Sprouts Farmers Market

a fundamental analysis

By Manuel Maurício

April 23, 2021

Symbol: SFM (NASDAQ)

Share Price: $26.55

Market Cap: $3.13 Billion

Slowly widening your circle of competence

I started this week by looking at the VMware spin-off from DELL. I set up a little Excel model to understand the valuation for both companies, I figured both were optically cheap, and then I decided to find out what VMware actually does.

I spent 2 days trying to understand it with limited success. I know that it develops software for Cloud providers where the software allows for several different users to be working on the same processor with different operating systems without any of them knowing about the other, but that’s it. That’s all I could understand.

The company obviously does a lot more than that, but I simply don’t have the mental bandwidth to get it.

With this feeling of ineptitude, I did what every intelligent investor should do; I went back to my circle of competence.

I had a list with a few companies that I wanted to look at, and Sprouts Farmers Market seemed simple enough for me to recover from the intellectual beating that I had just experienced.

A sad story for investors

If you look at the share price trajectory over the years, you’ll see that investors in Sprouts haven’t had many reasons to be happy. At least the long term ones.

This is the price you pay for a cheery consensus. Back in 2013, at the time of the IPO, Mr. Market was all crazy about natural products and he was offering 230x earnings for the company. It was even dubbed the best IPO debut since Linkedin. Then reality kicked in, the company didn’t reach the lofty growth expectations of Mr. Market and the multiples contracted to what can be called a cheap valuation today.

The business

Sprout’s calls itself a specialty retailer with a focus on fresh, natural, and organic foods, just like a farmer’s market. Think Whole Foods, but cheaper.

Unlike the typical retailer that displays produce (fruits and vegetables) right at the entrance of the store, Sprouts opts for a different approach where the produce is located at the center of the store with an open layout where everybody can see each other, just like in a traditional market.

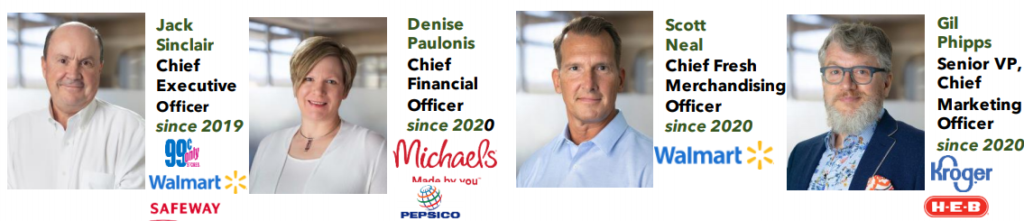

But a different layout isn’t enough to make a difference in one of the hardest industries there is. Back in 2019, Sprouts’ management was sacked due to poor performance, and veteran retail operator Jack Sinclair was brought in as the CEO who could turn it around.

Jack immediately begun analyzing the business to find out which levers could be pulled to put Sprouts back on the right track. He quickly devised a plan.

He brought in a new CFO, a new Chief Marketing Officer, a new Chief of Fresh Merchandising, a whole new experienced team.

The begining of a turnaround - Start with the distribution

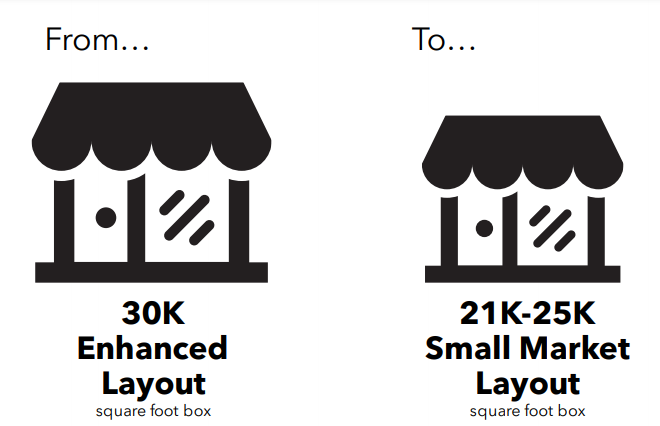

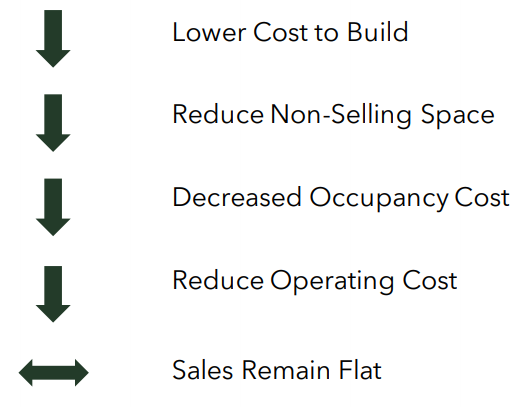

One of the problems that he found was that the company was expanding to larger locations with 30K square feet that weren’t exactly better locations.

He sought to fix that. He noticed that original smaller stores in San Diego were more profitable than the others, albeit with a bit lower sales. He decided to go back to the smaller locations with 21K square feet.

When asked if the smaller store wouldn’t lower their sales, the new CFO responded that it’s not the selling space that will shrink. It’s the backroom and areas such as the eat-in zone. Jack is known inside the company for constantly asking what’s the point of having tables and chairs to eat in if they’re always empty.

Smaller stores are less expensive to build and they have lower occupancy and operating costs. The company is also betting on their Deli and prepared foods sections for the turnaround. This is a good move. This is where Mama Mancini’s shines. The perimeter of the store is the growth area within food retailers and people perceive those products as being higher quality, thus supporting higher margins.

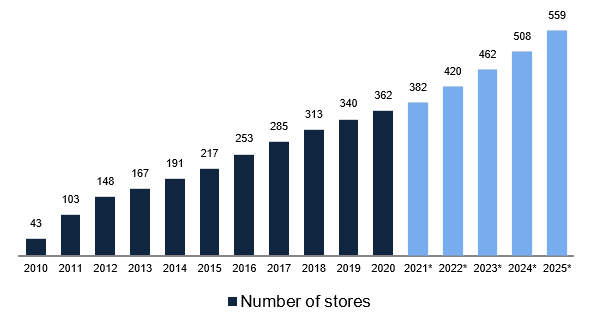

Jack has set the goal to grow the number of stores by 10% every year going forward. But to meet that goal, he must first outline the distribution strategy. It’s paramount to have good density of stores and Distribution Centers nearby.

The company wants its stores to be supplied by their own distribution centers that should be within a 250 mile radius (down from the current 500 mile). This in turn will help reduce the distribution time, the shrink and throwaways at the store level, while allowing for fresh products anytime.

But growing the number of stores isn’t exactly the driver for long term sustainable growth. The prior management team had been doing it with little success. In fact, several peers have filed for bankruptcy exactly because they had stretched their balance sheets too thin by investing too much in store growth.

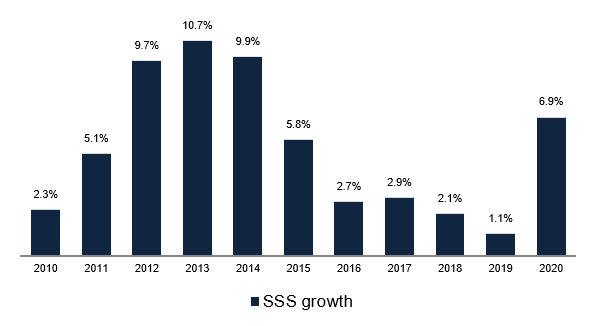

In retail, one of the most important metrics to look at is the Same-Store-Sales growth (also called “comparable sales”, or just “comps”). This metrics shows the underlying demand for the company’s products in mature markets.

Interestingly enough, Sprouts has never had a negative SSS growth. At least apparently. Analysts are too smart for management teams who don’t separate retail sales from online sales. In the case of Sprouts, their comps have been helped by the online sales that are mixed together with the store sales. If it weren’t for that, we would be seeing negative comps in 2019.

Of course, 2020 was an exception and shouldn’t be taken as the rule. In fact, this management team was pretty lucky to have outlined their plan just months before the pandemic hit. It’s not clear how the customer habits will change after the pandemic is over, but at least many customers got to know the new Sprouts during 2020.

In order to go back to positive low single digit comps, the management has also outlined a plan:

Finding its true colors

Prior to the management change, Sprouts was known for wanting to please everyone and anyone with its always-on discounted prices. Jack decided to figure out who his core customers were. He identified two target customers: the “health enthusiast” and the “innovation seekers”. He quickly started working to meet their needs.

Under Jack’s leadership, Sprouts has been shifting away from the commoditized products and general promotions. Jack knows he can’t win the fight against the Wall-Marts, Krogers, and other mass retailers with much higher bargaining power, so he went the other way; differentiating Sprouts through product selection.

Sprouts uses a mixed model where it buys most of its produce from regular distributors, but then, just like in a farmer’s market, the company has regional procurement teams in direct contact with local and smaller producers who have products that are not easily found in major retailers.

For example, on Thanksgiving, instead of regular turkey, Sprouts is selling no-antibiotic-ever turkey. This allows it to cater to its second demographic, the “innovation seekers”. 15% to 20% of the products will be different from month to month. Visiting a Sprouts location should feel like you’re on a treasure hunt experience much like what happens with Five Below.

I still pinch myself when I think of Five Below. It was a mistake not to buy it!

It’s not by chance that the CEO of Five is also a director on Sprouts board. I like this.

This constant pursuit for niche products makes Sprouts the go-to retailer for smaller producers wanting to market their innovations. Sprouts wants to become like an incubator, but instead of tech start-ups, it’s all about the new healthy food brands.

They’ve also dropped print media in favor of advertising on TV and digital media. They were printing millions of paper flyers every quarter. That clearly wasn’t the way to do it in this day and age.

They’re also shifting their store launch mode to a shorter period. They will still do a lot of fanfarre but they won’t make it as long as before – because that would challenge the comps for the next year. I’m still trying to figure out if this is a good strategy or not.

On the one hand, if the market rewards positive comps, it’s better to give it to them. On the other hand, it feels that the management is working to keep the analysts and Mr. Market happy instead of doing what’s best for the business.

A quick look at the financials

Let’s take a look at the financials.

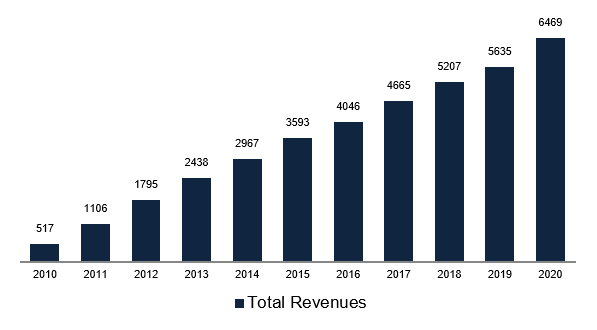

If one were to look just at the revenue, one wouldn’t understand the challenges Sprouts is facing.

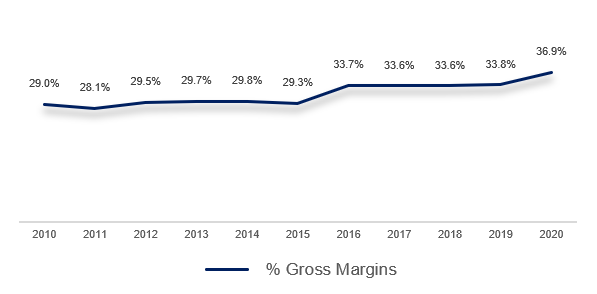

The same with the gross margin, which has even gotten higher in recent years (although I suspect it has come at the expense of paying earlier to the suppliers).

In fact, regular retailers sell a lot of Consumer Package Goods that are low margin so they must compensate with higher margins in products like produce. In the case of Sprouts, the margins between products are more evenly leveled (on the upside).

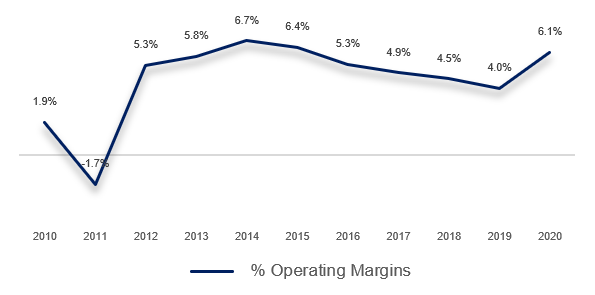

It’s only when we reach the operating margin that we see that things weren’t going that well. If we forget the year 2020, margins had been going down ever since the IPO. This was driven by the factors I’ve mentioned earlier: larger unproductive stores, lower comparable sales, constant promotions, etc.

The issue with food retailers is that they have low margins, and some operating leverage, as many of their costs are fixed (occupancy, labor, etc). They need steady foot traffic coming through their doors. If this foot traffic isn’t there, the fixed costs will soon become an issue. And that’s why investors and analysts put so much weight on one single metric – the Same Store Sales growth. It drives everything.

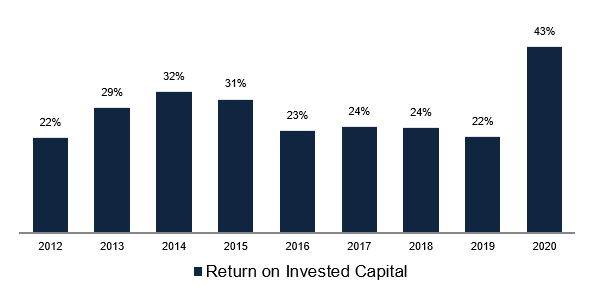

But even with lower comps and lower margins, the company has been able to get pretty good Returns on Invested Capital.

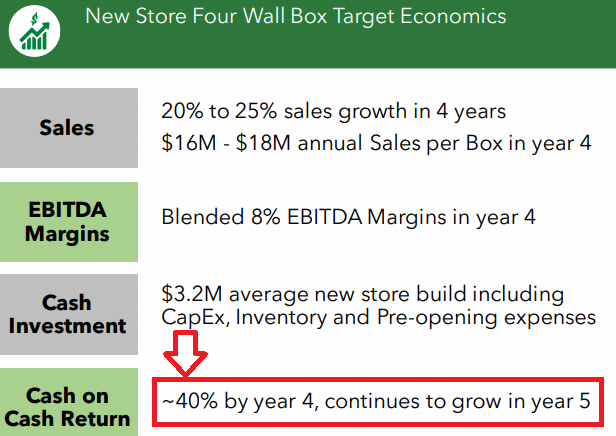

In fact, the new stores should have very good unit economics with cash-on-cash returns of 40%. By making the stores more efficient, Sprouts should be able to raise operating margins, and by reducing the investment and size of each store, they should be able to get higher Returns-on-Invested-Capital.

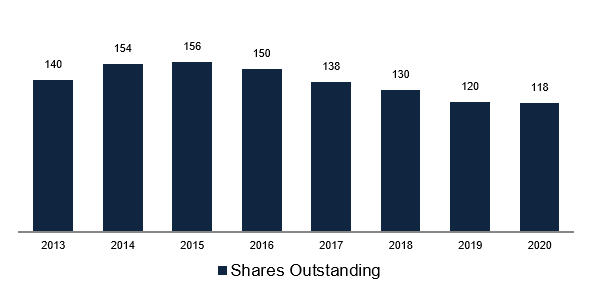

On top of this, the company has also been buying back its own shares at a good clip, having reduced the number of shares outstanding by 25% in the past 5 years.

This should go on in the future as the company has just authorized a new $300 million buyback plan.

Estimates and Valuation

Right now, the company is valued at about 15x earnings whereas Walmart is trading at 25x and Kroger at 14x. From this perspective alone, Sprouts appears to be relatively cheap.

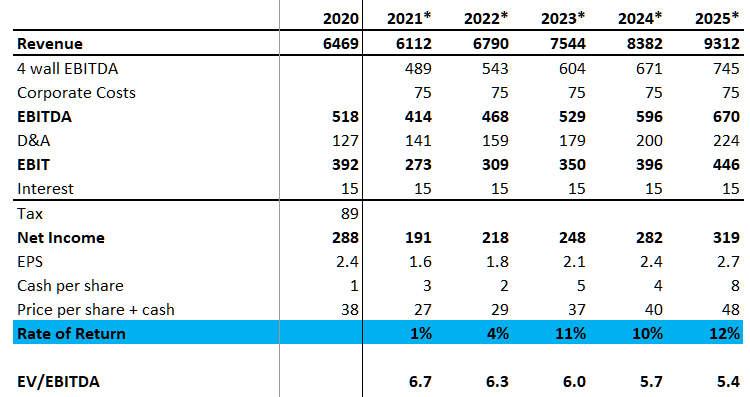

Let’s say that the management’s efforts are fruitful, that the comps will keep steady at 1% going forward, and that the number of stores will increase by 10% each year.

In this scenario the company would be making $2.7 per share in 2025. If we apply a conservative multiple of 15 times earnings and add back the cash generated until then, we could be getting a 12% return on investment.

In fact, if the company keeps buying back its own shares, the returns could be higher.

As a sanity check, the company is trading at 6.7x EV/EBITDA right now. The famous private equity firm Apollo paid 7x EV/EBITDA for The Fresh Market in 2016, and Amazon paid 11x for Whole Foods. From that perspective, the company is trading at a price that would be compelling for private buyers.

In fact, if we take the steady state Free-Cash-Flow, not accounting for growth Capital Expenditures, the stock is trading at around 9x to 11x. This is cheap.

Risks

- Very competitive industry. If Whole Foods attacks, there’s little that Sprouts can do.

- No assurance that the plan will work

- High distributor concentration.

Conclusion

I like Sprouts Farmers Market. It’s a simple story, it has a seasoned management team leading the ship, and if things go according to plan, it can easily become a multibagger.

But the issue with Sprouts is the industry it’s in. The food retailing business is brutal, and if the big boys (Walmart, Whole Foods, etc) were to launch a price war, Sprouts would be forced to lower its margins, thus lowering the returns of a potential investment. The management is constantly saying that they’re playing their own game, as if competition doesn’t affect them, but it would be naive to think so.

This is one of those great socks to buy during a price war between peers, when Mr. Market becomes way more frightened than he should.

For now, Sprouts Farmers Market is a pass for me.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.