Parts ID

a hidden compounder?

By Manuel Maurício

June 18, 2021

Symbol: ID (NYSE American)

Share Price: $6.55

Market Cap: $217 Million

Business

Parts ID is a technology enabled platform for car tires and accessories. Think of it as a two-sided marketplace for accessories, car tires, suspensions, etc but with an interesting model and technology.

The company owns virtually no inventory. The way it works is that for the past decade it has been onboarding a network of suppliers (original equipment manufacturers and distributors) that work on a drop-shipping basis. When a customer buys something on one of Parts ID websites, the supplier will ship the product directly to the customer without Parts ID ever touching or seeing the product. It’s kind of brilliant.

Parts ID platform “speaks” with the inventory management software for more than 1000 suppliers and updates the catalog in real-time. This allows Parts ID to offer an assortment of over 17 million different products – a unique feat in the industry. But unlike a regular marketplace, you’re not buying directly from the vendors, you’re buying from Parts ID. This way it can control the selling price.

The geo-optimized algorithm determines which product vendor to buy from while the sale is being made and incorporates factors such as real time inventory, customer proximity, shipping costs and profitability.

With other marketplaces it’s not uncommon for customers to buy a part online, wait a few days for it to get delivered, only to discover that that part doesn’t belong to their car model. That’s why the behavior of the typical buyer in a physical shop is to head straight to the help desk and ask for their part.

Hence, the most critical – and hardest – part of buying accessories and car parts is fitment. Fitment is the compatibility of each part and accessory to each specific vehicle year, make, model, engine type, and more.

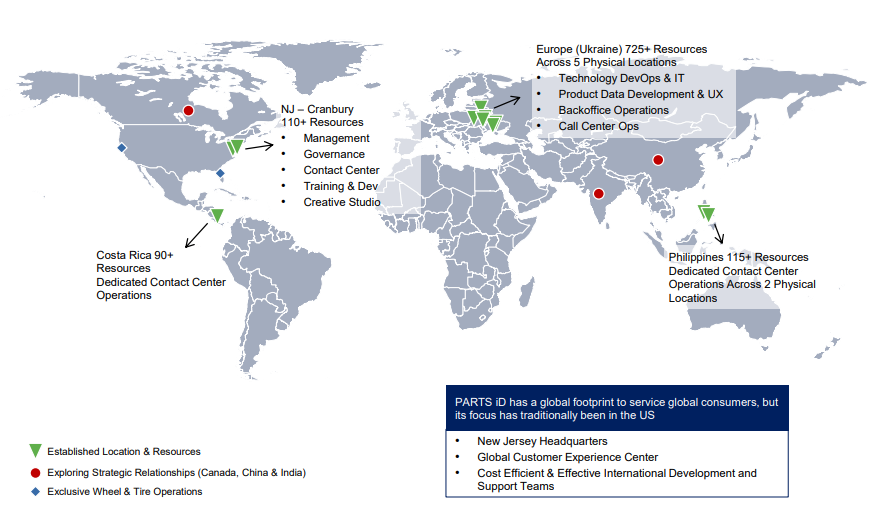

Over the years, Parts ID has been perfecting its technology and offers unparalleled fitment through its platform (at least that’s what they say). To make the experience even more reliable customers can browse through videos, tutorials, documents, and reviews that, together with expert-filled call centers in Eastern Europe and Asia, should improve the customer experience in an unrivaled manner.

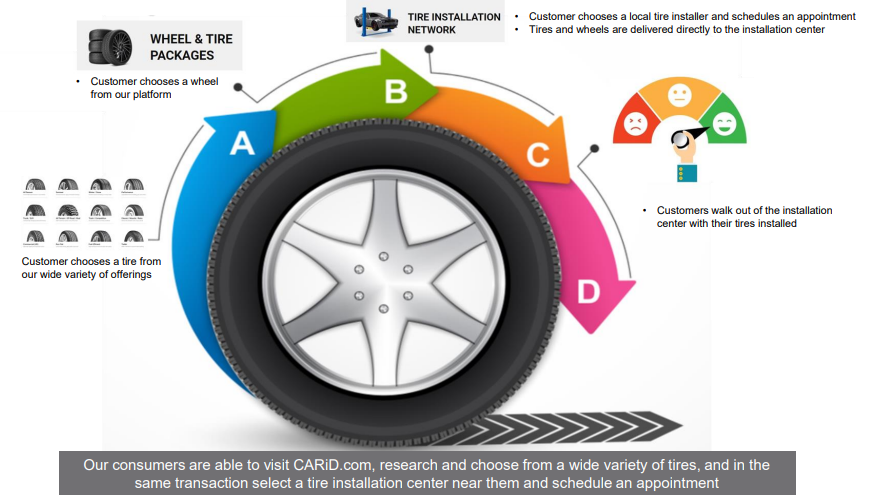

Partnerships with tire installers - a smart move

On top of this, the company has partnered with over 2000 tire installation locations and is on track to have over 9000 by the end of the year. These partnerships allow the customers to go to Car ID and choose from a huge variety of tires and, in the same transaction, select the tire installation center near them to schedule an appointment.

I don’t know how things are in the US, but ever since I was a little boy my father would take me with him to by new tires and he would teach me that to buy tires you need to be a good negotiator. And I would watch him bargaining prices that I would never thought possible. As with the automobile sales that I mentioned on my write-up on Cambria, the process of buying tires needs increased transparency. Parts ID is helping in that transformation.

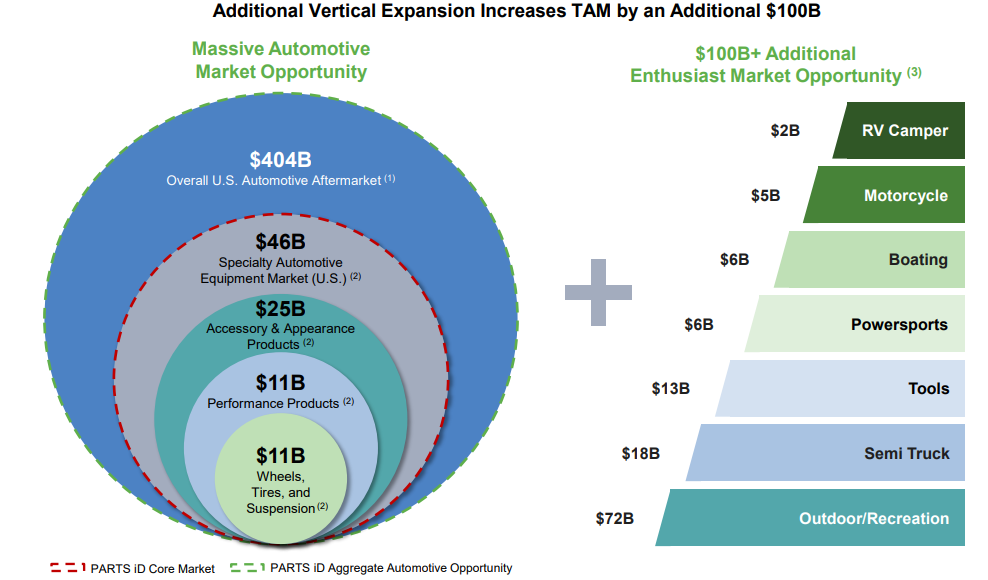

New verticals - The benefits of software

So far, most of the revenue has come from the website CARiD.com, but since the platform can be used with little to no adaptation in other verticals, in 2018 the company launched 7 new websites all using the same core technology: BOATiD, MOTORCYCLEiD, CAMPERiD, POWERSPORTSiD, RECREATIONiD, TRUCKiD, and TOOLSiD.

The typical customer of CarID.com is a blue collar male who owns a muscle car or a pick-up truck and typically has an ATV, Jet Ski or motorcycle in his garage, hence the opportunity to expand into those categories. You can buy simultaneously on all of those websites with only one checkout cart.

Although I can see how CARiD or TRUCKiD can differentiate themselves from other online platforms through the fitment technology, I don’t see how buying tools from these guys can be any different from buying them from Amazon.

Do it for me - the future

The management is now considering entering the Do-it-for-me (DIFM) market with original equipment and repair parts. I’ve tried to understand how they’re going to be doing this as I doubt that there’s a lot of people who will know what part they need.

One way they can do it is by marketing to the professionals. But will their algorithm and technology be any better than what the mechanics are already using? For a “regular” citizen, I understand that the whole “fitment” thing helps a lot, but what about for someone who already knows what part he’s looking for? The fitment suddenly doesn’t matter all that much. What matters is the availability and the time it takes to be delivered.

I’ve talked to Brendon from IRC, the company in charge of handling the Investor Relations for Parts ID and he couldn’t tell me exactly how they’re thinking of going about it.

Financials

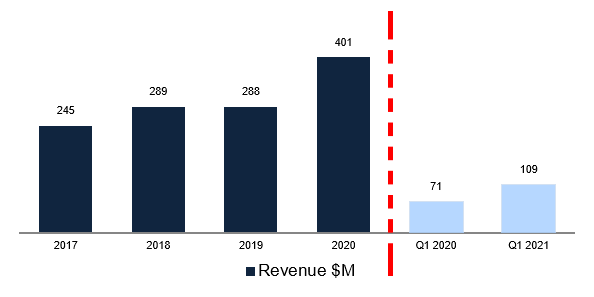

As the company went public through a SPAC in November 2020, we have limited financial data available. This, together with the fact that there was a pandemic that shifted the behavior of consumers towards online shopping, makes it very difficult to assess what is “true” growth in demand and what is simply coincidence.

Let’s take the first quarter of 2021 where the company grew the revenue by 56% (in light blue below). During the quarter a good percentage of American citizens were awarded stimulus checks by the Government. It is common belief that a lot of this money was used to purchase non-discretionary stuff such as the products that Parts ID sells. So is that demand here to stay?

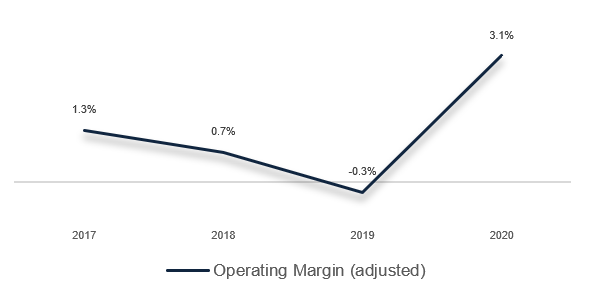

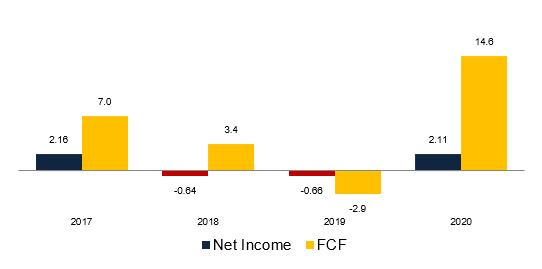

I’ve adjusted the operating margin for non-recurring charges like the IPO related costs and other. Although this seems like a low-margin commodity business, because Parts ID doesn’t actually own any stores or distribution centers, we should be seeing a high degree of operating leverage and margin expansion as the company grows (as we’ve seen in 2020).

Not only that, but the fact that the company collects from its clients at the time of sale, but takes 35 days, on average, to pay to its suppliers, makes it so that – as long as it keeps growing – it will generate more cash than profits.

I’ve mentioned this previously (most recently on the Cambridge Cognition write-up). It seems as if I’m pursuing these negative working-capital businesses on purpose.

When asked about how long was their delivery period, the CEO was fluid enough to say that 80% of all small package orders take 3 to 5 days to get delivered. But what about the other 20%? And what about the big package orders?

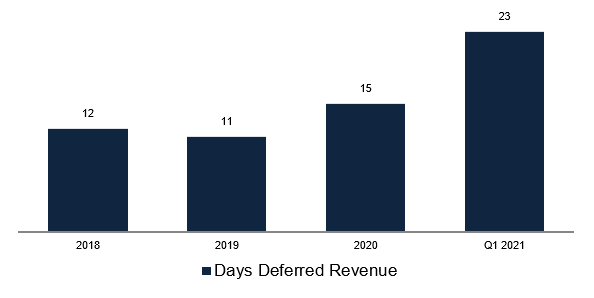

Given that the company recognizes revenue at the time of delivery rather than at the time of shipment (like its competitors), there is a line on the balance sheet called “Customer Deposits”. This is the same as “Deferred Revenue”: cash that the company has collected, but can’t yet be recognized as revenue because the product hasn’t been delivered yet.

This let’s us figure out how many days, on average, it takes from the moment that the customer places the order until he (or she) gets it. The lower the better.

Much to my displeasure this number has been going up, not down as I would expect to.

There are a few reasons this might be happening:

- The company has been messing up.

- The suppliers have been messing up.

- The delivery companies have been messing up.

- The current inbalance between supply and demand in the USA is leading to a shortage of products and longer delivery times.

Again, the times we’re living in are so different from the norm that it’s not easy to understand the real reasons behind the balooning delivery period.

Balance Sheet

The company currently has negative equity (also called deficit) which means that it’s technically bankrupt. But this doesn’t mean that it will close shop. The first company with negative equity that I looked at was McDonald’s, but McDonald’s had negative equity because it was buying back shares with debt.

There’s no share buybacks for PartsID. And there’s no debt. But still, there are more liabilities than assets on the balance sheet. This happens because of the negative working-capital that I’ve just mentioned and also because it has very little fixed assets. Kind of cool.

This is a major benefit as the company isn’t constrained by how much it has to tie in inventory, fulfillment centers or stores.

This also makes it so that the Return-on-Invested-Capital is infinite because there’s no invested capital. I wonder why the company went public if it doesn’t need the cash?! Brendon couldn’t tell me.

Management and ownership

The company is run by Antonio Ciappina who, although being just 39, has a long history of working with e-commerce companies.

Nino has been the CEO for just one year as the previous CEO, who was one of the two founders, left and has a lawsuit pending against the chairman.

I’m no specialist in the law, but from what I’ve been able to gather, in 2015, the two founders were looking to raise capital to grow the business and the current Chairman and largest shareholder bought a 43% stake.

The two founders now say that they were misled by Pathak (the Chairman) who told them that he exerted influence over the multi-billion dollar Canadian Tire Corporation (CTC) and that CTC had agreed to acquire a stake in Parts ID and help it grow. That never happened.

I don’t know what to think of this. It’s obviously a red flag, but I still don’t know who’s telling the truth.

What I do know is that the two founders still own 36% of the company and the Chairman owns 43%. If by any reason any of them wishes to sell their shares, there will be a downward pressure on the stock price.

Industry and competition

The car parts and accessories business is big and fragmented. The offline leaders are consolidators such as AutoZone or O’Reily Auto Parts. In fact, both of these two are excellent businesses and their stocks have turned out to be two-hundred baggers. I should really look into them as I suspect there’s still a long runway ahead of them.

The largest online competitor is carparts.com, but CarParts has a different model. Like Amazon, it’s building its own distribution centers across the US and it focuses more on the parts and collision repair whereas Parts ID has been focusing more on accessories, tires, and performance gear – although, as we’ve seen, that is changing.

All of this to say that, although this is a highly competitive market, the fact that it’s also a very fragmented one means that there should be room for everyone to grow.

Risks

- No real barrier to entry

- Trying to grow too fast and lack of focus on the core offerings.

- Legal issues and lack of integrity

- Dependence on Google ads

Conclusion

When I first heard about Parts ID I got really excited. A technology company disrupting the parts and accessories industry with a top notch fitment technology, negative working capital, no fixed assets, growing at 53%. It was like a dream come true.

On top of that, it was – it is – trading for a much lower valuation than its direct competitor CarParts. The Enterprise Value/Sales for Carparts is 1.3 whereas for Parts ID it’s 0.3 (I can’t find obvious reasons for this discrepancy).

But now my excitement has tempered.

By sheer coincidence, just this morning I was going through the Portuguese Tesla Facebook group (as I often do) and there was this guy talking about how he bought his tires online and how the website had shipped them directly to the tire installer.

This got me thinking in technology based moats, their replicability, and my ability to identify the resilience of such moats. Let’s take the case of Cambridge Cognition as an example. Although I have no expertise in algorithms or brain diseases, I can easily understand that its moat is wide and deep and any competitor will need decades of validation to get to where Cambridge is today. By then, Cambridge will be far ahead, again. I can’t say the same about Parts ID technological moat. I don’t know how hard it is to copy it, but I’m inclined to think that it should’t be that hard.

I’m thinking about the great Peter Lynch who famously said that “you want to buy in the second or third inning”. There’s no rush. And even if I’m wrong, even if this technology and business model are so unique that the stock will become a multibagger (which wouldn’t surprise me), I’ll have plenty of time to get in.

For now, I’ll be standing on the sidelines watching. I’ll revisit it if and when I gain the conviction to buy it. It could take years.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.