Lee Enterprises

might be very cheap!

By Manuel Maurício

January 21, 2022

Symbol: LEE (NASDAQ)

Share Price: $36.66

Market Cap: $212 Million

Last week, on the Glacier Media satisfaction survey, one of the subscribers wrote that I should be looking into Lee Enterprises. I had read something about it before and I knew Kuppy was a major shareholder so I decided to follow the advice.

Lee Enterprises owns more than 80 local newspapers and a few other digital publications. As with Glacier Media, Lee is slowly going from a print business to a digital business. This brings a whole bunch of advantages as the digital business requires much less capital (no prints and no plants), and the distribution costs are virtually zero. After the fixed costs are covered, every new dollar in revenue is virtually pure profit.

Not long ago, newspapers would charge you for the print edition and let you access their websites for free. They slowly understood that, as the print revenue declined, the advertising dollars weren’t high enough so they put paywalls on their websites and began charging subscription fees. But this took time.

Due to this inability to quickly adapt, newsroom budgets have been slashed and the result of this is that the news you get today are mostly commoditized (you’ll find the same news in all of the national news media outlets). Investigative or differentiated journalism isn’t dead, but there’s much less of it today.

However, that doesn’t happen for local news media. There’s nowhere else you can find news about what’s happening in your local community, be it a new school that is being planned, or the views of the new Mayor regarding immigration.

As a local news business, Lee is in an enviable position if it can transition successfully to digital.

That’s what Kuppy is counting on. After a low ball offer for the entire business by Alden Global Capital at $24 per share, Kuppy filed a letter to the board of directors telling them how dissatisfied he was that they were actually considering it. He believes that the company is worth $100 per share.

So is it? Let’s take a look.

The big picture

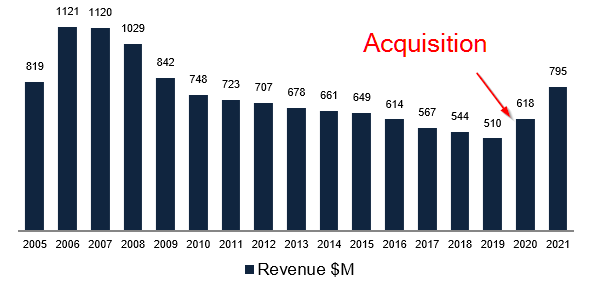

When one looks at Lee’s revenue history, one might be fooled into thinking that after years of underperformance, things are finally changing. And they might be. But it’s not the revenue chart that will tell us that.

What we’re seeing in 2020 and 2021 is not the business coming back to life. It’s the result of Lee buying all of the media businesses from ol’ Warren Buffett.

Lee had been managing the businesses for Berkshire for a few years and at some point Warren wanted out so he sold to Lee.

Why has Buffett sold if the business can be turned around by shifting to digital?

To shift from a traditional media company to a digital media company you have to fire a lot of people. Buffett has been through that before and he sure doesn’t need the headaches and the taint in his reputation at this point in his life.

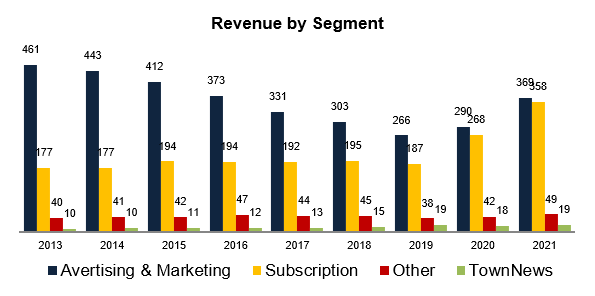

If we add some granularity to the chart above we see that it’s not only the advertising business that is growing, but also the subscription business.

Now, there’s a perceived notion that those people who paid for local news are old and don’t read news online – or at least they won’t pay for a digital subscription. I tend to think that way, but I admit that I might be wrong.

What the chart above tells us is that, from 2020 onward, not only has the advertising business gone up, but the subscription business has too and it looks like it might become an even larger contributor to total revenue than advertising.

This is good as subscription revenue should be stickier than advertising dollars in a recession.

But I don’t know how much of this recent growth has been fruit of the pandemic, the acquisition, or of higher interest in local online news. I get the feeling that all three might be true.

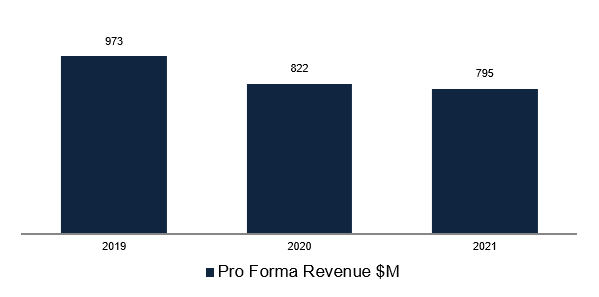

If we instead look at the pro forma revenue (as if the acquisition had been closed at the beginning of 2019), we see that things aren’t that good with revenue declining in each year.

Although informative, the information in the chart above is insufficient and I would like to see it going back a few more years. It looks like the revenue decline has slowed in 2021. Could Lee be at the inflection point where the revenue growth coming from digital is more than enough to offset the revenue decline coming from print?

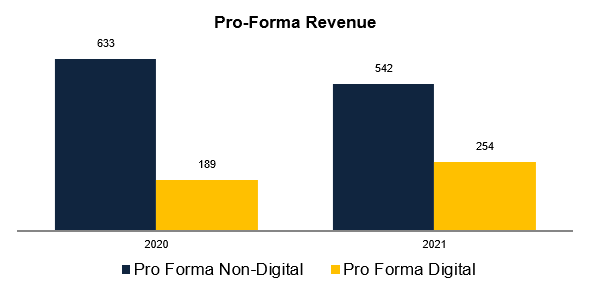

Well, in 2021, the non-digital revenue declined by $91 million whereas the digital revenue went up by $64 million. Close, but not yet.

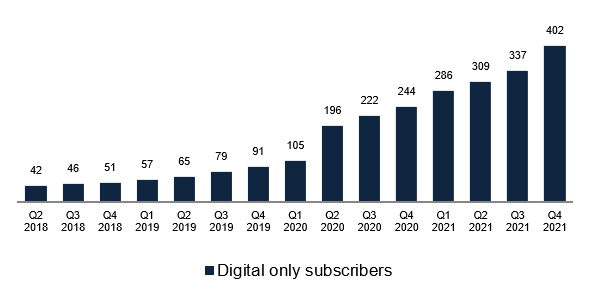

Another argument in favor of the “We’re at an inflection point and growth is here to stay” side of the argument is the growth in the number of digital subscribers. As the lockdowns ease, people shouldn’t be buying so many online newspapers.

But that line of thought doesn’t seem to hold true as the number of digital subscribers has been growing in every single quarter.

Now, I believe it’s because the company has been lowering its paywall fees to attract new subscribers. The management is still tinkering with all the data they are gathering, lowering the price for some subscribers, raising it to others.

In theory, Lee should be convincing subscribers of its print newspapers to migrate to digital. This would mean a cannibalization of its own business, but I’m not sure that is happening. The management mentions that 80% of its digital subscribers didn’t have a print subscription in the past 6 months prior to subscribing to digital. Interesting.

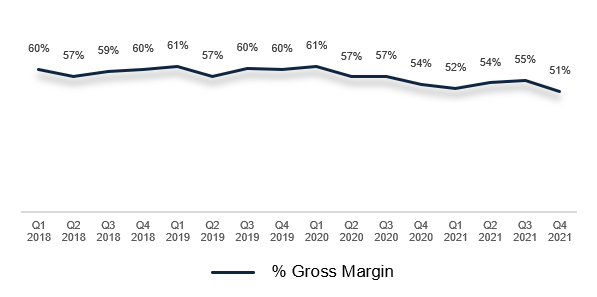

How is this translating into margins and profitability?

Well…. as the number of digital subscribers has gone up, the gross margin has gone down. I believe this is due to the above mentioned, but I still need to confirm it.

Will this be the strategy going forward or will the company be raising prices in the future? I don’t know.

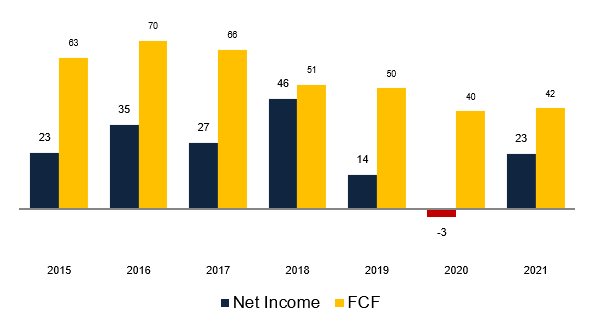

As many old businesses, Lee has a higher Depreciation & Amortization charge than its current needs for capital so it has higher Free-Cash-Flow than Net Income. In cases like this, investors should focus on FCF, not Net Income.

Balance sheet

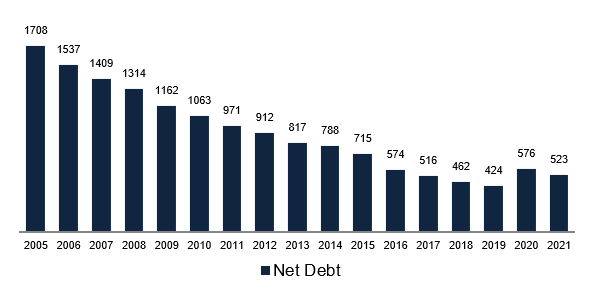

When one looks at Lee’s balance sheet one finds a high amount of debt. Whereas in the past, local newspapers were somewhat of a monopoly or duopoly (there’s not much room in a small town for more than a couple of newspapers), generating high and predictable cash flows that would allow them to have high levels of debt, as the business started shrinking, this debt became a problem.

Newspapers began to fire a lot of people, the weaker ones closed doors, consolidation happened and so on…

Lee is no exception. And as the revenue shrunk, so has the debt.

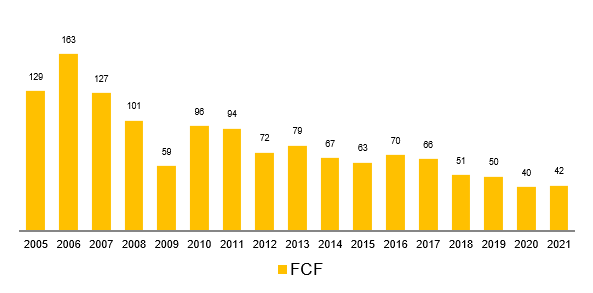

Typically I would applaud such debt paydown, but I don’t feel like it this time. You see, although the business has generated positive cash flows in every single year…

…those cash flows weren’t truly free to be distributed to the shareholders as they were used to pay down debt. Now, you might say that paying down debt is one of the tools at hand for capital allocators and by paying down debt (especially expensive debt) the company gets more flexibility.

That’s true, but since the newspaper business is a melting ice cube the debt pay-down wasn’t a choice, it was an inevitability. Shareholders couldn’t access the Free-Cash-Flow because it had to be used to pay down debt.

I’s only because a “new business” is coming to life that there is hope for shareholders. And I’m not referring to the old shareholders, just the new ones that were fortunate enough to buy the stock at the right time because after the offer by Alden and Kuppy’s letter the share price doubled.

It’s important to note that with the acquisition of Berkshire Hathaway’s media business back in 2020 came a debt refinancing. Warren Buffett saw an opportunity to make safer money than by holding the equity (aka being a shareholder). He offered to replace Lee’s existing debt with 12% interest rates for new debt with 9% interest rates.

In a world with 0% interest rates, this was a shrewd move by the old man. He also kept all the real estate for himself and leased it to Lee for 10 years.

It’s interesting that the management publicizes that this new debt doesn’t come with financial covenants, but depending on how you look at it, it’s even more restrictive.

Buffett demanded that all the Free Cash Flow should be used to pay down debt. No dividends, no share buybacks, and no big acquisitions. So he – as the lender – set the capital allocation policy; not the shareholders nor the board of directors.

I don’t know how low he demanded the debt to go, but the management has set 2.5x Net Debt/EBITDA as its 5 year goal.

Estimates and valuation

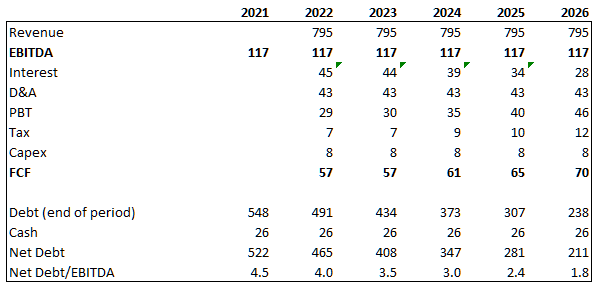

Now, let’s make a quick estimate. Let’s say that the revenue will stay flat going forward.

I’m also estimating for stable EBITDA, but this might be too conservative as, for the revenue to stay the same, the digital business would need to grow, thus showing higher margins.

With these conservative assumptions I believe that the company could beat its own guidance and reach a leverage ratio under 2.5x in 2025, 4 years from now.

In 5 years from now, with all the debt pay-down, the business could be making $70 million in Free-Cash-Flow.

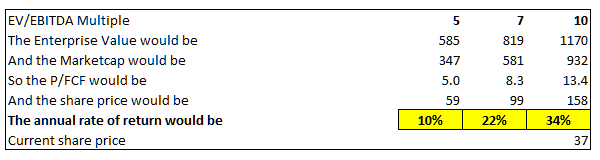

News businesses have been selling for anywhere from 3x EV/EBITDA multiple (the valuation at which Lee bought Berkshire’s media business) to 8x (the valuation at which Gannett bought New Media Investment Group).

What would be a right multiple for Lee? It depends on how the online business does, but anywhere from 5x EV/EBITDA to 10x EV/EBITDA seems fair.

If the subscription and digital business do really well, maybe these multiples are too conservative. For now, it’s better to play it safe.

So, even at a 5x multiple, we could be seeing the stock price deliver a 10% annual return for the coming 5 years. This looks tempting!

Conclusion

Lee Enterprises is a media business working in the most exciting (or least boring) niche of the industry – local news.

Although the secular trends are against it (print news is dying), Lee might be at the inflection point where the growth of the digital business is enough to offset the decline in the traditional print business.

The fact that it acquired Berkshire’s newspapers in 2020 and the effects of the pandemic make it hard for us to understand the recent trends, but if the company is really at an inflection point, it might be very cheap.

I can’t yet formulate an opinion as I need to spend more time looking at Lee’s financials and do some more research on similar companies. We’re entering earnings season so I’m not sure if I’ll be writing about a new company in the next couple of weeks, but when I get the chance, I’ll be looking into The New York Times as it seems to be the leading company in the digital transformation.

Lee Enterprises won’t be entering the Portfolio at this time.

To discuss this stock, head over to the Forum.

Further research material

I would like to hear your anonymous opinion!

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.