Riwi,

Q1 2019 - Results

May, 16 2019

1. CONTEXT

Riwi’s results came out yesterday. Although I still have its story fresh in my memory, I’ll take a quick look at my first write-up.

2. RESULTS

Here are the:

3. Analysis

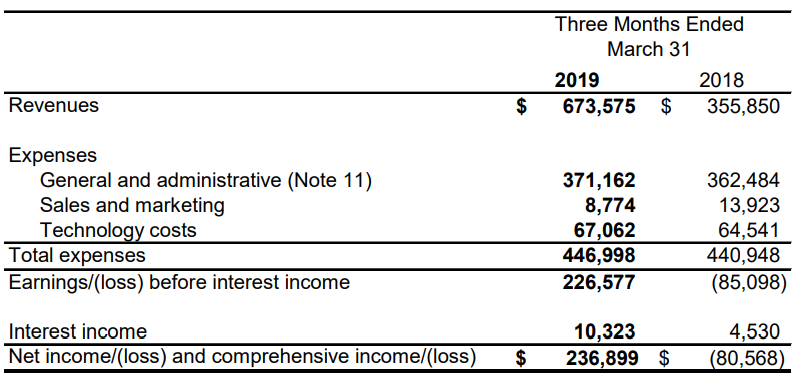

I’m going to try a different approach from the one I’ve been using so far. Instead of enumerating the positives and negatives, I’ll enumerate the relevant points sequentially, be they positive or negative. Here’s the income statement for this quarter:

3.1. Revenue

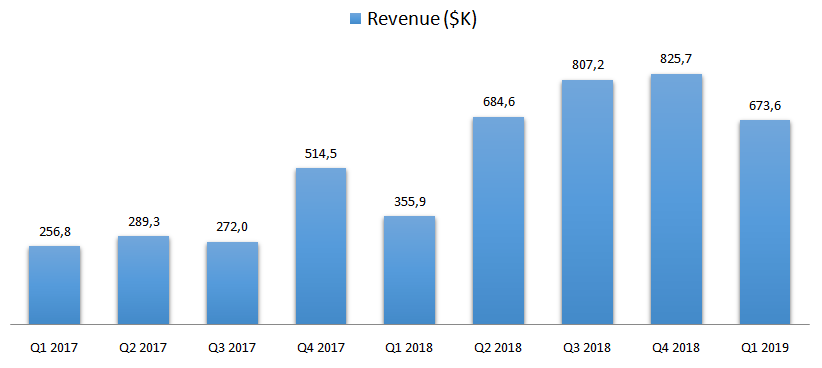

If you compare this quarter’s revenue of $674K with the Q1 2018 revenue of $356K, you might be happy.

If you compare it to the Q4 2018 revenue of $826K, you might be sad.

I’m a bit sad that this isn’t a linear growth story.

On my first write-up I’ve said that there isn’t a relevant seasonality to Riwi’s sales. I’m correcting that now. It seems that the first quarter is the weakest of them all.

3.2. Costs

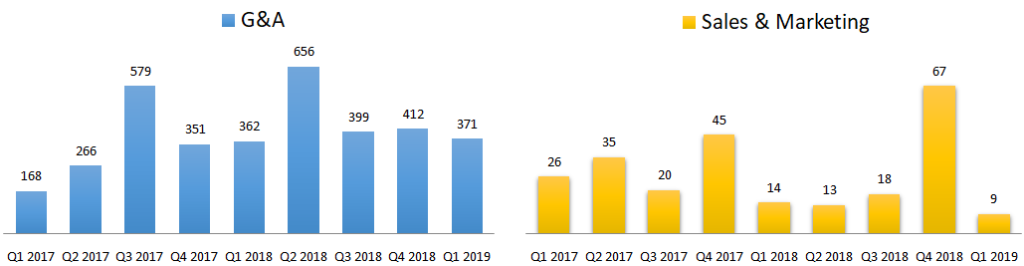

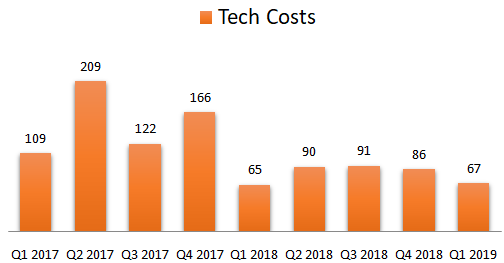

Expenses were mostly flat – year on year – which shows the scalability and operating leverage of the business.

The general and administrative expenses went up slightly due to higher salaries of new staff members. As the company brought the Sales and Marketing team in-house the related expenses came down dramatically.

3.3. Net Income

All of this led to a net margin of 35%, in line with what was expected. Again, the decline in the net income isn’t something I would like to be seeing but it is what it is.

3.4. Cash flow

Regarding the cash flows, we can see that the same is happening here. If you compare it to a year ago, you might be happy, if you compare it to last quarter you might be sad. But then again, this seems to be the slowest quarter so I think we should be comparing quarters on a year-on-year basis rather than sequentially.

3.5. Big Client

Finally we are allowed to know the name of that huge client the company had talked about in previous filings. It’s Bank of America Merrill Lynch.

3.6. US government shutdown impact

Aha, here is the main reason for the slow quarter.

The company says that due to the government shutdown they weren’t able to recognize certain parts of the revenue and that it also delayed the negotiation of new contracts. I consider this a minor bump in the road.

3.7. Growth prospects

The company maintains its guidance saying that the finance segment should grow at least 150% this year.

Regarding the Global Security segment the company says that it expects to see sustained growth over the next 5 to 20 years. For me this is a bit hard to understand. Although I like that a company has a long term focus, I’m not sure how they can predict (pune intended) the changes in technology so far ahead in time.

They also say that RIWI is eligible for multi year contracts ranging from $1M to $20M. Let’s remember that the current market cap for RIWI is around $52M CAD which is equivalent to about $38M USD. If and when the company lands one of these $20M contracts, we should see a considerable increase in the share price.

They also say they are expecting that other employees will get security clearances other than the CEO and CTO which shows that things are going well with the US Government.

And as before, they expect the Global Citizen segment to grow 150% this year.

3.8. The patent expiration date

I’ve been digging around and found out that the patent they have for their RDIT technology will expire in 2027. What does this mean? Does it mean that every other competitor will be able to reproduce what Riwi is doing now? I’m not quite sure about this and I’ll have to dig deeper.

Recently, Riwi’s CFO Daniel Im, reached out to me kindly letting me know of his availability to clear any doubt I might have regarding the company. I think I’ll take him up on his offer and clear this one out.

3.9. New patent

The company also says that both the CEO and CTO filed a new machine learning patent in the US. I’m not sure how this works but I need to understand if the patent will be issued to the two officers or to the company and what consequences can come out of that.

3.10. And a treat for the investors reading this

Riwi says that its technology helps analysts and investors find out things that otherwise would be very hard to. For instance Riwi helps “China long-short hedge funds trying to understand loyalty patterns of Chinese Millennials to products in order to predict the direction of Chinese equities.”

Reading this, I almost get traped in the pitfall of thinking I have no edge whatsoever against the big money, but then I remember that big money isn’t always the same as smart money. Riwi is the perfect example. Being such a small and illiquid company, all these hedge funds can’t get in.

4. OVERVIEW & CONCLUSION

4.1. OVERVIEW

I’ve got to be honest, I was expecting a higher revenue figure in this quarter so this part was kind of a disappointment. On the other hand, the fact that the costs were flat from a year ago reminds me of the scalability and operating leverage of this business. Businesses don’t follow Excel models so investors must understand that there will be good quarters and bad quarters. And it seems that this was a bad quarter just because of the US Government shutdown.

Fortunately the company tells us that they are discussing several new contracts with existing and new clients, and because I think this management team is of the highest integrity, I believe that we might be in for some good surprises in the near future.

The company still isn’t cheap on any metric but I’m not sure if we’ll ever see it cheap. Even with this slow quarter, I’m maintaining my previous estimates and I have no reason to believe the story will change.

And you? What’s your opinion about Riwi? You can tell us about it on our:

4.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

5. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.