The wonderful world of the

Financial Statements

for beginners

By Manuel Maurício

October 11, 2020

When I was at the beginning of my investment apprenticeship, I made a lot of mistakes; especially because I was flying blind. I had no one mentoring me on what I should or shouldn’t be learning at that particular stage. This led to a lot of time wasted learning about things I still couldn’t understand because I lacked the basic knowledge. (Not to mention the amount of money that flew from my pocket right to the pockets of more seasoned investors.)

That’s the reason why I’ve decided to write a series of articles on fundamental analysis for those who are new to investing in stocks. I was about to post this as a subscribers-only series, but I figured more people could use the help.

Behind every stock there is a business. And businesses speak their own language, accounting! Yes, I know. I used to think that accounting wasn’t for me either. But at some point in my life, that feeling went from “boriiing” to “WOW, I can make lots of money if only I can understand this“. And that’s how my love for valuing businesses begun.

Before you start to think that I’m a nerd, let me tell you that we as investors don’t need to understand the financial statements as deep as if we were accountants or investment bankers. No sir. We just need to understand the financial statements from a user’s point of view. This makes it a lot easier. Not to mention the fact that when we start to really understand the financials, it’s amazing to read the businesses. It’s like a treasure hunt.

This series of articles on how to read financial statements isn’t an extensive course, it’s just a way of helping novice investors jump-start their investment journey. If you’re interested in learning more about fundamental analysis, you can pre-register to my Fundamental Analysis Course HERE.

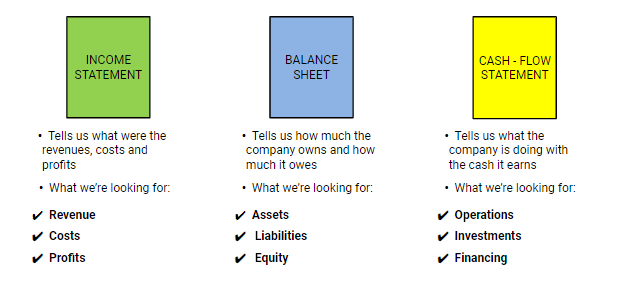

Every publicly traded company (the ones that are traded on the stock market) will release 3 different financial statements: The Income Statement, the Balance Sheet and the Cash Flow Statement.

In the following articles, I’ll be writing about each one of these statements individually, but before we get into the weeds, here’s a brief explanation:

INCOME STATEMENT

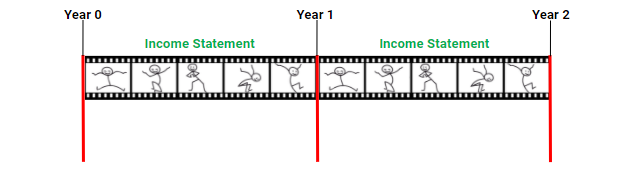

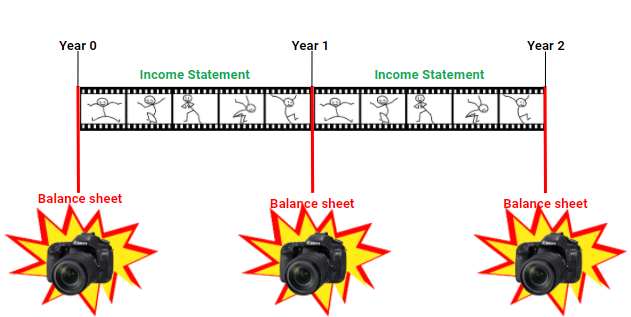

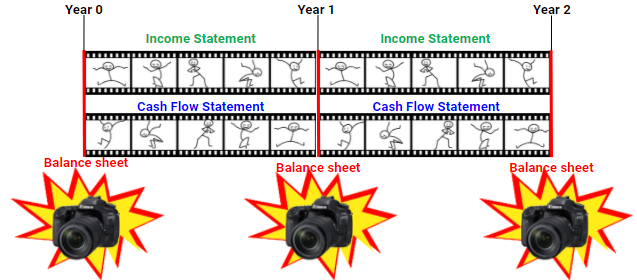

The Income Statement is where you’ll find how much profit the company is making. In it, the company will record how much of a product or a service it has sold (the Revenue, or Top Line), what it cost to get that revenue and what was the profit achieved during a period of time. Notice that I wrote “during a period of time“. The Income Statement tells a story that unfolded over 1 quarter, 1 semester or 1 year. It’s like a movie.

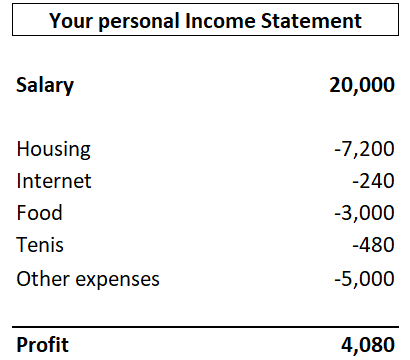

In order for you to understand this better, let’s say that you wanted to make your own personal Income Statement for the last year. You would write down every Euro (or whatever other currency) that you’ve earned and every Euro that you’ve spent.

You would start by writing down your salary (equivalent to the revenue, for a company), then you would write down your rent expense or the interest on the mortgage. You would also write down the internet connection monthly fee, your tennis club membership and any other costs and expenses. In the end, after subtracting all the costs from your salary, what you would be left with would be your Profit (also called Net Income or Earnings). That would be your Income Statement. Easy, right?

A company will do the same. Of course, when we’re talking about companies, it might get a bit more complicated, but if we learn the important stuff we’ll be way ahead of most investors out there.

Remember, that on the Income Statement, only the costs associated with the sales on that period will be recorded. If a company buys, let’s say a new factory which isn’t running yet, it won’t show that cash outlay because it hasn’t helped generate revenue yet (hint: that cost will go to the Cash Flow Statement).

BALANCE SHEET

The Balance Sheet is where the company states how much it’s worth. Unlike the Income Statement that tells a story over a period of time, the Balance Sheet is more like a photograph of a given moment (typically the last day of the quarter, semester or year). The Balance Sheet is where the company records what it owns and what it owes. Said in another way, its assets and liabilities.

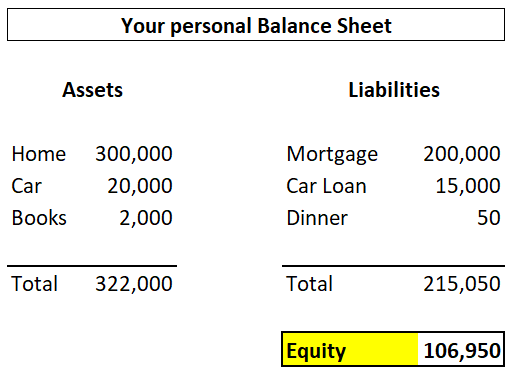

If you were to write your own Balance Sheet you’d write down everything that you own on one side, your house, car, furniture, phone, cash, etc; and everything that you owe on the other side, your car loan, the dinner you still owe to that friend, your credit card debt, and all else that you might owe someone. The difference between what you own and what you owe is your net worth, your equity.

In the case above, you would be worth €106,950. Similarly, when a company states its Balance Sheet, it will state its assets on one side (factories, equipment, inventory, receivables, cash…) and its liabilities on the other side (bank debt, bonds, customer debt…). The difference will be the shareholder’s equity.

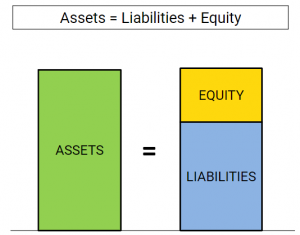

The two sides of the Balance Sheet have to balance, always (forget this you must not, my young Padawan). That’s why the equity is on the Liabilities side. If you add all the liabilities and the equity, you will get to an amount equivalent to the assets. The equity is a form of liability because it belongs to the shareholders, not the company.

CASH FLOW STATEMENT

The third financial statement is the Cash Flow Statement. This statement was created much later than the other two. The financial world (accountants, investors, regulators) felt that there was the need for more information that wasn’t stated on the Income Statement or the Balance Sheet. Similar to the Income Statement, the Cash Flow Statement is like a movie, it tells a story that unfolded over a period of time.

To better understand the Cash Flow Statement, let’s picture a scenario where you own a wine shop and you supply a bunch of restaurants in your city. Among those restaurants there’s John’s New Pizzeria, and Lucy’s Old Pizzeria. You have known Lucy for several years and you know that she is trustworthy so you let her pay at the end of the month. But you don’t know John so you ask him for cash at the moment of the sale.

If you sell each a case of wine in Christmas, you’ll record the sale of the two boxes of wine on the Income Statement. But while John is paying you right away, you won’t be seeing Lucy’s cash until the end of January. So we’ve got a problem.

If someone were to look at your Income Statement for that year, they would be led into thinking that you were paid for those two cases of wine. Even when you weren’t.

That’s one of the shortcomings of the Income Statement and it was hard for me to understand it. Why would someone record something that didn’t happen? Well, it happened. You sold the wine. But you weren’t paid – at least not yet.

That’s why the Cash Flow Statement was created. To record the actual cash that has flowed in and out of the business.

CONCLUSION

This quick explanation is obviously an oversimplification, but if you’re new to financial statements, I believe it’s better to go slow and steady. I’ll be writing about the three financial statements in depth in future articles.

If you liked this article and you want to hear more from us, do leave your name and email address below.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.