Quick Opinions #2

Formula 1, Yellow Pages, Richelieu, HP

By Manuel Maurício

June 03, 2022

You’ve read the title – which of those 4 companies do you think is the best investment right now? Don’t rush it. Think about it before answering. In fact, if you’re an investment geek like me you can even write it down so you can come back to it later.

Ok, now we can proceed.

Richelieu Hardware

How about a company that has compounded at 17% annually for the past 26 years? Surprising as it may seem, good old boring Richelieu Hardware did it. You would be very rich right now had you invested in it back in the 90’s.

What does the company do?

Richelieu distributes specialty hardware and building products. The principal categories include door handles, furniture, sliding doors systems, solutions for kitchen and closet storage, and much more. It sells thousands of SKU’s which tells me that it’s hard to replicate the business.

How does it make money?

The company sells its products to manufacturers and renovation superstores. It’s basically a middleman. And I know from past experience that distributors can be good businesses. Scale matters in the distribution business and Richelieu’s founder soon understood this. He has made dozens of acquisitions over the years.

Is it a great business?

With Returns-on-Capital consistently above 20%, this is a better-than-average business (the average business in the US earns 12% Return on Equity). It doesn’t surprise me. In my previous career as an architect and project manager, I understood that brands such as Assa Abloy or JNF are synonymous of quality. Architects and builders will want to work with them whenever possible. There are a lot of knock-offs, but more often than not, their quality doesn’t come close.

Where is the business heading?

As the industry is still fragmented, the management will keep applying the same algorithm of expansion through acquisitions and good execution.

But as the company has grown bigger the margins have been going down. This is due to the diversification into more and more products and also because of the negotiating power of its clients, which are increasingly the 3 big box retailers – Lowe’s, Home Depot, and Menard’s. I would definitely like to see otherwise.

Also, the business is tied to the construction industry which is a cyclical one, but there ate two mitigants to this apparent weakness. First, Richelieu is more exposed to the renovation market than to new construction. Second, the fact that it grows by acquisitions together with a very healthy balance sheet means that in an economic downturn it will be able to buy more of its struggling competitors which is a sign of anti-fragility.

How inside or outside my circle of competence is?

Distributors that grow by acquisitions are simple businesses to understand.

Are there signs that it’s undervalued?

Richelieu has definitely been over-earning in the past couple of years. Everyone seized the fact that they were stuck at home to make renovations. This has led to an apparent undervaluation. On the most recent earnings, the company is trading at 15x, or an earnings yield of 7%.

For most of the past 10 years, the stock has been trading above 20x having reached a peak of 31x twice. But we need to discount the fact that the company has seen a peak in demand that is likely to come down.

If we look at the 3 years immediately prior to the pandemic, we can see that the average Earnings-per-Share was $1,17. At the current $37 per share, the company is trading at a multiple of 32x. Not cheap.

Conclusion

At this valuation, there’s no apparent mispricing. I would like to buy Richelieu in the low double digits or even high single digits.

I can’t help but to think that the more businesses I know the more O’Reilly appears to be an amazingly good business. As it grows, the return on the capital employed goes up, the margins go up, etc, etc.

Yellow Pages (Canada)

I know, I know. Yellow pages are obviously a thing of the past (although they’re still around). But there might be something more than meets the eye behind this company.

What does the company do?

Yellow Pages still maintains the old legacy business – both print and digital – but it has been shifting its focus to new digital marketing offerings.

How does it make money?

Traditionally, it has been making money by getting fees from companies looking to be listed on the Yellow Pages directory.

This has allowed it to gain clients for its other digital products at virtually no cost. As the company runs its own websites – YP.CA; Canada 411; 411.CA – and as it attracts eyeballs, businesses want to advertise there. And as we know from looking at Facebook and Google, digital advertising is a high margin business.

Parallel to this, the company also offers other low margin segments such as website construction and social media management.

Is it a great business?

For decades, the Yellow Pages were protected by a deep moat. But the internet came to crush it.

In 2017 the current CEO took over and immediately started paying down the high debt. This is exactly what you want to be seeing in a declining business.

He also made other difficult decisions to stabilize the business such as dropping the less profitable customers. That’s why if you look at Yellow Pages’ revenue trend you’ll be scared. But although the revenue trend is horrible, I’ve got to hand it to them, the company has never lost money (on a FCF basis).

Where is the business heading?

As they’ve been focusing on the more profitable customers and dropping the bad ones, the revenue should stabilize some day, leading to good profitability.

Theoretically, the company can buy back shares, but there’s an issue. The volume is so low that buying back a significant amount of shares just isn’t possible. That’s why the company pays a dividend.

It’s funny to see that, on the Conference Calls, the management continuously celebrates the lower decline in revenue. The goal is, obviously, to stagnate that decline, but when that will happen, no one knows.

How inside or outside my circle of competence is?

I can understand this business well.

Are there signs that it’s undervalued?

The stock is very cheap on a multiple basis because everyone thinks that Yellow Pages are a thing of the past. And they are.

The company made $100 million in Free Cash Flow on a market cap of $383 so we’re talking about a Price/Free Cash Flow multiple of 4x or a yield of 25%. This means that, if they’re able to keep those cash flows constant, someone buying the whole company would get his money back in 4 years. Nice!

Conclusion

The problem with cash flows sustained by cost-cutting is that they can’t go on forever. I mean, there’s only so much cost-cutting that you can do.

As with most turnarounds, one must believe that the business will actually turn. A bet on Yellow Pages is a bet that the digital properties that they own will remain relevant. The problem is that I don’t believe they will. In fact, I don’t know how the Yellow Pages have lasted for so long. I might be jumping into ill-informed conclusions here, but I don’t see a bright future for this business so I think the valuation, although optically cheap, is granted.

HP

Warren Buffett recently invested in HP. I think that’s enough reason for me to look into it.

What does the company do?

HP’s core business is selling computers, printers, and supplies such as ink cartridges.

The company sources the hardware from several providers such as Intel or AMD, powers it with Windows or Google Chrome, assembles all the components in one case, puts its logo on it, and voilà. It’s basically a marketing play. The R&D expense in comparison to its revenue is around 2% whereas for Apple that is 6%.

How does it make money?

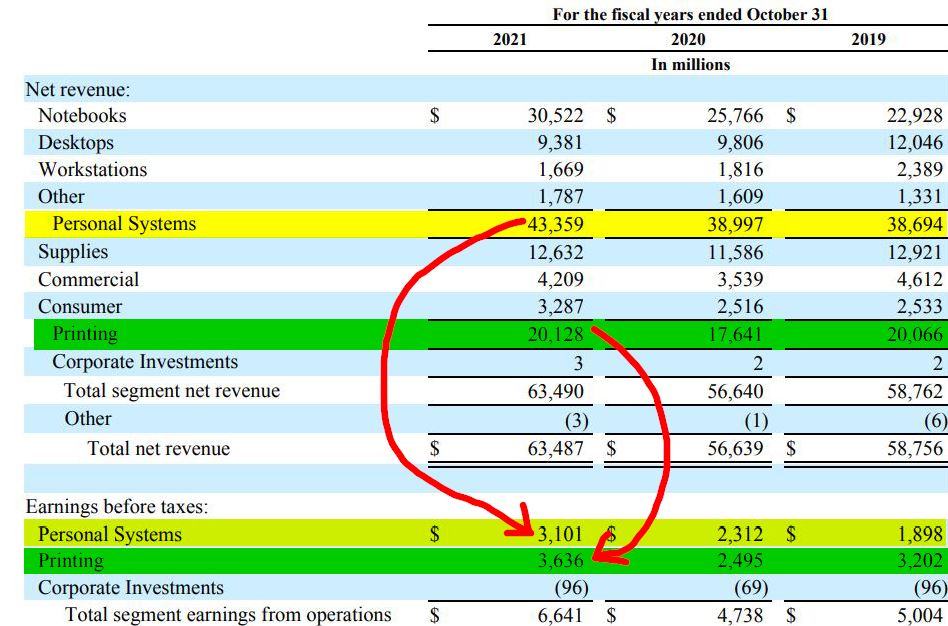

Although most of the revenue comes from computers, most of the profits come from ink cartridges.

Is it a great business?

Before I answer this, let’s look at a few data points.

The company’s Return on Capital is consistently around 80% to 90%. I don’t think I’ve ever seen such a high return on capital before.

Then, it has a negative Cash Conversion Cycle, meaning that it collects from its customers before it pays to its suppliers. This means that, even if the unit volume stays flat, in an inflationary environment the company will generate more cash flow.

Then, it needs very little capital expenditures (in tangible assets such as factories or machinery).

These are all signs of a great business. It doesn’t need capital to grow, it’s a great inflation hedge, it generates high cash flows.

Where is the business heading?

The famous investor Mohnish Pabrai (or was it Charlie Munger?) coined the term “cannibal” referring to mature companies that can’t reinvest their cash flows so they buy back their own shares instead. HP is such a company. So is DaVita (also owned by Buffett), and I hope Berry joins the group. The company expects to return 100% of the Free Cash Flow mostly through share repurchases.

But that’s on the capital allocation side of the business. What about the operating side? How stable are those cash flows?

On the computer and notebook side, the pandemic has come to massively increase the addressable market. And, according to the management, Gen Z is spending more time on their PCs than Millenials.

The management’s strategy is to continue to shift to more premium segments (same strategy as GoPro), expand the lifetime value of the devices (through Device-as-a-Service subscriptions), sell more peripherals (like webcams and microphones), and offer more services. So basically they’re looking to create a whole HP ecosystem and they’re willing to make some acquisitions to get there.

Historically the company has made a lot of money out of ink cartridges, but as we all know there’s now plenty of competition (although ink still contributes massively to the profits).

That’s why they’ve introduced the HP+ subscription. For an additional $40 on its printers, the company offers 6 months’ worth of free printing plus 2 years of extended guarantee. They must have run the math and figured that they could 1) bring the revenue forward and 2) increase the profitability as a lot of customers would buy their printers and then recharge them with competing ink cartridges.

How inside or outside my circle of competence is?

HP is easy to understand.

Are there signs that it’s undervalued?

I think a good way to look at valuation here is to think that the company will be making $4 billion in Free Cash Flow per year and use that cash to buyback shares. On today’s market cap, that’s 10% per year.

At some point, one of 2 things will happen. The valuation stays constant and those $4 billion will buy a lot more in percentage terms, or the valuation goes up. Either way, shareholders will benefit.

Conclusion

I’m liking HP at these prices and I’ll be learning more about it in the coming weeks.

Formula 1

Formula 1 is the only publicly-traded company that owns an entire sport.

What does the company do?

Typical of a John Malone (or Liberty Media) company, it’s hard to understand the technicalities of the business. For instance, the stock is a tracking stock. It doesn’t give shareholder’s the right of ownership, just the right to the economic profits, so it’s like a financial derivative. Anyways, that’s not what I want to be talking about today.

Liberty Media bought Formula 1 back in 2017. Formula 1 has a 100-year agreement with the FIA (Fédération Internationale de l’Automobile) and in that period it can do whatever it likes to make money from the sport. And there are signs that the changes that Liberty has been making have been good, not only for the business, but also for the sport.

How does it make money?

The company makes money in 4 different ways:

Race promotion – 31% of revenue. Race promoters are usually circuit owners, automobile clubs, or governments. They host the races and make money primarily through the sale of tickets. It’s interesting that the fees paid by the promoters to F1 vary widely. Monaco for example is rumored to pay very little while Asian and Middle East promoters can pay tens of millions of dollars.

Media rights: 40% of revenue. This is self-explanatory. Formula 1 is in charge of recording the races and then sells the rights to broadcast them to television networks.

Sponsorship: 16% of revenue. Trackside advertising and race title sponsorship.

Other: 13% of revenue. Shipment of cars and equipment to and from events outside of Europe and also the sale of tickets to the Formula 1 Paddock Club.

Is it a great business?

The financials aren’t crystal clear, but one needs to understand the history of the company and its earnings power going forward. I mean, who else owns an entire sport? This can become a huge cash cow.

Where is the business heading?

On a high level, the business is simple to run. Just keep the interest in the racing up, keep generating cash, and return it to shareholders in the most tax-efficient manner.

F1 is such a stable business that it had been running with high amounts of debt. But then the pandemic hit. To raise cash to comply with its debt covenants it sold LiveNation to its parent company Liberty (at a very low valuation), and now that the debt is low again and the lockdowns are over, it can raise debt again and start repurchasing shares.

But that’s from a capital allocation perspective. From an operational perspective, things aren’t that easy. You see, with brands like Formula 1, you want to reach as many fans as you can, but you also need to watch out for dilution of the brand. And that’s a fine balance that can be screwed in a heartbeat, especially so since Formula 1 has to negotiate with the teams, the FIA, the governments, and the television networks.

So far, the new owners and management seem to have been doing far better than the previous owners. Liberty wants to attract a larger crowd of fans by making the championship more competitive and spectacular.

An example of this is the Netflix series Drive to Survive. I watched the first couple of episodes, and although I liked them, at some point I lost interest. A few friends of mine are of the same opinion. I guess that because we don’t follow the races, we don’t feel it.

So the trick is to get us interested in the races. But how can we be attracted to a sport where we know that the same 3 teams (Ferrari, Mercedes, and Red Bull) will be wining all the races? There should be more unpredictability, more thrill. That’s hard when those 3 teams have budgets that far exceed all the other teams’. Liberty knows this.

That’s why they’ve been introducing rules such as a cap on the team spending (currently suspended due to the inflation). The management hopes that by limiting the amounts that the teams spend they will level off the playing field allowing for the smaller teams to become more competitive.

Formula 1 also changed the aerodynamics of the cars to allow for more overtaking. To those who don’t follow motorsports, overtaking is the most exciting part of the race so the more of it, the better.

Liberty also knows that they have to win the USA crowd. But it’s hard. Traditionally, the crowds in the US prefer Nascar and the Indy Car Series where’s there’s more unpredictability. In order to win the American crowd, they’ve added a race in Miami and will add another one in Las Vegas in 2023. Also, the first American pilot in years is set to debut this season. This should help attract the American crowd.

How inside or outside my circle of competence is?

Apart from all the ownership shenanigans typical of a John Malone company, the business is easy to understand. As long as they don’t kill the brand, I don’t see why Formula 1 can’t be here for the next generations.

Are there signs that it’s undervalued?

Just like with Iteris last week, it’s hard for me to make an estimate of the future cash flows, especially so when the company has recently renegotiated its Concorde agreement. The Concorde Agreement stipulates, among other things, how much Formula 1 will be paying the teams. The issue with the agreement is that it isn’t clear how much money each party will be making. Without having an estimate of the cash flows, it’s difficult to put a value on Formula 1.

What we know is that company is currently making $400-$500 million in Free Cash Flow per year. On today’s market cap that’s a Price/Free Cash Flow of 35x. This seems high.

Conclusion

I like Formula 1. I have no insights that lead me to believe that it’s undervalued, but I’ll keep following it just for the fun of it.

Although the exact terms of the Concorde agreement have been held secret, it is widely understood that Liberty has managed to increase its share of Formula One EBITDA once the 2019 threshold has been met. Under the old terms, the teams received ~68.5% of F1 EBITDA, but under the new agreement the teams will earn less than 50% of any incremental EBITDA above the 2019 base of $1.5bn. For every $100m of incremental EBITDA that Formula One makes above $1.5bn, FWONK will be making ~$20m more than it would have in the old framework, a roughly 5% uplift on 2021 consensus EBITDA numbers.

EBITDA 500

Net debt possivel 2.5B

Net debt atual 1B

Conclusion

Now that you’ve read it, which of these 4 companies do you think is the best investment right now? Let me tell you what I think.

HP and Richelieu are simple businesses to understand. HP seems to be cheap, Richelieu doesn’t. Yellow Pages is a melting ice cube. Formula One is the difficult one to get an opinion on.

Having said that, I’m thinking that HP could fit nicely in the Portfolio.

As in the prior week, I would be grateful if you could answer the survey below (it’s anonymous). Some of you have done it already, but many haven’t. Remember, without your feedback, I can’t improve the subscription.

To comment on each of the profiled companies, please visit Richelieu Hardware, Yellow Pages, HP, and Formula 1.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.