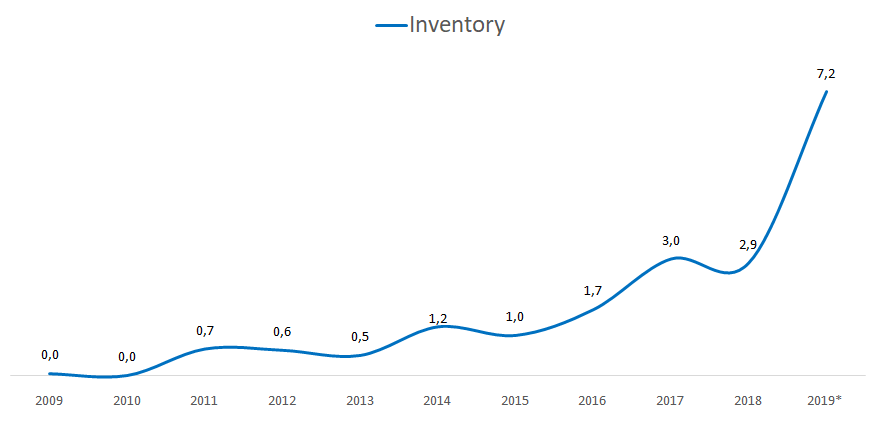

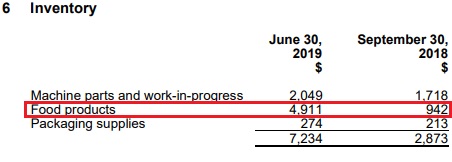

While looking at the Cash Flow Statement I’ve noticed the huge increase in inventory. This is attributable to the Most Valuable Member program over at Costco.

Almost $5M of the $7M in inventory is food products. I don’t know what the margins are on the cheese but let’s say that the gross margin is 35% and that they can sell $4M worth of inventory in the next quarter. That would amount to $6M. Not enough to reach the $41M mark in revenue for the full year.

3.8. DIVIDEND

The company doesn’t pay a dividend.

3.9. PROFITABILITY RATIOS

Unfortunately, because the company isn’t profitable yet, these ratios can’t be calculated.

3.10. BALANCE SHEET RATIOS

The balance sheet on the other hand is very healthy. The company has no debt whatsoever and the current ratio is 3,7. In fact, the company has a cash position of $22M which is always good in a micro-cap.

3.11. PRICE RATIOS

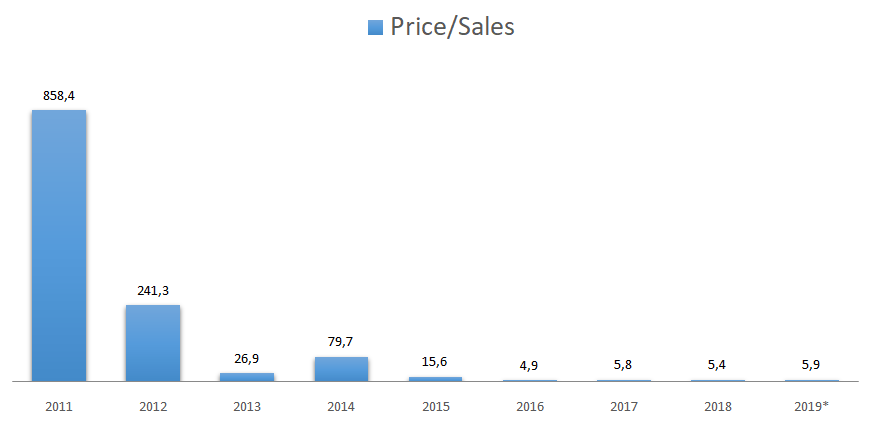

This is where it gets tricky. There is no PE ratio, no P/FCF ratio and not even a EV/EBIT ratio. We can only look at the Price/Sales ratio and even this one, at 6x is telling us that Mr. Market is really confident about Enwave.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

After looking at all these financial data, we can say that we’re facing a story stock. I don’t mean this in a bad way, no. I mean that the company is still at a pre-profitability stage and we have to go deeper in order to ascertain if it will soon turn a profit that justifies its current valuation or not.

In order to do that, we’ll need to dismember the business and understand each one of its segments.

The company is working on the following verticals:

- Packaged food

- Cannabis

- Army supply

- Pharmaceutical

Food:

Enwave has entered into royalty-bearing license agreements with 29 food, cannabis and pharmaceutical companies so far.

Most of these agreements are in the food space with Enwave granting exclusive rights around the globe. Just recently it revised its agreement with Bonduelle.

Together they are developing a new technology for freezed food which is called FreezeRev. Long story short, Bonduelle was using this technology for its B2B clients but the success was so big that it is now expanding it to its retail operations. Bonduelle lost its global exclusivity for this technology but it negotiated the exclusivity for the US territory. To secure this territory it must place an order for a 400Kw machine before the 30th of September. Tick Tack…

It seems that this machine alone could spit out $1,5M in royalty payments every year!

Nutradried:

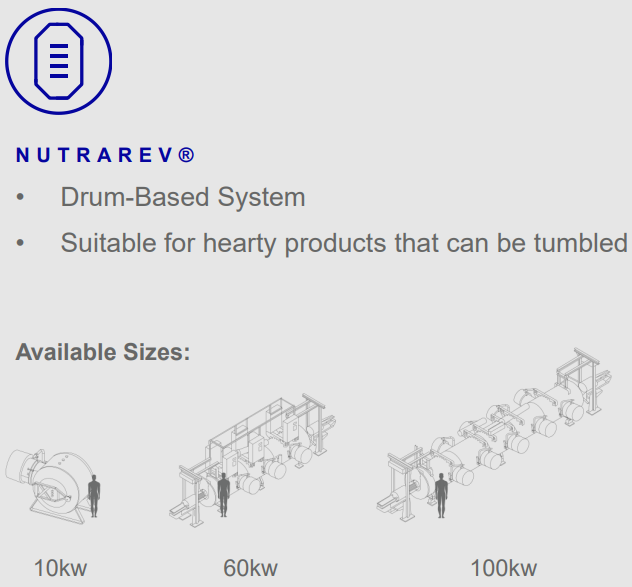

The wholly owned subsidiary uses two 100Kw machines and two 10Kw machines. It produces the Moon Cheese which is sold in 25.000 different locations across Canada and the USA.

Although the 5% royalties paid to the parent company of by Nutradried are eliminated from the consolidated financial statements, they can help us understand how much money the company can earn from royalties.

These are the royalty fees Nutradried has paid to Enwave. In 2018 they only had one 100Kw machine but starting September 2018 they’ve started talking about a new one. Recently the company has said that it is operating two 100Kw and two 10Kw machines so it’s not clear when they were working with which material but we could say that each 100Kw can produce up to $500K in royalties.

Cannabis:

Enwave’s technology allows the cannabis producers to dry their buds in less than one hour while it takes several days to do it through a traditional method of air drying in humidity controlled rooms.

Add to this the fact that the footprint of Enwave’s machine is far smaller than the traditional rooms needed to air dry the weed. All of this while preserving 100% of both the THC and the CBD which are the weed’s active ingredients.

The company is hoping for its technology to become the gold standard in weed drying. Unfortunately it seems that this technology still isn’t good enough to preserve the Terpenes (aka the aromatics) of the weed, so for now it is used only in the extraction methods.

The CEO has said that their technology can capture these Terpenes and it could develop a technology to “put them back” into the plant but this process hasn’t been authorized by the Canadian regulators yet and it isn’t clear if it will ever be.

In 2017 the company struck a deal with Tilray, one of the world’s leading companies in the Cannabis space which gave Tilray the exclusive rights to use the REV technology in Canada and Portugal. Tilray has bought one 10Kw for developing purposes and two 60Kw machines for commercial use purposes.

Earlier this year, the company has entered into an agreement with Aurora Cannabis, one of the world’s largest cannabis producer, where Aurora was granted non-exclusive rights to use REV technology in Canada. Following this agreement, Aurora bought two 160Kw machines and one 10Kw machine.

Enwave also granted Aurora an exclusive license to use the REV technology in Europe (excluding Portugal where Tilray is working). This agreement requires Aurora to buy an additional 160Kw machine for its European facilities as well as future undisclosed minimal equipment purchases and annual minimum royalties.

One month after these negotiations, Aurora signed another exclusivity agreement for South America (excluding Peru) with similar terms.

Add to all this the fact that Aurora recently invested in Enwave through a stock swap. Immediately after the swap, Enwave sold its shares in Aurora for $10M.

The CEO has said that they could earn a 1¢ to 2¢ per gram royalty on the cannabis dried with its machines. Aurora cannabis’ capacity alone is around 625 ton per year so that could account for $6M to $12M royalty fees per year which would all go to the bottom line.

This is the company’s current fabrication and commissioned pipeline of machines:

Army:

After three years working with the US army, they’ve just struck a deal for two 10Kw machines so the US army can develop better rations. Enwave will be making money through the US Army supply chain. The US Army will develop the rations and then its suppliers will have to fulfill their contracts by getting their own machines or rent them from Enwave. It seems that the company is already talking to these suppliers.

Pharmaceutical:

About two years ago, the company has struck an R&D agreement with the pharmaceutical giant Merck to develop several products. They are making progresses but due to the highly regulated environment, this vertical might take a while to show any profit.

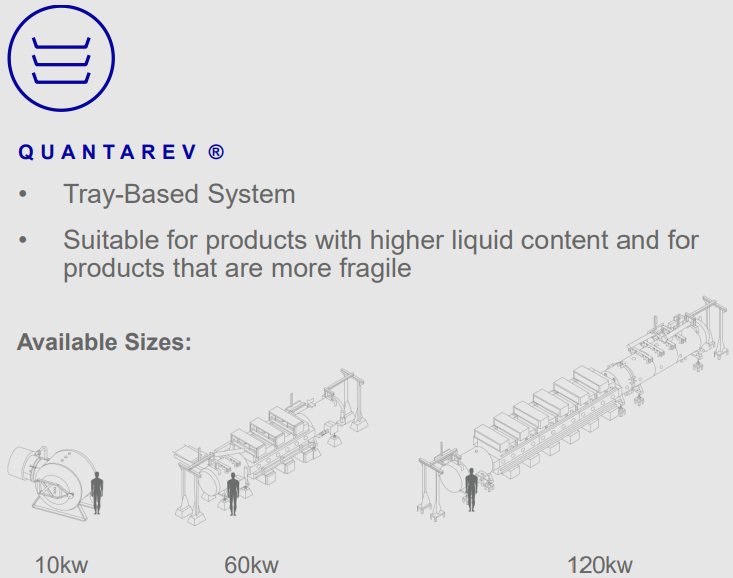

Since we’ve been talking about these machines and their power, I thought it would be good to post the different machines Enwave manufactures.

4.2. SEASONALITY

I’m not aware of any seasonality in the machine selling business but there might be seasonality related to the cheese snacks business.

4.3. TYPE OF PLAY

Enwave is a growth play.

4.4. RISKS AND COMPETITION

Most of the potential risks I see associated with Enwave’s business are similar to other product based companies.

- Like in any other patented based business, there is the risk of patent challenging.

- Customer concentration risk. 50% of the Nutradried sales comes from Costco.

- Because the company makes business in several currencies (CAD, USD and EUR), the foreign exchange rates are always a risk.

- The risk of a better mousetrap coming into the market.

- The risk of techincal failure, of course.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

If we were to look at the quantitative side of it alone, we would probably discard this company immediately. This is a story stock. Our role as investors is to discern if the future will be a continuation of the past, an evolution of the past or a break with the past.

I don’t doubt for a minute that this technology could become the standard technology for a lot of industries but I must be honest, I would like to see the insiders buying shares right now. Instead, they are promptly selling the shares that they earn as variable compensation.

Even so, let’s say that Enwave’s machines would be used to process all of the Aurora’s production capacity, wich as we’ve seen previously, could be around $10M per year. Let’s also say that all of the operating costs would be paid for by other machines and this one would be – after taxes – virtually all profit.

Disregarding the company’s NOL’s (net operating losses) that could offset the payment of taxes, at a 27% tax rate, those $10M would lead to a profit of $7,7M. At a multiple of 20x (which for a rapidly growing company like Enwave is perfectly acceptable) the market capitalization would be $154M .

Let’s say that Moon Cheese could get a 10% net margin and that they can sell $30M each year going forward. That would amount to another $3M which at the same 20x valuation would go for $60M. We’re already at a $214M market capitalization without factoring in all of the other customers, so at a Market Cap of $241M, the downside seems to be somewhat limited.

At the start of this write-up I’ve said that we would try to figure out if this stock could go any higher. I don’t doubt for a minute that this company can become huge in the future, especially when the royalties from all of these clients start coming in but I can’t make a decision without a better understanding of the competition, the kind of margins each of the segments can achieve and something I haven’t commented until now which is the type of agreement the company has with the owner of the patent which I think is the University of British Columbia.

I’ll continue my research on this one and I’ll come back to it soon.

In the meantime, you can join our community at our:

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431