Pool Corp

a monopooly!

By Manuel Maurício

February 18, 2022

Symbol: POOL (NASDAQ)

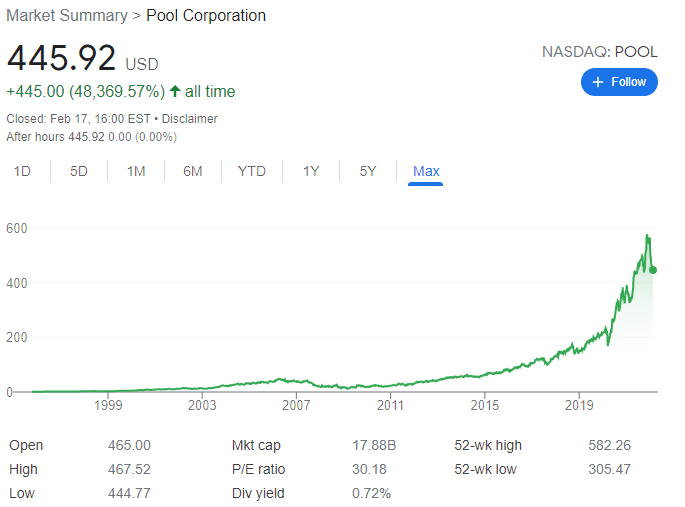

Share Price: $445

Market Cap: $17.9 Billion

Pool Corp is a 484-bagger since 1995. That’s an annualized return of 18.56% over 27 years!

I started the week by looking at a lousy staffing business because a fellow investor told me that it was cheap. At some point, I was confident enough with my understanding of the business to make a quick back of the envelope estimate. I figured that the stock “could” be a double from here, but it could also be just a +50% investment.

Although a “double” gets me excited, there just wasn’t enough meat on the bone to write about it.

But the same guy who told me about that lousy company also owns POOL and mentioned that it’s a monopoly.

I had heard about POOL before, but for some reason I had never looked into it. I guess the word “monopoly” did the trick.

The Business

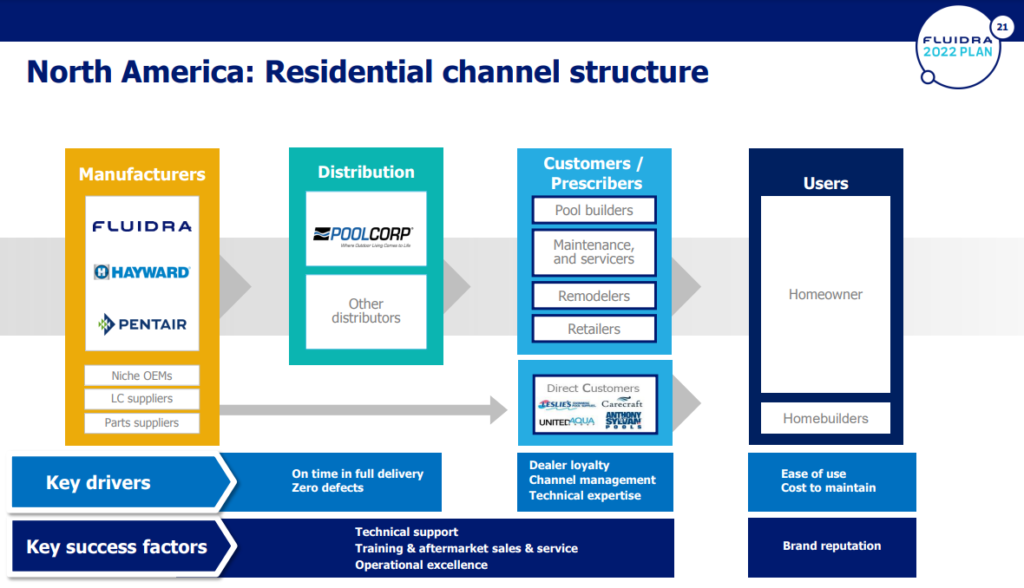

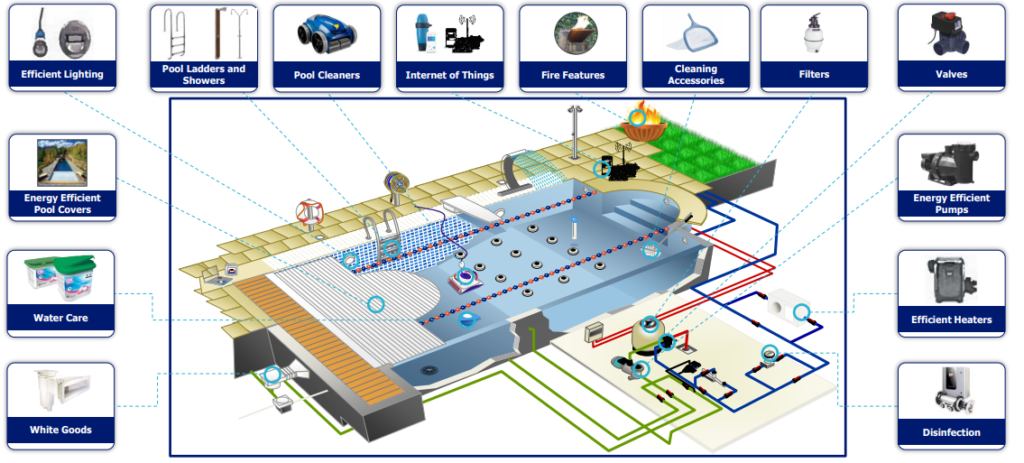

PoolCorp is the world’s largest wholesale distributor of swimming pool and related outdoor living products.

It sells over 600 product lines through 395 sales centers in North America, Europe, and Australia.

I’ve downloaded their catalog and it’s 546 pages long!

North America accounts for 94% of sales, Europe 5%, and Australia 1%. This suggests that there’s enough room to grow outside of North America.

Industry Dynamics

The industry is highly fragmented. Through its scale, POOL is able to purchase the products from a large number of manufacturers and then distribute them to their customers on conditions that are more favorable than the customers could obtain on their own.

Although distributors are usually meh businesses, there’s a few that are very good, requiring little capital and getting good returns on investment.

Buffett had this to say about distributors when he bid for Tech Data, a wholesale distributor of tech products, back in 2019:

“I may not understand all of the products that they sell and I may not understand what the customers who buy the products do with them, but I do understand the middleman’s role“

Pool has no national competition. Its competitors are small local (sometimes regional) companies. And even these small pool suppliers sometimes shop from Pool to meet their customer’s needs.

From time to time, these small competitors hurt POOL’s sales when they’re going out of business and want to liquidate their inventory at any price. But even in such situations, the harm done is very limited and POOL will buy the best ones out.

Here’s what the CEO had to say about competition back in 2018:

“the great majority of the acquisitions that we make, just like the lion-share of those that we compete with, have very modest, if any, operating margins. So therefore those businesses that are acquired come with little to no contribution“

This says a lot about the industry. No wonder that POOL is considered a monopoly.

Isn't POOL dependent on the housing market?

Yes. It is…

…BUT, the company actually makes more money selling maintenance and minor repair products – which are non-discretionary – than products for new pools or refurbishment of existing ones – which are partially discretionary.

In 2021, the maintenance and minor repair products accounted for almost 60% of sales, while the products for new pools, refurbishments, and replacements accounted for 40% of sales.

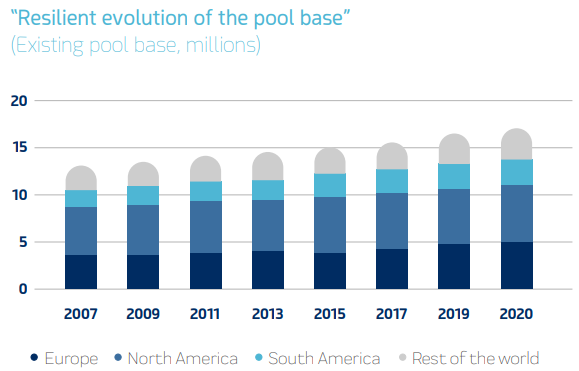

This means that the higher the installed base of swimming pools, the more recurring revenue the company makes.

And as we can see from the chart below, the installed base of swimming pools in North America (and the world) has only gone up in the last decade.

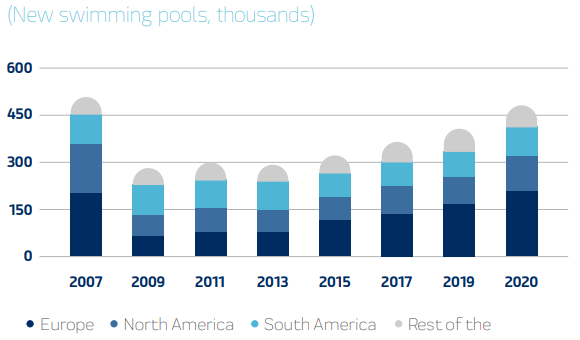

Sure, if there’s a big recession we’ll be seeing people building fewer houses and fewer swimming pools and the revenue will suffer, but while new pool construction and refurbishment represents 40% of revenue, new swimming pool construction comprises just over 15% with the remaining 25% going to replacement and refurbishment.

Below we can see the number of new swimming pool construction over the last 15 years. It looks like the numbers have never got back to where they were pre-financial crisis, but POOL’s revenue surpassed 2007’s revenue just in 2012. This shows that they’re not as tied to new construction as one might’ve thought or else their revenue would still be lower than in 2007.

On top of that, this is a monopoly. In times of economic trouble, although the business will suffer temporarily, weaker companies will close doors before POOL so POOL comes out of recessions on an even stronger position than before.

Financials

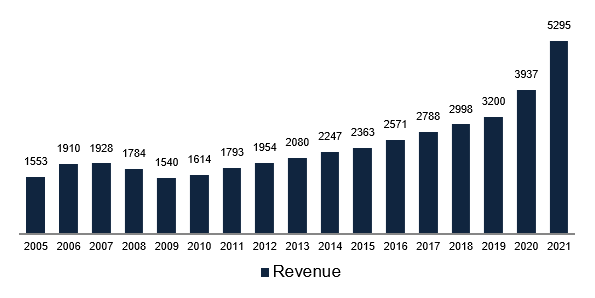

When we look at the revenue trend over the years, we can clearly see that the business suffered in the Great Financial Crisis with revenue coming down 20% from 2007 to 2009.

But it took POOL just 3 years, from 2009 to 2012, to reach a new All-Time-High.

POOL posted its 2021 results this week. On the chart below we can see the incredible revenue acceleration – it’s bonkers. Of course, we’re looking at a one-of-a-kind couple of years due to the stay-at-home policies. Although I expect 2022 to show similar growth, investors shouldn’t extrapolate it going far out into the future.

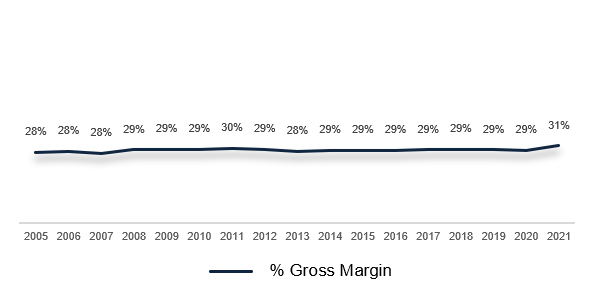

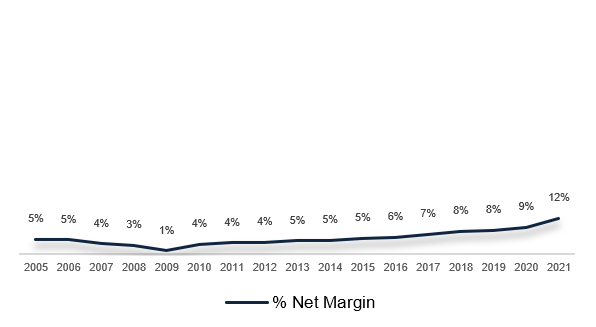

The gross margin has been as steady as they come, just below 30%.

I’ve got to be honest here, with increased scale and higher bargaining power, I was expecting the gross margin to have gone up over the years.

It’s only when we look at the Net Margin that we see the benefits of scale translating into operating leverage – the revenue goes up, the costs don’t go up as much, the net margin goes up disproportionately to revenue.

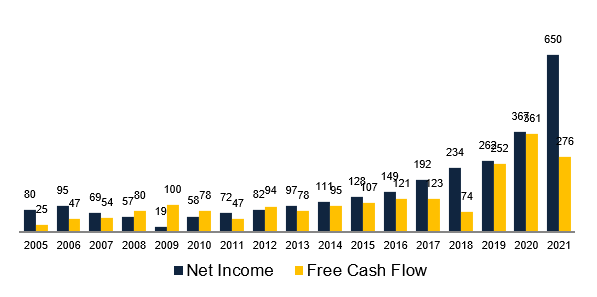

And the company has been able to convert the profits into cash very well over the years.

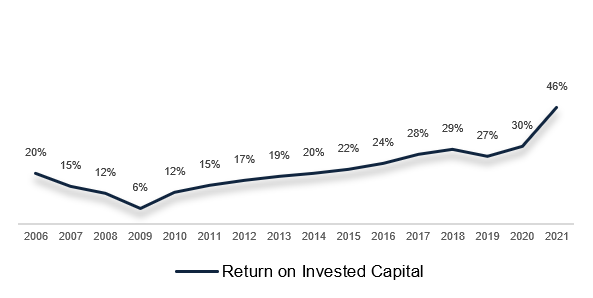

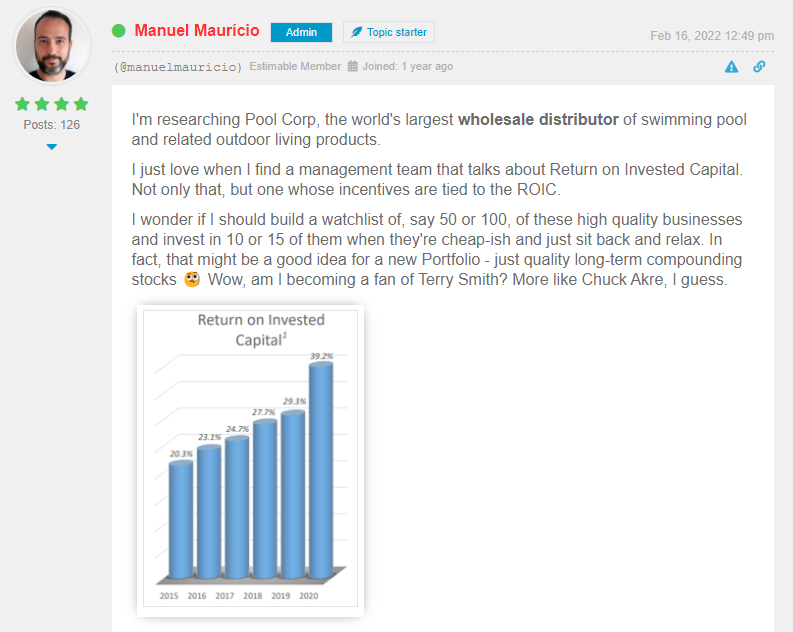

As you might’ve noticed, this is a low margin business. But low margins aren’t bad per se. What matters most is the return that the company gets on its invested capital.

And this has been trending in the right direction. An increasing Return on Invested Capital tells us that the company has been getting higher incremental returns every year. This is exactly what we want to be seeing: better than a high ROIC business is an increasing ROIC business.

Balance Sheet and Capital Allocation

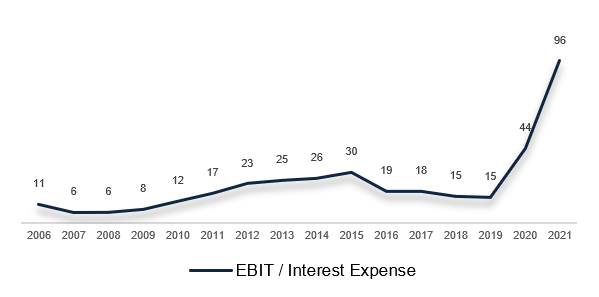

Turning now to the balance sheet, the company has kept a very sound interest coverage over the years…

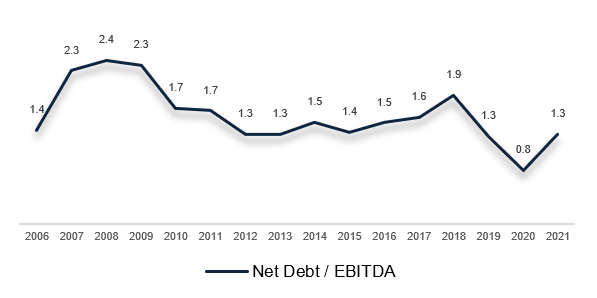

…which is the result of a prudent leverage profile.

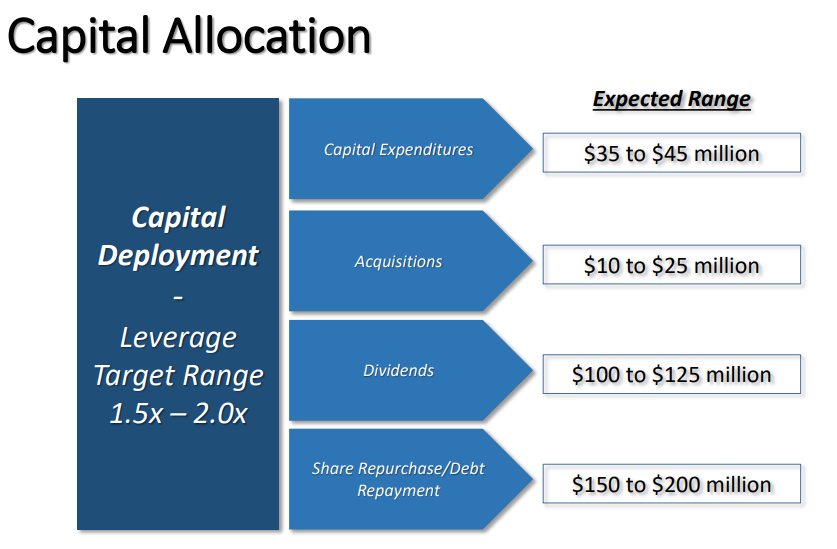

Right now, the management is targeting a leverage ratio of 1.5x to 2x so they’re well within their range.

So what does the company do with the cash that it generates?

I’m glad you asked because the management has a slide to answer that question.

First, they invest back in the business (11%), then they make a few, random, acquisitions, and then they pay dividends (31%) and repurchase stock (51%).

In “normal” times, the management favors share repurchases, and when opportunity knocks they acquire competitors.

Just a few months back POOL made its largest acquisition to date – Porpoise Pool and Patio – for $789 million.

Porpoise is, in fact, 3 different businesses: 1) a distribution business similar to POOL, 2) a chemical packaging business that packages and sells chemicals like chlorine tablets, and 3) a franchisor, Pinch a Penny, through which POOL expects to increase its exposure to the Do-it-Yourself market.

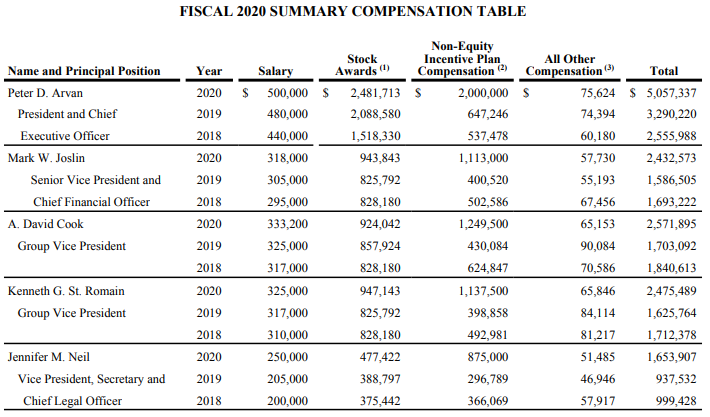

Management and Compensation

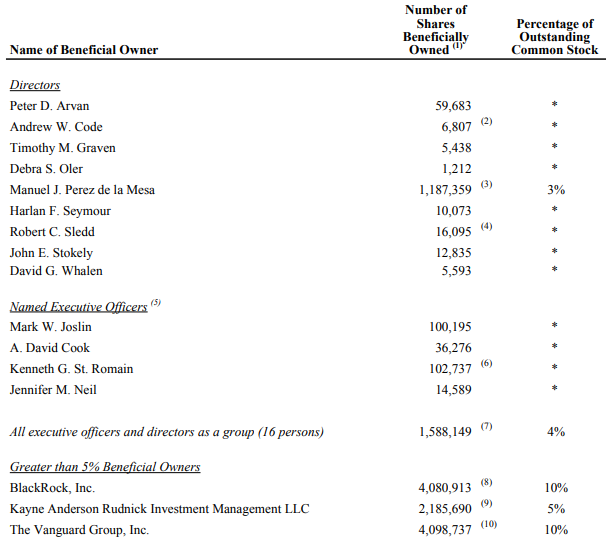

Unfortunately, none of the managers own significant amount of stock and the largest shareholders are the big money managers BlackRock and Vanguard. That’s disappointing.

But it’s surprising that, even with these big funds as largest shareholders, the company has a very well designed incentive structure. It’s a pleasure to read it.

To become eligible for the Annual Incentive Bonus, the management team must first achieve ROIC of, at least, 10% . Although 10% has historically been a low hurdle for POOL, I applaud the principle behind it.

And they even include their calculation of ROIC in every single presentation – music to my ears!

Then, the management’s incentives are tied to Operating Income, Operating Cash Flow, Earnings-per-Share, and other specific operating metrics. Very straight and well designed structure.

Valuation Multiples and Estimates

Now the million dollar question is “Is it cheap?”.

I have to tell you that there were times in the past when I would’ve answered that question much quicker than today.

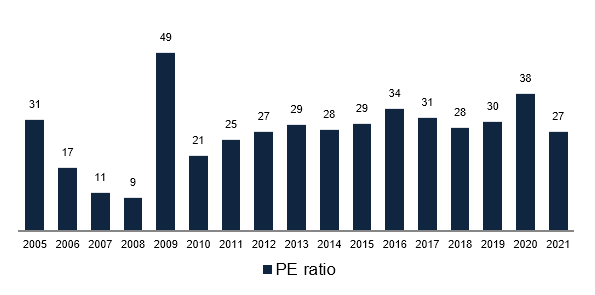

The stock is currently trading at 27x profits. The first thing that investors must bear in mind is the likelihood that those profits will decrease in the coming years when we get out of this pandemic-fueled craze.

But in the long run, I believe that POOL will keep growing both revenue and profit. The management guides for double digit growth in Earnings-per-Share in the long run so…. if the multiple stays flat, that’s what investors could expect – a double digit return.

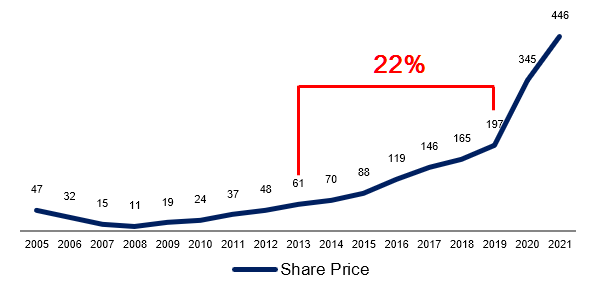

Take for instance the 6 years between 2013 and 2019 when there was no multiple compression or expansion.

With just 7% annual growth in revenue, the Earnings-Per-Share grew 21%, and the stock went up by 22% per year.

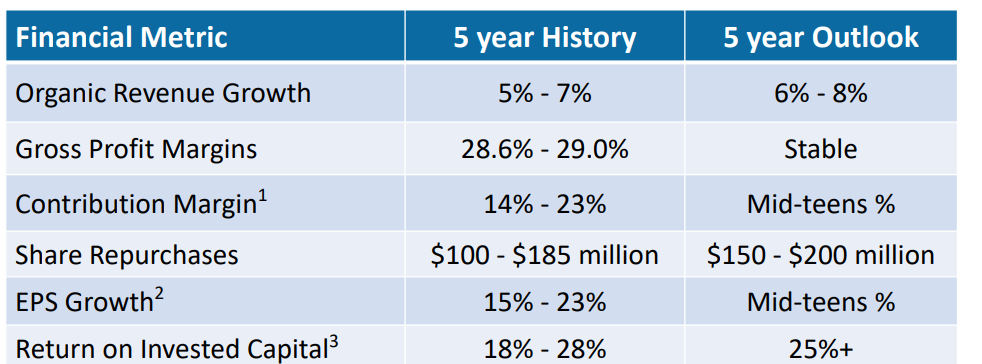

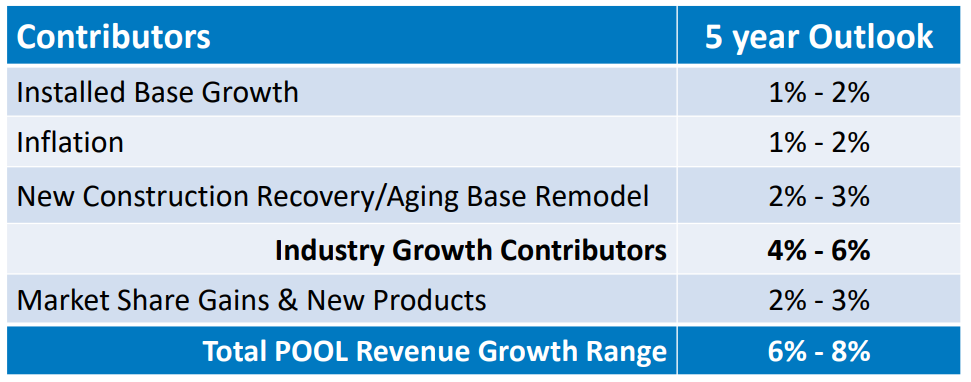

Below is the management financial model with their estimates for the coming 5 years. It was published in 2019 when there was no pandemic in sight, but I believe that the growth algorithm still remains valid.

Can they keep growing revenue at 7%? I think they can. The management’s assumptions for revenue growth are quite reasonable actually; a bit of inflation, a bit of construction growth, and a bit of market share gains.

So… if the multiple doesn’t expand or contract going forward, I think it’s reasonable to expect a mid teens return – that is, or course, if there’s no big crisis like the one in 2008/09. That will be the best time to buy a business like POOL.

Risks

- Bad acquisitions

- Dynamic competitive landscape

- High valuation

- Consolidation of suppliers

Conclusion

I obviously like POOL. What’s there not to like in a monopoly with a long runway ahead of it? The price, obviously.

POOL is the type of company that makes me re-think my investment strategy. As you might’ve noticed, I have a knack for small-cap, early-stage companies. But I also recognize the beauty in the boredom of owning POOL (or O’Reilly, or Costco, or ASML).

On Wednesday I posted this on the Forum:

It won’t be happening anytime soon, but I’ve been tinkering with the idea of creating a Portfolio of only high-quality, long-term (boring) compounders. They change so slowly that the maintenance of such Portfolio would be much easier than the current one. What do you think?

Going back to POOL, I would like to buy it when people get spooked by some temporary event – another recession, competition, or something of sorts.

Which leads me to think that there are a few industry participants, namely SRS distribution, Leslie’s, and Fluidra, that I should be researching before I’m able to say that I have a solid understanding of the industry.

The truth is I don’t see that many competitive threats to the business that could create the buying opportunity that I’m looking for so… Pool Corp won’t be entering the Portfolio at this time, but it will be a strong contender if and when the share price comes down.

* I’d like to invite you to fill out the survey form below. It helps me get better, which, in turn, helps you :).

**By the way, have you been to the new FORUM? Don’t be afraid. Come and say Hi!

I would like to hear your anonymous opinion!

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.