Qurate Retail

and the future of e-commerce

By Manuel Maurício

October 28, 2021

A couple of weeks ago I wrote about Qurate Retail and deferred a decision to buy (or not) to a later date.

I wanted to understand the dynamics of e-commerce in general and where the Livestreaming e-commerce in particular might be heading.

I’m glad that I postponed my decision, in part, because Gonçalo Garcia alerted me to some complicated details of the balance sheet which I had missed.

He was also kind enough to spend some time with me brainstorming about the implications of such details. It’s a great pleasure to have subscribers like him. Thanks Gonçalo!

First off, let’s start by defining Livestream e-commerce (or shoppertainmnet as some call it). I’ll let Feifei Liu do the honors as she put it much better than I could:

“Livestream ecommerce is a business model in which retailers, influencers, or celebrities sell products and services via online video streaming where the presenter demonstrates and discusses the offering and answers audience questions in real-time.

A livestream session could take place on an e-commerce website or on a social media platform. It can be store or brand-specific; influencers can also host livestream events promoting items from various vendors.” Feifei Liu – Livestream Ecommerce: What we can lean from China

Livestreaming e-commerce refers to a nascent way of selling stuff aided by technology allowing you to buy the items directly from an app with just a few clicks.

For the sake of simplicity, I’ll use the word “livestreaming” to refer to livestreaming ecommerce.

China

China is years ahead of the western countries in what relates to e-commerce and livestreaming (wink wink Diogo Gonçalves) so it’s only natural that we look at the nation of the rising sun to understand how Live streaming might be evolving in the West.

The big name in livestreaming in China is Alibaba, most specifically its Taobao Live platform with roughly 35% market share. If you haven’t read my write-up on Alibaba, Taobao is Alibaba’s core marketplace and it only works inside China. That’s the reason why most people in the West have never heard about it.

At some point, Alibaba understood that livestreaming was the way to go so they made it the most important feature in their platform. And with it, a whole new industry was born.

It’s estimated that there are around 85 thousand companies working in the Live streaming industry, of which 60 thousand were created in 2020. This goes to show the tremendous growth that the industry has seen during the pandemic.

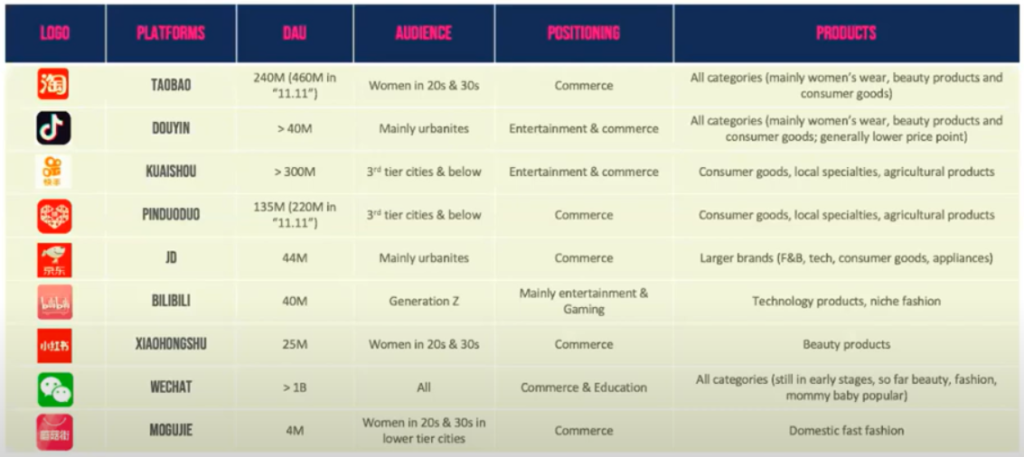

Today there are many platforms offering livestream e-commerce, each of them focused on a specific niche – from young women in major cities to restaurant owners in 3rd tier cities.

Depending on who you ask, the size of the industry is estimated to be somewhere between 157 and 261 billion euros in 2021. And that’s for China alone.

Spearheading this crazyness is a narrow group of influencers – which in the world of Livestreaming are called Key Opinion Leaders, or just KOL‘s – who are widely popular in China. The two most famous ones are Viya and Li Jiaki or “Lipstick King”. As you can see from the twit below, the numbers that these two are responsible for are just crazy.

The question then arises. Will the Livestreaming industry in the western world evolve to a model similar to that of China?

Competition and ecosystem

Although it isn’t hard to imagine a world where retailers, influencers, and celebrities will all be livestreaming and selling their products online, that model isn’t yet widely available in the the western world.

As I’ve mentioned previously, Amazon tried to launch a livestreaming platform back in 2017 called Style Code Live, but it was a flop.

Today there’s Amazon Live, but it still isn’t a big thing. Maybe because Amazon hasn’t yet taken it serious enough as Alibaba when it made it the core feature of its main marketplace.

Why hasn’t livestreaming e-commerce become popular in western countries?

We could point to a plethora of socio-cultural reasons but the most likely ones are the advanced stage of online payments in China and the advanced stage of e-commerce (especially on the distribution side) in China.

From my somewhat limited understanding of the payments technology, I believe that it isn’t an issue anymore. Maybe there’s still some attrition with payments within some apps, but I don’t see that as a major hindrance to the adoption of livestreaming.

What was really holding back livestreaming in my opinion was 1) the speed of delivery (being solved by Amazon and a bunch of other logistics companies) and 2) the shift (by social media and ecommerce companies) to having shops inside their ecosystems completely integrated with catalog, payments, etc.

Take Facebook as an example. Right now, Facebook relies on the advertising dollars that are generated by having millions of eyeballs on its apps all the time. But Facebook is already shifting to more of a marketplace model similar to that of Alibaba.

In fact, just this week Facebook announced a partnership with big retailers such as Walmart and Macys.

In a few years from now, Facebook could also be generating revenue by taking a cut of what’s sold inside its platforms.

The other big boy in town is Tik Tok. I have yet to understand why hasn’t Tik Tok adopted all the functionalities that its twin app Douyin has in China, but we should be seeing Tik Tok becoming one of the top players in Livestream ecommerce in the years to come.

Platforms

So how will this affect Quarte Retail in the next, say, 10 years?

I have become more and more cognizant of the fact that the barriers to entry that have protected QVC for years might be vanishing.

Whereas up until recently, to sell something through Livestreaming one would have to go through QVC (or its competitor HSN, which Qurate bought a couple of years back), in a few years everyone will be able to sell online.

This will be empowered by both e-commerce and social media platforms alike.

This democratization of the media reminds me of what happened to the big brands of the past and their monopolistic dominance of advertising. Small brands could still advertise in local papers, but if they wanted to reach a client in another country (or state) it was pretty hard to do it.

That was reserved for the big brands who had the dollars to launch national and international campaigns.

Once Facebook and social media came into existence, suddenly even the smallest of companies had the opportunity to advertise to their specific customers.

It was a major shift that lead the big brands, who once enjoyed scale advantages, to suddenly be threatened by smaller, local brands (Kraft Heinz is a good example of that).

QVC and HSN had a monopoly on Livestreaming commerce. Whereas in the past, you needed studios, producers, administrative people, analytics, and a distribution network, now you just need a phone and maybe a couple of lights (at least, in theory).

We’ve finally reached a point where you don’t need to own the distribution network as there’s several players offering theirs so you can focus on finding your client and selling your product.

Suddenly, QVC isn’t the only game in town. Competition is coming. There will be a lot of platforms, production companies, brands, and influencers entering this space in the near future. Whose going to be the winner, I’m not sure.

But don’t get me wrong. I’m not heralding the end of QVC.

If there’s someone in the world who knows a thing or two about media, that’s John Malone (and the rest of the management team). These guys sure aren’t sitting idle waiting for the Facebooks and Amazons of the world to come and take their customers away from them.

In fact, Discovery Communications – another giant business of which Malone is a director – recently bought Revision3, an internet media company that owns Internet TV channels such as Tekzilla or Epic Meal Time.

Also, QVC is expanding into all the other platforms to be “where their customer wants them to be”.

A question that I had when I started researching the Livestreaming e-commerce in China was about the distribution network needed to support all the transactions.

Apart from recent strides into distribution, Alibaba doesn’t own fulfilment centers like Amazon does. It relies on the distribution networks of other companies. So how do they guarantee that there are no frauds, no bottlenecks in inventory, or that your order is on time?

It turns out that Alibaba and all the other large platforms partner with Multi Channel Networks (MCN’s).

What are MCN's?

These Multi Channel Networks are intermediaries that stand between the influencers, the brands, and the platforms. They assist with product, programming, funding, cross-promotion, digital rights management, etc. They’re like the producers making it all happen.

The influencers working with these MCN’s get more traffic and don’t need to worry about a whole bunch of things outside their circle of expertise.

So do the platforms as the MCN’s will function like a filter preventing frauds and like a school teaching the influencers about filming, lighting, etc. MCN’s are beneficial to both sides.

In fact, in China there’s hardly any KOL (or influencer) still doing it on his/her own. Apart from the top KOL’s that is. Those have their own teams, sometimes with hundreds of people (these teams are, in essence, private MCN’s).

A brand wanting to advertise online on any of the Livestreaming platforms will reach out to a MCN and tell the MCN what it wants to sell, what demographic it wants to reach, what discounts it’s able to give, and the MCN will find the right KOL for that specific job and handle all the technicalities.

I can’t help but to ask if QVC is becoming just another MCN in a world filled with MCN’s? If so, what could its competitive advantage be?

Will QURATE be able to adapt?

After all this talk about livestreaming, the question is, how will Qurate Retail fair in this new world that is coming?

From what I’ve heard coming from people familiar with both models, QVC isn’t there yet. And this is assuming that the Chinese model will be successful in the West.

Right now, QVC feels more like institutional advertising, like if it were pre-recorded.

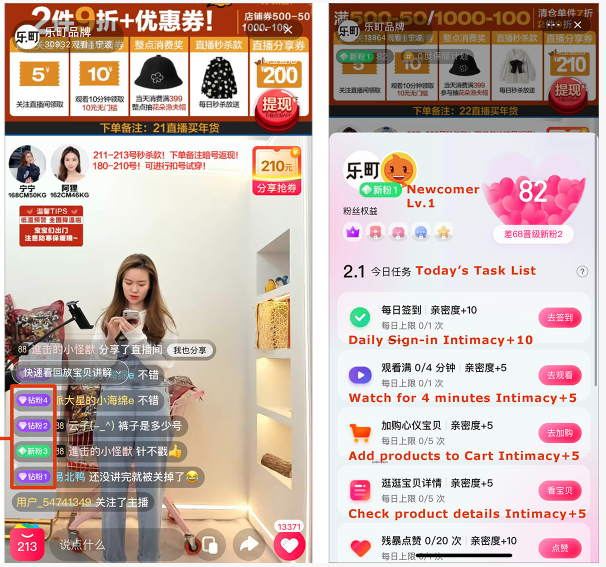

The success of Livestreaming in China is closely related to the informality of the streams and the proximity to the hosts.

They’re just regular people who you can relate to. Mix that with copouns, loyalty rewards, interactivity, and gamification and you get a much different result from the regular QVC stream.

QVC CEO Mike George, is of the opinion that the model in the West will be materially different from that of China.

Whereas in China the industry is dominated by a few major platforms and influencers (mostly on mobile), in the West people consume content through a bunch of different channels.

“I think it’s still early days to see exactly how this industry is going to evolve. I do think it’ll look different than in the east. In the east, what you’ve seen is a few big players that have these monstrous platforms filling a void and a gap and drawing these big audiences.

They tend to be a little bit more personality based models. The economics are a little bit challenging and they’re very much dependent on one or two big scale players to provide the viewers and the platform to aggregate large audiences.

The challenge that I think players in the west are finding, and that we have certainly learned over the years is a very fragmented series of ways in which people consume video content, live TV still matters, but there are hundreds of channels, many different kinds of providers of live TV, and then all of these different digital and social platforms.” Mike George, Qurate CEO

Also, the hosts that you see on QVC are typically much older than the hosts in China.

This is pretty interesting as it touches on the new plans that Mark Zuckerberg has for Facebook. On the last Conference Call he said that Facebook’s focus will be shifting to young adults aged 18-29. But this isn’t the age cohort that typically has the higher disposable income. And QVC management knows this.

In fact, although I applaud Zuckerberg’s vision to go after the younger crowd, I also admire the maturity with which Mike George says that QVC will be sticking to its core audience of women 35 and older.

Some say that this demographic is getting old and shrinking, and that QVC must expand to a younger crowd. Does it? I honestly don’t know.

Here’s a quote by the CEO Mike George taken from a recent interview:

“I think what a lot of livestream shopping folks miss is they’re trying to sell you something in the moment with technology, a flashy influencer and slick production values,” says George, who says his viewers often watch hours and hours of programming before springing for a purchase.

They’re not establishing any connection, relationship or intimacy with you. They’re not enticing you to come back tomorrow to discover something new. That is the magic of what we try and do.” Mike George, Qurate CEO

This is very interesting, especially when Mike has mentioned that many have tried to get into the livestreaming business, but there’s still only one QVC.

Maybe it really isn’t that easy to breakthrough in this industry.

Balance Sheet

As mentioned at the beginning of this write-up, there’s yet the subject of the exchangeable debentures. Yeah, a mouthfull.

I’ll try to keep it simple as this is highly technical. For those of you who are not fond of financial technicalities, you can skip to the conclusion.

Basically, Qurate issued exchangeable debt back in the 2000’s that will mature in 2029, 2030 and 2031. The issue with these bonds (or debentures) is that they are exchangeable, at the holders option, for a predetermined number of shares of Motorola, T Mobile, and Lumen.

The problem with that is that the number of shares is fixed, not the dollar amount. If the underlying shares go up in value, Qurate might be owing much more than originally anticipated.

Take for instance Motorola. If the holders of the debentures wish so, they’re entitled to 5.26 shares of Motorola for each debenture (originally worth $1000).

Right now, each share of Motorola is worth $250, meaning that the holder of each debenture could, right now, ask Qurate for those shares worth $1315 (a $315 gain).

Now, it’s not usual for the holders of such debentures to redeem them before maturity (could be good or bad, depending on where the Motorola stock price is heading).

This is obviously a risk for Qurate as the management doesn’t really know how much it will have to pay back.

Luckily, Qurate’s Chairman Greg Maffei is known for being one of the most savvy financiers in the business so he hedged those debentures with a financial instrument called Total Return Swap. This means that, for a small fee, Qurate will be safe should the Motorola shares go up in price.

Attached to this, there’s also complicated deferred taxes that must be paid when the debentures reach their maturities. I have no idea how Maffei will handle those liabilities, but he’s surely thinking of creative ways to do it.

A fellow shareholder of Qurate told me that, given these extremely complicated liabilities, he would never invest in Qurate if it weren’t for such a top notch management team.

I’ve asked for a call with the company in order to learn about these liabilities. They’ve replied saying that they can only do it after the Capital Markets Day on the 19th of November.

Conclusion

All of this to say that I haven’t yet gained the conviction to buy Qurate. And I’m not really sure why since the math is so appealing.

The company is cheap (trading at 4x cash flow) and the management has already expressed their intention to return all of this year’s cash flow to the shareholders. That’s 25% return in a few months. That’s amazing.

But somehow I find myself trying to convince myself that this is a good buy. And when that happens, I’ve learned to just let go and don’t worry about it anymore.

After doing all the work, if the conviction is to be gained, it will come naturally. Yeah,I know, kind of philosophical, but it works for me, so…

Having said all of this, I’ll keep following Qurate and the livestreaming industry very closely.

*If you have any insights on livestreaming that are not expressed here, do share them (on the FB group, please) as the more information and brainstorming, the better.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.