Veem

2019 FY Results

October, 25 2019

TICKER: VEE

ISIN: AU000000VEE3

SHARE PRICE: $0,55 AUD

MARKET CAP: $64M AUD6

INTRODUCTION

The first time I looked at Veem I found a 51 year old family business that had launched a new revolutionary product that promised to become a new avenue for growth: A gyrostabilizer for mega yachts and offshore-supply-vessels called “Gyro”.

I also remember that I was reading the book “Quality of Earnings” at the time (which went missing ever since) and I was eager to apply my newly acquired learnings to my research.

By coincidence, I’ve spotted some red flags about this company like a huge build up in inventory and the fact that the proceeds of the IPO went to the founding family’s pockets instead of being used to pay down debt or to support growth.

These were my conclusions at the time:

Don’t Like:

The fact that the family pocketed the proceeds of the IPO.

The fact that inventory is building up and sales are still flat.

The fact that debt is mounting while profits are going down and dividends are being paid.

Like:

The fact that this is a 51 year old company led by the founding family.

The fact that there is a new product with lots of potential.

The fact that Damen has spent a lot of time testing the thing and finally ordered one.

The fact that this can become a multibagger.

Today Veem released its Annual Report and I’m going to take a quick look at it and see if there’s anything new that might make me change my mind about investing in this company.

The stock price has gone up 10% since my first write-up, which is nothing.

NEW FACTORY

The company has taken possession of the new factory for the manufacturing and testing of the Gyro.

The CEO says that the rental costs for this facility are modest given that it will now house equipment that was located at other rented facilities. I remember that the company was renting its factory from the CEO at about $1M…. humm, was it? Let me check…

Yup, confirmed (read below). Not only was the company renting its facilities from the CEO and his brother but it has now signed a new lease for the new premises (I suppose it’s the Gyro factory) for $43K per month for the next 10 years. This is something that – although not a bad thing in and of itself – together with some other red-flags, makes me suspicious about the integrity of the management team.

When the company says that this new added cost is mitigated by the fact that they left the older facilities, I suspect that those older facilities belonged to the CEO as well. The original rent cost went from $115K per month to $110K. So they’ve exchanged a place that was rented for $5K for a new one that costs $43K. And who’s pocketing all this? Exactly.

Note: All currency in AUD unless stated otherwise.

MARGINS ARE DOWN

Here is something I like to see followed by something I don’t like to see. The revenue has increased by 10% while the operating margin has gone down to 6%, almost a third of what it was a couple of years ago.

Which in turn led to a huge decrease in the net income to $2,2M and a net margin of 5%.

PROFITABILITY RATIOS

And of course, with the profit decline, the profitability ratios decline too.

CASH FLOW

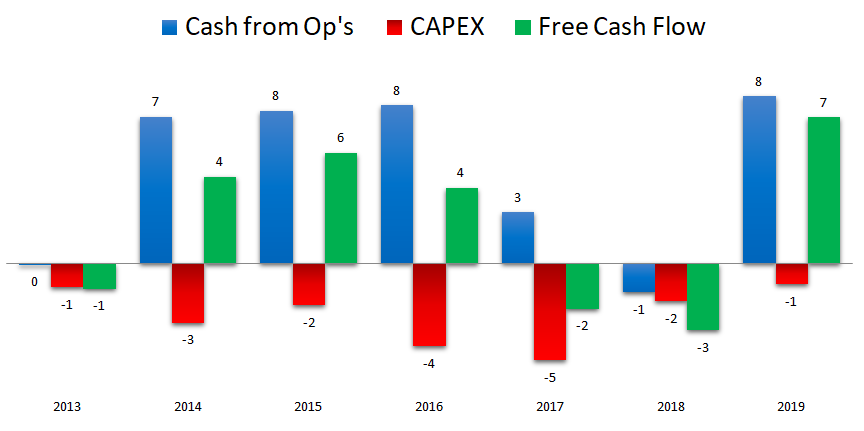

But while the net income has gone down, the Cash flow form operations and the FCF have risen a L O T.

FCF was $7M in 2018.

And what did they do with that money?

DEBT

They’ve paid down debt, which is a very sensible thing to do.

By the way, this week I was listening to this episode about Return-on-Equity where Geoff (whose articles I really like) was saying that you don’t want to invest in a company that has a lot of debt and that at some point decides to pay down its debt. According to him, this is the worst profitability-wise decision for an investor. Yes, I was kind of confused too so I will listen to it again and again until I get what Geoff was saying.

On my first look at Veem, I noticed that the inventory was out-growing the revenue. This time around, although the company has decreased its level of inventory…

When we compare and average it to sales, we see that it is still rising. The inventory sits on the factory floor for an average of 232 days. I would like to see this number going down, not up.

The other two ratios tell us if the company has been good at collecting and if it has been delaying its payments to its suppliers (which is usually a good thing…but not always).

Fortunately, the company has been able to diminish the number of days of collection from its clients to 56 days from 80 in 2018. Regarding the payables, they have gone up by a couple of days. Nothing drastic here.

This is a good example of how the balance sheet is related to the cash flow statement. The fact that the number of days that the company takes to collect has gone down, leads to more cash being available sooner, which leads to that spike in the Cash from operations.

Just as a last point regarding the inventory, what I’m seeing here is a whole lot less work-in-progress inventory. I wonder why…

DIVIDEND

The icing on top of the cake is the fact that the company is keeping its strategy of paying out 30% of the profits as a dividend, a decision I don’t feel is the wisest. I would like to see higher debt paydowns.

All of this to say that I’m still not feeling the love and I probably won’t until I see those Gyro orders coming in like crazy. In the meantime, I’ll keep following Veem and its progress.

In the meantime, you can join our community at our:

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431