Microsoft,

Q3 2019 - Results

April, 29 2019

1. PREVIOUS ANALYSES

I remember that I felt bored when I first analysed Microsoft. Don’t get me wrong, I love the company but I like to research companies that for one reason or another may be overlooked or oversold by Mr. Market and this wasn’t the case for Microsoft.

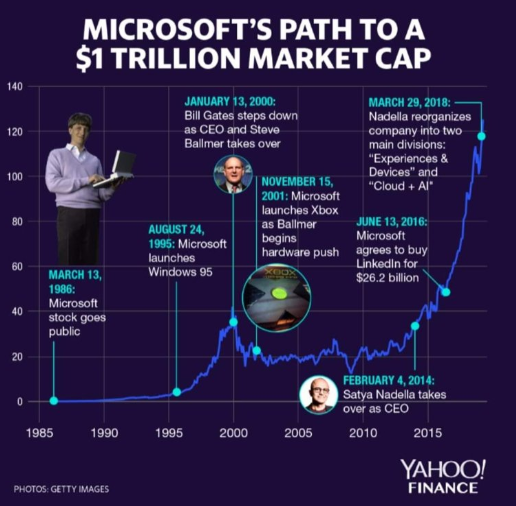

I also remember that I wished I had seen it coming in 2014 when Satya Nadella took the reins and shifted the core business to a SaaS business powered by the cloud…

2. RESULTS

3. Summary

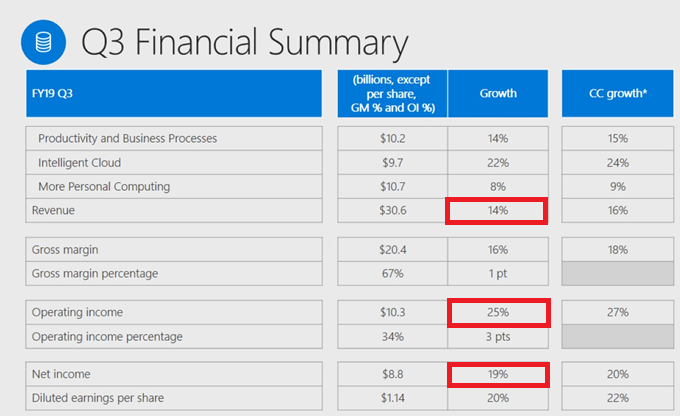

Microsoft is firing on all cylinders. Revenue was up by 14%, the operating income was up by 25% (!) and the net income was up by 19%.

And although the Intelligent Cloud grew by 22%, Azure grew by 73%.

The SaaS (Software-as-a-Service) business model backed by the cloud was and is Microsoft’s tour de force, the great legacy Satya Nadella leaves for future generations.

By turning itself into a cloud based SaaS, Microsoft has managed to transform itself and rise from the ashes. The SaaS model has a lot of benefits both for the provider as for the customer:

- All of the processing is done remotely, allowing the customers to store their documents and software away from their hardware, allowing for less potent hardware and access to the data everywhere;

- The security issues one might have by storing everything on a local computer/server are reduced as the security budgets of these big companies are way higher than those of a small company or single person;

- The clients don’t have to pay huge amounts of upfront cash for the software licenses, deferring these costs over time by paying a monthly fee. Although in the long term this option might be more expensive, for companies, especially for the smaller ones this is a very important progress;

- With this model, the software can be tweaked and adapted to the client’s needs so the provider is seen as a collaborator rather than someone who is selling you a finished product. This tweaking and close relationship will in turn lead to higher switching costs;

- As the company solves a big problem for a client, it is able to sell additional products creating a vicious cycle on a land-and-expand model.

All of these (and more) are fueling Microsoft’s incredible growth.

5. OVERVIEW & CONCLUSION

5.1. OVERVIEW

I could’ve analysed all the relevant points from the earnings release but I will leave that to the time the Annual Report comes out.

In the meantime, although Microsoft seems to be poised for great growth in years to come, I still feel the same way about the company as I did on my first analysis. Great company, great growth prospects but at a P/FCF of 27 for a company growing at 14% annually, I’m not seeing any market inefficiency that I can use to my benefit.

While we wait for the FY results, think about the following image…

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.