Redishred

2019 Q3 Results

December, 04 2019

TICKER: KUT

ISIN: CA7574891098

SHARE PRICE: $0,9

MARKET CAP: $73M

INTRODUCTION

Redishred is one of those businesses that will drive the action-thirsty investors crazy. It’s not as if the paper shredding business changes quickly. On the contrary. This is an ol’ boring business that will test anyone’s patience. That’s why I love it!

The company has released its Q3 results recently so I’m taking a quick look at them.

Let’s see where the price is today compared to when I first discovered this company.

The first time I wrote about Redishred the price was CAD$0,94 while today it’s CAD$0,9.

REVENUE

The revenue has been rising steadily and this year I expect it to reach $21,5M growing 55% from last year. Most of this growth is related to the recent acquisitions.

Let’s look at the company-owned sales breakdown.

Most of the revenue comes from the Shredding Service and just 14% of sales comes from the recycling and sale of SOP (Sorted-Office-Paper). Again, due to recent acquisitions the revenue from shredding has increased massively.

PAPER

And although we can see a growth in recycling revenue, the truth is that we’re witnessing historical lows for paper price.

Paper is a commodity, and as such, its price goes up and down and no one really knows what it will do next. Even Jeff, the CEO, has said that if he knew, he would be playing that game instead of this one. But he doesn’t know. So we can’t predict this part of the business.

What we can do instead is look at the tonnage sold. This will tell us how the operating part is going, regardless of what the price is doing.

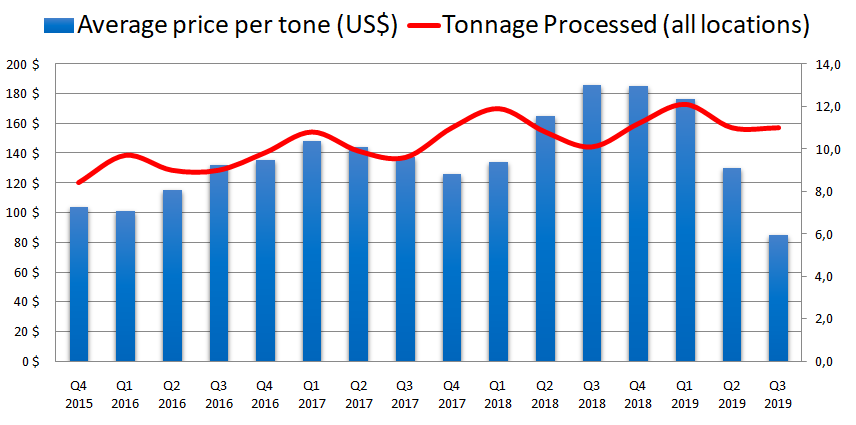

There are several things that I take from the chart below. The first is that the paper prices are really low compared to what they’ve been historically (blue bars). Although I’m not showing prior quarters here, I went and looked as far back as 2009 and this is the lowest it has been since.

The largest buyer of SOP (Sorted-Office-Paper) is China and with all this trade-war going on prices just plunged. Although no one can predict where prices are going next, the CEO is hopeful they stay low. Why do I say hopeful? We’ll talk about that in a minute.

The second thing I take from the chart below is that there is some seasonality to the tonnage sold (red line) but the long term trend indicates a modest but steady growth. When prices go back up again, this will give a pretty good boost to the total revenue.

SYSTEM SALES

The total system sales have dropped from $11,7M in Q2 to just shy of $11M due in great part to the Recycling segment that has gone from $2,2M a year ago to $1,2M this year.

If we compare the lowest points in this chart to the lowest points in the previous chart, we can see that the paper price has some influence on short term sales, but in the long term, it doesn’t matter that much.

The management’s plan is to reach 70% of scheduled sales so most of its revenue becomes recurring. Right now, those $5,7M (red bar) represent 50% of the total system sales. There’s still a long way to go.

We’ve already looked at the system-sales by service, let’s now look at the system-sales by location type.

We can clearly see the corporate locations gaining ground to the franchised ones. Why? Mostly because the company is buying those franchised locations.

If we look at the EBITDA margins, both are consistent to what we’ve been seeing in recent years.

The operating profit is also on the rise although the operating margin is likely to come down to 10% at years end.

And if we look at the income from operations (not accounting for corporate expenses), we see that there’ll be a slight growth in 2019.

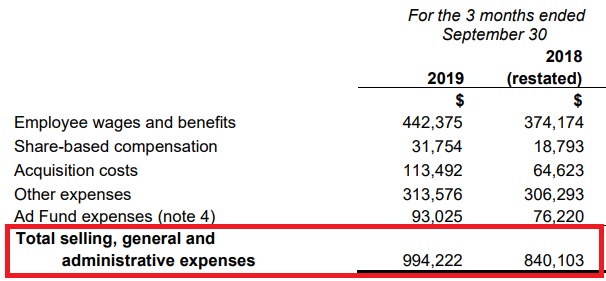

I was hoping that the massive revenue growth would translate into profits but it was offset by higher costs as well. SG&A was higher due to new hires and the costs related to the Chicago acquisition.

THE GRAND SCHEME OF THINGS

The current situation – with the paper price so low – is the perfect setting for this company to grow.

On the Q3 Conference Call, Jeff, the CEO, repeatedly said that there are a lot of small independent firms to whom this drop means serious losses.

And on top of that, there are a lot of them that just don’t have the balance sheet to sustain losses for more than a few quarters. So Jeff is actually hoping that the paper price stays low for some time so he can buy them on the cheap.

I’ve already seen this happening in my home country of Portugal with Corticeira Amorim, the world leader in the production of cork stoppers. As the strongest, company it took (and keeps taking) advantage of bad times to swallow up its weaker competitors. And do you know what has happened to Corticeira? It has become a twenty-bagger in ten years (also because its multiples were really low and they’ve expanded since).

It’s interesting that Jeffrey has hardly talked about expansion through franchising on the Conference Call. As I wrote on my first analysis, there just isn’t a lot of interest out there to operate these paper shredding businesses… which is actually a good thing for Redishred. Redishred can buy its smaller competitors for 50 cents on the dollar. Clearly, the way to go now is by acquisitions and organic expansion in the East Coast (where they can really get route density – an important metric for this business and for businesses like last-mile-delivery or postal services), not through franchising.

Recently the company raised $11,25M through a private placement at a price per share of $0,95 (in which the insiders have participated) leading to a cash balance of $16M at the end of September.

In the meantime, the company has made its largest acquisition so far. The Chicago location for $14M of which part was settled in cash and part in earn-out (to be paid depending on the achievement of certain operating milestones). This acquisition was done at a multiple of 7,3x, much higher than the usual 4x to 6x due to the unusual size of the acquired company. I estimate that in 2019, Proshred Chicago will generate $5,4M in revenue and around $1,9M of EBITDA, but as it was bought just recently, we won’t be seeing that contribution just yet.

Subsequent to this acquisition, several of the credit agreements were revised (on better terms) and an advance of US$5M on a line of credit was made in November. This means that we should be seeing yet another (or several) acquisition soon.

Let’s say that the company spends those CAD$6,65M (US$5M) in acquisitions, which at an EBITDA multiple of 6x would mean the company would be buying CAD$1,1M in EBITDA or revenue of CAD$3,7M (assuming 30% margin) for a Price/Sales multiple of 1,8x.

This would mean that the company could reach the end of 2020 with revenue of CAD$30M (adding 2019 revenue + Chicago 2019 + new acquisition) or EBITDA of $8,92M, corresponding to a 2020EV/EBITDA of 9,5. To me this is neither expensive nor cheap but we should remember that in 2015 Stericycle (the largest competitor) bought Shred-It for 12x EBITDA. At that valuation, Redishred would be worth $1,4 for an upside of 50%.

All of this to say that I still like this company, I like its prospects and I will keep following it closely.

By the way, the new All in Stocks subscription service will be launched in January. If you want to gain access to my best investment ideas, click the link below.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431

Recent

[the_ad id='17156']