Uranium

The saga continues

22/05/2020

So far, I’ve written about Uranium twice. HERE and HERE. I’ve written about the Macro Story, Cameco and Denison Mines. If you haven’t read the previous posts, I’d suggest you read them as an introduction to this one, especially the part where I talk about the Section 232 and the Nuclear Fuel Working Group (NFWG).

Today we’re going to be looking at three different uranium companies. One mining company and two interesting investment vehicles.

Energy Fuels

Symbol: UUUU (NYSEAmerican); EFR (Toronto Stock Exchange)

Share Price: $1,63

Market Cap: $188,8 Million

Energy Fuels is one of the few remaining uranium companies in the USA. It has been the largest American uranium producer for some time now having produced 34% of all US uranium over the past 15 years.

Petition

It’s also one of the two who have filed a petition with the Government of the USA to try to revive the American uranium and nuclear industry. You see, the world consumes about 180 million pounds of uranium per year and the US alone consumes 40 million pounds while producing close to zero pounds of uranium. Those 40 million pounds are used to power 20% of the country’s electric needs. With a good chunk of those 40M/lbs coming from Russian friendly countries, one can easily understand how this could turn into a national defense issue. And that’s the argument these petitioners have used to lure the “America First” Administration into giving them some kind of special treatment, be it in the form of quotas or tax advantages to the utilities to buy american uranium.

The petition was filed back in 2018 and until recently it went back and forth with no real decision. Recently the NFWG released the report everyone was waiting for, and although it showed several good intentions, it lacked concrete steps and measures. But it’s not all bad. Not at all. For decades, every government has neglected the american uranium industry, so having a report about it, saying that steps will be taken to change things is actually a victory to the petitioners.

But the concrete measures came out of the President’s proposed budget for 2021 instead. It proposes the creation of a Uranium Reserve that could purchase up to $1,5 billion worth of Uranium from US producers over the next ten years. That’s $150 Million per year. If it were bought at the $60 that Energy Fuels is asking for, it would amount to 2,5 million pounds, which – let’s face it – isn’t much. But hey, it’s a start. And if those $150M were to be bought from just a couple of producers, that would mean $75 million dollars per year for each producer. By looking at the chart below, we can see how those $75M would be a windfall for Energy Fuels.

The Company

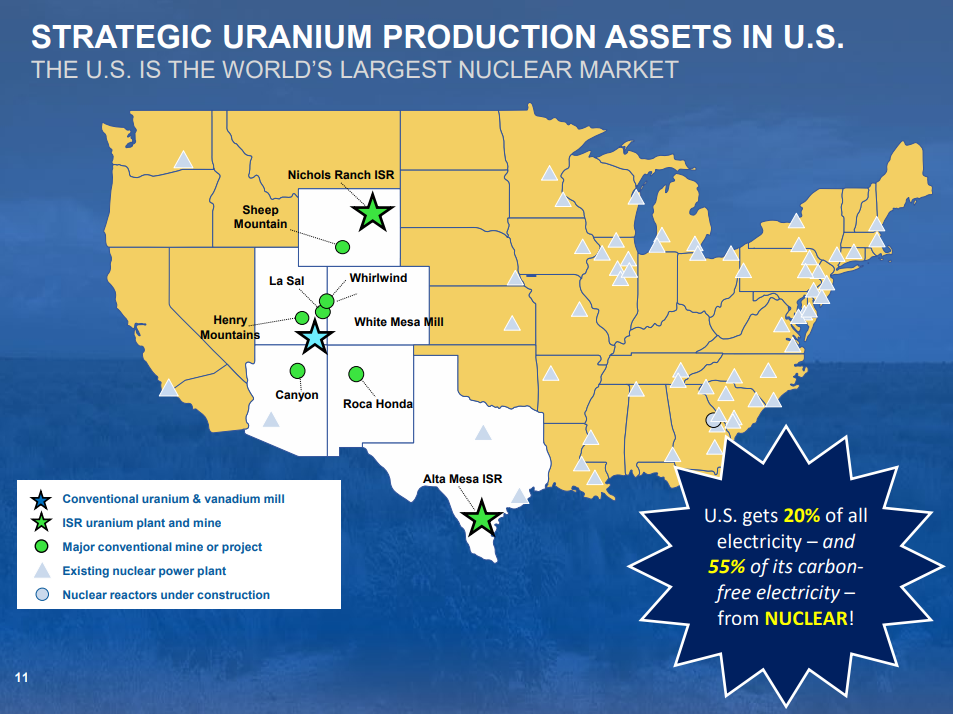

Energy Fuels has a bunch of properties from which they can get uranium. You see, if we start digging into the USA uranium history we’ll find a long history of exploration, production, mergers and acquisitions, you name it. I won’t be looking at every single property in detail or I would bore you (and me) to death so here are the most important ones:

The Alta Mesa Project, in Texas, is a fully-licensed ISR (In Situ Recovery) with capacity for 1,5 million pounds of uranium per year. At $60, that would mean $90 million in revenue. The company has said that it can resume operations in 12 to 18 months.

The Nichols Ranch in Wyoming is another ISR operation with a license to produce up to 2 million pounds per year or $120 million in revenue. Operations at Nichols Ranch can resume in 6 to 12 months.

Then there are several other conventional mines like Roca Honda or La Sal, to name a few. What is important is that the two most important ones are ISR (cheap operations) whereas the conventional mines are located around the White Mesa Mill.

The Mill

The White Mesa Mill is THE facility that makes Energy Fuels a one of a kind company.

As we’ve learned on the first analysis, after you take the uranium out of the ground from a conventional mine, it will have to go through a mill to be transformed into yellow cake (U3O8). How many mills would you say there are in the USA? 5? 4? 3? Guess again. There is only 1 fully licensed and operating uranium mill in the USA. And this creates a true competitive advantage for Energy Fuels. It is a monopoly that gives the company immense power over its competitors. It is licensed to process up to 2.000 tons per day and to extract over 8M/lbs of U3O8 per year. The company says that the mill has contributed historically with anything in between $5M to $50M per year, but they see no reason why it couldn’t go up to $100M (they’re miners, remember).

When the price of uranium finally goes up and the new American producers need to mill their uranium, they will have to pay Energy Fuels for its milling capacity or send the uranium overseas, which would be costly. On top of being able to set the price it wants, Energy Fuels will also be able to control who mills what, when and how much, effectively controlling the production of its competitors.

The company’s contracts to sell uranium have all reached the end of their terms in 2019 so during 2019 only 70.000 pounds were produced at the mill. In 2020 the company expects to recover approximately 120.000 to 170.000 pounds of U3O8 from in-circuit uranium inventories (recovered from the tailings ponds) and reach an inventory position of 700.000 pounds of uranium.

But not only is this mill fully licensed for handling uranium, it can also be used – and it has been used – to process other minerals such as vanadium. Several of these uranium companies are trying to squeeze whatever they can get from secondary sources of revenue. Denison Mines takes care of mines that are in Care & Maintenance while Energy Fuels recovers vanadium from its tailings ponds. They are all trying to stay afloat. But vanadium is only extracted when its prices are high, and the prices are extremely volatile. Vanadium, when combined with iron becomes ferrovanadium and is used in the steel industry, especially in China. Exactly because Chinese authorities have recently demanded a higher concentration of vanadium in rebar, the price spiked to $17,38, but due to several reasons it came down again to $6,88 per pound. While the price of vanadium doesn’t go up, the company holds 1,6 million pounds of it just waiting for better prices.

But there’s more. The mill is licensed not only to handle uranium and vanadium, but also to handle 17 other streams. This means that they can extract uranium from other sources such as waste-water, rare-earth-elements, etc.

And that’s the management’s most recent bet. Rare-Earth-Elements. There are several companies that can’t go ahead with their projects because many of these rare earths are mixed with uranium and it would take many years for these companies to get the permits and build the facilities to handle uranium, not to mention fighting the environmental opposition they would surely be facing. Energy Fuels, on the other hand, is already able to handle those elements. How big can this be? The company still hasn’t assessed that.

The large quantity of projects, assets and revenue streams is something that investors should welcome since if one doesn’t go according to plan, the company can still explore other revenue streams. Multi asset companies are better than single asset companies.

Financials

Looking at these companies’ financials almost hurts inside. I should be looking at great companies, not these lousy businesses. As we can see, the company has been selling less and less each year, to the point where it sold more vanadium than uranium in 2019. I wonder how far could these guys go without government intervention.

On the other hand, it’s kind of amazing how some of these companies were able to endure a 10 year bear market. We’ve got to remember that there were hundreds of companies in the last cycle, so the ones that are still left must have something special.

Unfortunately, those ever shrinking revenues haven’t been enough to generate cash.

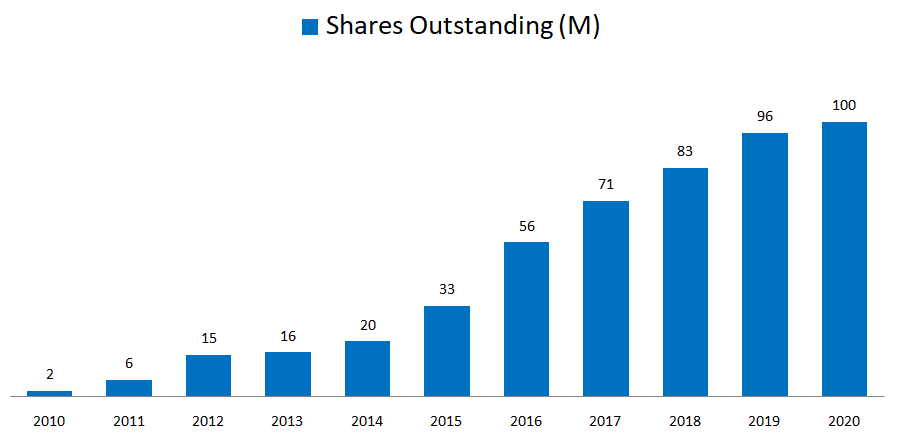

So the company has been relying on the issuance of shares to fund the operations.

Which in turn led to massive dilution.

The company has raises $20 Million dollars in February and at the end of March it had $26M in cash and anticipates inventory of 700.000 pounds of uranium at the end of 2020 which it hopes to sell to the US government or to the utilities at significantly higher prices than today. Let’s say that uranium prices go up to $40. This means that the company would be sitting on $28 Million dollars worth of uranium. It also has 1,6 million pounds of vanadium which at today’s spot price of $6,88/lb is equivalent to $11 Million. Uranium and vanadium together, the company will be sitting on roughly $40 Million dollars worth of inventory at the end of the year.

On the liabilities side, it has $15 Million worth of debt in the form of Convertible Debentures that must be paid until the end of 2020 with cash or shares. The management says that they have the liquidity to pay it down in cash if needed, but with $20 Million in the bank and a quarterly cash burn of around $8 Million, I don’t see how they will be able to pay it down without further issuing shares or selling some of the inventory.

Management

Mark Chalmers is the guy you’d want to be leading your uranium company. He started out as a mining engineer back in the 70’s and he has climbed his way up to where he is today by working with Cameco, Rio Tinto, BHP and Paladin.

Then there’s Paul Goranson, the COO, who is also a veteran: In what relates to management, I think it’s safe to say that this is one of the best teams in the world.

These guys’ compensation scheme is similar to that of Denison Mines. There is a Base Salary of $400K and $287K for the CEO and CFO and then there are short and long term incentives:

The Short Term Incentives are connected to Minimum Production (15%); Net Recurring Cash Flow (which was negative) (25%); Minimum Working Capital (20%); Licensing and Permitting milestones (5%); the ongoing pursuit of relief under the Section 232 petition (15%); subjective component (20%).

The Long Term incentives are tied to Share Price performance against other uranium companies (35%); obtaining Board approval for the 2020 Budget (?) (35%), securing future business activities (10%); and subjective component (20%).

I’m still against the incentive tied to the share price performance related to the peers and I don’t really understand the “obtaining board approval for the 2020 budget” milestone.

All things considered, Chalmers has made $788K in 2019 after an amazing 2018 when he made $2,4 million.

Unfortunately, no executive owns a good chunk of the shares outstanding. Chalmers owns 236k shares which is less than 1% of the company.

The directors all earn “modest” compensation. More or less double that of Denison Mines, but that was to be expected. After all, this company has been in production recently.

ENERGY FUELS CONCLUSION

Energy Fuels is currently a money losing company, that’s true, but it owns something that no other American company owns: THE MILL. The mill is the single largest competitive advantage this company has. Its estimated replacing cost is around $300M to $400M and it would take at least 10 years to build it (if ever). In a $188 Million Market Cap company, it could be said that we’re looking at an undervalued company just by looking at its replacement cost.

Energy Fuels is the best positioned company to benefit from the resurgence of the American uranium industry. Depending on how history unfolds, we could be seeing Energy Fuels being worth many times its current Market Cap.

Let’s say that it can produce up to 3,5 million pounds per year (which is only its ISR operations). At a historical cost of $35 and a spot price of $60, that would mean that the company would be making $88 Million in gross profit. Let’s say that its operating costs would be around $40 Million. The company could be making around 50 cents per share. Depending on the market’s sentiment, we could be seeing Energy Fuels trading at a multiple anywhere between 10x and 20x which would mean a share price of $5 or $10. Today‘s share price is $1,63, so you do the math.

The problem is at what pace will history unfold? If it takes years to get to a 3,5M/lbs production and the company has to keep issuing shares, we won’t be seeing 50 cents per share, but 40, 30, 20, and so on. Either way, this is a company to keep under the radar.

Yellow Cake PLC

Symbol: YCA (London Stock Exchange)

Share Price: 220 GBX (£2,2)

Market Cap: £192,7 million

INTRODUCTION

So far, I’ve been focused on the miners, but there is another group of companies that can be of interest to investors who want to get exposure to uranium. Enter the “financial players”: the English Yellow Cake and the Canadian Uranium Participation Corp. These companies are interesting because they are not miners and they don’t produce uranium. What they do is to HOLD uranium so you can invest (or speculate) in it without the risks associated with a mining operation. If the price of uranium goes up, you win, if it goes down, you lose. Quite a clever solution, I should say.

I first heard about Yellow Cake when I visited the Horos Asset Management office in Madrid in 2019. Back then, uranium was something very strange to me and I nodded my head while Rodrigo was telling me about the benefits of owning Yellow Cake. Little did I know that one year later, I would be researching it.

By the way, I should thank Alejandro Martín from Horos for helping me out so many times with this and other companies.

COMPANY

Yellow Cake’s IPO was back in 2018 and most of the gross proceeds of $200 million dollars were used to buy 8,2 million pounds of uranium (U3O8) at US$21/lb. Since then, the company has raised more money (US33,9M) and bought more uranium (1,5M/lbs). It now holds 9,62 million pounds of uranium at an average price of US$21,68. Just so we can situate ourselves, the world consumption in 2019 was around 170 million pounds so YellowCake holds about 5-6% of the global annual consumption.

The company has agreements with three different companies:

1- They’ve purchased those 9,6 million pounds of uranium from Kazatomprom, the Kazakh giant at a 2,5% discount to the spot price. The agreement also allows YellowCake to purchase up to $100 million dollars per year at the spot price for nine years. Simultaneously, Kazatomprom can also buy back 25% of the initial amount bought just after the IPO until 2027 at a discount to the spot price. There a couple more “plays” in the agreement but I will spare you the details.

2- Yellow Cake isn’t licensed to hold uranium so it set up an agreement with Cameco to store the uranium at its Port Hope conversion facility in Canada. This makes it so that if Yellow Cake wishes to sell its inventory, it will have to do it with companies that also have inventories with Cameco so the trade will be a book trade, not a physical one.

3- To manage the company, there is an agreement with “308 Services” who do all the work. 308 Services is compensated in several different ways, from a fixed fee of US$275.000 to a % of sales and purchases of uranium, which as you might imagine, I’m not keen about.

MANAGEMENT AND OWNERSHIP

Yellow Cake has a staff of 2, the CEO and the CFO. The CEO earns US$215.000 in base salary and the CFO US$172.000. Then they have an annual incentive bonuses tied to subjective criteria that can reach 100% of the salary and a Long-term incentive bonus that can reach 150% of the salary.

Yellow Cake is owned by several institutions from which I can identify AzValor, the famous Spanish investment boutique that has been hammered down recently with its bets on commodities and cyclical companies (really interesting story) and Horos also owns a small stake in the company.

FINANCIALS

With $6,5 million on the balance sheet and a long term liability of $2,6 million (tied to the future sale of U3O8 to Kazatomprom), the company has $3,9 million dollars in available liquidity. With costs running in the order of $1,5M per year ($1M in G&A expenses, $275.000 to “308 Services” and some other variable fees), the company has enough liquidity to cover more than 2 years.

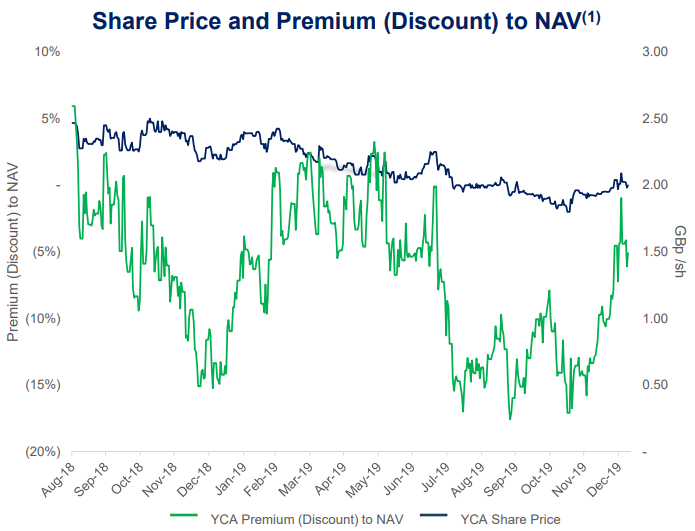

The current number of shares outstanding is about 88 million. If we divide the number of pounds held in inventory by the number of shares outstanding, we will get the equivalent of 0,11 pounds per share. At today’s spot price of $33,5, each share should be worth £3 ($33,5 x 0,11 = £3 at the conversion rate = 1,23) which is its NAV (Net Asset Value). This means that at the current share price of £2,2 the company is trading at a discount to NAV of 28%.

COMPANY STRATEGY

This discount allows the company to make use of some arbitrage similar to what Gus Kelly is doing over at Aercap to increase shareholder value. The company will sell uranium when the shares trade at a discount to NAV and buy Uranium whenever the shares trade at a premium to NAV. How exactly does this increase the shareholders’ value?

Let’s simplify things and say that the company owns 10 pounds of uranium, there are 10 shares outstanding, each belonging to a different shareholder (10 shareholders). Let’s say that the uranium price is $30 per pound to make it a round number. Each share is equivalent to 1 pound of uranium, so each shareholder owns $30, right? That’s the NAV per share. The company’s NAV is $300 (10 pounds x $30 = $300). Now let’s say that, for some unknown reason, the 10 shareholders are trading shares among themselves at $20. The ones buying the shares are making a good deal. They are buying $30 worth of uranium for $20. So whenever there are investors willing to sell their shares for less than the underlying value (or NAV), which in this example is $30, the company will sell uranium and use the proceeds to buy shares from them, increasing the NAV per share for the other 9 shareholders.

The company sells 1 pound of uranium for $30 and then buys back 1 share (that is worth $30 of uranium) for $20 (and cancels that share). The NAV of the whole company is now $280 ($300 – $20 = $280) which is lower than before, but the NAV of each share went from $30 to $31. You see, although the company is now worth less, each shareholder has seen its percentage of ownership in the company go up without spending a dime ($280 / 9 = $31). That’s the beauty of share buybacks. And if the shares trade at a premium to NAV, the company will sell overvalued shares to buy uranium. It’s financial engineering working for the shareholders.

Now you might say that if the company believes that the price of uranium is going to go up, it shouldn’t be selling uranium at these price levels and should wait (like Energy Fuels is doing). But that would mean that the company itself would be speculating on the price of uranium and the management has been candid in saying that they won’t do that. They’ll leave that part to the investors.

Important to say that the share price has always traded at a discount to NAV so we shouldn’t be waiting for it to close that gap without a catalyst. I believe it will be only when we see the price of uranium shoot up that the investors will close the gap or even pay a premium to NAV in anticipation of future price appreciation.

YELLOW CAKE CONCLUSION

Yellow Cake is indeed a very interesting vehicle to invest in uranium. Its costs are very low so the downside is very limited and it has a decent upside. If the uranium price goes up to $45, that would mean a 34% increase from here, and I’m not even accounting for the gap between price and NAV to close. If the spot price goes to $50 the upside is 50%. At $60, the upside is 80%. When will the spot price get to those numbers? I don’t know, but even if it takes 2 years to get to $45, we’re talking about a minimum 16% annual return! This is nothing compared to the potential gains we we could see in the miners, but the risk is much lower. I’m seriously thinking of adding Yellow Cake to the All in Stocks Portfolio.

Uranium Participation Corp

Symbol: U (Toronto Stock Exchange)

Share Price: CAD$4,94

Market Cap: CAD$682 Million

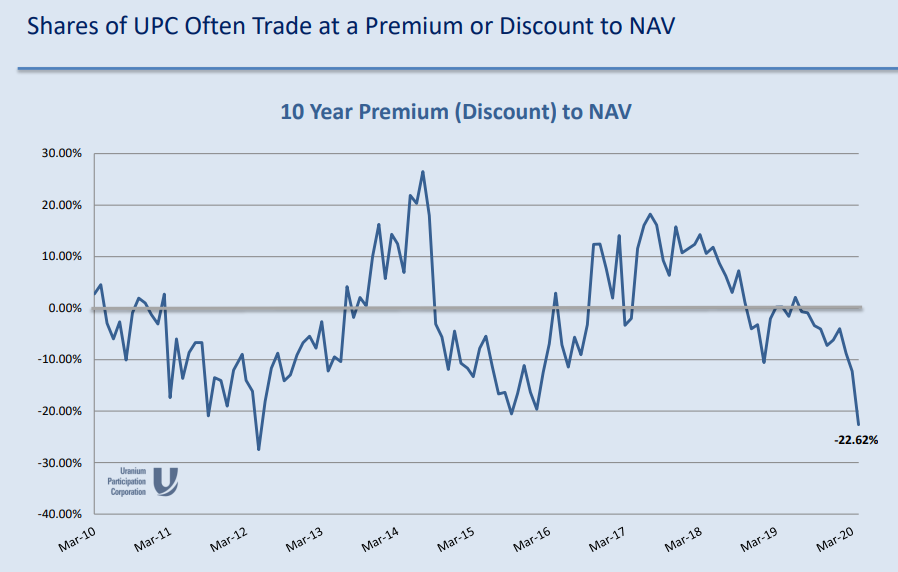

The Canadian Uranium Participation Corp. (UPC) is very similar to Yellow Cake. It holds uranium in the form of U3O8 and UF6 (the gas that will be enriched) allowing for investors to “play” the uranium space without the risks associated to a mining operation.

MANAGEMENT AND OWNERSHIP

Like YellowCake, UPC is also owned by several funds and institutions, and AzValor and Horos are both there as well.

The company has a management agreement with Denison Mines so David Cates, Denison’s CEO is also UPC’s CEO. Denison’s has earned $ 2,3 million dollars in 2019 from UPC. This compensation has a fixed fee of $400.000 and then there are some variable fees related to things like the purchase and sale of uranium. As in Yellow Cake’s agreement with 308 Services, I don’t really like this scheme because it rewards activity that might not be needed, but I guess this is common.

FINANCIALS

With CAD$4,1 Million in net current assets and annual expenses of about CAD$6 Million, the company will have to sell some of its uranium to keep the lights on. I’m not worried about this since the company has plenty of uranium to sell.

With 15,6M/lbs of U3O8 and 600.000 KgU of UF6, the company’s Net Asset Value is CAD$6 per share, which at today’s price of $4,94 means a 17% discount to NAV.

UPC CONCLUSION

There are slight differences between UPC and Yellow Cake. UPC is larger than Yellow Cake so it has more liquidity, UPC has its inventory spread across several locations while Yellow Cake has it in one single location, UPC has both U3O8 and UF6, which gives it optionality if the prices of conversion go up more than the prices of the U3O8 (as it has happened recently), so all things being equal, I prefer UPC to Yellow Cake. The thing is that UPC is trading at a discount to NAV of 17% while Yellow Cake is trading at a discount of 28%, so I think I’ll take both.

Conclusion

So far we’ve looked at two producers (Cameco and Energy Fuels), one developer (Denison Mines) and two investment vehicles (Yellow Cake PLC and Uranium Participation Corp).

My strategy in this first phase, is to buy the companies that present the lowest risk and the first ones to feel the variation of the spot price. You see, if this cycle takes longer than expected to turn, I will want to protect my downside. That being said, the lower risk companies are Yellow Cake and UPC. They’re also the ones with the lower upside. If uranium doubles, these companies will double while the miners will go up several times fold. I’m well aware of that. My strategy will be to blend the low risk of these companies with some of the upside offered by the more riskier ones.

I am planning of devoting 5 to 10% of the All in Stocks Portfolio to uranium companies. At this stage of the cycle, I know that I want to own both Yellow Cake and UPC so I’ll buy 2,5% of each. This way I will still be left with another 5% for the miners. Both Yellow Cake and UPC will be added to the Portfolio on Monday at the closing price.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.