Stryve Foods

are you eating?

By Manuel Maurício

February 11, 2022

Symbol: SNAX (NASDAQ)

Share Price: $2,64

Market Cap: $138 Million

Strive Foods is an early stage healthy food company that makes and sells air-dried meat snacks called Biltong.

Biltong is the South African version of Beef Jerky, a category that has long been dominated in the USA by Jack Links.

For those of you from outside the US, beef jerky is basically dried pieces of meat with seasoning.

It looks like “presunto” (in Portuguese) or “jamón” (in Spanish), but it’s much worse. I’m sorry, it is!

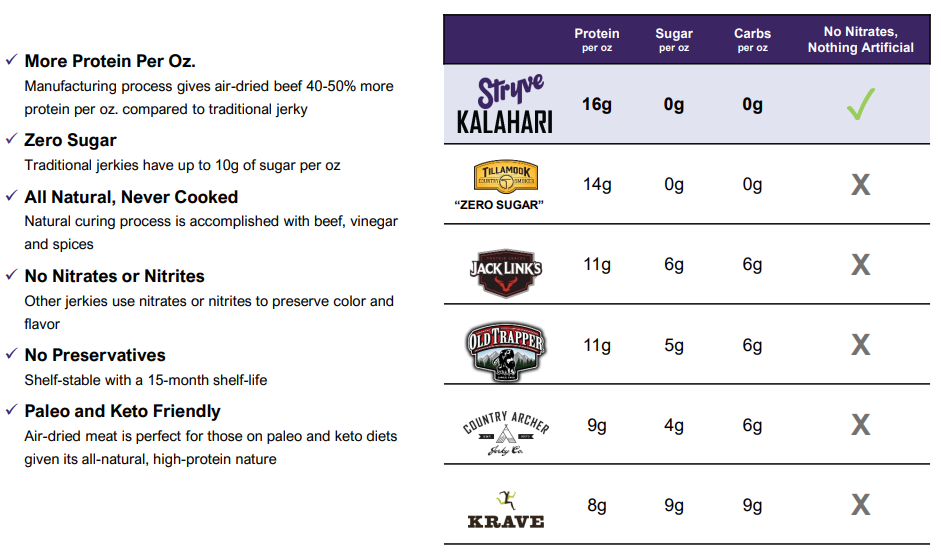

But whereas beef jerky is processed and contains added sugar, Biltong is an all-natural and minimally processed snack using only vinegar and spices. It’s never cooked, it has a higher amount of proteins, and is free of nitrates and preservatives.

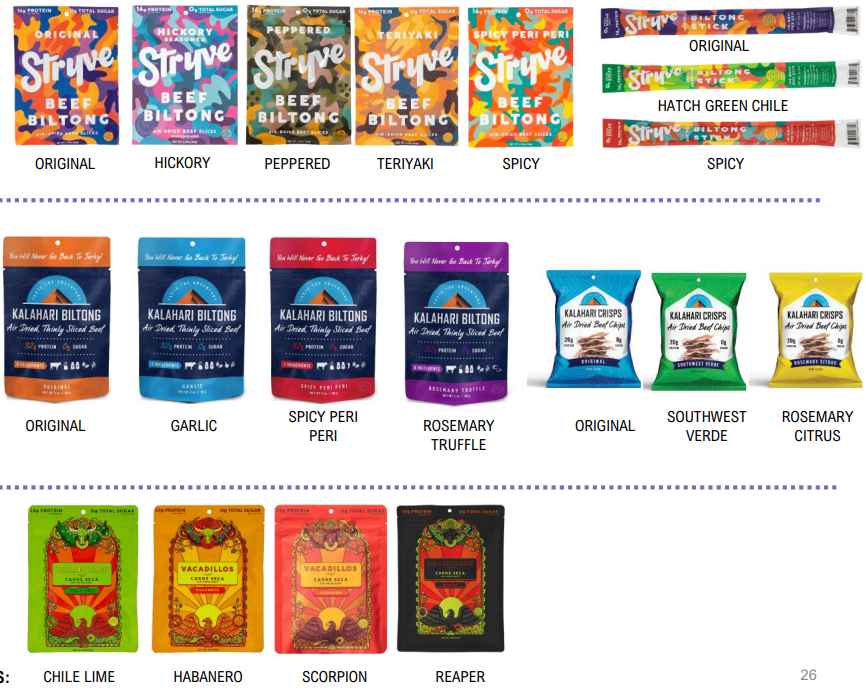

The company currently sells under 4 brands: Stryve Biltong (the “main” product), Vacadillos (aimed at the hispanic community), Kalahari brands (aimed at outdoors explorers), and Braaitime.

Stryve food was founded in 2017 and became public through a de-SPAC* process in July 2021.

*SPAC: Special Purpose Acquisition Company.

The reason why it went public? To fund growth. You see, there’s currently huge demand for healthier snacks, especially in the US.

And Stryve Biltong is in a category of its own. Yes, there are other brands selling Biltong in the US, but they’re mom and pop shops with very limited scale. These guys saw the opportunity to be the leaders in a category that has room to grow and took it.

Factory

Importing of processed meat is prohibited in the USA so that’s one barrier to competition right there. But it doesn’t stop here.

The company has the largest air dried manufacturing facility in the U.S. with a full grant of inspection by the USDA (the regulator).

Apparently, it’s really difficult to get this grant of inspection. The company mentions that the Chief Marketing Officer spent over nine years working with the USDA to establish the food safety protocols for Biltong production in the United States.

They also mention that they know of only one other air dried facility in the US, but that it’s 1/3 of the size.

If a competitor were to set up its own facility, it would take several years before it was up and running at scale. This would obviously give time for Stryve to grow.

On its filings, the management mentions that, with only modest capital expenditure, they could achieve over $100 million of revenue capacity with their current facility in Madil. Then, on a recent document, they started talking about $200 million.

On top of that, on one the Q3 earnings call, they mentioned that they’re thinking about building a new factory.

This was a bit too confusing for me so I’ve sent an email to their Investor Relations asking about it.

I talked to Raphael last night and he told me that they’re looking to expand the drying area of their current facility because they believe that the meat tastes better if its dried for longer. This is currently a bottle neck, and once solved, should lead to $100 million capacity for the current facility.

Additional to that, they’re looking to build a new facility in Texas where they can get manufacturing and offices under one roof. This should be located a little closer to Dallas, Texas, which is 1.5 hour drive from the existing plant.

Despite the lack of clear communication, it’s apparent that Stryve is seeing a lot of order inflow; enough to be expanding their current facility and building a new one at the same time.

If their own brands fail to grow as they expect, the fact that they also produce private label for retailers is a good way to quickly absorb excess plant capacity and provide meaningful volumes with no marketing investment by Stryve.

Distribution

This is where it starts to get interesting.

At the end of the third quarter, the company sold products in over 30.000 stores and it has been announcing consecutive placements in some of the largest retailers in the US, notably Costco, Walmart, and 7-Eleven, among many others.

In December, the company announced that it was going to participate in Costco’s Multi Vendor Mailer Program – a coupon book that is sent to all Costco members. This is huge news! So much so that the company had to raise capital just to secure this customer (more on this later).

The way it works with Costco is that the brands will be awarded a region. If they sell well in that region, they can go to another region and present their product (the regions work somewhat separately), and so on until they get national distribution.

Getting national distribution with Costco is a huge achievement and is only achievable to those who get a very high level of sales and satisfaction within their regions. This is a story that I know all too well since Mama Mancini’s has been adding Costco regions but hasn’t yet gotten national distribution. The fact that Stryve has got it speaks to the quality of their product.

So they got their second permanent region in Costco that will be rolling out in the first quarter, and the national expansion through the coupon book (limited time) should launch in Q2. 2022 should be a massive year for Stryve.

It’s important to mention that there has been some historical distributor concentration, with Aldi representing 26% of revenue (most of it is private label), but I expect that to be diluted as the company gains new customers.

Financials

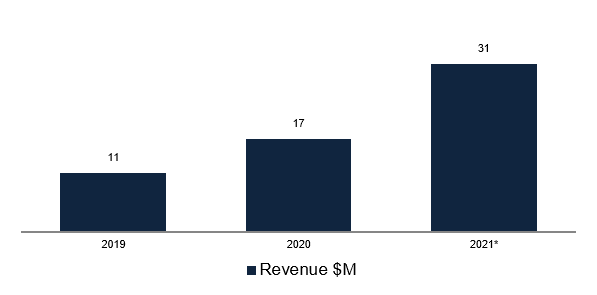

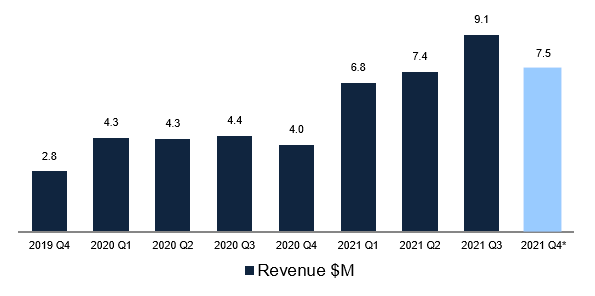

The revenue has been growing at 82% per year and I believe that, by the reasons explained above, it’ll be growing even more in the coming year.

At the time of the IPO (or de-Spacing), the management was talking about revenue of $50 million for the full year. Then COVID happened, Costco and Wallmart expansion was postponed and the guidance for the full year came down to the current $31 million. This is one of the reasons why we’ve seen the share price weakness in the last months.

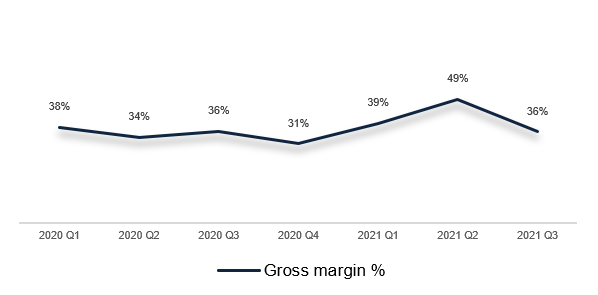

Gross margins are pretty good in the 30’s having reached 49% in the second quarter of 2021 due to a favorable mix of online sales – online has higher margins.

The management mentioned that, with scale, they expect the margins to go higher, but I don’t think they were thinking it through as the margin came down just the next quarter due to a higher mix of wholesale sales – which supports lower margins than online.

I expect the margin to go lower in the next couple of quarters as this big expansion into Costco should be lower margin, but as the company ramps its online sales this will probably even out in the long run.

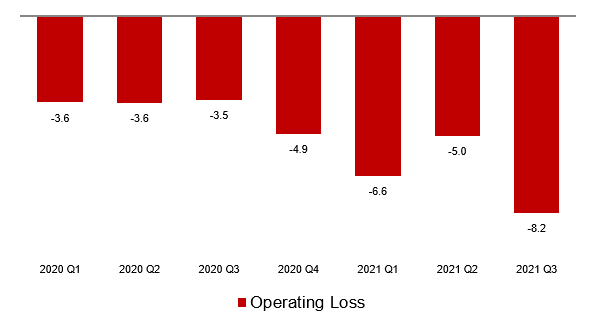

It’s when we get to the operating costs that the picture gets ugly.

As I mentioned at the beginning of this write-up, Jack Links is the beef jerky leader in the United States. And it is so because it was the first brand to reach scale and get broad recognition. There’s a significant first mover advantage in the snacking industry.

Stryve’s management understands this and that’s the reason why they’re investing aggressively in Sales & Marketing. The other option would be to grow the brand slowly over many years allowing for the Jack Links and others to front run them.

This makes it so that the company is loss making – for now.

Balance Sheet and Recent Capital Raise History

After several delays of contracts with big retailers, the company saw itself in the unfortunate situation of having to raise additional capital in last January, thus diluting shareholders.

After the recent private placement the company raised $35 million and now has 23K shares outstanding and an additional 19K warrants that can be exercised at $3.6 per share (and a further 11K warrants that can be exercised at $11.5 per share).

This means that, if the share price gets above $3.6, shareholders will be seeing their ownership get diluted by almost 100%. That’s not good.

But there’s good reason for this dilution. The capital was raised to buy inventory and to accelerate the expansion of the new manufacturing facility. The CMO has recently mentioned that, for Costco alone, they need $10 million in inventory. This tells me that if they get a 30% gross margin they’ll be making, at least, something like $14 million in additional sales this year, just for Costco alone. That represents 45% growth in revenue and we’re not even accounting for the other clients that the company has been announcing recently.

Management and Ownership

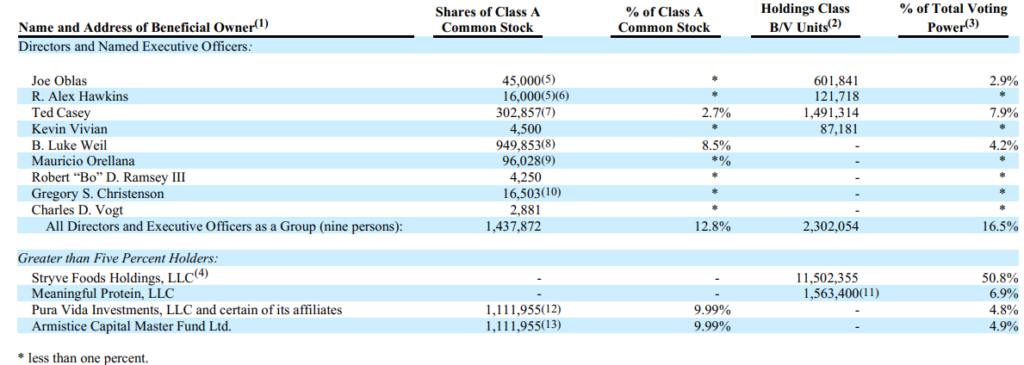

The insiders own approximately 67% of the business.

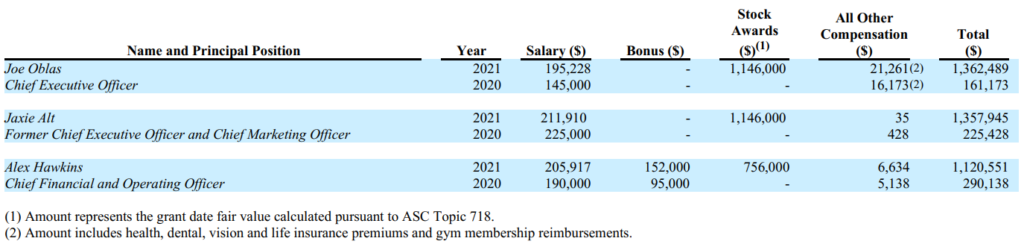

The CEO, Joe Oblas, makes $250.000 in base salary and an annual cash performance-based bonus with a target of 100% of the base salary. Unfortunately, the performance objectives to reach this 100% bonus aren’t clear on the filings.

I also wasn’t able to figure out the stock awards that both him and the other two executives got in 2021. Going forward, that’s an area that I want to dig deeper into.

To better understand where Stryve is going, one must understand the background of both its CEO, Joe Oblas, and its Chairman of the Board, Ted Casey.

Prior to founding Stryve, Mr. Oblas was the co-founder and Chief Operating Officer of ProSupps USA, a successful sports nutrition brand, from November 2007 until December 2016.

Ted Casey was the founder and CEO of Dymatize Nutrition, a nutritional supplement company that he sold to Post Holdings in 2014. Since 2011 he’s also been the CEO of DryBev, a manufacturer of branded and private label nutritional supplements.

Functional Nutrition

So, what have these two guys got in common?

Exactly. They both worked with nutrition products before. And I get the sense that they’re suffering from the “man with a hammer syndrome”. For a man with a hammer, everything looks like a nail.

These guys see nutritional products as a natural expansion for Biltong. I’m not sure what to make of this. On the one side, they know hundreds of distributors, the market is highly fragmented so they might have a shot. The opportunity is clearly there as exemplified by my write-up of FitLife Brands.

On the other side, Biltong looks to be a very good product with very little direct competition and I fear that they might be losing their focus. Only time will tell.

Risks

- The company might not turn a profit for long

- The company might be diluting its existing shareholders

- Any risk associated with health issues

Conclusion

Stryve Foods is right at the start of expansion and replication phase; it has HUGE growth prospects, and it might become one of the biggest, if not the biggest, player on a category all of its own.

I mean, no product gets national distribution with Costco (and others) if it wasn’t selling a lot. The company is currently worth $138M, but I wouldn’t be surprised if we saw it grow to the $1 billion market cap in the next few years, making it a multi-bagger.

That is, if Jack Links doesn’t buy it first as I believe there is the strong likelihood of that happening.

Having said that, I’m still not comfortable investing in Stryve.

The fourth quarter will be a wash-out, but I’m hoping that the management will be talking about the first quarter and full year 2022 on the earnings call. Is it possible that I’ll be missing a strong revaluation of the share price? No doubt about it.

But that’s the way it goes. I’ll let you know when and if I change my mind.

Stryve Foods won’t be entering the Portfolio at this time.

The fourth quarter will be a wash-out, but I’m hoping that the management will be talking about the first quarter and full year 2022 on the earnings call. Is it possible that I’ll be missing a strong revaluation of the share price? No doubt about it.

But that’s the way it goes. I’ll let you know when and if I change my mind.

Stryve Foods won’t be entering the Portfolio at this time.

It’s very important to me (and you, as a subscriber), to get feedback on this write-up. I would like to ask you to quickly fill out the survey form below. This way I’ll be able to improve my work.

On top of that, you can tell me what you think of Stryve Foods on the Forum. The more comments on the Forum, the more valuable it gets.

Further research material

I would like to hear your anonymous opinion!

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.