GoPro

a fundamental analysis

By Manuel Maurício

December 17, 2021

Symbol: GPRO (NASDAQ)

Share Price: $10.53

Market Cap: $1.64 Billion

On the most recent episode of Investment for Beginners, me and Michael Wiggins de Oliveira discussed GoPro, an American company that sells action cameras to a crowd who loves outdoor activities, especially sports.

We had planned ahead for Michael to be the bull and I the bear. This is investing lingo meaning that Michael would defend the company while I would try to counter-argument.

But the truth is that while I was doing my research I actually liked what I saw so I failed miserably at my job.

By the way, the bear charges from top to bottom while the bull charges from the bottom up, hence the terminology. A bull market goes up, whereas a bear market goes down.

Yes, I know. My first reaction was also “GoPro, really? Aren’t those guys dead? Isn’t GoPro the new Kodak?”.

I thought that smartphones had killed GoPro.

It turns out, it might not be so. People don’t want to mount their smartphones onto their helmets or surfboards and risk damaging them (a screen can cost as much as a GoPro).

But let’s rewind the tape a little bit first. GoPro went public in 2014 at a Price-to-Earnings ratio of 89x and soon after it was trading at double that (!). Needless to say that growth expectations were too high and investors got burnt.

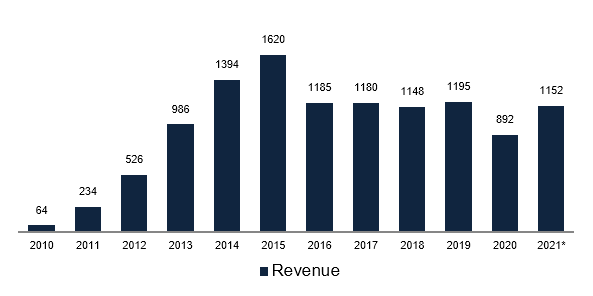

As the revenue growth stopped in 2016, investors who were extrapolating recent trends out into the future realized that GoPro wouldn’t grow to the sky. This reminds me of what we’re seeing today with some high growth stocks.

A thing that surprised me in the chart above is the fact that ever since 2016 – and excluding 2020 for obvious reasons – the company has been holding its revenue steady. Who would’ve known…

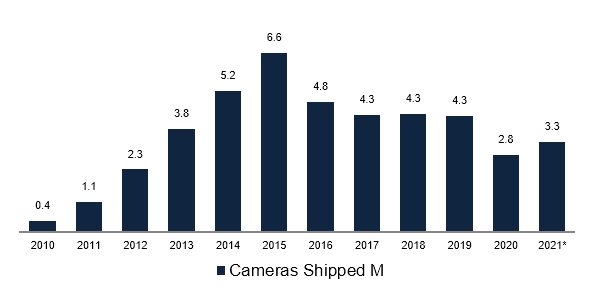

And the way these guys have done it is also interesting. Although the number of cameras sold has decreased by 30% since 2016 to the 3.3 million estimated for 2021…

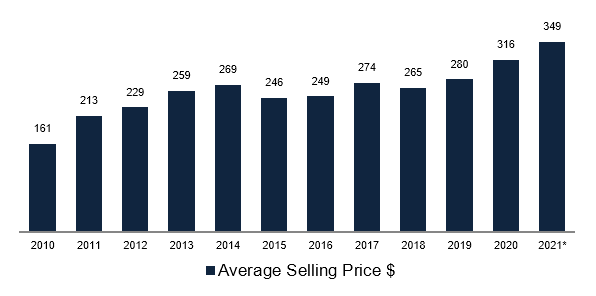

… the company has been successful in increasing the price per camera sold – especially in the last 2 to 3 years. They understood that they couldn’t compete on price with all the cheap cameras that flooded the market so they decided to go the opposite way.

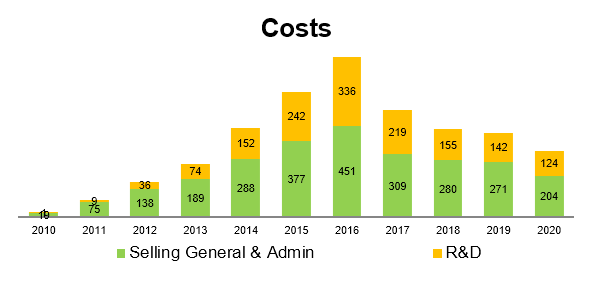

Not only that, but the management has been very competent in transitioning from a hyper growth company with the corresponding growth in costs to a rational and thoughtful cost control discipline.

And what happens when revenue stays flat and costs are cut?

Exactly.

The company becomes profitable.

I’ve got to hand it to these guys. All of these charts combined make a beautiful thing to look at (if you’re a business nerd like me). It shows great discipline and a well executed strategy.

And it doesn’t end here. Over the years, the management had its fair share of mishaps with the introduction of weak cameras and complicated price points, not to mention a drone that was a fiasco.

But it looks like they’ve finally got it.

The company’s strategy now stands on 4 different pillars:

- Going Direct-to-Consumer through the GoPro.com website.

- Selling higher priced cameras.

- Selling a subscription for unlimited cloud storage bundled with a no-questions-asked damaged camera replacement guarantee.

- Selling an app for video edition which is available to everyone, not only GoPro users.

These 4 points combined create a Lollapalooza effect that supercharges profitability:

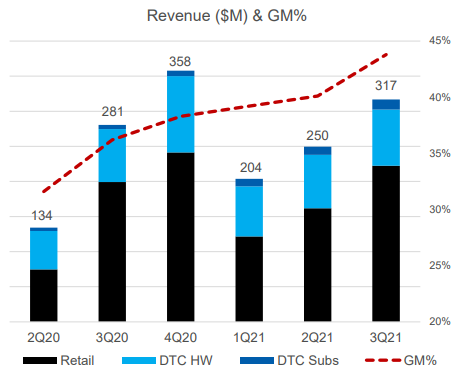

1. The shift to Direct-to-Consumer (DTC) reminds me of FitLife Brands (I wrote about it here). Without the need to pay retailers a cut of the revenue (think Amazon and Fnac), the company is able to get higher margins. Historically, the mix between retail and DTC was 90%-10%, but now it stands at 68%/32% and the company expects to be selling more than 40% through its own website in the future.

2. Higher priced cameras mean more dollars coming in (it might also mean higher margin, but that’s not always the case as the cost might go up as well).

3. Now comes the interesting part – the subscription. The problem with a consumer business like GoPro’s is the fact that the company has no control of the customer after he or she buys a camera. In retail lingo, it doesn’t own the customer. To deal with this, they’ve borrowed from Apple’s book.

GoPro now offers a free 1 year subscription for unlimited cloud storage only to the customers who buy a camera from the GoPro.com website.

As if this wasn’t enough, this option comes with a $100 discount relative to buying the camera without the subscription. It’s a no-brainer.

This bundle is important for a couple of reasons: as it drives the traffic away from the retail channels and into the company’s own shop, the company gets higher margins.

With those higher margins the company can give serious discounts and “offer” the subscription. I use quotation marks around “offer” because the company isn’t really offering the subscription, it’s selling the 1 year subscription hidden inside that $399 price.

The rationale behind offering the first year of cloud subscription is the belief that users will keep paying for storage in the ensuing years.

The more videos a user uploads to the cloud, the stickier the cloud gets. Here too the management was smart. They’ve built in a feature in the cameras that guarantees that every single video is automatically uploaded to the cloud. And with higher and higher resolution videos, the higher the need for storage space.

On top of this, users get a no-questions-asked replacement guarantee. Although at first I didn’t think much of this, I’m slowly starting to believe that it was a genius move. Someone buying a GoPro for the first time (80% of customers) will want to know that in the case they wreck it, they can simply ship it back to the factory and get a new one in return. This is used as a bait to sell the cloud subscription.

4. The most common pain point reported by GoPro owners is the time it takes to edit videos. The company listened and revamped its video editing app called Quik. It costs $9.99/year and it’s available, not only for GoPro users, but for everyone wanting to edit videos recorded with their smartphones. Right now there’s only a few hundred thousand subscribers (as compared to the 1.3 million subscribers for the cloud subscription) and I’m not sure how much traction this will gain.

So, to sum it all up, the company is raising the average price of their cameras showing some serious pricing power, it’s selling Direct-to-consumer, and with the subscription business it’s tackling the main flaw of its business which is making a sale and immediately losing contact with its customers leaving money on the table.

The subscription business is what’s getting the few GoPro bulls all excited about. But it also bears risks.

The company doesn’t reveal how many users churn out of the subscription after that first free year. The management says that the churn is low and in line with expectations, but that might mean different things for different people. I expect the churn to be high among first year users, but then, those who stick around should stick around for long.

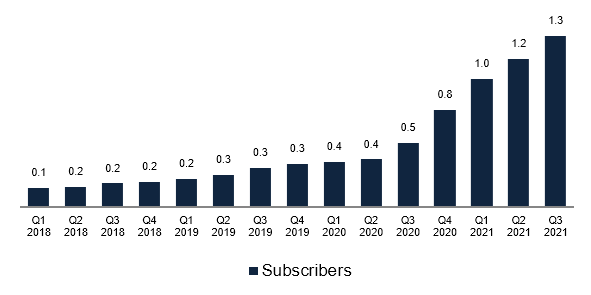

Still, the company has been able to more than double the number of subscribers each year. Even if churn is 50%, if they can keep doing it, it doesn’t matter much.

Is the stock cheap?

After years of losing money, the company is now (very) profitable. I estimate that it will be making anything between $100 and $150 million in profits in 2021.

Today, you can buy the whole company for $1.64 billion, which means that the stock is trading somewhere between 10 and 16 times earnings. Considering that profits should be going up in the coming years, that looks cheap.

What about the balance sheet?

In 2022, the company will need to settle some convertible notes in the amount of $130 million. By the end of the previous quarter, it had $296 in cash and by the end of the year, the cash pile should rise to something around $350 million so it will have no trouble fulfilling its debt obligations.

Conclusion

At a Price-to-Earnings of 10x, the valuation isn’t demanding. If the company keeps delivering, I can see this re-rating to a 15 or 20x multiple, especially so if the subscription is a success. Subscription businesses these days sell for hefty valuations.

And if the company is able to successfully enter new verticals like bodycams, dashcams, and home monitor surveillance – all of which should go nicely with the subscription business – investors in GoPro might be well rewarded.

But I’m not sold yet. This is still a camera business. Things that would make me change my mind would include share buybacks, the management aggressively buying shares, low churn rates, or successful new products.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.