Redishred,

a fundamental analysis!

Redishred,

a fundamental analysis!

September, 09 2019

TICKER: KUT

ISIN: CA7574891098

SHARE PRICE: CAD$0.94

MARKET CAP: CAD$64M

September 06, 2019

TICKER: KUT

ISIN: CA7574891098

SHARE PRICE: CAD$0.94

MARKET CAP: CAD$64M

1. INTRODUCTION

I love to find multibaggers in the making. It was the case with The Joint and it seems to be the case with Redishred. I’ve even seen other investors comparing it to The Boyd Group and Envirostar. If you don’t know these two, I recommend you to take a look. Just follow the links and then click “max” on the chart.

After taking a look around at the company’s website and reading the latest presentation and the MD&A, I must take my hat off to these guys because they can put to shame even some of the largest companies in the world. The level of detail and information they put into their filings is nothing short of amazing.

As always, a word of appreciation to anoop who brought this one to my attention. (I love the fact that there is this unwritten rule among investors which sways us to credit the people who helped us with the research. It’s so “gentlemanish”).

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

Redishred Capital is the owner of ProShred Security, a provider of on-site shredding services.

How does the shredding business work? Customers (law firms, accounting firms, medical institutions, etc) deposit their confidential documents – which need to be destroyed – in locked office bins, then a redishred employee comes in, takes the bins out to the shredding van that is parked outside, shreds the documents and mixes them with other shredded paper. The company then sells this paper to paper brokers. It couldn’t be simpler.

The shredding can be scheduled, which means recurring revenue but lower margin or it can be unscheduled which has a higher margin but it’s harder to predict. Investors tend to prefer the recurring nature of the scheduled model and that’s one of the reasons the management team is pushing to increase the scheduled revenue from the current 50% to 70% of total revenue. The average customer spends $100 per month for one visit and the shredding of 3 to 4 bins.

The company operates its own locations but it also works as a franchisor, and as such, Redishred makes money from the initial franchise and license fees paid to secure territories (US$35.000) as well as from royalties paid as a percentage of the franchisees monthly revenue which are 6,5%. As in other franchising businesses, Redishred also collects fees for advertising (1-3%) and IT services (1,5%).

2.2. LARGEST SHAREHOLDERS

Among the largest shareholders there are a lot of insiders. Collectively they own more than 20% of the company so the quick test for alignment of interest has been passed.

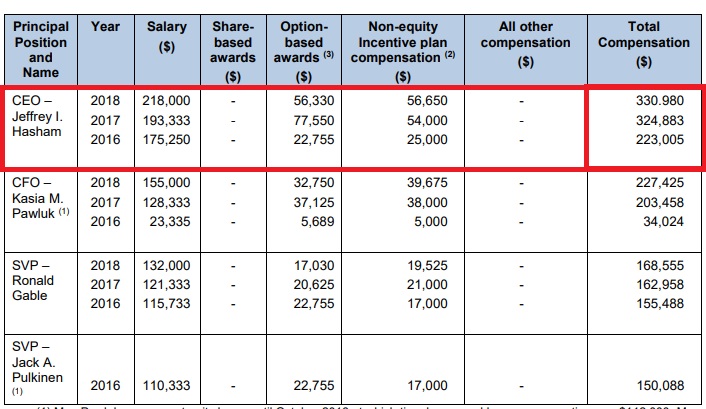

2.3. MANAGEMENT TEAM

The CEO is a chartered accountant. Whenever I find that an accountant is running the business I remember the infamous finance teacher Aswath Damodaran saying that investors should be wary of companies where the CEO is an accountant. He definitely didn’t hear about the Boyd Group.

Jeffrey, the CEO has earned a total compensation of $330K in 2018 which is around 2,2% of sales. It seems perfectly reasonable.

I’m making a spreadsheet where I record the compensation figures for different management teams so I can have a better framework when analysing this metric. If you’d like to help just send me an email or a message on Facebook.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

At the end of the first day of trading back in 2007 the share price was at $0,65 and the current share price is $0,94 but from the all time low of $0,02 in 2013 until today, the stock price has multiplied by 47x!!!

3.2. MARKET CAP AND SHARES OUTSTANDING

The common wisdom says that one of the bigger risks for microcap investors is dilution. For the most part, I agree with that but if a management team finds that its own stock can be traded (directly or through raising cash) for undervalued businesses or assets, that can work wonders to shareholder value.

So what we’re seeing here is a lot of dilution in the last three years. The company has issued new shares through private placements in order to fund its growth.

On the other hand, it’s good to know that insiders bought stock in the latest capital raise that took place in July 2019 at a price of $,95 which resulted in a total amount of $11,25M raised.

Note: All currency in CAD unless stated otherwise.

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

At this point, and before looking at the revenue chart, I should remind you that this isn’t a hot tech company. This is a boring old paper shredding business. The fact that its revenue has grown at 23% CAGR for the past seven years is nothing short of amazing.

About half of the sales are scheduled which means a lot of recurring revenue. The other half is divided in unscheduled sales (30%) and recycling (20%). The margins are steadily increasing due to the asset light business model. The highest costs Redishred has are labour and truck maintenance.

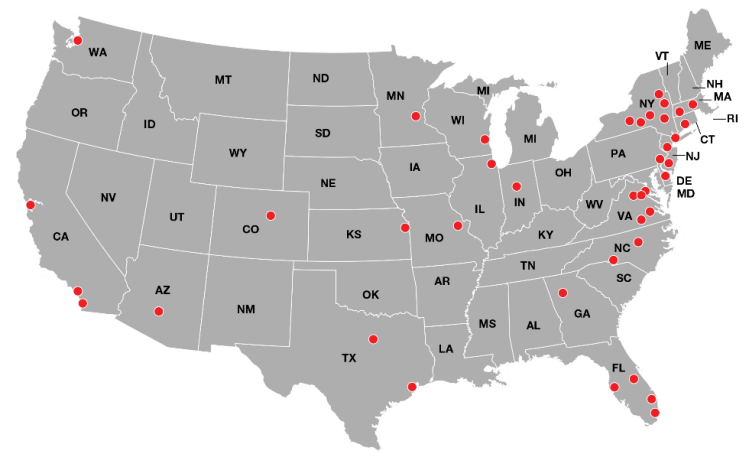

3.4. LOCATIONS BY GEOGRAPHY

Almost all of the company’s revenue comes from the USA. They are clearly concentrated on the East Coast.

3.5. RELEVANT OPERATING METRICS

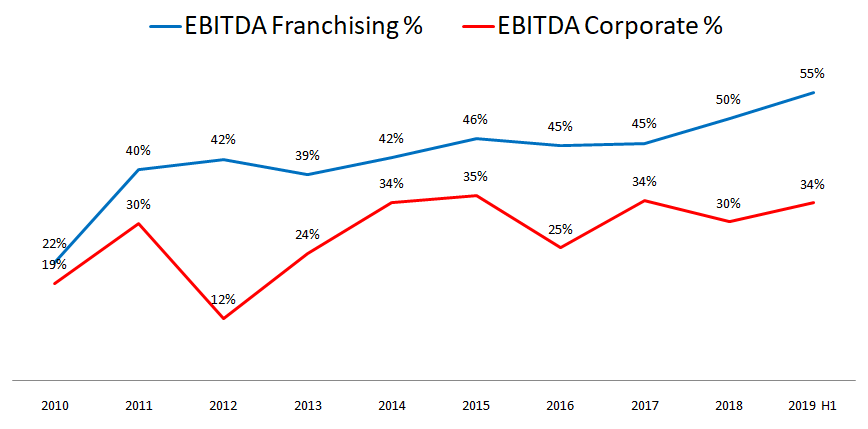

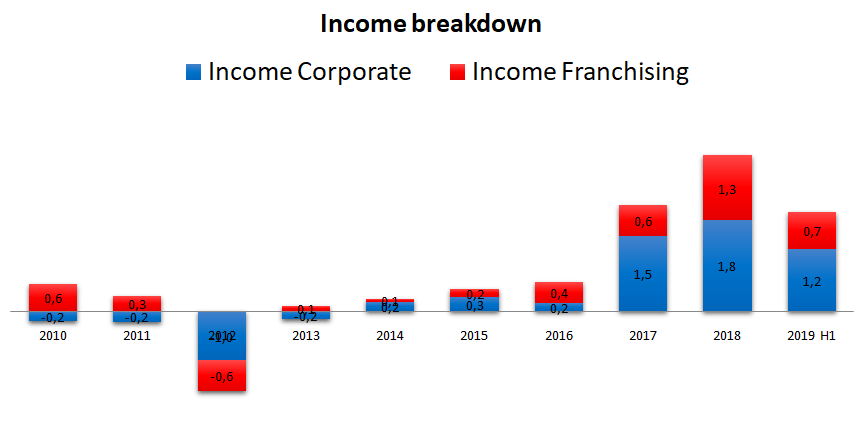

Most of the revenue growth comes from the corporate locations…

…and as expected in a franchising business, the EBITDA margin of the franchising segment is higher than that of the company owned locations (the franchisor doesn’t have to run each location) but I am positively surprised by the high margin the corporate locations show in a business that should be a commodity-like business (people don’t really care about who is taking the trash out as long as it is taken out so price is one of the differentiating factors, usually leading to lower margins).

This leads to a consolidated EBITDA of around 30% in 2019 which for a commodity type business is A LOT!

Let’s dig deeper and add some granularity to this. This is the part some of you will probably want to skip to the next section.

If we look at the franchisees revenue breakdown, we see that the bulk of the revenue is coming from the royalty and license fees and that the initial franchise fees are just a small part of the whole.

On top of this, due to new accounting rules, the company started to recognize the franchise fees along a period of time and not at a point in time as before. All thing being equal, it will appear that the growth in franchise fees is lagging behind compared to previous years.

Looking now at the corporate stores, the shredding service is the main contributor to revenue. I just love to see a chart like this. It seems that there is only one way for this to go. I know, I know. I can’t just blindly project the past into the future but given the recurring nature of the revenue, I think it’s fair to assume that there is a high probability for this trend to persist.

And if that is the case, if we just annualize the H1 revenue, the total revenue for 2019 originated from the company operated locations will grow to $19M which would represent a 55% increase year-on-year!!!

A word of caution here. The recycling revenue is highly dependant on the price of SOP (sorted office paper) and this has been in decline in recent quarters given that China is the largest buyer and we know how the relations between China and the US have soured recently.

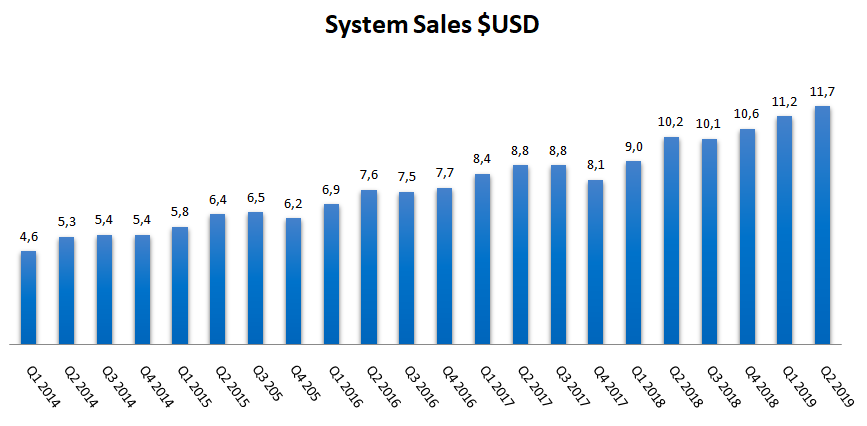

3.5. SYSTEM SALES

The system sales is the total revenue combining franchised locations and corporate locations. If we look at the chart below we can see that the trend is positive and that on the second quarter of 2019 the company has reached record system sales of $11,7M USD.

But what if the company is growing by acquisitions and it’s the new stores that are bringing all the new system sales? To clear this doubt we should be looking at the Same Store System Sales.

Still the same story here. Regular growth. The same store growth rate was 12% in the first half of 2019. Really solid numbers.

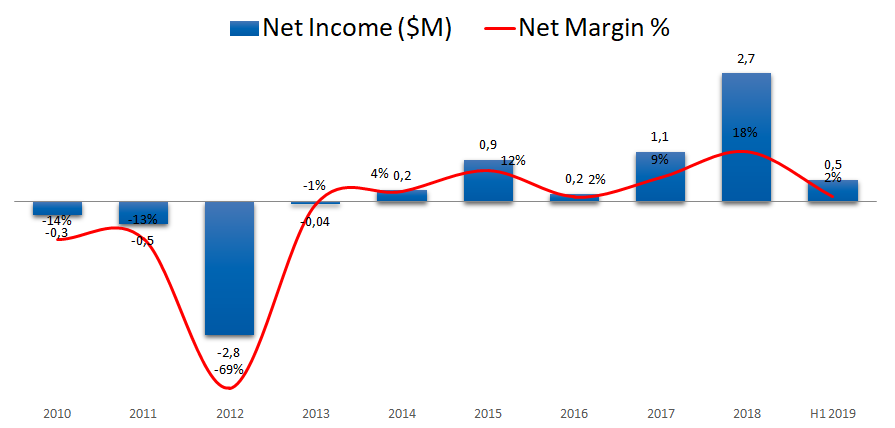

3.6. NET INCOME

Let’s now take a look at the bottom line, the net income.

What we’re seeing here is a company going from a “startup” stage to the beginning of a recurring revenue growth company.

If we were to look at the 2019 first half net income we would probably be thinking that with higher sales, there must’ve been something going wrong with the operations that lead to such a depressed net income.

If we weren’t diligent investors we would probably think that the company is incurring in new, grater expenses to get those ever greater sales. But if we look closer we can find that at the locations level, the profits are still rising and they seem to be on track for a record year.

The reason for such a low net income in the first half of 2019 was a foreign currency effect that offset a lot of this growth. You see, this is a Canadian company whose business is virtually all located in the US so there is the risk of foreign currency affecting the results.

It is highly beneficial for the company that the USD goes up in value compared to the Canadian dollar. That way, each USD dollar that the company earns, when converted, will bring a lot more Canadian dollars to the company’s pockets.

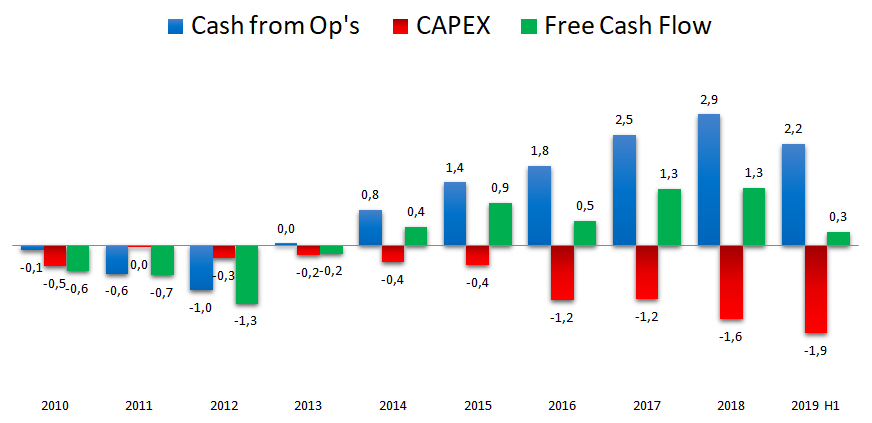

3.7. CASH FLOWS

But let’s compare this to the cash that is being generated. The cash from operations has been growing since 2012 and if we double the H1 numbers, we will get $4,4M at years end.

This is the FCF the company is generating AFTER capital expenditures for growth. If I were to compute maintenance FCF we would see that the company is able to generate much more cash.

The higher Capex was related to the buying of 4 new trucks.

The management says that a truck in the southern states can last for more than 10 years with little maintenance while trucks in the northeast can be in a poor state after 7 years because of the weather, road conditions and commuter type of route. The average age of the company’s trucks is 4 to 5 years old and the management intends to keep it that way.

3.8. DIVIDEND

The company doesn’t pay a dividend.

3.9. PROFITABILITY RATIOS

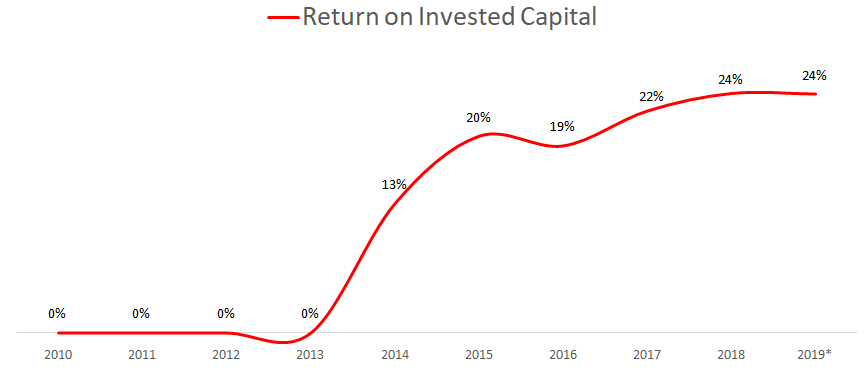

This time around I’ve decided to calculate the Return-on-Invested Capital for Redishred instead of the Return-on-Equity. The ROIC has slowly been rising up to the current 24% which goes to show the quality of the business.

And here’s the ROIC for the corporate locations:

Like many other investors out there I’m increasingly paying more attention to the return a business can get on its invested capital.

The theory says that in the very long term it doesn’t matter how much you pay for a company. Your returns will tend to approximate the ROIC. Well, if that’s true, I’m very happy to get a 24% rate of return on my investment.

3.10. BALANCE SHEET RATIOS

The current ratio is now 1,5 and the debt to equity ratio is 0,6 so the balance sheet is quite healthy.

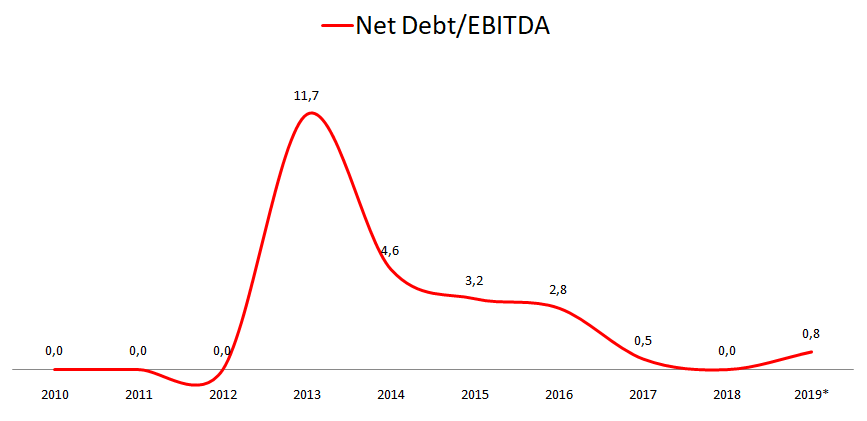

and if we compare the net debt to EBITDA as the bankers like to do, we can see that the company used the cash raised from the investors to pay down debt and still has room to ask for more if that’s the case.

In fact, at the end of the 2nd quarter, the company had $6,2M in cash and an undrawn bank loan of US$5M so I think we can expect further acquisitions going forward without the need for further dilution.

Also important is the fact that the company has incurred in $3.7M NOL’s that can be carried forward to reduce taxes payable in Canada and US$3,2M that can be carried forward to reduce taxes payable in the US.

3.11. PRICE RATIOS

So, is it cheap? Surely such a good business must be trading at a steep valuation.

Well, at a 2019 EV/EBITDA of 9x I would say that Mr. Market isn’t overvaluing this company but he might be undervaluing it.

Is it tremendously undervalued? I wouldn’t say that but for such a high quality business with recurring revenues which have been growing at 23% for the past 5 years and that will grow 50% in 2019, I think we can say that this is a great business at a fair valuation.

Shred-it, the largest shredding company in the US, was bought by Stericycle for 12x EBITDA and Recall Holdings was bought by Iron Mountain (the second largest competitor) for 10x EBITDA.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

If we were to look at the numbers alone we would likely think that the company should be increasing the number of franchisees because these have less expenses thus higher margins and returns-on-capital.

Given the industry specifics, the fact that the sons and daughter of all the shredding mom-and-pop shops out there don’t want to keep their parents’ businesses and the widespread idea that paper use is in decline (which is obviously true), the best thing the company can do is to acquire existing locations at great prices and successfully integrate them.

That’s the beauty of this business. Although the Tangible Addressable Market (TAM) is decreasing ($3,6B industry), it still is a highly fragmented industry (with more than 1000 independent operators) and the competition is steadily decreasing. This way, Redishred can go on increasing its market share. It reminds me of Altria (the maker of the Marlboro cigarettes) who is an amazing compounder in an ever shrinking universe of smokers.

As I’ve said before, the largest competitors are Stericycle and Iron Mountain but both of these are off-site shredders which means that they have centralized shredding plants and because of their size, their clients are big firms, not the small companies Redishred is aiming at.

4.2. SEASONALITY

There is some seasonality to the business especially in the unscheduled segment where the 2nd and 3rd quarters are stronger. One of the reasons for this is the need for accounting firms to shred confidential documents after their tax season.

4.3. TYPE OF PLAY

Redishred is a growth stock.

4.4. RISKS AND COMPETITION

- As any other roll-up, there is the risk of poor integration into the current platform and the risk of overpaying for new acquisitions.

- Dilution in the form of equity raises.

- Dependance on the price of paper.

- Foreign currency exchange.

- Low barriers to entry.

- Secular decline in the use of paper. This one is both a risk and an advantage given that there is this wrong idea that this is a dying business.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

I don’t usually like to invest in industries suffering from declining secular trends but I think it was Peter Lynch who once said that he loved to find growth companies in declining industries. At some point these companies would benefit from less competition and the industry would consolidate around a small number of companies.

I believe that’s exactly what we’re witnessing here. I think Redishred can go on like this for many years to come. The top risks I’ll keep an eye on are the dependency on paper prices and the low barriers to entry. Especially this last one is what I like less about this story.

Having said that, what multiple does a business growing at 25% yoy, with recurring revenue, 30% EBITDA margin, 24% ROIC, same location growth of 12%, more than 20% insider ownership, long runway, fragmented industry, low customer concentration combined with acquisition targets being sold at very cheap valuations should be valued at?

Let’s be conservative and say 10x. I believe Redishred is perfectly capable of growing at 20% yoy for the next 5 years leading to an EBITDA of $14M in 2024. At a 10x multiple, that would represent a $140M Market Cap which is more or less double from here leading to a 15% CAGR.

“The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine.” — Warren Buffett

If you’d like to follow our take on Redishred, you can join our community at our:

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431